Earnings summaries and quarterly performance for MARKETAXESS HOLDINGS.

Executive leadership at MARKETAXESS HOLDINGS.

Christopher Concannon

Chief Executive Officer

Christophe Roupie

Head of EMEA and APAC

Dean Berry

Group Chief Operating Officer and Chief Executive Officer, EMEA & APAC

Ilene Fiszel Bieler

Chief Financial Officer

Kevin McPherson

Chief Revenue Officer

Naineshkumar Panchal

Chief Information Officer

Scott Pintoff

General Counsel and Corporate Secretary

Board of directors at MARKETAXESS HOLDINGS.

Carlos Hernandez

Chairman of the Board

Emily Portney

Director

Jane Chwick

Director

Kourtney Gibson

Director

Nancy Altobello

Director

Richard Ketchum

Director

Roberto Hoornweg

Director

Stephen Casper

Director

Steven Begleiter

Director

William Cruger

Director

Research analysts who have asked questions during MARKETAXESS HOLDINGS earnings calls.

Eli Abboud

Bank of America

7 questions for MKTX

Patrick Moley

Piper Sandler & Co.

7 questions for MKTX

Michael Cyprys

Morgan Stanley

6 questions for MKTX

Alex Kramm

UBS Group AG

5 questions for MKTX

Chris O'Brien

Barclays

4 questions for MKTX

Christopher Allen

Citigroup

4 questions for MKTX

Kyle Voigt

Keefe, Bruyette & Woods

4 questions for MKTX

Simon Clinch

Redburn Atlantic

4 questions for MKTX

Alexander Blostein

Goldman Sachs

3 questions for MKTX

Dan Fannon

Jefferies & Company Inc.

3 questions for MKTX

Jeffrey Schmitt

William Blair

3 questions for MKTX

Alex Blostein

Goldman Sachs Group, Inc.

2 questions for MKTX

Benjamin Budish

Barclays PLC

2 questions for MKTX

Brian Bedell

Deutsche Bank

2 questions for MKTX

Chris Allen

Citi

2 questions for MKTX

Daniel Fannon

Jefferies Financial Group Inc.

2 questions for MKTX

Jeff Schmitt

William Blair & Company, L.L.C.

2 questions for MKTX

Patrick O'Shaughnessy

Raymond James

2 questions for MKTX

Rit Roy

Jefferies Financial Group Inc.

2 questions for MKTX

Aditya Sharma

Goldman Sachs

1 question for MKTX

Ben Budish

Barclays PLC

1 question for MKTX

Chris O’Brien

Barclays PLC

1 question for MKTX

Christopher Bryan

Barclays PLC

1 question for MKTX

Josh Smith

William Blair

1 question for MKTX

Simon Alistair Clinch

Redburn Atlantic

1 question for MKTX

Recent press releases and 8-K filings for MKTX.

- MarketAxess reiterated 3-year targets of 8-9% annual revenue growth and 75-125 bps margin expansion, supporting new client- and dealer-initiated protocols.

- Blocks protocol ADV increased 24% in 2025; U.S. blocks ADV rose 18%, EM 27%, and Eurobonds 66%, highlighting significant U.S. upside.

- Dealer-initiated trading advanced with the late-2025 Mid-X launch; sessions now run daily, handling $3.2 billion in January, with plans to add more.

- Automation and AI efforts include expanding Auto-X usage, integrating Pragma algos, launching CP+ with 5.3 trillion pricing inquiries in 2025, and developing AI Select for blocks.

- 2026 expense guidance is set at $530 M–$545 M (≈8% increase), leveraging $17 M of self-funded savings to invest in X-Pro enhancements, EM expansion, and protocol rollouts.

- MarketAxess reaffirmed three-year targets of 8–9% annual revenue growth and 75–125 bps margin expansion, driven by strategic rollouts of Blocks, Portfolio Trading, and Mid-X on its XPRO platform.

- The Mid-X dealer-initiated protocol, launched end-2025 in the US and expanded to daily sessions in January, achieved $3.2 billion in January volume, with plans to increase session frequency.

- Growth outside the US remains pivotal, notably in Emerging Markets where Blocks ADV rose 27%, Portfolio Trading 172%, and dealer volume 33% in 2025, highlighting opportunities in both hard-currency and local markets.

- Automation and AI initiatives include scaling Auto-X with Pragma algos and launching commercial AI products like CP+, which processed 5.3 trillion pricing inquiries in 2025, plus development of AI-powered dealer selection tools.

- For 2026, MarketAxess guided ex-notables expenses of $530–545 million with mid-single-digit services growth, while returning capital via a $300 million ASR, regular buybacks, and raising dividends to $0.78 per share .

- MarketAxess set three-year targets of 8%–9% annual revenue growth and improved margins.

- Key 2025 initiatives include Blocks protocol rollout in EU, EM and US pilots tapping large untapped block trading market ; Portfolio Trading US share reached 19% (+270 bps YoY), with high-yield share up to 15% ; and Mid-X dealer-initiated solution delivering $3.2 bn in January volume from one daily session.

- International expansion in Emerging Markets saw 27% ADV growth, 172% increase in Portfolio Trading, and 33% growth in dealer RFQ volumes, underscoring electronification opportunities.

- Continued innovation in automation and AI with Auto-X adoption including large-ticket trades; launched CP+ AI-driven pricing handling 5.3 tn inquiries in 2025; developing Smart Dealer Select for block trades.

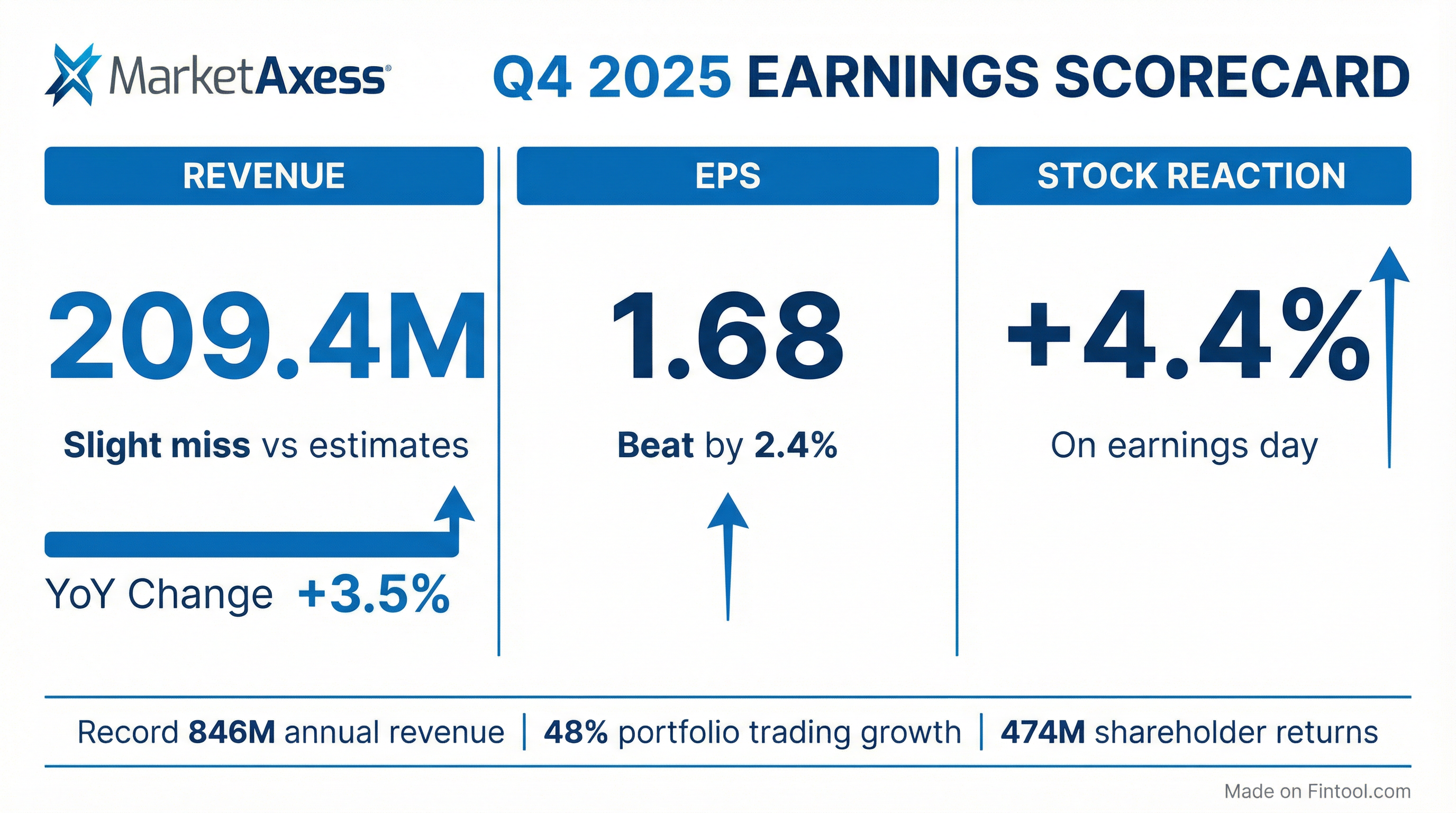

- Q4 revenue of $209 million (+3.5% YoY) and non-GAAP EPS of $1.68; full-year 2025 revenue of $846 million and record free cash flow of $347 million.

- Record trading activity in 2025: block trading ADV up 24% to $5 billion, global portfolio trading ADV up 48% to $1.4 billion, and dealer-initiated ADV up 33%.

- Returned $474 million to investors in 2025 via $360 million of share repurchases and $114 million in dividends.

- 2026 guidance: services revenue growth in the mid-single digits; total expenses (ex-notables) of $530–545 million; effective tax rate of 24–26%; capital expenditures of $65–75 million.

- MarketAxess delivered record FY 2025 revenue of $846 million (up 3% YoY) and GAAP EPS of $6.64

- In Q4 2025, total revenue rose 3.5% to $209 million, with commissions of $181 million (+4%) and services revenue of $28 million (+2%), driving net income of $92 million and EPS of $2.51

- Generated record free cash flow of $347 million in 2025 and returned $474 million to investors through $360 million in share repurchases and $114 million in dividends, ending with $679 million in cash and investments

- Issued FY 2026 guidance for mid-single digit services revenue growth, total expenses (ex-notable) of $530–545 million (~8% increase), effective tax rate of 24–26% and capex of $65–75 million

- MarketAxess delivered record full-year revenue of $846 million (+10% growth outside US credit) and $209 million in Q4 revenue (+3.5% YoY), with non-GAAP EPS of $1.68 in Q4.

- Full-year free cash flow reached $347 million, and the company held $679 million in cash and investments as of December 31, 2025.

- Returned $474 million to shareholders in 2025 via $360 million in share repurchases (including a completed $300 million ASR retiring 1.7 million shares) and $114 million in dividends; $205 million remains on repurchase authorization.

- 2026 guidance calls for mid-single-digit growth in services revenue, non-GAAP expenses of $530 million–$545 million, an effective tax rate of 24%–26%, and $65 million–$75 million in capital expenditures.

- Continued product momentum with 29% growth in block trading ADV, record portfolio trading ADV of $1.4 billion (+48%), and over $3 billion in December MIDX volume.

- Full-year 2025 revenue reached $846 million (+10% in non-US credit), underpinning record free cash flow of $347 million and reflecting strong ADV and commission growth.

- Q4 revenue totaled $209 million (+3.5% YoY), with non-GAAP EPS of $1.68 per share.

- Trading volumes in 2025 showed major gains: block trading ADV +24% to $5 billion, portfolio trading ADV +48% to $1.4 billion, and dealer-initiated ADV +33%.

- Total credit commission revenue was $165 million (+2%), with US high-yield +4%, emerging markets +6%, eurobonds +9%; meanwhile, non-GAAP expenses rose 8% and headcount fell to 869.

- Returned $474 million to shareholders via $360 million of buybacks and $114 million of dividends; ended Q4 with $679 million in cash and investments and increased the quarterly dividend to $0.78 per share.

- Entered into an Amended & Restated Credit Agreement extending its revolving credit facility maturity to February 2, 2029 with $750 million in commitments (plus a $375 million upsizing option), eliminated the 0.10% SOFR spread adjustment, and increased the cash netting limit to $200 million.

- Q4 2025 revenues of $209.4 million (+3.5% YoY) and net income of $92.4 million (EPS $2.51); full-year 2025 revenues of $846.3 million (+4% YoY) and net income of $246.9 million (EPS $6.64).

- Achieved record trading volumes in 2025: block trading ADV up 24% to $5 billion, portfolio trading ADV up 48% to $1.4 billion, and dealer-initiated ADV up 33% to $1.7 billion.

- Board authorized an additional $400 million share repurchase, commenced a $300 million accelerated share repurchase in December 2025 (1.98 million shares for $360 million), and declared a quarterly dividend of $0.78 per share.

- Record total revenues of $209.4 million in Q4 (+3.5%) and $846.3 million in FY2025 (+4%), including $406 million from growth outside U.S. credit.

- Diluted EPS of $2.51 in Q4 on net income of $92.4 million and $6.64 for FY2025 on net income of $246.9 million.

- Strong volume growth across strategic channels in Q4: block trading ADV +29%, portfolio trading ADV +41% to a record $1.5 billion, and dealer-initiated ADV +32% to $1.8 billion.

- Expanded shareholder returns with a $505 million buyback authorization (including a $300 million ASR commenced) and a quarterly dividend of $0.78 per share declared.

- 2026 outlook includes mid-single digit services revenue growth, non-GAAP expenses of $530–545 million, an effective tax rate of 24–26%, and capital expenditures of $65–75 million.

- Achieved 28% YoY growth in total credit ADV to $18.6 B and 19% YoY growth in total rates ADV to $29.1 B in January 2026.

- Emerging markets credit ADV rose 50% YoY to a record $5.5 B, driven by record hard currency (+28%) and local markets (+94%) ADV.

- Strategic channel momentum: block trading ADV up 56% to $3.7 B, portfolio trading ADV up 126% to $2.0 B, and dealer-initiated ADV up 13% to $1.8 B.

Fintool News

In-depth analysis and coverage of MARKETAXESS HOLDINGS.

Quarterly earnings call transcripts for MARKETAXESS HOLDINGS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more