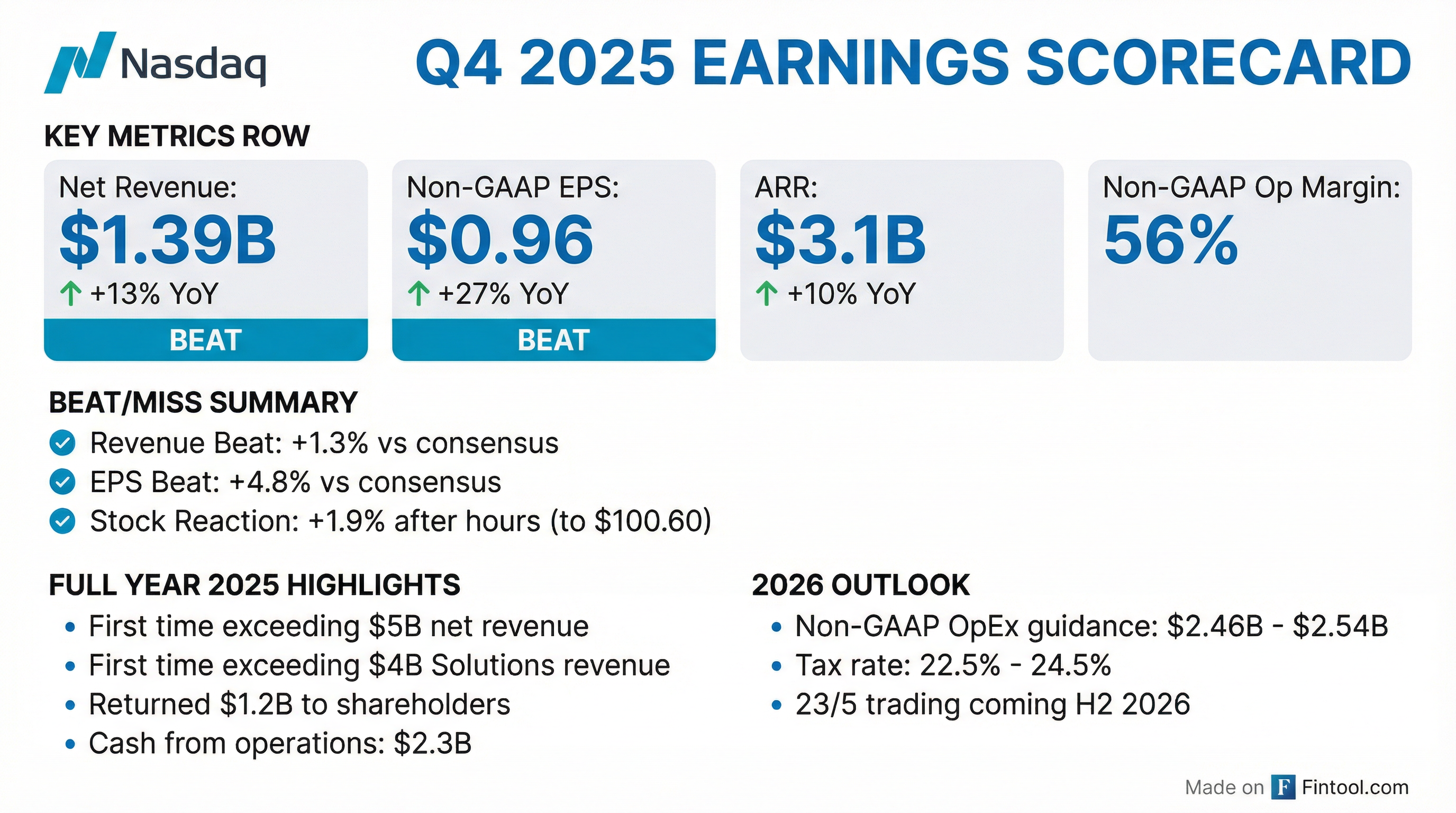

Earnings summaries and quarterly performance for NASDAQ.

Executive leadership at NASDAQ.

Adena Friedman

Chair and Chief Executive Officer

Bradley Peterson

Executive Vice President and Chief Information Officer/Chief Technology Officer

Bryan Smith

Executive Vice President and Chief People Officer

Jeremy Skule

Executive Vice President and Chief Strategy Officer; Executive Chair, Financial Crime Management Technology

John Zecca

Executive Vice President and Chief Legal, Risk and Regulatory Officer

Michelle Daly

Senior Vice President and Controller and Principal Accounting Officer

Nelson Griggs

President

Sarah Youngwood

Executive Vice President and Chief Financial Officer

Tal Cohen

President

Board of directors at NASDAQ.

Alfred Zollar

Director

Charlene Begley

Director

Essa Kazim

Director

Holden Spaht

Director

Jeffery Yabuki

Director

Johan Torgeby

Director

Kathryn Koch

Director

Melissa Arnoldi

Director

Michael Splinter

Lead Independent Director

Thomas Kloet

Director

Toni Townes-Whitley

Director

Research analysts who have asked questions during NASDAQ earnings calls.

Alexander Blostein

Goldman Sachs

8 questions for NDAQ

Brian Bedell

Deutsche Bank

7 questions for NDAQ

Michael Cyprys

Morgan Stanley

7 questions for NDAQ

Ashish Sabadra

RBC Capital Markets

6 questions for NDAQ

Benjamin Budish

Barclays PLC

6 questions for NDAQ

Owen Lau

Oppenheimer & Co. Inc.

6 questions for NDAQ

Patrick Moley

Piper Sandler & Co.

6 questions for NDAQ

Alex Kramm

UBS Group AG

5 questions for NDAQ

Dan Fannon

Jefferies & Company Inc.

5 questions for NDAQ

Jeff Schmitt

William Blair & Company, L.L.C.

5 questions for NDAQ

Michael Cho

JPMorgan Chase & Co.

5 questions for NDAQ

Eli Abboud

Bank of America

4 questions for NDAQ

Simon Clinch

Redburn Atlantic

4 questions for NDAQ

Craig Siegenthaler

Bank of America

3 questions for NDAQ

Daniel Fannon

Jefferies Financial Group Inc.

3 questions for NDAQ

Kyle Voigt

Keefe, Bruyette & Woods

3 questions for NDAQ

Alexander Kramm

UBS Group AG

2 questions for NDAQ

William Katz

TD Cowen

2 questions for NDAQ

Y. Cho

JPMorgan Chase & Co.

2 questions for NDAQ

Ben Budish

Barclays PLC

1 question for NDAQ

Brian Bertram Bedell

Deutsche Bank AG

1 question for NDAQ

Christopher Allen

Citigroup

1 question for NDAQ

Jeffrey Schmitt

William Blair

1 question for NDAQ

Kwun Sum Lau

Oppenheimer

1 question for NDAQ

Simon Alistair Clinch

Redburn Atlantic

1 question for NDAQ

Recent press releases and 8-K filings for NDAQ.

- New Era Energy & Digital, Inc. (Nasdaq: NUAI) filed its Annual Report on Form 10-K for the fiscal year ended December 31, 2025.

- The company will host a business update conference call and webcast on Tuesday, March 17, 2026, at 5:00 p.m. ET to review recent developments and strategic priorities.

- New Era is developing Texas Critical Data Centers LLC (TCDC), a 438-acre AI and high-performance computing data center campus in Ector County, Texas, master-planned to scale to over 1 GW of capacity.

- The vertically integrated model offers powered land and powered shells, enabling hyperscale, enterprise, and edge operators to accelerate deployments and optimize total cost of ownership.

- Record fourth-quarter revenue of $96.1 million (+16% YoY) and full-year revenue of $365.0 million (+18% YoY).

- Total Platform Assets reached $94.1 billion (up 17% YoY), with full-year net deposits of $6.7 billion.

- Non-GAAP Adjusted EBITDA of $170.7 million (47% margin) and free cash flow of $151.1 million, ending the year with corporate cash above $440 million; board authorized a $100 million share repurchase program.

- Expanded product suite with early access to Wealthfront Home Lending and launch of the proprietary Wealthfront Treasury Money Market Fund.

- Fitell Corporation (NASDAQ: FTEL) announces its rebrand to GMEX Robotics, marking a strategic shift from fitness equipment e-commerce to AI-powered consumer and commercial robotics; legal name change effective March 2, 2026.

- The company’s Nasdaq ticker will change from FTEL to GMEX at market open on March 12, 2026; no shareholder action is required and the CUSIP remains unchanged.

- GMEX Robotics will continue its fitness and health product business as a core foundation while focusing on three pillars: consumer/commercial robotics, AI-driven hardware, and an interconnected innovation ecosystem.

- To drive this strategic pivot, GMEX Robotics is assembling a new leadership team and technical workforce specializing in mechatronics, computer vision, and machine learning.

- Eagle Nuclear Energy Corp. (NASDAQ: NUCL) became a member of the Uranium Producers of America, the leading domestic uranium trade association advocating for a secure U.S. nuclear fuel supply chain.

- According to the U.S. Energy Information Administration, the U.S. relies on imports for 95% of its uranium, with domestic production projected at 1 million pounds in 2026 versus the 50 million pounds needed annually.

- The company began trading publicly on Nasdaq under the ticker NUCL in February 2026, marking its entry into the U.S. nuclear development sector.

- Eagle owns the largest conventional U.S. uranium deposit, with the Aurora Project containing 32.75 million pounds Indicated and 4.98 million pounds Inferred near-surface resources, plus the adjacent Cordex deposit for further expansion.

- Pipeline updates include Q2 2026 initial clinical data for CD19 T cell engager CLN-978 in SLE and RA, completion of Taiho’s rolling NDA submission for EGFR ex20ins inhibitor zipalertinib and full enrollment of the REZILIENT3 frontline NSCLC study (top-line results expected by end 2026), and planned CLN-049 registrational development in AML

- Cash position: ended 2025 with $439.0 million in cash, cash equivalents, investments, and interest receivable, providing runway into 2029

- Expenses: R&D expenses were $42.9 million in Q4 2025 (FY 2025: $187.4 million) and G&A expenses were $12.3 million in Q4 2025 (FY 2025: $54.2 million)

- Net loss attributable to Cullinan was $50.7 million for Q4 2025 and $219.9 million for full year 2025

- FDA accepted the New Drug Application for lorundrostat in adults with hypertension, assigning a PDUFA target action date of December 22, 2026.

- Phase 2 Explore-OSA topline results showed no meaningful reduction in apnea-hypopnea index but demonstrated an 11.1 mmHg blood pressure reduction with lorundrostat versus 1.0 mmHg with placebo (6.2 mmHg placebo-adjusted; p < 0.0003).

- Lorundrostat was well tolerated with no serum potassium excursions above 5.5 mmol/L in the trial population.

- Full year 2025 revenue grew 25% to $194.1 million, and adjusted EBITDA rose 309% to $15.3 million.

- Fourth quarter revenue increased 4% to $46.9 million, with adjusted EBITDA up 348% to $4.8 million.

- Exited 2025 with $36.8 million of cash and no debt, positioning the company for growth investments.

- Oral Wegovy launched subsequent to year end, with over 80% of new weight management patients initiating branded therapy and record Q1 sign-ups.

- 2026 guidance: expects full-year revenue of $220 million to $230 million and adjusted EBITDA of $12 million to $17 million.

- Nasdaq and Payward will build an xStocks-powered gateway to connect regulated equity markets with permissionless DeFi networks, enabling seamless tokenized equity transfers.

- Since its June 2025 launch, xStocks have recorded $25 billion in transaction volume and attracted 85,000 unique holders across supported blockchains.

- The gateway will facilitate swaps of tokenized equities between institutional trading environments and DeFi, with KYC/AML onboarding and Payward serving as the initial settlement layer.

- Nasdaq’s equity token design and related DLT services are expected to become operational in H1 2027, marking a significant step in equity tokenization.

- NovaBridge and Visara announced positive topline results from the randomized Phase 2a study of VIS-101, a dual VEGF-A × ANG-2 inhibitor for wet AMD, in 38 patients in China.

- VIS-101 achieved a mean improvement in BCVA of >10 ETDRS letters and a median CST reduction of 100–150 µm across 3 mg and 6 mg cohorts.

- Durability was notable, with ~two thirds of patients retreatment-free at 4 months and ~half retreatment-free at 6 months after three loading doses.

- The safety profile was favorable with no dose-limiting toxicity and only 8% treatment-related TEAEs in the 6 mg cohort.

- A dose-determining Phase 2b study is expected in H2 2026, followed by a global Phase 3 program in 2027.

- Total revenue of $28.1 M in Q4 and $84.3 M for full year 2025, driven by $72.2 M in U.S. neffy product sales.

- Net loss of $41.3 M (–$0.42 per share) in Q4 and $171.3 M (–$1.74 per share) for FY2025.

- Cash position of $245.0 M in cash, cash equivalents and short-term investments as of December 31, 2025, supporting operations through anticipated cash-flow break-even.

- U.S. commercial launch momentum: negotiating unrestricted payor access with $0 co-pay for eligible patients, coverage by eight state Medicaid plans, new DTC ad launched January 2026, and planned sales force expansion to 150 in Q2 2026.

- Global expansion advances with CHMP positive opinion for EUR neffy 1 mg (Jan 2026), approvals in China and Australia (Dec 2025), and Canada approval anticipated in Q2 2026.

Fintool News

In-depth analysis and coverage of NASDAQ.

Quarterly earnings call transcripts for NASDAQ.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more