Earnings summaries and quarterly performance for MITEK SYSTEMS.

Executive leadership at MITEK SYSTEMS.

Edward West

Chief Executive Officer

Christopher Briggs

Chief Product Officer

David Lyle

Chief Financial Officer

Garrett Gafke

Chief Operating Officer

Jason Gray

Chief Legal Officer, Chief Compliance Officer and Corporate Secretary

Michael Diamond

Senior Vice President, Deposit Solutions

Board of directors at MITEK SYSTEMS.

Research analysts who have asked questions during MITEK SYSTEMS earnings calls.

Allen Klee

Maxim Group

6 questions for MITK

George Sutton

Craig-Hallum

4 questions for MITK

Mike Grondahl

Lake Street Capital Markets

4 questions for MITK

Surinder Thind

Jefferies Financial Group

4 questions for MITK

Jacob Roberge

William Blair

3 questions for MITK

Derek Greenberg

Maxim Group

2 questions for MITK

Jacob Zurbuchen

William Blair

2 questions for MITK

Jake Roberge

William Blair & Company, L.L.C

2 questions for MITK

Logan

Craig-Hallum

2 questions for MITK

Jake Roberts

TPH&Co.

1 question for MITK

Logan W Lillehaug

Craig-Hallum Capital Group LLC

1 question for MITK

Lucas John Horton

Northland Capital Markets

1 question for MITK

Mike

Northland Securities

1 question for MITK

Recent press releases and 8-K filings for MITK.

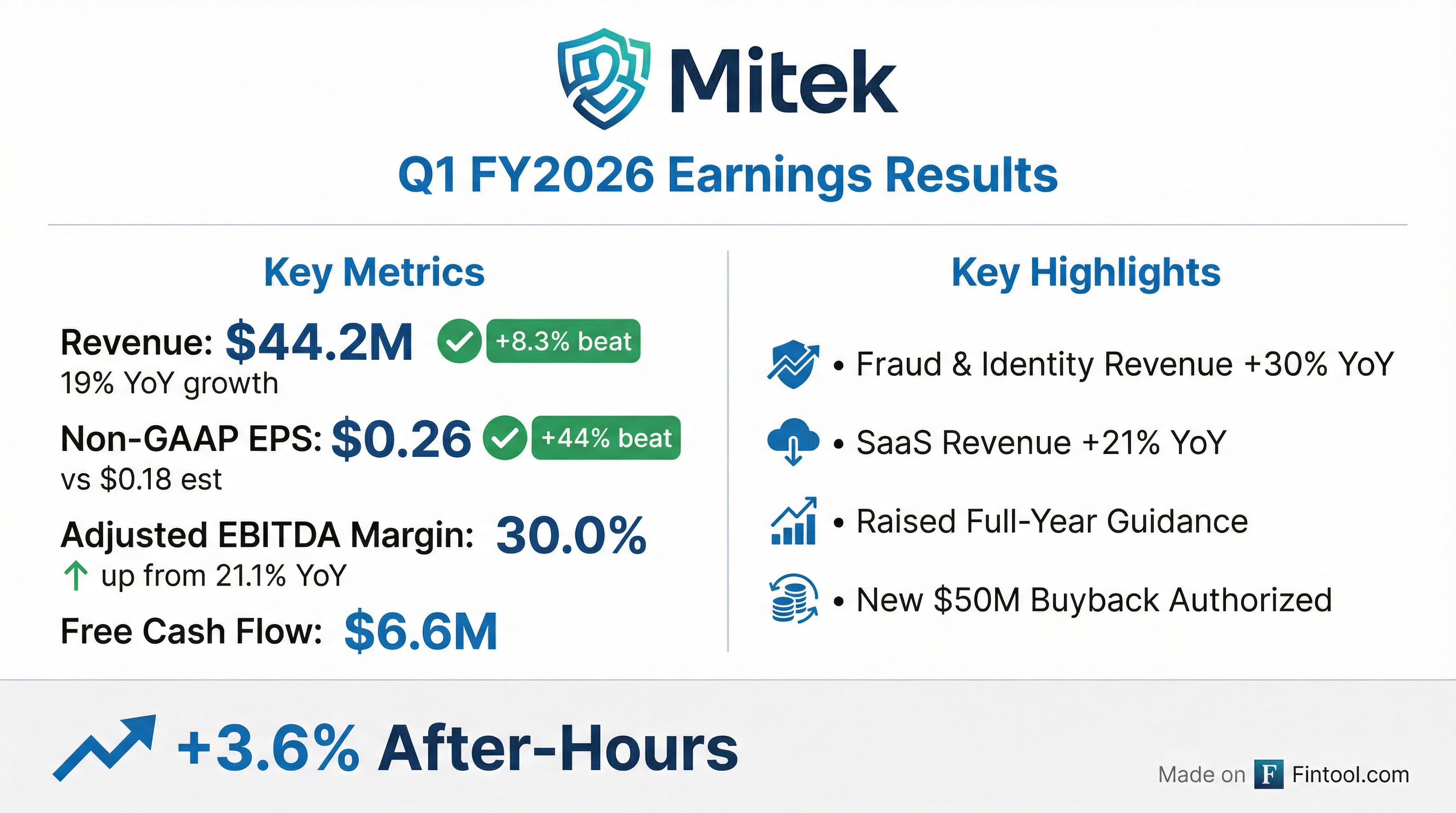

- Mitek Systems reported strong fiscal Q1 2026 financial results, with total revenue increasing 19% year-over-year to $44.2 million and Adjusted EBITDA growing 69% year-over-year to $13.3 million.

- The company raised its fiscal year 2026 revenue guidance to $187 million-$197 million and its Adjusted EBITDA margin guidance to 29%-32%, citing strong Q1 execution and improved visibility.

- Growth was primarily driven by the fraud and identity segment, which saw revenue increase 30% year-over-year to $25.5 million, with SaaS revenue growing 21%. The Check Fraud Defender (CFD) product's annualized contract value grew 44% year-over-year to approximately $17 million.

- Mitek announced a new $50 million share repurchase authorization after fully retiring its convertible senior notes, demonstrating a focus on disciplined capital allocation and shareholder value.

- Mitek reported Q1 FY26 Total Revenue of $44 million, marking a 19% year-over-year increase, with Fraud & Identity Solutions Revenue growing 30% to $25 million and SaaS Revenue increasing 21% to $22 million.

- For Q1 FY26, Adjusted EBITDA reached $13 million, up 69% year-over-year, with the Adjusted EBITDA Margin expanding by 900 basis points to 30.0%.

- The company ended Q1 FY26 with a net cash position of $33 million and authorized a $50 million share repurchase program.

- Mitek raised its Fiscal Year 2026 guidance, with Total Revenue now expected to be between $187 million and $197 million and Adjusted EBITDA Margin projected to be between 29% and 32%.

- Fraud & Identity Solutions continue to be a significant growth driver, representing 51% of LTM revenue and growing 18% year-over-year on an LTM basis to $96 million as of December 31, 2025.

- Mitek Systems reported strong fiscal Q1 2026 results, with total revenue increasing 19% year-over-year to $44.2 million and Adjusted EBITDA growing 69% year-over-year to $13.3 million, leading to adjusted EPS of $0.26 per diluted share.

- The company raised its fiscal year 2026 revenue guidance to $187 million-$197 million and its Adjusted EBITDA margin guidance to 29%-32%.

- Fraud and Identity revenue grew 30% year-over-year to $25.5 million, with SaaS revenue up 21%. Check Verification revenue increased 6% year-over-year to $18.8 million, maintaining stable annual transaction volumes of approximately 1.2 billion.

- Mitek announced a new $50 million share repurchase program and simplified its balance sheet by retiring $155 million in convertible senior notes.

- The Check Fraud Defender (CFD) product's annualized contract value reached approximately $17 million, a 44% year-over-year increase, with its datasets now covering over 50% of U.S. checking accounts.

- Mitek Systems reported strong Fiscal First Quarter 2026 financial results, with total revenue of $44.2 million, up 19% year-over-year, and Adjusted EBITDA of $13.3 million, up 69% year-over-year. Adjusted EPS grew approximately 80% year-over-year to $0.26 per diluted share.

- The company is raising its fiscal 2026 revenue guidance to a range of $187 million-$197 million and its Adjusted EBITDA margin guidance to 29%-32%.

- Fraud and Identity revenue grew 30% year-over-year to $25.5 million, with SaaS revenue in this segment growing 21%. Check Verification revenue was $18.8 million, up 6% year-over-year, maintaining an annual run rate of approximately 1.2 billion mobile deposit transactions.

- Mitek announced a new $50 million share repurchase program and simplified its balance sheet by retiring $155 million in convertible senior notes.

- Mitek Systems reported strong fiscal Q1 2026 financial results, with total revenue increasing 19% year-over-year to $44.2 million and a shift to GAAP net income of $2.8 million compared to a net loss in the prior year.

- The company raised its full-year fiscal 2026 guidance, now projecting total revenue between $187 million and $197 million and an Adjusted EBITDA margin of 29% to 32%.

- Mitek's Board of Directors authorized a new $50 million share repurchase program on February 5, 2026, which will become effective after the completion of the existing 2024 program, and the company repaid its $155.3 million Convertible Senior Notes in full on February 1, 2026.

- Mitek reported total revenue of $44.2 million for the first quarter ended December 31, 2025, marking a 19% increase year-over-year, and achieved GAAP net income of $2.8 million compared to a GAAP net loss in the prior year.

- Fraud and Identity revenue grew 30% year-over-year, driven by 21% SaaS growth.

- The company raised its fiscal year 2026 guidance, projecting total revenue between $187 million and $197 million and an Adjusted EBITDA margin of 29% to 32%.

- Subsequent to the quarter end, Mitek repaid $155.3 million in Convertible Senior Notes and authorized a new $50 million share repurchase program.

- Mitek closed Fiscal 2025 with $180 million in total revenue, a 4% year-over-year increase, driven by 15% growth in fraud and identity revenue to $90 million and a 21% acceleration in SaaS revenue, which now constitutes 43% of total revenue.

- The company achieved $54 million in Adjusted EBITDA for Fiscal 2025, representing a 30% margin, and generated $54 million in free cash flow, equating to 100% conversion of Adjusted EBITDA.

- Mitek ended Fiscal 2025 with a $40 million net cash position and repurchased $5 million in shares during the year, with an additional $7.7 million repurchased through December 10, 2025.

- For Fiscal 2026, Mitek expects revenue between $185 million and $195 million, implying approximately 6% growth at the midpoint, with Adjusted EBITDA margins projected to be in the 27%-30% range.

- The company also announced the full remediation of all previously reported material weaknesses in its internal controls.

- Mitek reported Q4 FY25 total revenue of $45 million and full-year FY25 total revenue of $180 million, both up 4% year-over-year.

- Fraud & Identity Solutions revenue grew 15% year-over-year to $90 million for FY25, now representing 50% of total revenue, while SaaS revenue increased 21% to $77 million for FY25, reaching 43% of total revenue.

- The company achieved FY25 Adjusted EBITDA of $54 million (30% margin) and generated $54 million in free cash flow, ending the year with a $40 million net-cash position.

- For Fiscal Year 2026, Mitek projects total revenue between $185 million and $195 million and Fraud & Identity Solutions revenue between $101 million and $105 million.

- Mitek Systems reported Q4 2025 total revenue of $44.8 million, a 4% increase year over year, driven by 19% SaaS revenue growth.

- For the full Fiscal Year 2025, total revenue reached approximately $180 million, growing 4% year over year, with fraud and identity revenue increasing 15% to $90 million.

- Adjusted EBITDA for FY 2025 grew 15% to $54 million, achieving a 30% margin, and free cash flow was $54 million, representing 100% conversion of adjusted EBITDA.

- The company forecasts Fiscal 2026 revenue between $185 million and $195 million, implying roughly 6% growth at the midpoint, with fraud and identity revenue projected to grow approximately 15%.

- Mitek expects Fiscal 2026 Adjusted EBITDA margins in the 27%-30% range due to strategic reinvestment and has fully remediated all material weaknesses in internal controls. The company also plans to pay off its $155 million convertible debt maturing in early 2026.

- Mitek Systems (MITK) reported Fiscal 2025 total revenue of $180 million, a 4% consolidated increase year-over-year, with Q4 2025 revenue at $44.8 million, also up 4% year-over-year.

- The company's SaaS revenue grew 21% in Fiscal 2025, now representing 43% of total revenue, and achieved $54 million in Adjusted EBITDA, a 30% margin.

- Mitek introduced a new reporting structure, disaggregating revenues into fraud and identity (which grew 15% to $90 million in Fiscal 2025) and check verification.

- For Fiscal 2026, Mitek projects total revenue of $185 million to $195 million (approximately 6% growth at the midpoint) and expects Adjusted EBITDA margins in the 27%-30% range, reflecting deliberate reinvestment.

Quarterly earnings call transcripts for MITEK SYSTEMS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more