Earnings summaries and quarterly performance for MARINE PRODUCTS.

Executive leadership at MARINE PRODUCTS.

Board of directors at MARINE PRODUCTS.

Research analysts who have asked questions during MARINE PRODUCTS earnings calls.

Recent press releases and 8-K filings for MPX.

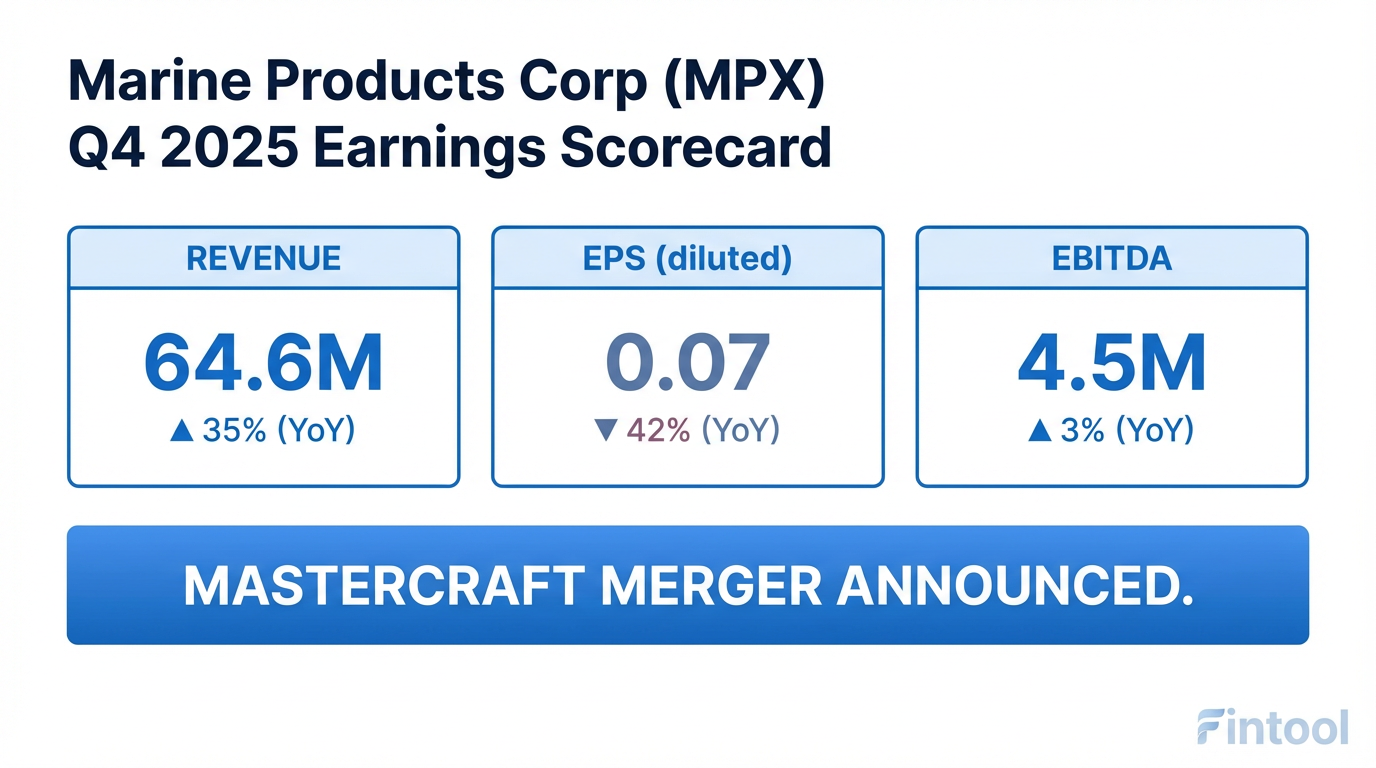

Marine Products Corporation Enters into Merger Agreement with MasterCraft Boat Holdings

MPX

M&A

Takeover Bid

- Marine Products Corporation (the "Company") has entered into an Agreement and Plan of Merger with MasterCraft Boat Holdings, Inc. (the "Parent") and its wholly-owned subsidiaries, Titan Merger Sub 1, Inc. and Titan Merger Sub 2, LLC, dated February 5, 2026.

- The agreement outlines a two-step business combination where Marine Products Corporation will first merge into Titan Merger Sub 1, Inc., and then immediately merge into Titan Merger Sub 2, LLC, with Titan Merger Sub 2, LLC continuing as the surviving company.

- The Parent Board has unanimously approved the transactions, including the Mergers and the issuance of Parent Common Shares, and has recommended that Parent's stockholders approve the Parent Common Share Issuance.

- For U.S. federal income tax purposes, the Mergers are intended to constitute a single, integrated transaction that qualifies as a "reorganization" within the meaning of Section 368(a)(1)(A) of the Code.

1 day ago

Marine Products Corporation Announces Q4 and Full Year 2025 Results and Acquisition by MasterCraft

MPX

Earnings

M&A

- Marine Products Corporation reported Q4 2025 net sales of $64.6 million, a 35% increase year-over-year, and full-year 2025 net sales of $244.4 million, up 3% year-over-year.

- Q4 2025 net income was $2.4 million (diluted EPS of $0.07), a 45% decrease year-over-year, while full-year 2025 net income was $11.4 million (diluted EPS of $0.32), down 36% year-over-year.

- MasterCraft Boat Holdings, Inc. announced its acquisition of Marine Products Corporation in a cash and stock transaction valued at approximately $232.2 million, net of acquired cash.

- Marine Products shareholders will receive $2.43 in cash and 0.232 shares of MasterCraft common stock per share, representing an implied value of $7.79 per Marine Products share as of February 4, 2026.

- The acquisition, unanimously approved by both companies' Boards, is anticipated to close in the second calendar quarter of 2026 and be accretive to adjusted EPS in Fiscal 2027.

1 day ago

Marine Products Corporation Reports Q4 and Full Year 2025 Financial Results

MPX

Earnings

M&A

Dividends

- Net sales for Q4 2025 increased 35% year-over-year to $64.6 million, and for the full year 2025, they increased 3% year-over-year to $244.4 million.

- Net income for Q4 2025 decreased 45% year-over-year to $2.4 million, with diluted EPS of $0.07, while full year 2025 net income decreased 36% year-over-year to $11.4 million, with diluted EPS of $0.32.

- The company ended Q4 2025 with $43.5 million in cash and cash equivalents and no debt.

- Adjustments to net income and EPS for Q4 and Full Year 2025 were primarily due to taxes on company-owned life insurance policies liquidated as part of a previously announced dissolution of a non-qualified supplemental retirement income plan.

- Marine Products Corporation also announced a joint announcement with MasterCraft Boat Holdings, Inc., and will not be hosting a conference call to discuss these results.

2 days ago

MPX Announces Q3 2025 Financial Results

MPX

Earnings

Demand Weakening

Product Launch

- Net sales for Q3 2025 increased by 7% year-over-year to $53.1 million, however, net income decreased by 22% to $2.7 million, leading to diluted Earnings Per Share (EPS) of $0.07.

- EBITDA for Q3 2025 was $3.7 million, a 15% decrease year-over-year, with the EBITDA margin falling 170 basis points to 6.9%. The decline in net income was partly attributed to higher R&D investments related to new products and cost true-ups.

- Management expressed cautious optimism that the industry has reached a turning point as dealer inventory has adjusted to stabilizing demand, noting strong interest in larger boats and positive feedback on 2026 model year offerings, despite continued restraint from finance buyers.

- The company maintains a strong balance sheet with approximately $47.4 million in cash and no debt as of the end of Q3 2025.

Oct 30, 2025, 12:00 PM

Marine Products Corporation Reports Q3 2025 Results

MPX

Earnings

Revenue Acceleration/Inflection

- Marine Products Corporation (MPX) reported a 7% increase in third-quarter sales compared to the prior year, marking the first quarter of year-over-year growth in over two years.

- Gross profit for Q3 2025 increased 11% to $10.2 million, with the gross profit percentage rising by 80 basis points to 19.2%.

- Diluted EPS for the third quarter was $0.07, down from $0.10 in the prior year, and EBITDA decreased 15% to $3.7 million.

- The company maintained a strong financial position, ending Q3 2025 with $47.4 million in cash and no debt, while reducing field inventory by 6% year-over-year.

Oct 30, 2025, 12:00 PM

Marine Products Corporation Reports Q3 2025 Financial Results and Declares Dividend

MPX

Earnings

Dividends

- Marine Products Corporation reported a 7% increase in net sales, reaching $53.1 million for the third quarter ended September 30, 2025.

- Net income for Q3 2025 was $2.7 million, representing a 22% decrease year-over-year, with diluted Earnings Per Share (EPS) of $0.07. This decline was primarily attributed to higher R&D investments related to new products and cost true-ups.

- EBITDA for the quarter was $3.7 million, a 15% decrease compared to the prior year period.

- The company maintained a strong balance sheet, ending Q3 2025 with approximately $47.4 million in cash and no outstanding debt.

- A regular quarterly dividend of $0.14 per share was declared, payable on December 10, 2025.

Oct 30, 2025, 10:45 AM

Marine Products Corporation Reports Q3 2025 Financial Results and Declares Quarterly Dividend

MPX

Earnings

Dividends

Demand Weakening

- Marine Products Corporation reported net sales of $53.1 million for the third quarter ended September 30, 2025, representing a 7% increase year-over-year.

- Net income was $2.7 million, a 22% decrease year-over-year, with diluted Earnings Per Share (EPS) of $0.07.

- The company concluded Q3 2025 with approximately $47.4 million in cash and no debt.

- A regular cash quarterly dividend of $0.14 per share was declared, payable on December 10, 2025.

- Management expressed cautious optimism regarding a turning point in the industry, noting adjusted dealer inventory and strong interest in new model year offerings, although finance buyers remain restrained.

Oct 30, 2025, 10:45 AM

Quarterly earnings call transcripts for MARINE PRODUCTS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more