Earnings summaries and quarterly performance for MOLINA HEALTHCARE.

Executive leadership at MOLINA HEALTHCARE.

Joseph Zubretsky

President and Chief Executive Officer

Debra Bacon

Executive Vice President, Medicaid

James Woys

Chief Operating Officer

Jeff Barlow

Chief Legal Officer and Secretary

Mark Keim

Chief Financial Officer

Maurice Hebert

Chief Accounting Officer (Principal Accounting Officer)

Board of directors at MOLINA HEALTHCARE.

Research analysts who have asked questions during MOLINA HEALTHCARE earnings calls.

Andrew Mok

Barclays

8 questions for MOH

Justin Lake

Wolfe Research, LLC

8 questions for MOH

Ryan Langston

TD Cowen

8 questions for MOH

Joshua Raskin

Nephron Research

6 questions for MOH

Michael Ha

Robert W. Baird & Co.

6 questions for MOH

Sarah James

Cantor Fitzgerald

6 questions for MOH

Scott Fidel

Stephens Inc.

6 questions for MOH

Erin Wright

Morgan Stanley

5 questions for MOH

Kevin Fischbeck

Bank of America

5 questions for MOH

George Hill

Deutsche Bank

4 questions for MOH

John Stansel

JPMorgan Chase & Co.

4 questions for MOH

Stephen Baxter

Wells Fargo & Company

4 questions for MOH

Stephen Baxter

Wells Fargo

4 questions for MOH

A.J. Rice

UBS Group AG

3 questions for MOH

Albert Rice

UBS

3 questions for MOH

Jason Cassorla

Guggenheim Partners

3 questions for MOH

Lance Wilkes

Sanford C. Bernstein & Co., LLC

3 questions for MOH

Adam Ron

Bank of America Corporation

2 questions for MOH

A.J. Rice

UBS

2 questions for MOH

Ann Hynes

Mizuho Financial Group

2 questions for MOH

Josh Raskin

Nathron Research

2 questions for MOH

David Windley

Jefferies Financial Group Inc.

1 question for MOH

Hua Ha

Robert W. Baird & Co. Incorporated

1 question for MOH

Joanna Gajuk

Bank of America

1 question for MOH

Michael Hall

Robert W. Baird & Co. Incorporated

1 question for MOH

Recent press releases and 8-K filings for MOH.

- On February 4, 2026, Molina Healthcare entered into a First Amendment to its credit agreement, reducing the required minimum consolidated interest coverage ratio from 3.00:1.00 to 1.75:1.00 for each quarter ending March 31 through December 31, 2026, before gradually restoring it to 3.00:1.00 by Q4 2027.

- The company will record in Q1 2026 an estimated non-cash, pre-tax impairment charge of approximately $93 million related to intangible assets, due to exiting the Medicare Advantage Prescription Drug product for 2027; this charge will be excluded from adjusted net income.

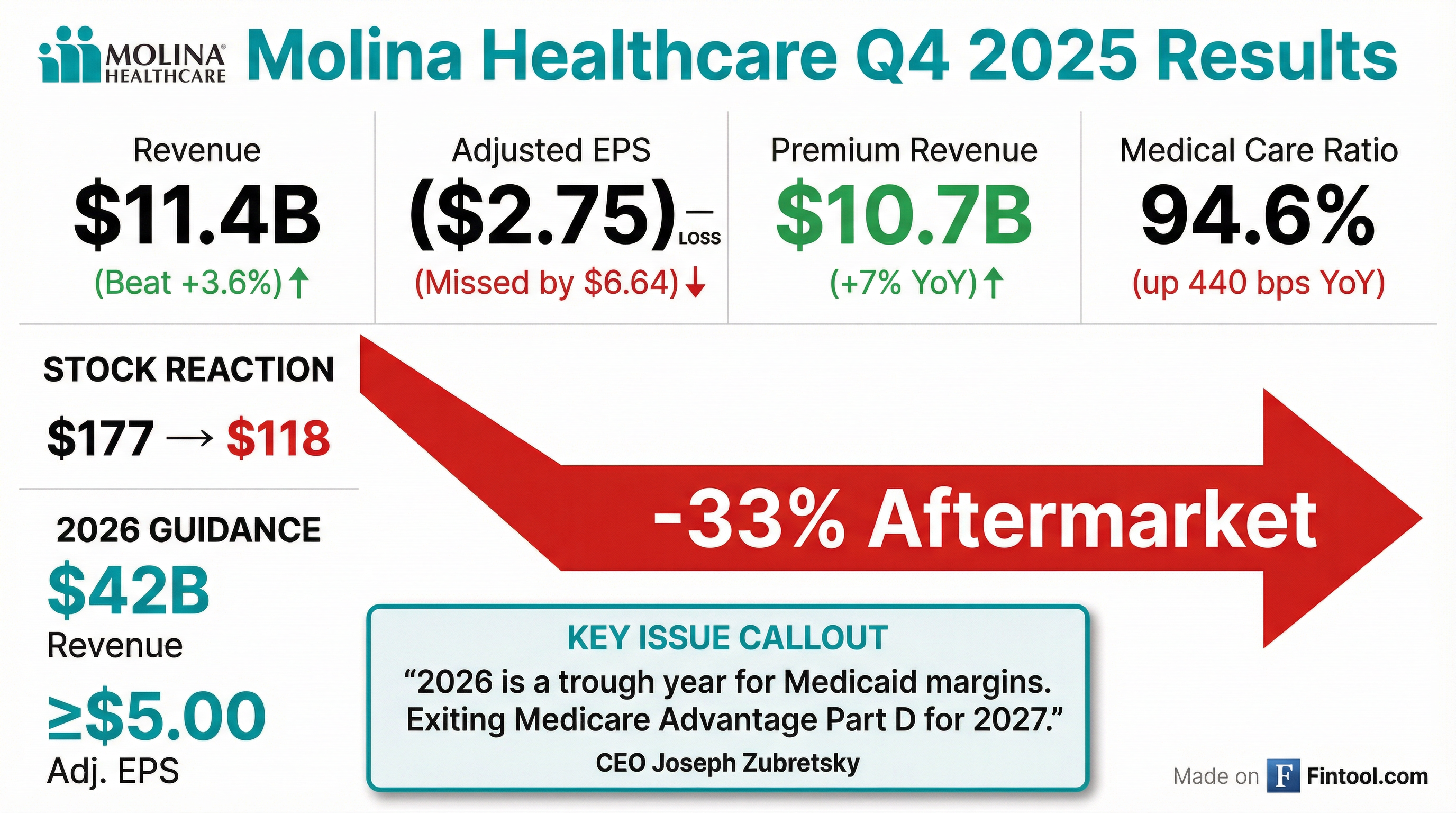

- Q4 adjusted loss per share of $2.75 on $10.7 billion of premium revenue; full year 2025 premium revenue was $43 billion, adjusted EPS $11.03, and pretax margin 1.6%.

- Q4 MCRs were 93.5% in Medicaid, 97.5% in Medicare, and 99% in Marketplace, with full year MCRs of 91.8%, 92.4%, and 90.6%, respectively, driven by elevated utilization and retroactive Medicaid rate actions.

- 2026 guidance calls for ~$42 billion of premium revenue and at least $5 of adjusted EPS (approximately $7.50 underlying), based on 4% Medicaid rate increases vs 5% medical cost trend; will exit traditional MAPD product in 2027.

- Secured key RFP wins including a $6 billion annual run-rate Florida CMS contract; maintains a $50 billion pipeline; closed an $850 million senior note issuance due 2031 and ended 2025 with aggregate RBC ratio of 305%.

- In Q4 2025, Molina reported an adjusted loss per share of $2.75 on $10.7 billion of premium revenue; MCRs were 93.5% in Medicaid, 97.5% in Medicare, and 99% in Marketplace.

- For FY 2025, premium revenue grew 11% YoY to $43 billion, with adjusted EPS of $11.03 and a 1.6% pretax margin, down from initial guidance of $24.50 EPS.

- Underperformance in Q4 and FY was driven by strong trend pressure in Medicare and Marketplace and $2 per share of retroactive Medicaid rate adjustments in California.

- 2026 guidance assumes $42 billion of premium revenue, at least $5.00 EPS (underlying ~$7.50 after a $2.50 headwind), with Medicaid rates of ~4% vs. trend of 5% and exit of the MAPD product.

- Growth initiatives include a $6 billion annual run rate Florida Children’s Medical Services contract, a 90% renewal and 80% new RFP win rate, a $50 billion active pipeline, and opportunistic M&A targeting underfunded plans.

- Molina reported a Q4 adjusted loss per share of $2.75 on $10.7 billion of premium revenue; full-year 2025 premium revenue was $43 billion (+11% y/y) with adjusted EPS of $11.03 and a 1.6% pretax margin.

- Medicaid medical cost ratio (MCR) was 93.5% in Q4 (restated to 92.3% after $2 per share retroactive items) yielding a 2.0% adjusted pretax margin; full-year Medicaid MCR was 91.8% with a 2.8% pretax margin.

- 2026 guidance calls for ~$42 billion of premium revenue and adjusted EPS of at least $5 (underlying ~$7.50), reflecting Medicaid MCR of 92.9% (1.2% pretax margin) and headwinds from the new Florida CMS contract and MAPD exit.

- Strong capital position with aggregate RBC of 305%, parent company cash of $223 million, debt at 3.7× EBITDA, and embedded earnings exceeding $11 per share.

- Q4 2025 GAAP loss per diluted share of $3.15 and adjusted loss per diluted share of $2.75; full-year 2025 GAAP EPS of $8.92 and adjusted EPS of $11.03.

- Full-year 2025 premium revenue of $43.05 billion, up 11% year-over-year, driven by acquisitions, rate increases, and organic growth.

- 2026 guidance: premium revenue of approximately $42.2 billion; GAAP EPS at least $3.20; adjusted EPS at least $5.00, including a $2.50 per share headwind from new Medicaid contracts and MAPD underperformance.

- Full-year 2025 medical care ratio (MCR) of 91.7% and GAAP G&A ratio of 6.6%, reflecting medical cost pressures and disciplined expense management.

- Molina posted a surprise Q4 net loss of about $160 million (≈$3.15/share) as medical costs surged, missing expectations.

- Shares plunged 27.9% to $127.43 after the company issued weak 2026 guidance, forecasting at least $5 adjusted EPS on $44.5 billion revenue and calling it a “trough year”.

- Full-year profit fell to $472 million from $1.2 billion, while revenue rose to $45.4 billion from $40.7 billion.

- Molina said it will exit traditional Medicare Advantage MAPD/Part D products in 2027 to focus on dual-eligible members.

- Class Period: February 5, 2025 to July 23, 2025; Lead Plaintiff Deadline: December 2, 2025.

- Complaint alleges defendants failed to disclose adverse medical cost trend assumptions, a dislocation between premium rates and medical costs, reliance on underutilized services, and that FY 2025 financial guidance was likely to be cut, rendering prior positive statements materially misleading.

- Investors wishing to serve as lead plaintiff must contact Bragar Eagel & Squire, P.C. by the deadline; more information available at the firm’s website.

- Class Period: February 5, 2025 to July 23, 2025

- Lead plaintiff deadline: December 2, 2025

- Complaint alleges failures to disclose material adverse facts on medical cost trends, premium rate dislocation, underutilization of key services, and likely FY 2025 guidance cut

- Investors are urged to contact Bragar Eagel & Squire to serve as lead plaintiff in the lawsuit

- Molina Healthcare closed the private offering of $850 million aggregate principal amount of 6.500% senior notes due 2031, sold under Rule 144A and Regulation S to qualified institutional buyers and certain non-U.S. persons.

- Interest on the notes is 6.500% per annum, payable semi-annually on February 15 and August 15 (commencing August 15, 2026); notes mature February 15, 2031.

- Net proceeds were approximately $838 million, to be used for general corporate purposes, including repayment of outstanding delayed draw term loans under the existing credit agreement.

- Kahn Swick & Foti, LLC and former Louisiana Attorney General Charles C. Foti, Jr. remind investors with losses in excess of $100,000 on Molina Healthcare securities acquired between February 5, 2025 and July 23, 2025 that they have until December 2, 2025 to file lead plaintiff applications in the class action lawsuit.

- The lawsuit, Hindlemann v. Molina Healthcare, Inc., alleges the company and certain executives failed to disclose material information during the class period.

- On July 23, 2025, Molina reported Q2 2025 GAAP net income of $4.75 per diluted share (down 8% year-over-year) and cut its full-year 2025 adjusted EPS guidance to no less than $19.00 per diluted share.

- Following this announcement, Molina’s shares fell $32.03 (16.84%) to close at $158.22 on July 24, 2025, on unusually heavy trading volume.

Fintool News

In-depth analysis and coverage of MOLINA HEALTHCARE.

Quarterly earnings call transcripts for MOLINA HEALTHCARE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more