MOLINA HEALTHCARE (MOH)·Q4 2025 Earnings Summary

Molina Healthcare Q4 2025 Earnings: Massive Miss, Stock Plunges 27%

February 6, 2026 · by Fintool AI Agent

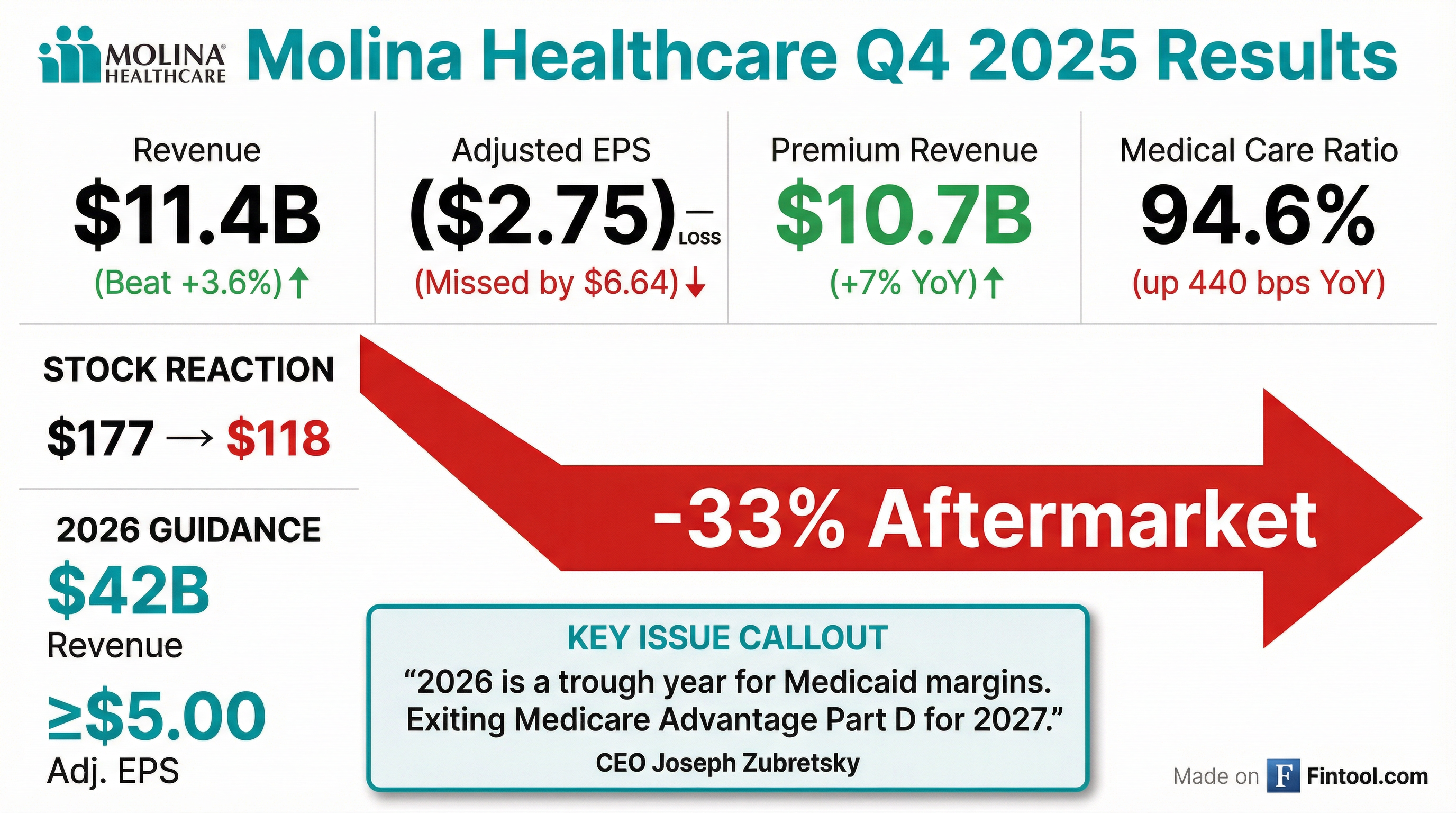

Molina Healthcare (MOH) reported a disastrous Q4 2025, swinging to an adjusted loss of ($2.75) per share versus consensus expectations. The stock cratered 27% to $128.87 on February 6, its worst single-session move in years. While revenue beat estimates by 4.3%, the massive earnings miss, elevated medical costs, and sharply reduced 2026 guidance spooked investors.

Did Molina Healthcare Beat Earnings?

No — and it wasn't close. Molina reported one of its worst quarters in company history:

The Q4 results were "approximately $3 below our expectations, with approximately $2 driven by unexpected retroactive premium items in California Medicaid, and the remainder due to continued trend pressure in Medicare and Marketplace."

For the full year, Molina earned adjusted EPS of $11.03 on premium revenue of $43 billion, representing 11% year-over-year growth.

How Did the Stock React?

MOH shares collapsed 27.1% on February 6, falling from $176.84 to $128.87 — wiping out over $2.4 billion in market cap in a single session.

This continues a brutal stretch for the stock:

The stock has now fallen 64% from its 52-week high of $359.97 and trades at just $6.98 billion market cap.

What Did Management Guide for 2026?

Management issued guidance that shocked investors with its severity:

The guidance is burdened by $2.50 per share of specific headwinds:

- $1.50/share: Florida CMS contract startup (one quarter at hot MCR + G&A prep)

- $1.00/share: Traditional MAPD underperformance (exiting for 2027)

Adjusting for these, underlying earnings are ~$7.50/share.

What Changed From Last Quarter?

Several significant developments mark a strategic pivot:

1. Exiting Medicare Advantage Part D (MAPD)

Molina announced it will exit the traditional MAPD product for 2027, stating: "We have determined that the MAPD product does not align with our strategic shift to focus exclusively on dual-eligible members in Medicare."

Excluding MAPD, the Medicare segment pre-tax margin is "closer to breakeven" versus the reported -1.7% guidance.

2. Medical Care Ratio Spike

The MCR deteriorated sharply across all segments:

The Q4 Medicaid MCR of 93.5% includes 160 bps of retroactive items. Adjusting for these, the MCR was 92.3% with a 2% pretax margin — "better than our expectation for the quarter."

3. Cash Flow Turned Negative

Operating cash flow for 2025 was an outflow of $535 million due to Medicaid risk corridor settlements, tax payment timing, and lower H2 operating performance.

4. Debt Covenants Amended

With 3.7x debt/EBITDA and 49% debt-to-cap at year-end, management "secured an agreement with our bank syndicate to appropriately amend these metrics."

What Did Management Say?

CEO Joe Zubretsky acknowledged the difficult environment but remained optimistic about the longer-term trajectory:

"We believe our 2026 forecast for Medicaid is the trough for managed Medicaid margins. In this margin trough, we expect that Molina Medicaid will produce a low single-digit margin, not losses, and that the market is underfunded by 300-400 basis points."

Key management points:

- 2026 is the trough: "There is little question that Medicaid rates and medical cost trends are imbalanced. We are confident in the outlook for this business and that rates and trend will eventually reach equilibrium."

- Industry-leading despite headwinds: "Many published reports indicate our Medicaid performance is industry-leading by 300-400 basis points in pre-tax margin."

- Embedded earnings now >$11/share: Updated from prior $8.65, adding $4.50 for Florida CMS and netting MAPD exit

- RFP win rate: 90% on renewals ($14B retained), 80% on new ($20B new revenue since growth strategy began)

- Investor Day: May 8, 2026 — will provide long-term goals and "detailed playbook for achieving our growth rates and maintaining industry-leading margins"

What Are the Key Risks Going Forward?

Near-Term Concerns

- Medicaid rate inadequacy: 4% rates vs 5% trend = continued margin compression

- OB3/Big Beautiful Bill: 2-4% annual membership impact over next 3 years on expansion population

- California pullback: Retro items assumed to continue in 2026 "out of conservatism"

- Medicare integrated product margins: First-year margins expected lower before reaching potential in years 2-3

Upside Catalysts

- Rate restoration cycle: "100 basis points on the Medicaid MCR is worth nearly $5 per share" — even 50-75 bps annual improvement is significant

- Trend moderation: 2025's 7.5% trend included 250 bps acuity shift now behind them

- Embedded earnings >$11/share: Florida CMS ($4.50), plus Georgia, Texas STAR CHIP (now 2027 go-live)

- M&A opportunities: "Perfect time to acquire revenue" — pursuing troubled single-state plans at book value

Segment Performance: FY 2025 vs 2026 Outlook

2026 Membership Guidance:

- Medicaid: 4.6M year-end (flat, organic contraction offset by Florida CMS go-live October 2026)

- Medicare: 230K (stable, product mix shift to integrated duals)

- Marketplace: 280K Q1 → 220K year-end (down 50%+ from 650K)

Balance Sheet Position

In November 2025, Molina closed an $850 million bond offering (senior notes due 2031) to repay term loans. "Based on our current guidance, we took action to address any issues with our debt covenants."

Historical Beat/Miss Record

Molina has struggled to meet estimates recently, missing in 4 of the last 5 quarters:

*Values retrieved from S&P Global

What Did Management Say on the Call?

On California Retroactive Items ($2/share hit)

CFO Mark Keim explained the two California issues totaling $135 million:

"On the corridor for the undocumented immigration status, normally, CMS has a rule that they can't put retro corridors in place... However, since this undocumented program in California is state-funded, the CMS restriction doesn't apply. On the risk adjustment, there was enough change in the population in LA that it was material to us."

The undocumented population (~180,000 members) used fewer services than expected, triggering a clawback. LA County saw dramatic membership churn requiring a risk adjustment true-up.

On Why 2026 is the "Trough"

CEO Joe Zubretsky outlined why he believes margins bottom this year:

"States are using a 2024 cost baseline. That baseline does not include the full impact of what we're calling the great inflection here over the last two years. When the 2025 cost baseline, fully developed, begins to be used as the baseline off of which to trend, rates will become stronger."

He noted discrete rating factors (LTSS, pharmacy, behavioral health) are "very transparent" and actuaries can debate costs in a "clinical and actuarial" fashion.

On Medical Cost Trend Assumptions (5%)

Zubretsky provided detailed trend breakdown for 2026:

"We didn't soften any of the current trends that we're experiencing in 2025... the 2026 number is fully loaded for all the supply and demand dynamics being experienced in the market."

On the Florida CMS Contract Win

The sole Children's Medical Services contract in Florida represents $6 billion in annual run rate premium:

"We believe it's accretive. We wouldn't have put $3 of ultimate run rate into our embedded earnings if that wasn't the case."

The $1.50/share drag in 2026 reflects startup costs (hiring before revenue), typical new program MCR run-hot, and initial reserve builds — not ongoing economics.

On Marketplace Membership (Down 50%+)

The conscious pullback is proceeding as planned:

Keim noted effectuation rates are running ~60% (vs 70-80% historically) and renewal retention is ~30% (vs 60% historically) as partially subsidized members see their new premiums.

Q&A Highlights

On exiting states (Joshua Raskin, Nephron): "No state where the regulatory environment is so unfriendly to managed care that we are contemplating an exit."

On OB3/Big Beautiful Bill (A.J. Rice, UBS): "Across the next three years, we see any place between 2% and 4% annual impact... but that's also before any influx of new members." Impact on expansion population (1.3M members, ~$8B premium) expected to be 15-20% over 3 years.

On membership attrition (Justin Lake, Wolfe): 2% attrition assumed for 2026 (vs 4% in 2025, 13% in 2024). Low/no user population already 5% smaller than two years ago — "mostly out of the system now."

On 100 bps = $5/share leverage: "Imagine an environment that improves rates versus trend by 50, 75, or 100 basis points a year for the next 2 or 3... Given the leverage effect of $32 billion of revenue, 100 basis points to the MCR in Medicaid for Molina is $5 a share."

On M&A pipeline: "This is the perfect time to acquire revenue... give me a property at book value, and I'm good to go, and we'll get it to target margins in our 2-3-year period."

This analysis is based on Molina Healthcare's Q4 2025 earnings release and conference call transcript filed February 6, 2026.

Related: