ALTRIA GROUP (MO)·Q4 2025 Earnings Summary

Altria Q4 2025 Earnings: EPS Miss as E-Vapor Impairment Weighs; Guides 2026 Growth of 2.5-5.5%

January 29, 2026 · by Fintool AI Agent

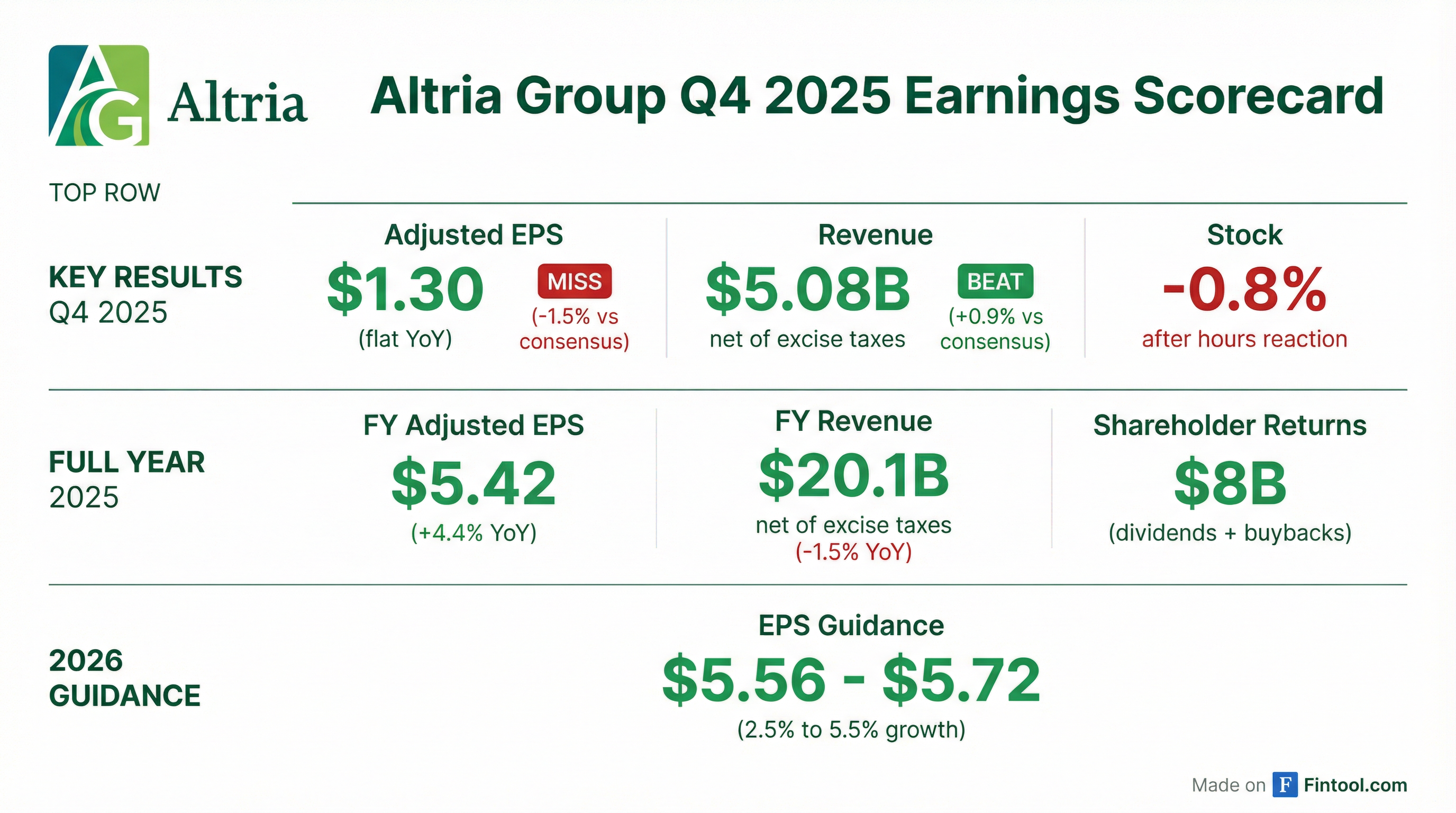

Altria (MO) reported Q4 2025 results that narrowly missed EPS estimates while beating on revenue. The tobacco giant delivered adjusted EPS of $1.30, flat year-over-year, against consensus expectations of $1.32—a slight miss that reflects the ongoing pressure from declining cigarette volumes and significant headwinds in its e-vapor business.

The quarter was overshadowed by a $1.3B non-cash impairment charge related to e-vapor goodwill and intangibles, as the NJOY ACE product remains excluded from the U.S. market due to ITC orders. For the full year, Altria grew adjusted EPS by 4.4% to $5.42, returning $8 billion to shareholders through dividends and buybacks.

Did Altria Beat Earnings?

Altria's adjusted EPS of $1.30 was unchanged from Q4 2024, driven by a lower adjusted tax rate (22.8% vs 24.1%) and fewer shares outstanding, offset by lower adjusted operating companies income. The gap between adjusted EPS ($1.30) and reported EPS ($0.66) reflects $1.3B in Q4 impairment charges.

For the full year:

The stark decline in reported EPS reflects the absence of the 2024 IQOS commercialization rights sale gain ($2.7B) and significantly higher non-cash impairments in 2025.

How Did the Stock React?

MO shares closed at $63.13 on January 28, down 0.58% heading into the report. In after-hours trading following the release, shares traded at $62.94, down an additional 0.3%.

The muted reaction reflects a market that was largely expecting the results—the slight EPS miss was offset by in-line guidance and continued shareholder return commitments. Altria shares have gained 25% over the past 12 months, outperforming the broader market as investors seek yield in an uncertain rate environment.

What Did Management Guide for 2026?

Altria issued 2026 adjusted diluted EPS guidance of $5.56 to $5.72, representing growth of 2.5% to 5.5% from the $5.42 base.

Key guidance assumptions:

- Growth expected to be weighted to the second half due to progressive cigarette import/export activity

- Adjusted effective tax rate: 22.5% to 23.5%

- Capital expenditures: $300M to $375M (up YoY to support contract manufacturing)

- NJOY ACE not expected to return to market in 2026

- Limited impact from illicit e-vapor enforcement on combustible/e-vapor volumes

The guidance midpoint of $5.64 implies ~4% growth, consistent with Altria's mid-single-digit EPS CAGR target through 2028.

What Changed From Last Quarter?

E-Vapor Impairment Deepens: Q4 brought an additional $1.3B in non-cash impairments (goodwill + intangibles) for the e-vapor segment, bringing full-year charges to $2.2B. The ITC exclusion order on NJOY ACE continues to block the product from U.S. sales.

ON! PLUS FDA Authorizations: In a positive development, Helix received FDA marketing authorizations in December 2025 for ON! PLUS products in mint, wintergreen, and tobacco flavors at 6mg and 9mg nicotine strengths. The 12mg variants remain under review.

CEO Transition: The Board elected Salvatore Mancuso (current CFO) to the Board effective January 29, 2026. He will become CEO following the May 2026 Annual Meeting.

Discount Shift Accelerates: The cigarette discount segment share reached 32.9% in Q4 (up 2.6pp YoY), reflecting consumer pressure from inflation and economic uncertainty. Marlboro retail share declined to 39.8% (down 1.5pp YoY).

What Are the Segment Trends?

Smokeable Products (86% of Adjusted OCI)

Cigarette volume declines of 7.9% (reported) or ~7% (adjusted for inventory) slightly outpaced industry declines of ~6.5%. Management attributed the elevated decline to illicit e-vapor growth and consumer income pressures.

For the full year, smokeable adjusted OCI grew 1.3% to $11.1B with margin expansion of 1.8pp to 63.4%, demonstrating the segment's pricing power despite volume headwinds.

Oral Tobacco Products (14% of Adjusted OCI)

The margin compression reflects higher SG&A costs and mix shift toward lower-margin on! nicotine pouches versus MST. For the full year, on! shipment volumes grew 10.9% to 177.8M cans.

Competitive pressure intensified: on!'s share of the U.S. oral tobacco category fell to 7.7% in Q4 (down 1.0pp YoY) as the nicotine pouch category grew to 56.9% of total oral. on!'s share of the nicotine pouch category dropped to 13.4% (down 5.3pp YoY).

E-Vapor Products

The segment recorded a $1.26B operating loss in Q4 2025, driven almost entirely by impairment charges. NJOY ACE remains blocked from the market, with management guiding it will not return in 2026.

Capital Returns and Balance Sheet

Altria returned $8 billion to shareholders in 2025:

- Dividends: $7.0B ($1.8B in Q4)

- Buybacks: $1.0B (17.1M shares at avg $58.50)

The company has $1B remaining under its $2B share repurchase program, which expires December 31, 2026.

Balance Sheet Metrics (Dec 31, 2025):

- Total Debt: $25.7B

- Cash: $4.5B

- Net Debt: $21.2B

- Debt-to-EBITDA: 2.0x (at target)

- Net Debt-to-EBITDA: 1.7x

The dividend yield remains compelling at approximately 6.7% based on the current share price and quarterly dividend of $1.06/share.

Key Quotes From Management

"2025 was a year of continued momentum for Altria, marked by strong financial performance, strategic progress across our smoke-free portfolio, new relationships in support of our long-term growth goals and significant cash returns to shareholders." — Billy Gifford, CEO

"We expect 2026 full-year adjusted diluted EPS growth to be weighted to the second half of the year, reflecting a progressive increase in cigarette import and export activity over the course of the year." — 2026 Guidance Commentary

Q&A Highlights

Duty Drawback Program and Investment Payback

Analysts pressed management on the import/export duty drawback program driving the elevated 2026 CapEx guidance ($300-375M). CFO Sal Mancuso confirmed the payback is less than one year and positions Richmond manufacturing for international markets:

"The return on investment for the import/export is very strong. The payback is less than a year... we're making investments today. They generally precede the volume." — Sal Mancuso, CFO

The investments include new pack configurations and track-and-trace capabilities for international markets. Management emphasized they "won't be at a competitive disadvantage" versus competitors with both domestic and international manufacturing.

Basic Strategy vs. Marlboro Erosion

Goldman Sachs' Bonnie Herzog pressed on Marlboro's retail share dipping below 40% for the first time. CEO Billy Gifford pushed back on the narrative that Basic is cannibalizing Marlboro:

"We're only deployed in roughly over 30,000 stores... with our analytics, we feel comfortable that it's not impacting or cannibalizing Marlboro in the marketplace." — Billy Gifford, CEO

Gifford characterized the Basic investment as targeting consumers under "severe economic pressure" who would otherwise go to deep discount brands. The strategy mirrors historical approaches with L&M. Management confirmed the ~30k store footprint is near the ceiling but they'll "make adjustments around the fringes."

ON! PLUS Pricing Strategy

Morgan Stanley asked about ON+ pricing positioning. Management confirmed a premium strategy:

"We do believe ON! PLUS is a differentiated product and commands a premium in the marketplace." — Billy Gifford, CEO

Notably, Altria is bucking competitive pricing trends. While competitors' average retail prices declined 3% sequentially and 12% YoY, ON! prices increased ~4% sequentially and 3% YoY. The national rollout is on track for H1 2026, resuming shipments in Florida, North Carolina, and Texas following FDA authorization.

Industry Dynamics Update

Management updated their cigarette category decomposition, now estimating cross-category impacts (primarily illicit e-vapor) contributed 2-3% to cigarette industry decline—down from the prior 3-4% estimate. The total nicotine space has shifted dramatically: smoke-free alternatives now represent over 50% of total nicotine consumption, up 5pp YoY.

Risks and Concerns

-

E-Vapor Strategy Uncertain: With $2.2B in 2025 impairments and NJOY ACE excluded, Altria's path in the largest growth category remains unclear. Management is "evaluating potential pathways" for a modified product.

-

Illicit E-Vapor Competition: Management cited illicit disposable e-vapor products as a key driver of cigarette volume declines. While enforcement has increased, sustained action is needed to materially impact the market.

-

Consumer Downtrading: The discount segment's growth to 32.9% of cigarettes signals persistent consumer pressure. This trend compresses margins as smokers shift from premium Marlboro to value brands.

-

on! Competitive Position: Losing share in the nicotine pouch category to Zyn and others despite ON! PLUS launch creates questions about Altria's ability to capture smoke-free growth.

Forward Catalysts

The Bottom Line

Altria delivered a quarter largely in line with subdued expectations—a slight EPS miss driven by flat year-over-year earnings as the company continues navigating cigarette volume declines and e-vapor headwinds. The full-year results were more constructive, with 4.4% adjusted EPS growth and $8B returned to shareholders demonstrating the defensive quality income investors seek.

The 2026 guidance of $5.56-$5.72 (+2.5-5.5%) is reasonable given the headwinds but sits below the "mid-single-digit CAGR" enterprise goal through 2028, suggesting acceleration will be needed in later years. The ON! PLUS FDA authorizations provide a path forward in nicotine pouches, but market share losses to Zyn raise execution questions.

For income-focused investors, Altria's 6.7% dividend yield and 60-year history of dividend increases remain the primary attraction. The stock's muted reaction suggests the market is comfortable with the story—steady cash generation funding generous returns despite a declining core business.

View the full Q4 2025 8-K filing and Q4 2025 Earnings Call Transcript for additional details.