Earnings summaries and quarterly performance for Merck & Co..

Executive leadership at Merck & Co..

Robert M. Davis

Chief Executive Officer and President

Betty Larson

Executive Vice President and Chief Human Resources Officer

Caroline Litchfield

Executive Vice President and Chief Financial Officer

Dean Li

Executive Vice President and President, Merck Research Laboratories

Richard R. DeLuca, Jr.

Executive Vice President and President, Merck Animal Health

Board of directors at Merck & Co..

Christine E. Seidman, M.D.

Director

Douglas M. Baker, Jr.

Director

Inge G. Thulin

Director

Kathy J. Warden

Director

Mary Ellen Coe

Director

Pamela J. Craig

Director

Patricia F. Russo

Director

Paul B. Rothman, M.D.

Director

Risa J. Lavizzo-Mourey, M.D.

Director

Stephen L. Mayo, Ph.D.

Director

Surendralal L. Karsanbhai

Director

Thomas H. Glocer

Lead Independent Director

Research analysts who have asked questions during Merck & Co. earnings calls.

Mohit Bansal

Wells Fargo & Company

7 questions for MRK

Umer Raffat

Evercore ISI

7 questions for MRK

Akash Tewari

Jefferies

6 questions for MRK

Daina Graybosch

Leerink Partners

6 questions for MRK

James Shin

Analyst

6 questions for MRK

Christopher Schott

JPMorgan Chase & Co.

5 questions for MRK

Vamil Divan

Guggenheim Securities

5 questions for MRK

Evan Seigerman

BMO Capital Markets

4 questions for MRK

Steve Scala

Cowen

4 questions for MRK

Terence Flynn

Morgan Stanley

4 questions for MRK

Trung Huynh

UBS Group AG

4 questions for MRK

Alexandria Hammond

Wolfe Research

3 questions for MRK

Carter L. Gould

Barclays

3 questions for MRK

Courtney Breen

AllianceBernstein

3 questions for MRK

Alex Hammond

Sidoti & Company, LLC

2 questions for MRK

Asad Haider

Goldman Sachs

2 questions for MRK

Chris Schott

JPMorgan Chase & Company

2 questions for MRK

Geoff Meacham

Citigroup Inc.

2 questions for MRK

Geoffrey Meacham

Citi

2 questions for MRK

Luisa Hector

Berenberg

2 questions for MRK

Tim Anderson

Bank of America

2 questions for MRK

Timothy Anderson

BofA Securities

2 questions for MRK

Chris Shibutani

Goldman Sachs Group, Inc.

1 question for MRK

Louise Chen

Cantor Fitzgerald

1 question for MRK

Recent press releases and 8-K filings for MRK.

- FDA approves NUMELVI (atinvicitinib), the first second-generation JAK inhibitor for control of pruritus in dogs six months and older; availability expected in spring 2026.

- Once-daily treatment with high JAK1 selectivity (>10× vs JAK2, JAK3, TYK2), offering a favorable safety profile and reducing itch from the first dose.

- Designed for convenience: treats dogs weighing as little as 4.4 lb, requires no vaccination schedule adjustments, and features a stable formulation with extended shelf life.

- Addresses a significant market need, as skin conditions account for up to 20 % of cases in general veterinary practice and negatively impact animal and owner quality of life.

- Doravirine/islatravir (DOR/ISL), Merck’s once-daily two-drug regimen, met primary endpoints in three Phase 3 trials with non-inferior efficacy and a comparable safety profile in both treatment-naïve and switch patients.

- In the MK-8591A-053 trial, DOR/ISL achieved 91.8% viral suppression at week 48 versus 90.6% for the comparator BIC/FTC/TAF.

- Two additional trials (MK-8591A-052 and MK-8591A-051) showed DOR/ISL maintained durable viral suppression through week 96.

- The Phase 3 data support Merck’s New Drug Application for DOR/ISL, with an FDA target action date of April 28, 2026.

- Doravirine is already approved in the U.S. for HIV-1 treatment, providing an established safety profile for the combination.

- Merck presented Phase 3 results for investigational doravirine/islatravir (DOR/ISL) showing non-inferior viral suppression at Week 48 versus BIC/FTC/TAF (91.8% vs. 90.6%; treatment difference 1.2%) in treatment-naïve adults, with similar safety profiles (drug-related AEs 14% vs. 18%; discontinuations 1.1% vs. 2.2%).

- DOR/ISL maintained high rates of virologic suppression through Week 96 in both treatment-naïve and switch trials, with no new safety signals and comparable discontinuation rates.

- The U.S. FDA has set a PDUFA target action date of April 28, 2026 for the DOR/ISL New Drug Application, potentially expanding Merck’s HIV treatment portfolio.

- Second-season Phase 3 SMART trial data show ENFLONSIA (clesrovimab) was well tolerated in children under 2 at increased risk for severe RSV, with safety profiles consistent with season 1 and no drug-related serious adverse events reported.

- Pharmacokinetic exposures in season 2 participants matched levels seen in healthy infants from the pivotal CLEVER trial, supporting efficacy extrapolation for the second RSV season.

- Through Day 180 (6 months) in season 2, RSV-associated medically attended lower respiratory infection and hospitalization rates were 7.3% and 3.0%, respectively, reflecting higher baseline risk post-pandemic.

- Merck plans to submit these findings to the FDA and other regulators to seek an expanded indication for ENFLONSIA in children entering their second RSV season; the antibody is already approved for first-season use in the U.S., Canada and select markets.

- Merck and Mayo Clinic launch a research and development collaboration to apply AI and advanced analytics in drug discovery and precision medicine.

- Merck will integrate Mayo Clinic Platform’s de-identified clinical and genomic datasets, advanced AI tools and analytics to improve target identification and early development decisions.

- The collaboration initially targets high-need areas: IBD, atopic dermatitis, and multiple sclerosis.

- This represents Mayo Clinic’s first large-scale strategic collaboration with a global biopharmaceutical company.

- Poxel generated consolidated revenue of €5.0 million in FY 2025, down from €6.6 million in FY 2024

- Fourth-quarter TWYMEEG® gross sales in Japan rose 15% sequentially and 40% year-on-year, with royalties at 10% in Q1/Q4 and 8% in Q2/Q3 (including retroactive adjustments)

- Cash and cash equivalents totaled €0.9 million as of December 31, 2025, up from €0.6 million at September 30, 2025

- Lyon Commercial Court approved Poxel’s continuation plan on January 22, 2026, ending its judicial reorganisation proceedings

- Poxel expects double-digit royalty growth on TWYMEEG® sales in 2026 under its recovery plan

- Chinese prosecutors have charged an AstraZeneca subsidiary and former China head Leon Wang with unlawful data collection, illegal trade and medical insurance fraud, consolidating November 2025 indictments into a single proceeding.

- Authorities allege about 24 million yuan (≈$3.5 million) in unpaid import taxes on cancer drugs Imfinzi, Imjudo and Enhertu, which AstraZeneca contends it prepaid.

- China accounted for about 11% of AstraZeneca’s $58.7 billion revenue in 2025, underscoring the market’s materiality amid legal uncertainty.

- Following the indictments, AstraZeneca has overhauled its China leadership, appointing a new international executive vice president, and reaffirmed a $15 billion investment pledge in the region.

- Helus Pharma appoints Michael Cola as CEO to lead its next phase of CNS-focused R&D and commercialization executing key pipeline milestones.

- Cola brings over 30 years of experience in neuroscience, rare diseases and specialty pharmaceuticals, including senior roles at Shire, Astra-Merck, AstraZeneca and Avalo Therapeutics.

- Under his leadership, Helus will advance key clinical programs—processing upcoming HLP004 II data and planning for HLP003 III topline results in Q4 2026—while strengthening its global 350+ patent portfolio.

- Helus Pharma appoints Michael Cola as CEO, effective immediately.

- Cola brings 30+ years of experience in neuroscience and specialized pharmaceuticals, including leadership at Shire’s Specialty Pharmaceutical division, Astra-Merck and AstraZeneca.

- He led Shire’s market cap growth from $5 billion to $20 billion and the expansion of Vyvanse into a multibillion-dollar franchise.

- Helus expects Phase 2 HLP004 data this quarter and Phase 3 HLP003 top-line data in Q4 2026, while focusing on global regulatory engagement and long-term commercial planning.

- The company holds a robust IP portfolio with 350+ patent applications pending and 100+ patents granted worldwide.

- Microbiotica’s oral precision microbiome therapy MB310 met primary and secondary endpoints in 29 ulcerative colitis patients, showing a safety profile comparable to placebo and successful engraftment of all eight bacterial strains.

- In the intention-to-treat analysis, 63.2% (12/19) of MB310-treated patients achieved clinical remission versus 30.0% (3/10) on placebo, with all responders remaining in remission and resolving rectal bleeding during follow-up.

- The trial demonstrated improvements in histological markers of mucosal damage and reductions in inflammatory biomarkers, including fecal calprotectin, suggesting a potential disease-modifying mechanism via gut barrier restoration and immune regulation.

- Microbiotica plans an adaptive Phase 2/3 program combining MB310 with standard anti-inflammatory or immunomodulatory agents and is evaluating partnering and financing options for late-stage development and commercialization.

- Investors IP Group and Flerie hold undiluted stakes of approximately 16.7–17% (valued at ~£13.9 million) and 10%, respectively, underscoring strong backing if larger trials confirm these findings.

Fintool News

In-depth analysis and coverage of Merck & Co..

Merck Splits Pharma Division as $30B Keytruda Cliff Looms

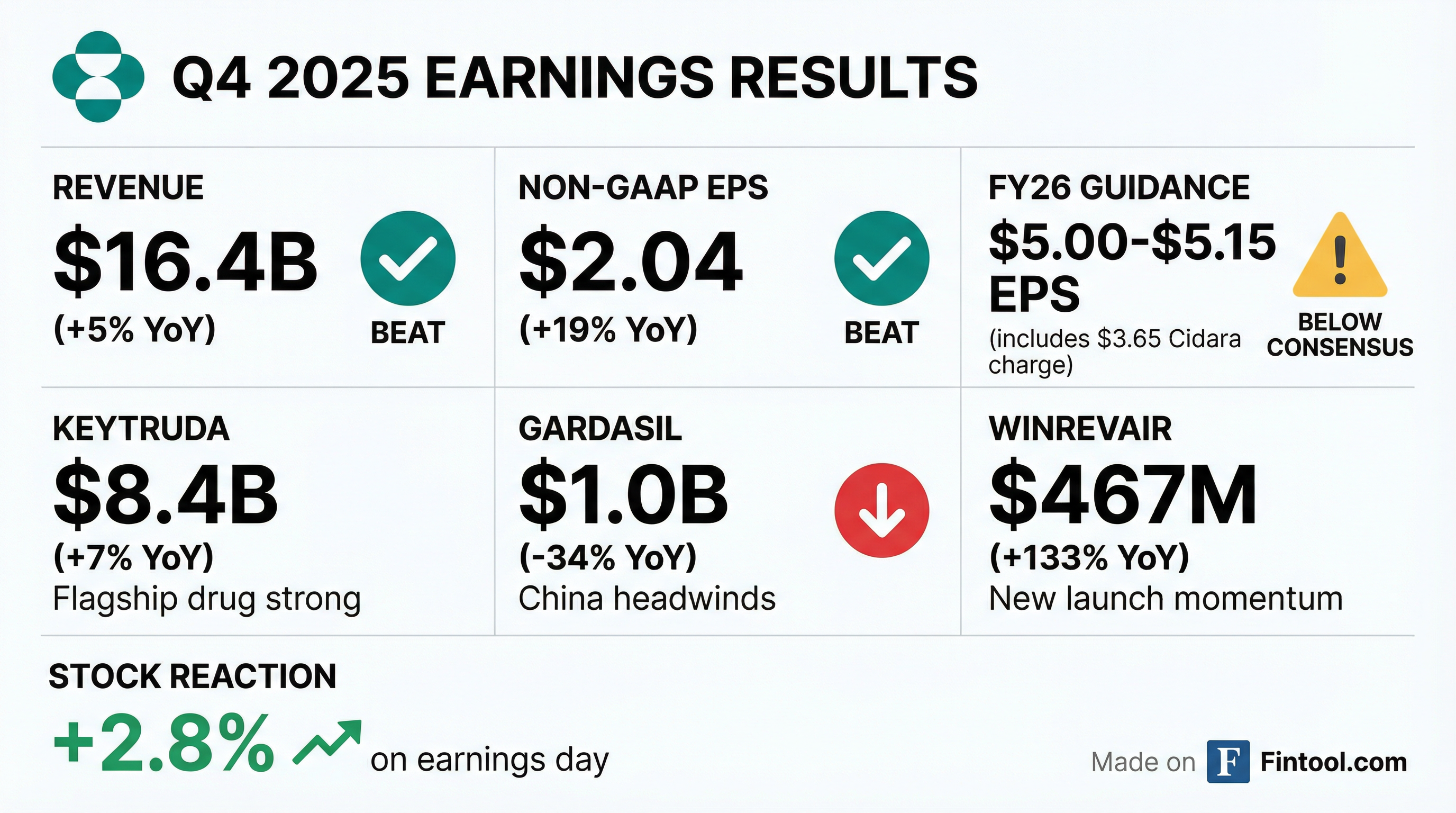

Merck Beats Q4 Estimates But Guides Low as Gardasil Headwinds Persist

Merck Walks Away From $30 Billion Revolution Medicines Deal; Stock Plunges 22%

Merck Emerges as Lead Suitor for Revolution Medicines at $28-32 Billion

Patient Deaths Halt Merck's $5.5 Billion ADC Trial: Second Major Blow to Daiichi Partnership

Quarterly earnings call transcripts for Merck & Co..

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more