MSCI (MSCI)·Q4 2025 Earnings Summary

MSCI Posts 11th Straight Year of Double-Digit EPS Growth; Stock Drops 4% as Revenue Misses

January 28, 2026 · by Fintool AI Agent

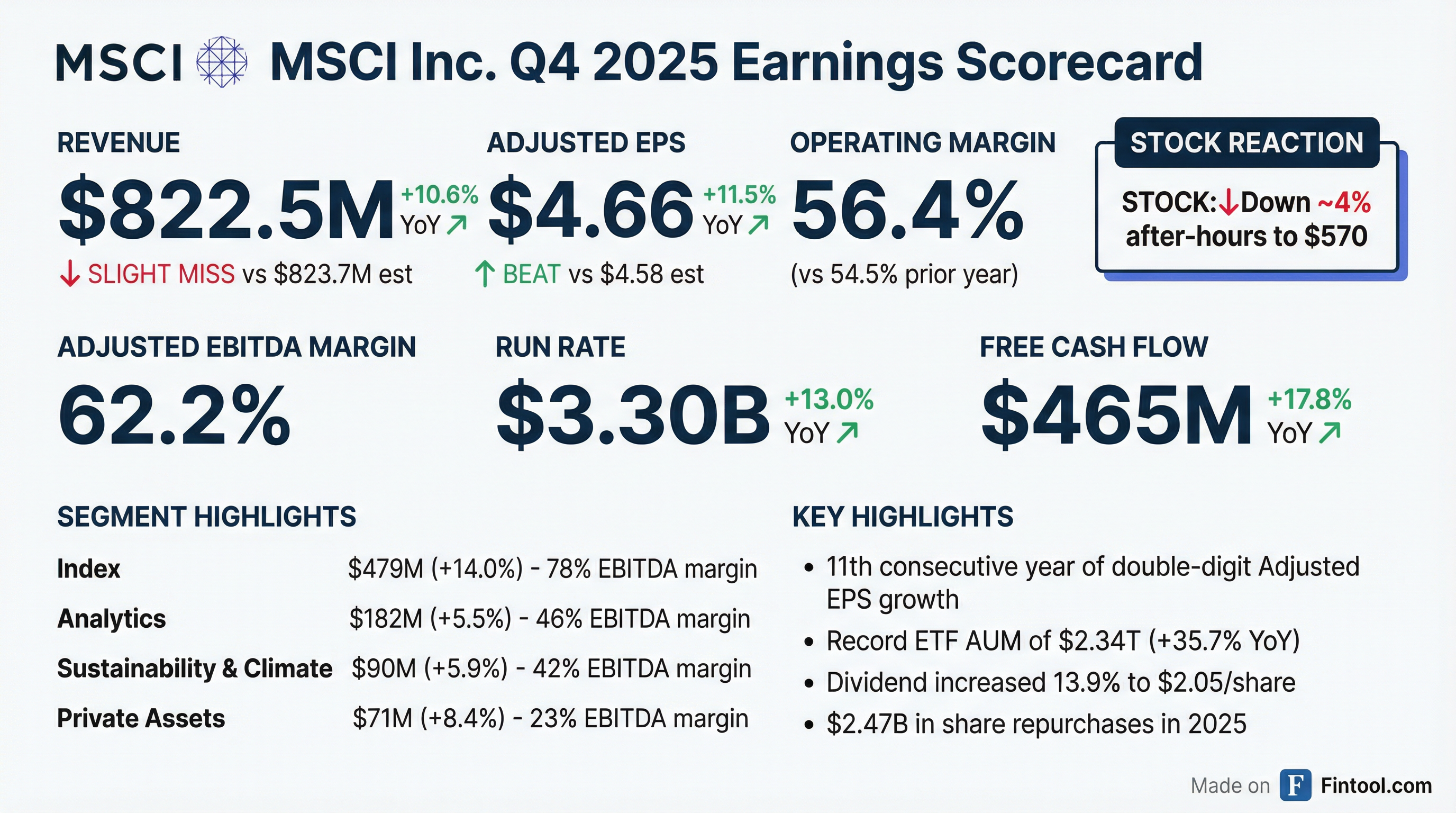

MSCI delivered a mixed Q4 2025, beating adjusted EPS estimates while slightly missing revenue expectations. The index and analytics provider reported $822.5 million in revenue (+10.6% YoY) versus consensus of $823.7 million, while adjusted EPS of $4.66 topped expectations of $4.58 by 1.7%.

Despite the EPS beat, shares dropped approximately 4% in after-hours trading to $570, down from the prior close of $594.16. The market reaction appears driven by concerns over GAAP EPS declining 2.3% YoY to $3.81 (impacted by a $38M tax charge from internal restructuring) and the slim revenue miss.

Did MSCI Beat Earnings?

The quarter extended MSCI's streak to 11 consecutive years of double-digit adjusted EPS growth, a remarkable consistency for a financial data provider. CEO Henry Fernandez highlighted the company's "deep-rooted competitive advantages" and growing momentum across product lines.

What Drove the Quarter?

Index Segment: The Growth Engine

The Index segment remained MSCI's powerhouse, delivering $479.1 million in revenue (+14.0% YoY) with an exceptional 78.1% adjusted EBITDA margin.

Key drivers:

- Asset-based fees surged 20.7% to $211.7M, powered by record ETF AUM of $2.34 trillion (+35.7% YoY)

- Record Q4 ETF inflows of $67 billion, totaling $204 billion for full year 2025

- Index subscription run rate accelerated to 9.4%, including 16% growth in custom indexes

- Recurring subscriptions grew 7.8% to $246.4M, driven by market-cap weighted products

- Run Rate reached $1.87B (+16.2% YoY) with organic subscription growth of 9.3%

- Best-ever quarter for new recurring subscription sales in Index

Client Segment Performance

Notable deal: A major hedge fund signed for MSCI's new extended custom index module spanning nearly 5,000 custom indices.

Analytics Segment: Steady Performance

Analytics generated $182.3 million in revenue (+5.5% YoY) with EBITDA margin of 46.0%.

- Run Rate of $757.4M (+8.4% YoY), organic growth of 7.0%

- Second-highest Q4 ever for new recurring sales

- Strong traction with enterprise risk and performance tools, especially with banks and asset owners

- Retention Rate improved to 93.7% from 93.3% YoY

Sustainability & Climate: Margin Expansion Story

The Sustainability and Climate segment saw revenue grow 5.9% to $90.3 million, but the real story was margin expansion—EBITDA margin improved dramatically to 42.3% from 34.8% a year ago (+750 bps).

- Organic growth slowed to 3.1% as ESG investing sentiment remains mixed

- New recurring sales declined 5.0% YoY, with retention rate dipping to 91.0%

- EMEA remains the primary growth driver for Ratings and Climate products

Private Assets: Breakout Quarter

Private Assets revenue grew 8.4% to $70.9 million, with Private Capital Solutions driving 86% recurring sales growth.

- Nearly $8 million of new recurring subscription sales in Q4 alone

- Strong traction with Total Plan offering and transparency data products

- Run Rate of $292M (+9.5% YoY)

- Retention Rate improved significantly to 89.2% from 86.4%

- Management sees tokenization as potential "big accelerant" for private asset tools

How Did the Stock React?

MSCI shares fell approximately 4% in after-hours trading to $570, erasing recent gains. The stock had been trading near 52-week highs above $590 heading into the print.

The sell-off appears driven by several factors:

- Slight revenue miss despite strong EPS beat

- GAAP EPS decline of 2.3% YoY (vs adjusted EPS +11.5%)

- Tax headwinds: $38M charge from internal restructuring, though management expects ~$88M benefit in 2026

- Sustainability & Climate growth deceleration (organic growth just 3.1%)

What Changed From Last Quarter?

Notable shifts:

- Margin expansion accelerated in Q4 as operating leverage kicked in

- ETF inflows remained strong with $66.9B in Q4 alone (vs $46.4B in Q3)

- Retention Rate ticked down sequentially, though still above prior year

What Did Management Guide?

MSCI provided FY 2026 guidance that implies continued margin expansion:

Key callouts:

- Management expects ~$88M tax benefit in 2026 from the internal restructuring (excluded from non-GAAP measures)

- Free cash flow guidance of $1.47-1.53B implies ~5% growth from FY 2025's $1.46B

Long-Term Targets (Reiterated):

Important change: MSCI will no longer maintain product line-specific long-term targets, instead managing investments across integrated product lines. Current reporting and disclosure will remain unchanged.

Free Cash Flow Context: 2026 FCF guidance reflects several headwinds vs. 2025:

- ~$100M higher cash taxes (includes $30M payment deferrals from 2025, $50M one-time benefits in 2025)

- ~$90M step-up in cash interest (two 2025 debt issuances had no interest payments that year)

- ~$25M London office build-out CapEx

Capital Allocation Highlights

MSCI continued its aggressive capital return program:

Through January 27, 2026, MSCI repurchased $2.47B worth of shares (4.4M shares) at an average price of $559.85—demonstrating management's confidence in the stock.

Long-term track record:

- $9.0B in cumulative share repurchases since 2012

- 23% CAGR in dividend per share since 2014

- Historical payout ratio target of 40-50% of adjusted EPS

Balance Sheet:

- Cash: $515.3M

- Total Debt: $6.2B

- Debt/Adjusted EBITDA: 3.3x (within 3.0-3.5x target range)

- Credit Ratings (all stable outlook): Moody's Baa3, S&P BBB-, Fitch BBB-

- Next debt maturity not until 2029, providing flexibility

What Did Management Say on the Call?

BlackRock ETF Agreement Extended Through 2035

A major announcement: MSCI is extending its ETF agreement with BlackRock through 2035, solidifying the partnership that underpins much of MSCI's asset-based fee revenue.

The trade-off: MSCI will lower fee floors on certain "super scale" ETFs where they've been capturing a larger share of economics. The aggregate impact is ~0.1 basis points based on year-end 2025 AUM, split evenly between January 2026 and January 2027.

International Rotation Accelerating

One of the most notable exchanges came when asked about the shift away from US assets. Henry Fernandez confirmed MSCI is seeing significant benefits:

"We saw record $200+ billion of flows into ETFs linked to MSCI indices... a strong indication that people are putting their assets in non-dollar assets. On the subscription side, our run rate in EMEA in index, including subscription and ABF, is higher now than the Americas. Which is an incredible feat given the nature of the capital markets in the United States."

— Henry Fernandez, CEO

This geographic shift—with EMEA Index run rate now exceeding the Americas—represents a structural change that could persist if the rotation away from US assets continues.

AI: "The Company is Turning Into a Total AI Machine"

Henry Fernandez provided extensive detail on MSCI's AI strategy, noting 120-140 AI projects currently underway across the company:

Efficiency applications:

- AI agents for ESG controversy monitoring

- Automated data gathering for private assets

- Custom index creation automation—training AI to handle methodology design and backtesting faster than humans

Product applications:

- AI Insights embedded in analytics portfolios

- Risk and correlation analysis via digital agents

- Faster custom index and basket creation via Basket Builder

"It's still early days in our application of AI across the board in MSCI... The company is turning into a total AI machine, and we think it's a godsend to us."

— Henry Fernandez, CEO

Private Assets: "Massive Opportunity"

Andy Wiechmann highlighted strong traction in Private Capital Solutions, which saw 86% recurring sales growth:

- Total Plan offering and transparency data driving momentum

- Strong growth in both Americas and EMEA

- New capabilities enabled by AI, including document management and Source View

- Tokenization identified as a potential "big catalyst" for private asset tools

Sustainability & Climate: "Europe Recovering, US Still Soft"

On the ESG front, Fernandez was candid about regional dynamics:

- Europe: Recovery underway, benefiting from supplier consolidation. Major Q4 deal with European wealth tech platform positions MSCI as embedded sustainability provider.

- Americas: "I don't think we have reached bottom yet in the U.S. market, given some of the political undertones."

- Strategic pivot: Expanding beyond ESG to analyze tariffs, supply chains, and AI impact on companies—leveraging existing data and capabilities.

Active Asset Managers: Changing the Approach

Management acknowledged active asset managers have faced challenges but outlined a strategic shift:

- Helping clients convert active portfolios to ETF wrappers

- Transforming MSCI from cost center to profit/product development center

- Offering supplier consolidation as clients look to reduce vendor complexity

This contributed to 13% recurring net new sales growth with active managers in Q4.

Leadership Transition: Baer Pettit Retiring

President Baer Pettit, a 26-year MSCI veteran, announced his retirement effective March 1, 2026. In his final earnings call remarks:

"If there's one thing that has characterized MSCI in the quarter of a century that I've been here, it is the firm's constant ability to reinvent itself and to seek new opportunities... The great power of the MSCI franchise is rooted in our talented people, who I know will continue to set new standards and drive innovation."

— Baer Pettit, President

Alvise Munari and Jorge Mina will assume expanded leadership roles following Pettit's departure.

Key Quotes From Management

"In the fourth quarter, MSCI delivered strong results while achieving a number of key milestones, including our 11th straight year of double-digit adjusted EPS growth, a record asset-based-fee run rate driven by record inflows into ETF products linked to our indexes, and our best-ever quarter for recurring sales in Index."

— Henry A. Fernandez, Chairman and CEO

"It feels like we kind of bottomed out in the second quarter of last year. We feel pretty confident and encouraged by the pace of innovation, the pace of selling, the dialogue with clients... and the level of innovation and product launches that we are achieving."

— Henry Fernandez, CEO

Key KPIs to Watch

Emerging Growth Opportunities Run Rate:

Bottom Line

MSCI delivered a solid Q4 with adjusted EPS beating by 1.7% and margins expanding, but the slight revenue miss and 2.3% GAAP EPS decline weighed on shares. The Index segment remains the standout performer with 14% revenue growth and record ETF AUM of $2.34 trillion. Sustainability & Climate growth has decelerated (organic growth just 3.1%), though margin expansion there is impressive (+750 bps YoY).

Bull case: 11th consecutive year of double-digit adjusted EPS growth, record ETF inflows ($204B for FY25), best-ever Index sales quarter, BlackRock ETF agreement extended through 2035, EMEA run rate now exceeding Americas, Private Capital Solutions up 86%, and management sees AI as "a godsend."

Bear case: Revenue miss (albeit small), GAAP EPS decline, Sustainability & Climate growth slowdown, US ESG headwinds haven't bottomed, fee floor reductions on super-scale ETFs (~0.1 bps impact), and elevated leverage at 3.3x debt/EBITDA.

The 4% sell-off may present an opportunity for long-term investors given MSCI's durable competitive moat in the index and analytics space, consistent execution, aggressive capital return program, and Henry Fernandez's declaration that "it feels like we bottomed out in Q2."

View the full Q4 2025 earnings transcript | MSCI company page