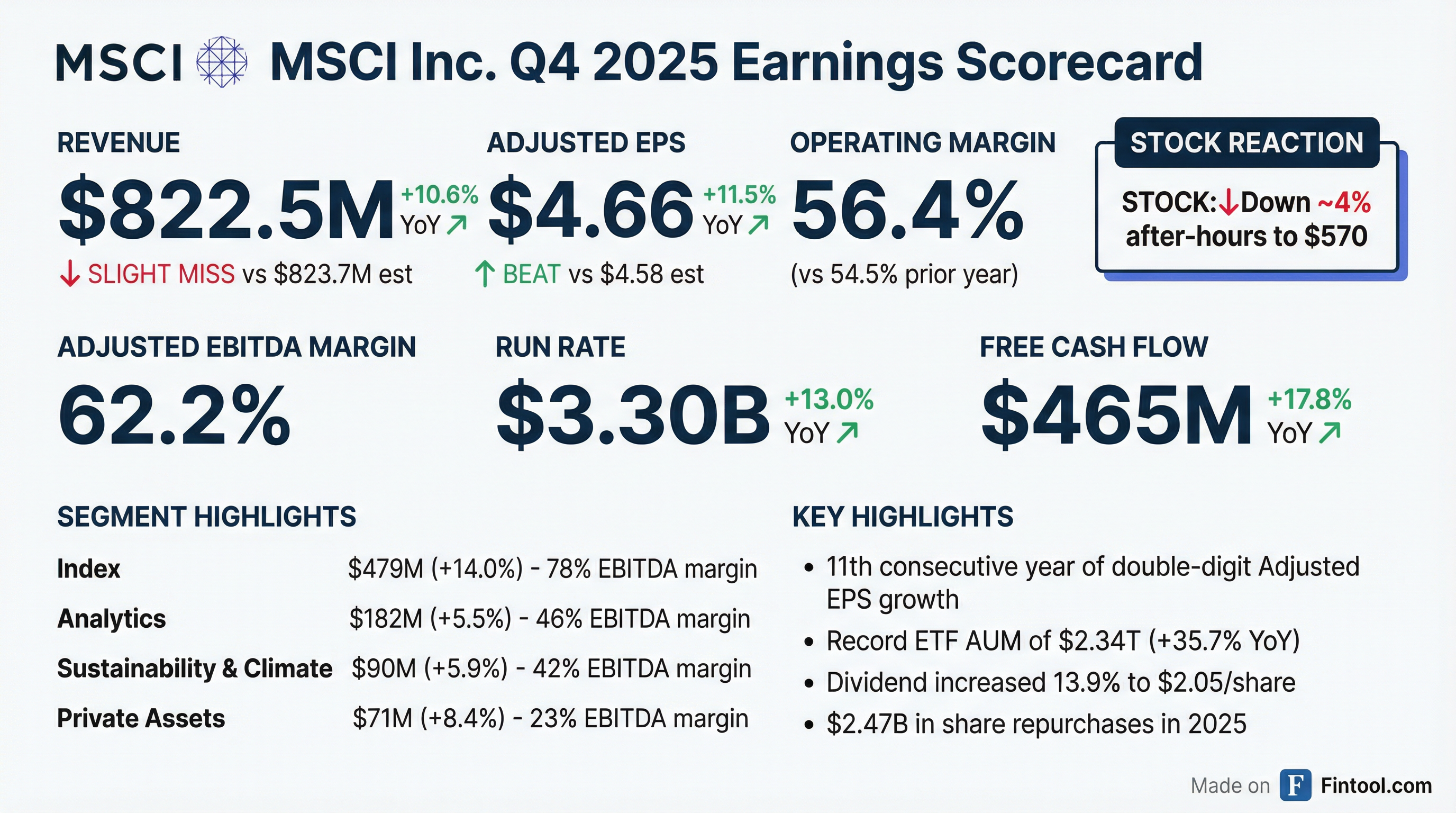

Earnings summaries and quarterly performance for MSCI.

Executive leadership at MSCI.

Board of directors at MSCI.

Jacques Perold

Director

June Yang

Director

Linda Riefler

Director

Marcus Smith

Director

Michelle Seitz

Director

Paula Volent

Director

Rajat Taneja

Director

Robert Ashe

Lead Independent Director

Robin Matlock

Director

Sandy Rattray

Director

Research analysts who have asked questions during MSCI earnings calls.

Ashish Sabadra

RBC Capital Markets

8 questions for MSCI

Craig Huber

Huber Research Partners

8 questions for MSCI

Kelsey Zhu

Autonomous Research

8 questions for MSCI

Scott Wurtzel

Wolfe Research

8 questions for MSCI

Toni Kaplan

Morgan Stanley

8 questions for MSCI

Faiza Alwy

Deutsche Bank

7 questions for MSCI

Alex Kramm

UBS Group AG

6 questions for MSCI

David Motemaden

Evercore ISI

6 questions for MSCI

Gregory Simpson

BNP Paribas

6 questions for MSCI

Jason Haas

Wells Fargo

6 questions for MSCI

Manav Patnaik

Barclays

6 questions for MSCI

Owen Lau

Oppenheimer & Co. Inc.

6 questions for MSCI

Russell Quelch

Redburn Atlantic

6 questions for MSCI

Alexander Hess

JPMorgan Chase & Co.

5 questions for MSCI

Alexander EM Hess

JPMorgan Chase & Co.

4 questions for MSCI

George Tong

Goldman Sachs

4 questions for MSCI

Alex Kram

UBS

2 questions for MSCI

Anja Huang

Goldman Sachs

2 questions for MSCI

Brendan

Barclays

2 questions for MSCI

Keen Fai Tong

Goldman Sachs Group Inc.

2 questions for MSCI

Kwun Sum Lau

Oppenheimer

2 questions for MSCI

Patrick O'Shaughnessy

Raymond James

2 questions for MSCI

Audey Ashkar

Wells Fargo

1 question for MSCI

Faiza Awi

Deutsche Bank

1 question for MSCI

Joshua Dennerlein

BofA Securities

1 question for MSCI

Jun-Yi Xie

Wells Fargo & Company

1 question for MSCI

Wahid Amin

Bank of America

1 question for MSCI

Recent press releases and 8-K filings for MSCI.

- Gross gaming revenue up 1% to €8,706 m, while turnover declined 3% to €3,678 m due to over €50 m of tax increases, reflecting regulatory headwinds.

- Recurring EBITDA of €902 m with a 24.5% margin, in line with targets, and free cash flow of €782 m, converting 87% of EBITDA into cash.

- Completed the integration of Kindred and accelerated its multi-year performance plan, raising the end-2028 efficiency target from over €120 m to over €150 m—one year ahead of schedule.

- Proposed dividend increase to €2.10 per share (80% payout ratio), with payment on 30 April and ex-dividend on 28 April.

- 2026 guidance: slight revenue growth and a stable 24.5% EBITDA margin, with medium-term targets unchanged—revenues to grow ~5% by 2028 and EBITDA margin above 26%.

- Gross gaming revenue up 1% to €8,706 m in 2025 while revenue fell 3% to €3,678 m due to higher taxes and tighter regulation; recurring EBITDA was €902 m (24.5% margin).

- Kindred integration completed and multi-year performance plan reached its 2026 goal one year early, with the end-2028 savings target lifted from over €120 m to over €150 m.

- Proposed dividend increased to €2.10 per share, representing an 80% payout ratio of adjusted net income.

- 2026 outlook calls for slight revenue growth and a stable recurring EBITDA margin of 24.5% despite nearly €90 m of additional gaming taxes; on a constant tax basis, revenue is expected to accelerate to around +5% by 2028 with EBITDA margins above 26%.

- Pony.ai will be added to the MSCI China Index after market close on February 27, 2026, becoming the first Robotaxi company in the benchmark.

- The inclusion reflects Pony.ai’s progress in scaled mass production and commercialization, including seventh-generation Robotaxi city-wide unit economics breakeven in Guangzhou.

- MSCI China Index inclusion is expected to broaden Pony.ai’s global institutional investor base and underscore the company’s capital efficiency and operational resilience.

- MSCI positions itself as the “intellectual infrastructure” of the investment universe, sustaining 13% revenue CAGR since IPO and delivering 11% revenue growth in Q4 with 13% adjusted EBITDA growth.

- Analytics momentum remains strong: factor models and equity analytics are growing in solid double digits, with expanding front-office adoption and differentiated private asset risk models fueling growth.

- Sustainability and climate solutions have decelerated, particularly in the Americas, but MSCI is gaining share through physical risk insights, geospatial AI, and corporate sustainability offerings outside the U.S..

- Real assets face cyclical headwinds from reduced CRE transactions, though green shoots in office, retail, and infrastructure are emerging; Private Capital Solutions grew mid-teens (15%), driven by enhanced benchmarks, classification standards, and broader international go-to-market.

- AI is a major enabler—driving 30%+ cost savings in data sourcing, powering new AI-driven products (AI insights, private credit transparency, geospatial risk, custom indexing), generating $10 million in AI-enabled tool sales in 2025 and advancing MSCI’s total-portfolio solution.

- MSCI has delivered a 13% revenue CAGR since its IPO and in Q4 achieved 11% revenue growth along with 13% Adjusted EBITDA growth and 14% operating income growth, underscoring strong momentum.

- Growth is being fueled by an acceleration in index subscriptions, expansion in private asset solutions (PCS), a pickup in custom indexing, and a faster cadence of new product and capability releases.

- Client segmentation efforts have driven elevated sales with hedge funds, trading firms, broker-dealers, asset managers, wealth managers, and insurance firms, while retention has improved through upsells, product enhancements, and expanded account management.

- MSCI anticipates maintaining steady price increases, supported by healthy client adoption, enhanced product value, and increased usage of its data and analytics tools.

- AI integration has cut data production costs by over 30%, sped up engineering and product development—particularly in private markets and custom indexing—and generated approximately $10 million in AI-driven tool sales during 2025.

- MSCI frames itself as the “intellectual infrastructure” of the investment universe, targeting double-digit subscription growth and low-to-mid-teens Adjusted EBITDA growth, with a track record of 13% revenue CAGR, 15% Adjusted EBITDA CAGR and 16% Adjusted EPS CAGR since its IPO.

- In Q4 2025, MSCI achieved 11% revenue growth and 13% Adjusted EBITDA growth, fueled by new product releases, accelerated index subscriptions, private asset solutions and broad-based strength across client segments.

- AI integration has cut data-production costs by over 30% in hard-to-source areas (e.g., private markets), enabled rapid capability expansion, and drove $10 million of AI-enabled tool sales in 2025, while accelerating product development and client value delivery.

- Retention improved year-over-year in Q4, underpinned by multi-product client stickiness, ongoing product enhancements and enhanced account management; MSCI also maintains steady pricing power through value-linked price increases.

- Capital allocation remains opportunistic, with ongoing share repurchases calibrated to cash flow and market volatility, and selective bolt-on M&A focused on private-asset and custom-indexing capabilities to accelerate core growth areas.

- A warning from MSCI about opaque shareholding structures triggered panic, sending the Jakarta Composite Index down 8–10% over two days—the worst rout since 1998—erasing roughly US $80 billion in market value.

- MSCI will temporarily freeze certain index changes and effectively gave Jakarta until May to improve transparency before risking further action.

- Regulators doubled the minimum free-float requirement to 15% and indicated the Danantara sovereign wealth fund may step in, helping to spark a late partial rebound.

- Political concerns under President Prabowo Subianto and foreign bond holdings at their lowest in nearly two decades have compounded capital outflows and raised questions about Indonesia’s investability.

- On January 27, 2026, MSCI and BlackRock Fund Advisors executed an amendment extending the Master Index License Agreement for exchange-traded funds through March 31, 2035, with automatic three-year renewals thereafter.

- Effective January 1, 2026 (with further adjustments on January 1, 2027), the amendment updates license fees for certain funds—calculated based on assets under management and expense ratios—while preserving existing fee constructs.

- No other material changes were made; the revised fee structure is intended to support long-term growth via a price-volume tradeoff.

- MSCI delivered 9.4% index subscription run rate growth (including 16% growth in custom indexes) and 26% asset-based fee run rate growth, with record equity ETF inflows of $67 billion in Q4 (and $204 billion for full year 2025).

- Across client segments, MSCI achieved 13% subscription run rate growth and 26% recurrent net new sales growth in hedge funds; nearly 11% subscription run rate growth in wealth managers; and over 9% subscription run rate growth in banks and broker-dealers.

- Private capital solutions saw $8 million of new recurring subscription sales, up 86% year-over-year, and analytics subscription run rate grew over 8%, driven by enterprise risk and performance tools.

- MSCI extended its ETF agreement with BlackRock through 2035 with fee floor reductions (~0.05 bps effective Jan 2026 and Jan 2027), and provided 2026 guidance reflecting a Q1 tax rate of 18–20%, plus elevated CapEx for a new London office and software capitalization.

- President Baer Pettit will retire and step down on March 1, 2026, with Alvise Munari and Jorge Mina set to succeed him as MSCI leadership evolves under CEO Henry Fernandez.

- Achieved organic revenue growth of >10%, adjusted EBITDA growth of >13%, and adjusted EPS growth of ~12% in Q4 (and ~14% for FY), marking 11 consecutive years of double-digit EPS growth; repurchased $958 M of shares in Q4 (total $3.3 B over two years).

- Generated $65 M in net new subscription sales and $31 M in non-recurring sales (total $96 M), driving a total run rate of $3.3 B (+13%); asset-based fees run rate was $852 M (+26%) and recurring subscriptions $2.4 B (+9%).

- Index business saw 9.4% subscription run rate growth (including 16% custom index growth) and record Q4 ETF inflows of $67 B (total $204 B for FY).

- 2026 outlook includes continued investment in growth initiatives, an expected Q1 tax rate of 18–20%, approximately $100 M higher cash taxes, $90 M of additional interest expense, and $25 M of CapEx for a new London office, underpinning strong free cash flow per share trajectory.

Fintool News

In-depth analysis and coverage of MSCI.

Quarterly earnings call transcripts for MSCI.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more