Earnings summaries and quarterly performance for ALTRIA GROUP.

Executive leadership at ALTRIA GROUP.

William F. Gifford, Jr.

Chief Executive Officer

Heather A. Newman

Senior Vice President, Chief Strategy and Growth Officer

Jody L. Begley

Executive Vice President and Chief Operating Officer

Robert A. McCarter III

Executive Vice President and General Counsel

Salvatore Mancuso

Executive Vice President and Chief Financial Officer

Board of directors at ALTRIA GROUP.

Debra J. Kelly-Ennis

Director

Ellen R. Strahlman

Director

George Muñoz

Director

Ian L.T. Clarke

Director

Kathryn B. McQuade

Chair of the Board

M. Max Yzaguirre

Director

Marjorie M. Connelly

Director

R. Matt Davis

Director

Richard S. Stoddart

Director

Virginia E. Shanks

Director

Research analysts who have asked questions during ALTRIA GROUP earnings calls.

Bonnie Herzog

Goldman Sachs

8 questions for MO

Eric Serotta

Morgan Stanley

6 questions for MO

Matthew Smith

Analyst

6 questions for MO

Faham Baig

UBS Group

4 questions for MO

Damian McNeela

Deutsche Numis

3 questions for MO

Emma Rumney

Reuters

3 questions for MO

Gaurav Jain

Barclays

3 questions for MO

Mirza Faham Baig

UBS

3 questions for MO

Pallav Mittal

Barclays

2 questions for MO

Callum Elliott

Bernstein

1 question for MO

Gerald Pascarelli

Needham & Company

1 question for MO

Matthew Edward Smith

Stifel

1 question for MO

Matt Smith

Bank of America

1 question for MO

Mirza Faham Ali Baig

UBS Investment Bank

1 question for MO

Recent press releases and 8-K filings for MO.

- CEO Billy Gifford to retire in May, with CFO Sal Mancuso named successor.

- Oral tobacco category grew 12.5% in 2025; nicotine pouch volumes rose >40%, driving on! to 178 million cans (CAGR 58%), and on! PLUS national launch slated for H1 2026.

- Smokeable product segment adjusted OCI up $950 million over the past five years (CAGR 1.8%), with margins expanding 7 pp to 63.4% in 2025; industry cigarette volume decline moderated to 8%, with cross-category impacts of 2%–3%.

- Board raised quarterly dividend 3.9% to $1.06, with $1 billion remaining under the $2 billion share repurchase program; debt/EBITDA ratio at 2×.

- Combustible cigarette volumes fell from 11.2 billion packs in 2020 to 8.8 billion in 2025, while smoke-free alternatives grew—oral tobacco from 2.4 billion to 3.0 billion and e-vapor from 2.4 billion to 5.8 billion equivalent packs.

- Altria’s oral tobacco business posted on! volume gains from 18.2 million cans in 2020 to 177.8 million in 2025 (CAGR 57.8%) and Adjusted OCI rose to $1,835 million in 2025 (CAGR 1.3%).

- Illicit disposable e-vapor remains ~70% of the category, with U.S. disposable vaper counts at ~14.5 million in 2025, driving Altria to maintain a measured investment until the regulatory framework solidifies.

- The smokeable products segment achieved Adjusted OCI of $11,064 million in 2025 (1.8% CAGR) and margin expansion to 63.4%, led by Marlboro’s 59.4% share of the premium market and >95% loyalty.

- Altria highlighted its transition to a smoke-free portfolio, noting total equivalized nicotine volumes grew 2.5% in 2025 and by 2% CAGR over five years, with over 50% of the 55 million U.S. nicotine consumers using smoke-free products and 10 million former smokers fully transitioned.

- In oral tobacco, the category grew 12.5% in 2025, nicotine pouch volumes rose >40%, and on! volumes reached 178 million cans (CAGR ~58%); FDA-authorized on! PLUS (currently in FL, NC, TX, ~16% pouch volume) is slated for national rollout by mid-2026.

- The Ploom heated-tobacco system, developed with JT Group, has a combined PMTA/MRTPA filed with the FDA; consumer studies show 31% of users fully switched from cigarettes and 42% halved consumption.

- E-vapor grew ~15% in 2025, driven by illicit disposables (~70% share); enforcement actions and tariffs have moderated disposable-vaper growth to 8% (vs. >40% in 2024), prompting a measured investment approach until the regulatory framework strengthens.

- Traditional nicotine businesses remain cash engines: smokable segment adj. OCI grew $950 million over five years (CAGR 1.8%) with 63.4% margins in 2025; dividend was raised 3.9% to $1.06 (60th increase in 56 years), $1 billion remains in the share buyback program, and debt/EBITDA is 2×.

- CEO Billy Gifford to retire in May, succeeded by CFO Sal Mancuso, marking a leadership transition at Altria.

- Advancing smoke-free portfolio: national launch of on! PLUS in H1 2026, Ploom heated-tobacco PMTA/MRTPA filed, and a measured e-vapor pipeline under review.

- Strong smokable and oral segment performance: smokable adjusted OCI up >$950 M over past 5 years with margins at 63.4%, oral tobacco segment adjusted OCI CAGR of 1.3% and 178 M cans of pouches in 2025.

- Optimize and Accelerate initiative delivering >$600 M in savings, AI-enabled sales execution, and expanded import/export capabilities.

- Dividend raised 3.9% to $1.06, marking the 60th increase, with $1 B remaining in a $2 B repurchase program; debt/EBITDA at 2× year-end 2025.

- Altria participated in the Consumer Analyst Group of New York Conference, with CEO Billy Gifford and CFO Sal Mancuso outlining the company’s smoke-free portfolio and long-term growth strategy.

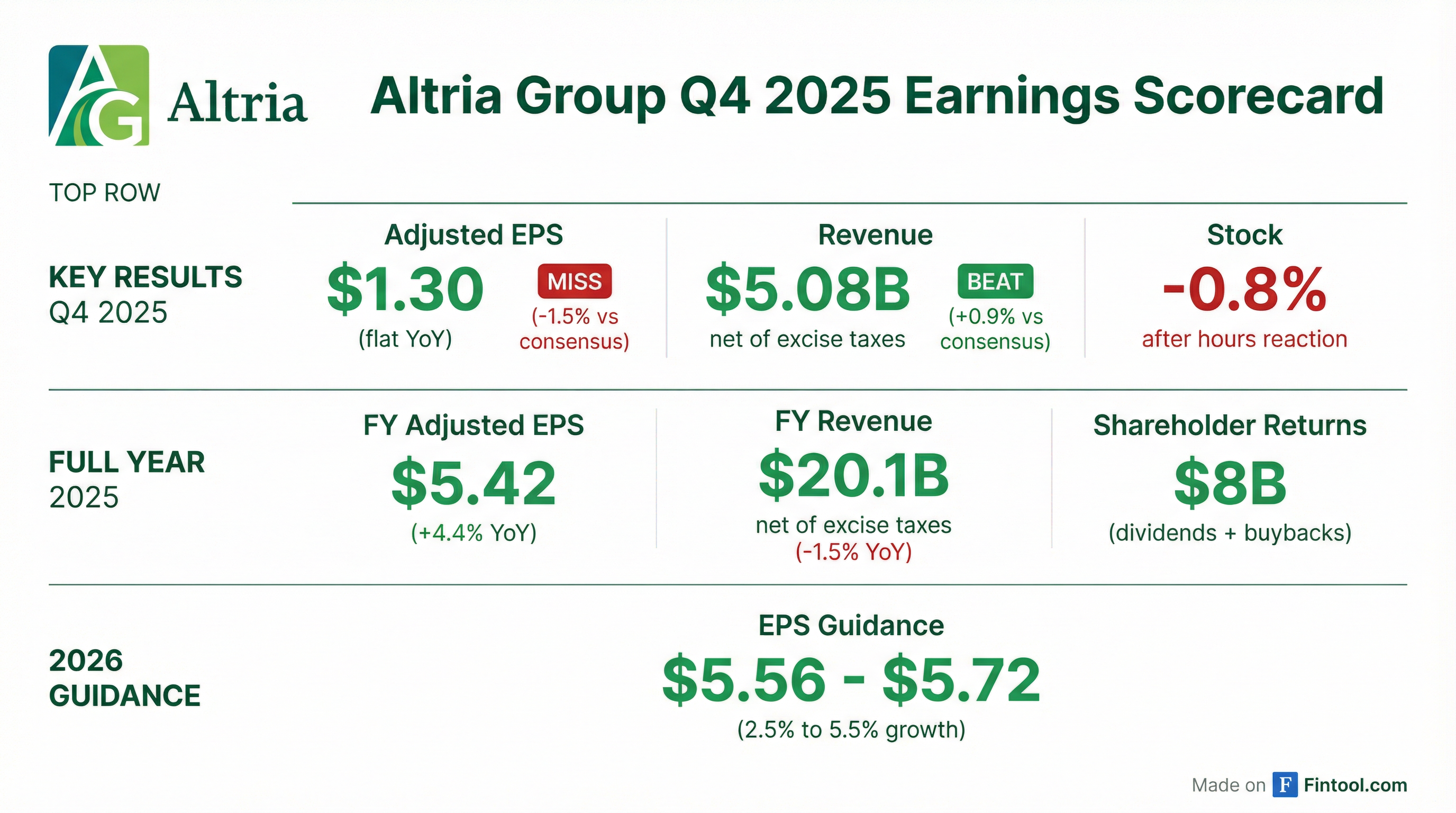

- The company reaffirmed 2026 full-year adjusted diluted EPS guidance of $5.56 to $5.72, implying 2.5% to 5.5% growth from a $5.42 base in 2025, with stronger earnings anticipated in the second half.

- Guidance assumes planned investments in contract manufacturing, limited volume impact from illicit enforcement, and that NJOY ACE will not return to market in 2026; excludes certain non-GAAP adjustments.

- Full-year 2025 adjusted diluted EPS of $5.42 (up 4.4%); Q4 non-GAAP EPS of $1.30

- 2026 adjusted EPS guided to $5.56–$5.72, implying modest, back-loaded growth

- Returned ~$8 billion to shareholders in 2025 via ~$7 billion of dividends and ~$1 billion of buybacks, while raising the dividend

- Cigarette volumes down ~10% in 2025, and next-generation products pressured by an e-vapor impairment and an NJOY import block

- CEO Billy Gifford to retire in May, succeeded by CFO Salvatore Mancuso

- Altria returned $8 billion to shareholders in 2025, comprising $7 billion in dividends and $1 billion in share repurchases; debt/EBITDA was 2.0× as of December 31, 2025.

- Full-year 2026 adjusted diluted EPS is guided to $5.56–$5.72, representing 2.5%–5.5% growth from the 2025 EPS of $5.42.

- Smokeable products segment full-year adjusted OCI rose 1.3% to $11,064 million in 2025; Q4 adjusted OCI fell 2.4% to $2,643 million.

- Q4 cigarette volume declines moderated, with Altria’s segment down 7.0% vs. -11.0% in Q4 2024; total industry decline was 6.5%.

- 2025 results: full-year adjusted EPS rose 4.4% and $8 billion returned to shareholders; Q4 domestic cigarette volumes declined 7.9% (7% adjusted) and Altria recorded a $1.3 billion e-vapor impairment

- 2026 guidance: full-year Adjusted Diluted EPS of $5.56–$5.72, up 2.5%–5.5%, with growth weighted to the second half reflecting import/export ramp and product investments

- Smoke-free portfolio: FDA authorized on! PLUS Mint, Wintergreen, and Tobacco; Helix full-year on! shipments grew 11% to 177 million cans; national on! PLUS rollout planned in H1 2026

- Capital allocation: $7 billion dividends (3.9% increase) and $1 billion share repurchase (17 million shares); $1 billion remaining under program; debt / EBITDA 2.0×

- Adjusted diluted EPS grew 4.4% to $5.42 in 2025; returned $8 billion to shareholders via dividends and share repurchases.

- 2026 EPS guidance of $5.56–$5.72, implying 2.5%–5.5% growth, weighted to H2 as import/export (duty drawback) and smoke-free investments ramp.

- Smokable product segment delivered > $11 billion in full-year adjusted OCI, with margins up 1.8 pp to 63.4%; Q4 adjusted OCI declined 2.4% and margins contracted to 60.4% amid higher manufacturing costs.

- Oral tobacco: on! shipment volumes rose 11% to 177 million cans in 2025, with full-year retail share at 8.2%; FDA authorized on! PLUS (6 mg & 9 mg) in December, with national launch planned H1 2026.

- Smoke-free alternatives represented > 50% of the total nicotine market; e-vapor grew ~15% in 2025 (illicit disposables ~70% share), and a $1.3 billion impairment was recorded on e-vapor intangibles in Q4.

- Full-year 2025 adjusted diluted EPS rose 4.4% and Altria returned $8 billion to shareholders, comprising $7 billion in dividends and $1 billion in share repurchases; dividend raised 3.9% marking the 60th increase in 56 years.

- Smokable products delivered $11 billion+ in adjusted OCI (63.4% margin, +1.8 ppt) for 2025; Q4 adjusted OCI declined 2.4% (60.4% margin, -0.8 ppt); domestic cigarette volumes down 7% Q4 and 9.5% FY (adjusted).

- Oral tobacco segment shipped 177 million cans in 2025 (↑11%), with adjusted OCI up 1.3% (67.9% margin) and on! retail share at 8.2%; FDA authorized on! PLUS in three variants in December, with national rollout in H1 2026.

- Recorded a $1.3 billion non-cash impairment on e-vapor intangible assets amid slower enforcement of illicit disposable e-vapor products.

- 2026 outlook: Adjusted diluted EPS guidance of $5.56–$5.72 (2.5%–5.5% growth), weighted to H2 reflecting increased import/export activity and planned smoke-free investments.

Quarterly earnings call transcripts for ALTRIA GROUP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more