MARKETAXESS HOLDINGS (MKTX)·Q4 2025 Earnings Summary

MarketAxess Beats on EPS as Stock Rallies 4.4% Despite Revenue Miss

February 6, 2026 · by Fintool AI Agent

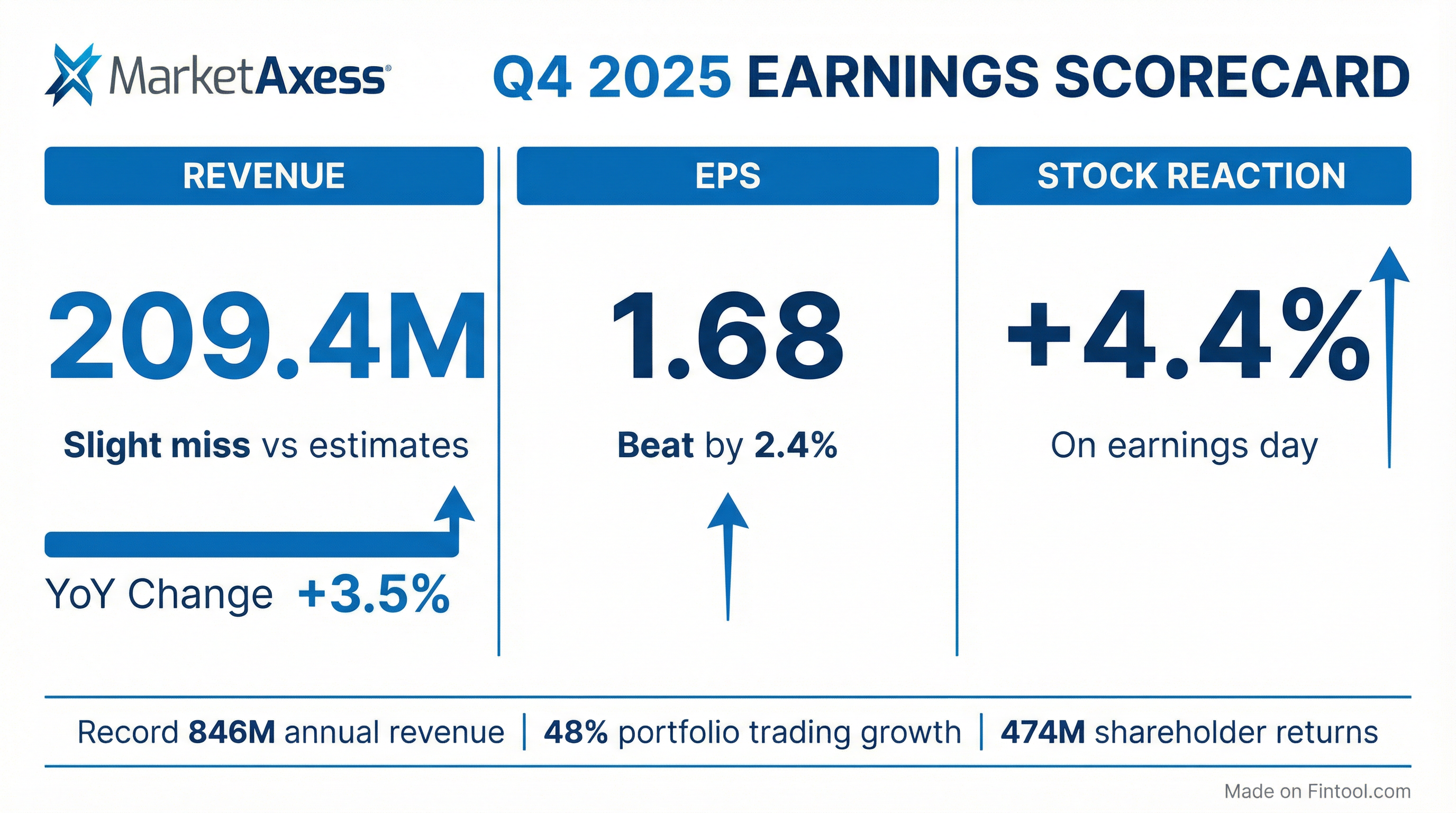

MarketAxess delivered a mixed Q4 2025, beating EPS estimates while slightly missing on revenue. The electronic bond trading platform posted adjusted EPS of $1.68, topping the $1.64 consensus by 2.4%. Revenue of $209.4 million came in 0.9% below the $211.4 million estimate, though it represented 3.5% year-over-year growth. Investors focused on the strong full-year results and strategic execution, pushing shares up 4.4% on earnings day.

Did MarketAxess Beat Earnings?

EPS Beat, Revenue Miss. The company delivered its ninth consecutive EPS beat, with adjusted earnings of $1.68 per share exceeding the $1.64 consensus. However, revenue came in slightly light at $209.4 million versus the $211.4 million estimate.

*Consensus estimates from S&P Global.

The GAAP EPS of $2.51 was significantly higher due to a one-time tax benefit from releasing a reserve that had been established in Q1 2025.

What Did Management Highlight?

CEO Chris Concannon emphasized 2025 as a "significant strides" year with record results across multiple metrics:

- Record revenue: $846 million for FY 2025

- Record free cash flow: $347 million

- Record trading volumes: Total credit ADV up 10%, rates ADV up 15%

- Shareholder returns: $474 million returned via buybacks ($360M) and dividends ($114M)

What Changed From Last Quarter?

Several key metrics showed meaningful shifts from Q3 2025:

The sequential EPS decline was driven by higher expenses (+8% YoY excluding notables), including strategic talent upgrades, consulting expenses for X-Pro development, and increased technology costs.

What's Driving Growth?

MarketAxess continues executing on three strategic channels:

1. Client-Initiated Channel

- Block trading ADV grew 24% to a record $5 billion

- U.S. credit block trading up 18%, emerging markets up 27%, eurobonds up 66%

2. Portfolio Trading Channel

- Total portfolio trading ADV surged 48% to record $1.4 billion

- U.S. credit portfolio trading market share reached 19%, up 270 basis points YoY

- U.S. high-yield portfolio trading share hit 22.8% in Q4

3. Dealer-Initiated Channel

- Dealer-initiated ADV grew 33% to $1.7 billion

- Mid-X matching protocol launched in the U.S. in September 2025 with 102% ADV growth

Key Performance Indicators

The company saw strong volume growth but U.S. credit market share slipped 40 basis points, a key focus area for 2026.

What Did Management Guide?

For FY 2026, management provided the following guidance:

The expense guidance reflects continued investment in technology, X-Pro platform, and strategic hires. Management did not provide specific revenue guidance.

How Did the Stock React?

The stock initially surged on the earnings release, hitting an intraday high of $168.28 (+3.3% from prior close of $162.83), before fading to close at $161.30 (-0.9%). The reversal may reflect profit-taking after the initial enthusiasm for the EPS beat and strong January metrics.

The stock is trading at $161.43, down 31% from its 52-week high of $232.84. Investors may remain cautious about fee capture compression and the 8% expense growth guidance outpacing revenue growth.

Capital Allocation

MarketAxess returned $474 million to shareholders in 2025:

- Share repurchases: $360 million (2.0 million shares)

- Dividends: $114 million ($0.78/share quarterly)

- ASR completion: Final delivery of 360K shares in early February 2026, bringing total to 1.7 million shares retired

- Remaining authorization: $205 million

The company ended Q4 with $679 million in cash, cash equivalents, and investments, with $220 million in borrowings under its credit facility related to the accelerated stock repurchase program.

Risks and Concerns

1. U.S. Credit Market Share Pressure Market share in U.S. credit (high-grade + high-yield) declined 40 basis points to 17.7%. Competition from Tradeweb and other platforms remains intense.

2. Fee Capture Compression Total credit fee capture declined 8% YoY due to protocol mix, partially offsetting the 11% growth in credit ADV.

3. Expense Growth Outpacing Revenue FY 2025 expenses grew 5% (excluding notables) while revenue grew 4%. The 2026 guidance for 8% expense growth could further pressure margins if revenue growth doesn't accelerate.

January 2026: Strong Momentum Continues

January 2026 data showed accelerating momentum across key initiatives:

CEO Chris Concannon noted that block trading now represents a third of credit volume in January, up from lower levels historically. The strong January was partially offset by a 92% increase in new-issue block activity, which temporarily pressured high-grade market share.

Q&A Highlights

Block Trading Momentum

Analyst Question (Patrick Moley, Piper Sandler): What's driving the 56% block growth and where is it coming from?

Chris Concannon: "A third of our credit volume is now in blocks during the month of January... The data is a key ingredient to our success in block. We are now able to price blocks based on their size and their direction."

Key block stats shared:

- High-grade blocks up 33% in January, high-yield up 42%

- EM blocks up 92%, eurobonds up 89%

- Multiple protocols driving growth: Targeted RFQ, automation, algos, MIDX, auctions

Fee Capture Dynamics

Analyst Question (Jeff Schmitt, William Blair): Is competitive pricing pressuring fee capture? What's assumed in medium-term targets?

Chris Concannon: Explained fee capture mechanics with an example:

- A $50,000 order generates $17 at $350 fee per million

- A $5 million block generates $700 at $140 fee per million

- "Much of the new initiatives that may come in at a lower fee per million are obviously growing revenue, incremental revenue."

CFO Ilene Fiszel Bieler: "We have not baked in any fee per million accretion" in three-year targets.

Emerging Markets Opportunity

Analyst Question (Alex Kramm, UBS): What's the EM roadmap and competitive landscape?

Chris Concannon: "The electronic penetration in EM is somewhere under 10% and growing... We're not seeing we're competing dramatically with chat and phone in the EM market."

EM January highlights:

- Record ADV over $5 billion (+50% YoY, +56% MoM)

- Block volumes up 92%, setting new record

AI Strategy and Data Moat

Analyst Question (Michael Cyprys, Morgan Stanley): What are your AI ambitions? What portion of flows is automatable?

Chris Concannon: Outlined a comprehensive AI strategy:

- Productivity gains: AI-assisted development and operations already in use

- Local market transparency: Using AI to create pricing transparency in opaque EM markets

- Portfolio construction: Clients provide exposures, AI suggests baskets for PT

- Trading signals: Pattern recognition across global markets before US opens

- Depth of liquidity: AI-powered insights into bond market depth

- Spread prediction: AI models predicting spread movement

On data strategy: "We made a strategic decision not to sell all of our data and to use it for things like trading solutions." The platform sees:

- 5.3 trillion in inquiry volume (up 13% YoY)

- 91 million prices

- $35 trillion in notional prices annually

Closing Auction Update

Analyst Question (Eli Abboud, Bank of America): Update on the closing auction initiative?

Chris Concannon: The closing auction launched on Pragma's tech stack in Q4 pilot phase, now rolled out broadly as of two weeks ago:

- 3 dealers supporting liquidity

- 11 buy-side clients active

- $2 billion in notional orders staged

- $900 million+ orders submitted

- 600+ participants on a recent webinar

- "Anchor dealers" now posting block-size liquidity

Management expects gradual ramp as clients adjust to the time-based protocol in late afternoon.

New Board Members

MarketAxess announced two new board members effective March 1, 2026:

- Doug Cifu: Deep fintech market structure and regulatory expertise from a major global market maker (Virtu Financial CEO)

- Ken Schiciano: Three decades in fintech and private equity

Key Themes for 2026

Management outlined several priorities for 2026:

- U.S. credit market share recovery through Targeted RFQ, automation, and new dealer-centric protocols

- Block market penetration: Converting phone and chat blocks to electronic, now ~50% of remaining opportunity

- MIDX momentum: Strong December and January performance with plans for multiple matches per day

- Closing auction buildout: Gradual ramp expected through 2026

- AI and data leverage: Commercializing proprietary data through AI-powered trading solutions

- Disciplined expense management while investing in growth initiatives

Data sources: MarketAxess Q4 2025 earnings call transcript , MarketAxess Q4 2025 earnings presentation , S&P Global estimates, market data.