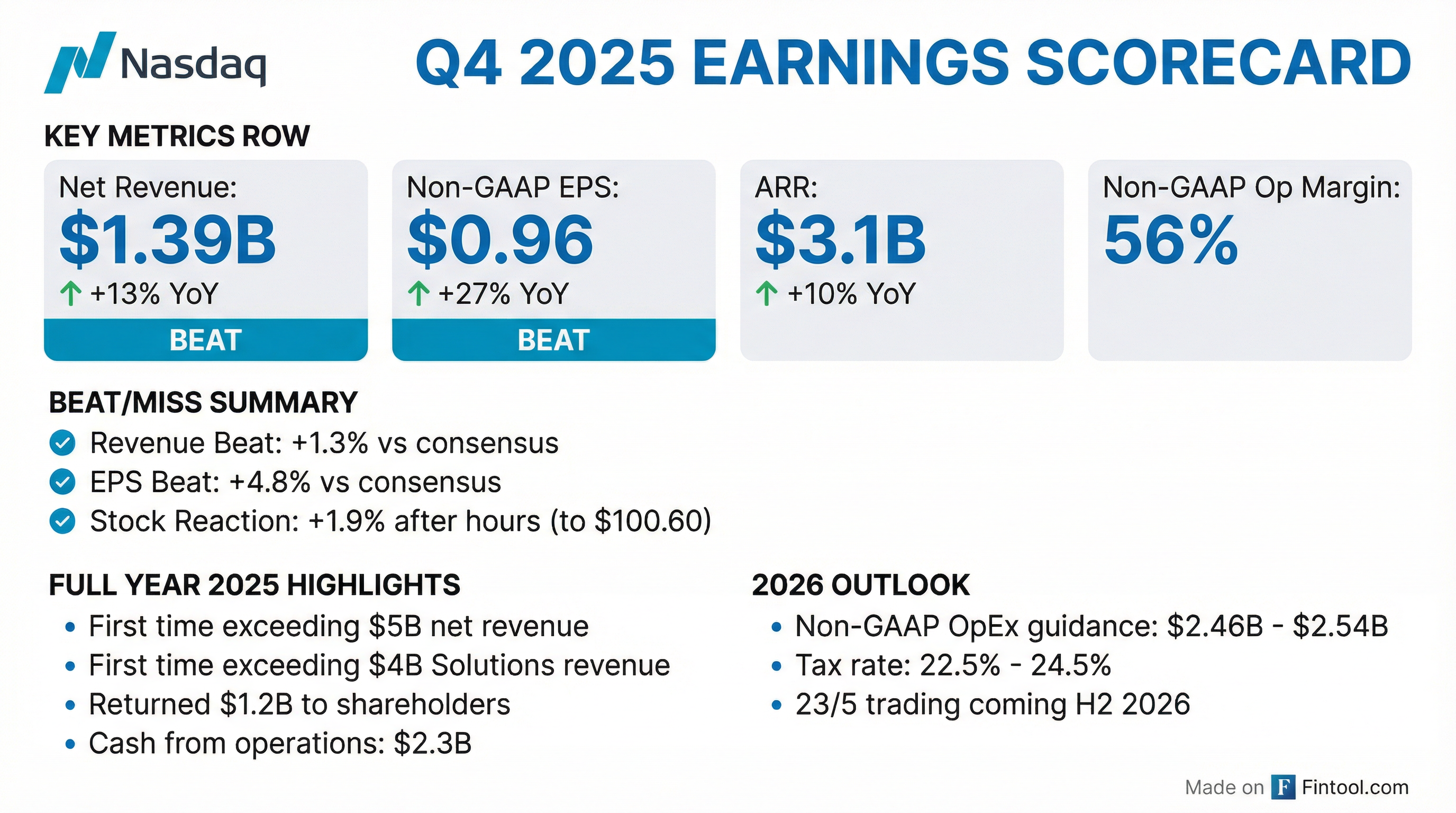

Earnings summaries and quarterly performance for NASDAQ.

Executive leadership at NASDAQ.

Adena Friedman

Chair and Chief Executive Officer

Bradley Peterson

Executive Vice President and Chief Information Officer/Chief Technology Officer

Bryan Smith

Executive Vice President and Chief People Officer

Jeremy Skule

Executive Vice President and Chief Strategy Officer; Executive Chair, Financial Crime Management Technology

John Zecca

Executive Vice President and Chief Legal, Risk and Regulatory Officer

Michelle Daly

Senior Vice President and Controller and Principal Accounting Officer

Nelson Griggs

President

Sarah Youngwood

Executive Vice President and Chief Financial Officer

Tal Cohen

President

Board of directors at NASDAQ.

Alfred Zollar

Director

Charlene Begley

Director

Essa Kazim

Director

Holden Spaht

Director

Jeffery Yabuki

Director

Johan Torgeby

Director

Kathryn Koch

Director

Melissa Arnoldi

Director

Michael Splinter

Lead Independent Director

Thomas Kloet

Director

Toni Townes-Whitley

Director

Research analysts who have asked questions during NASDAQ earnings calls.

Alexander Blostein

Goldman Sachs

8 questions for NDAQ

Brian Bedell

Deutsche Bank

7 questions for NDAQ

Michael Cyprys

Morgan Stanley

7 questions for NDAQ

Ashish Sabadra

RBC Capital Markets

6 questions for NDAQ

Benjamin Budish

Barclays PLC

6 questions for NDAQ

Owen Lau

Oppenheimer & Co. Inc.

6 questions for NDAQ

Patrick Moley

Piper Sandler & Co.

6 questions for NDAQ

Alex Kramm

UBS Group AG

5 questions for NDAQ

Dan Fannon

Jefferies & Company Inc.

5 questions for NDAQ

Jeff Schmitt

William Blair & Company, L.L.C.

5 questions for NDAQ

Michael Cho

JPMorgan Chase & Co.

5 questions for NDAQ

Eli Abboud

Bank of America

4 questions for NDAQ

Simon Clinch

Redburn Atlantic

4 questions for NDAQ

Craig Siegenthaler

Bank of America

3 questions for NDAQ

Daniel Fannon

Jefferies Financial Group Inc.

3 questions for NDAQ

Kyle Voigt

Keefe, Bruyette & Woods

3 questions for NDAQ

Alexander Kramm

UBS Group AG

2 questions for NDAQ

William Katz

TD Cowen

2 questions for NDAQ

Y. Cho

JPMorgan Chase & Co.

2 questions for NDAQ

Ben Budish

Barclays PLC

1 question for NDAQ

Brian Bertram Bedell

Deutsche Bank AG

1 question for NDAQ

Christopher Allen

Citigroup

1 question for NDAQ

Jeffrey Schmitt

William Blair

1 question for NDAQ

Kwun Sum Lau

Oppenheimer

1 question for NDAQ

Simon Alistair Clinch

Redburn Atlantic

1 question for NDAQ

Recent press releases and 8-K filings for NDAQ.

- The FDA granted accelerated approval for YUVIWEL® (navepegritide) as the first once-weekly treatment to increase linear growth in children aged 2 years and older with achondroplasia, based on improved annualized growth velocity.

- YUVIWEL is designed to provide continuous systemic exposure to C-type natriuretic peptide (CNP) over the weekly dosing interval to counteract overactive FGFR3 signaling.

- Commercial availability is expected in the early part of Q2 2026, supported by Ascendis’s U.S. Signature Access Program offering patient journey and financial assistance services.

- The FDA also issued a Rare Pediatric Disease Priority Review Voucher, granting priority review for a subsequent drug application.

- SEGG Media acquired a controlling supermajority interest in Veloce Media Group for $61 million, expanding its international footprint and scaling its top line.

- Veloce’s five-pillar revenue model spans digital advertising, creator representation, esports/sim racing services, sustainable motorsport, and direct-to-consumer commerce via Quadrant.

- In 2025, Veloce posted $2.17 million in digital advertising and its esports/sim racing division earned $3.36 million, while Quadrant’s H2 2025 partnerships revenue reached $2.45 million alongside $675,000 in merchandise sales.

- Management projects that Veloce and Quadrant will generate over $20 million in revenue in 2026.

- New Era Energy & Digital will deploy 450 MW of behind-the-meter generation capacity at its Texas Critical Data Center (TCDC) in partnership with Thunderhead Energy and Turbine-X Energy.

- The arrangement secures key power equipment and advances procurement to keep the project on its anticipated development and construction schedule.

- The plan aligns with the Trump Administration’s Ratepayer Protection Pledge to protect the public grid and promote private power solutions for large-scale data centers.

- TCDC is a 438-acre AI and high-performance computing campus in Ector County, Texas, master-planned to scale to 1+ gigawatt of capacity, offering turnkey digital infrastructure and integrated power assets.

- FullPAC, a nonpartisan campaign technology provider for over 5,000 clients, highlights its role in powering high-volume communications ahead of the 2026 Midterm Elections.

- The 2026 election cycle is projected to reach $10.8 billion in advertising spend, a 20% increase over the 2022 midterms.

- In October 2025 and January 2026, FullPAC acquired Advocacy Lab (AI content generation) and Govt.com (constituent outreach), expanding its service offerings and recurring revenue base.

- The Company’s platform also supports corporate proxy communications for Nasdaq- and NYSE-listed issuers, and it has reserved the “GOTV” ticker for a planned Nasdaq Capital Market listing via a Reg A+ offering, targeting $15 million in market value of unrestricted securities.

- ProCap Financial repurchased 159,904 shares on February 26, 2026 at approximately 25% discount to Net Asset Value (NAV).

- The firm is pursuing aggressive share repurchases to narrow its NAV discount, according to CEO Anthony Pompliano.

- Founded in 2025 with over $750 million raised, ProCap Financial trades on Nasdaq under the ticker BRR.

- New Era entered a non-binding LOI to acquire 54 acres adjacent to its 438-acre Texas Critical Data Centers campus in Ector County, Texas, supporting ongoing lease talks with a hyperscale tenant.

- The acquisition will enhance the campus—master-planned to scale to 1+ gigawatt—by optimizing power interconnection design and enabling direct power offtake arrangements.

- Ongoing site work includes land clearing, removal and relocation of pipeline infrastructure, and subsurface soil sampling to support civil engineering design.

- Management expects the corridor to boost negotiating leverage with power producers, reduce grid congestion risk, and improve redundancy and reliability for high-performance computing tenants.

- ProCap repurchased 159,904 shares at an approximate 28% discount to NAV on February 25, 2026.

- NAV stands at ~$316 million, with 82,800,271 basic shares outstanding, implying a NAV per share of ~$3.82 and a current discount of ~28%.

- CEO Anthony Pompliano reaffirmed commitment to ongoing buybacks, stating every purchase is accretive and will continue if the discount persists.

- Reported $10.8 million revenue in 2025 vs. none in 2024, a full-year net loss of $153.9 million (Q4 loss $92.4 million), R&D expenses of $138.1 million, and held $213.2 million cash as of Dec. 31, 2025, funding operations into 2028.

- Completed a $185 million private placement in December 2025 to support key clinical readouts beginning Q1 2027.

- Announced a strategic partnership with Sichuan Kelun-Biotech granting Crescent rights to CR-003 outside Greater China and Kelun-Biotech rights to CR-001 in Greater China.

- Advanced pipeline: FDA cleared the IND for CR-001, first patient dosed in the Phase 1/2 ASCEND trial, with first ADC combination trial expected H2 2026.

- N2OFF will rebrand as Nexentis Technologies Inc. and change its Nasdaq ticker to NXTS effective February 26, 2026.

- On October 20, 2025, N2OFF completed the acquisition of MitoCareX Bio Ltd, marking a strategic pivot from cleantech to biotech and making MitoCareX a wholly owned subsidiary.

- The company plans to leverage the MITOLINE™ computational platform for mitochondrial carrier biology across precision oncology and inflammatory metabolic diseases, while continuing to manage its non-core solar energy investments.

- Early in vitro results from MITOLINE-powered discovery rounds have shown anti-tumor activity and reduced pro-inflammatory markers, supporting further preclinical lead optimization.

- Eagle Nuclear Energy Corp. commenced trading on the Nasdaq under the ticker symbols NUCL and NUCLW.

- It is the first U.S. domestic uranium exploration company with exclusive small modular reactor (SMR) technology to list on a U.S. exchange.

- The company’s flagship Aurora Uranium Project hosts the largest conventional, measured and indicated uranium deposit in the U.S., with 32.75 million pounds indicated and 4.98 million pounds inferred of near-surface uranium.

Fintool News

In-depth analysis and coverage of NASDAQ.

Quarterly earnings call transcripts for NASDAQ.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more