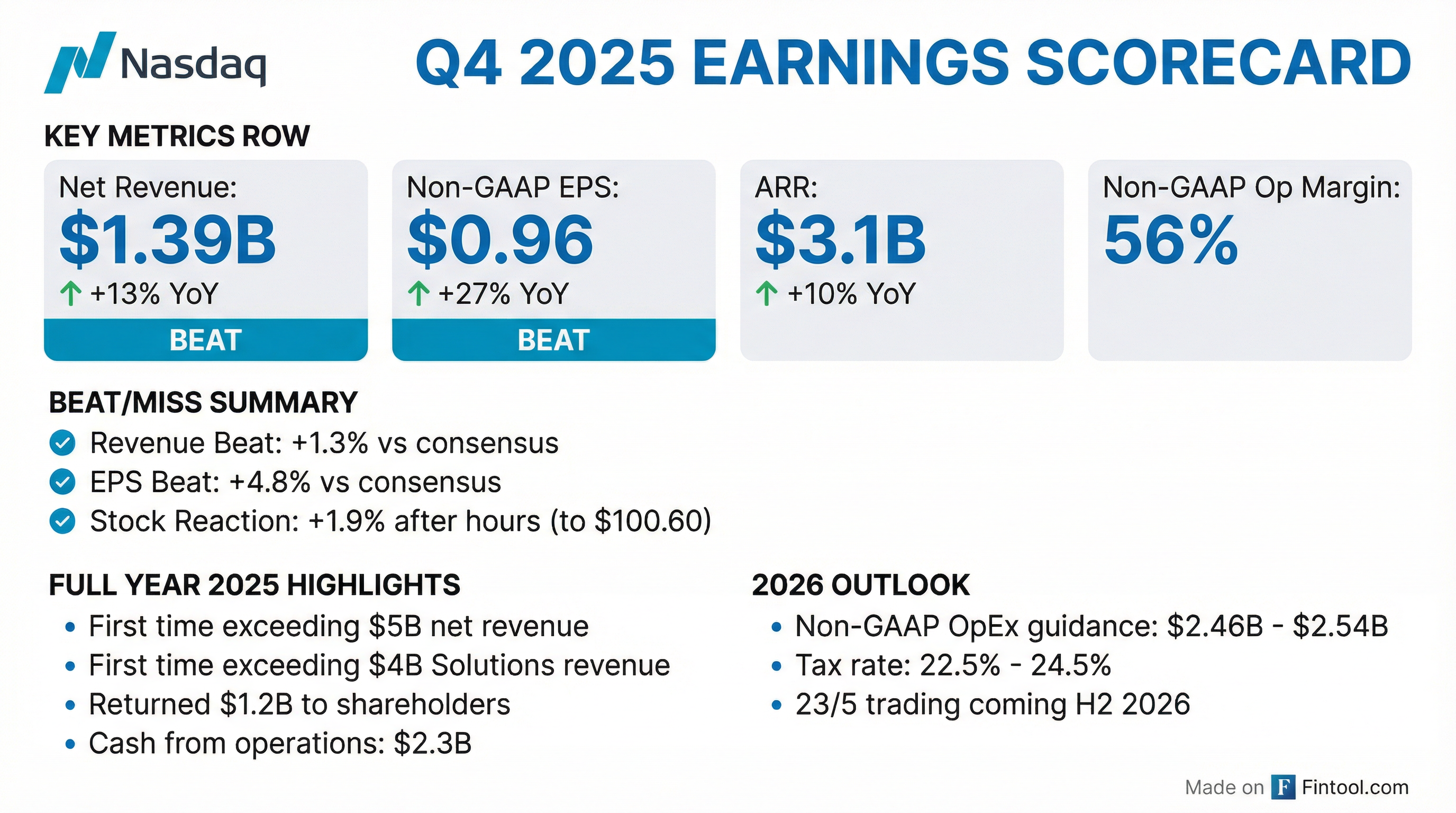

Earnings summaries and quarterly performance for NASDAQ.

Executive leadership at NASDAQ.

Adena Friedman

Chair and Chief Executive Officer

Bradley Peterson

Executive Vice President and Chief Information Officer/Chief Technology Officer

Bryan Smith

Executive Vice President and Chief People Officer

Jeremy Skule

Executive Vice President and Chief Strategy Officer; Executive Chair, Financial Crime Management Technology

John Zecca

Executive Vice President and Chief Legal, Risk and Regulatory Officer

Michelle Daly

Senior Vice President and Controller and Principal Accounting Officer

Nelson Griggs

President

Sarah Youngwood

Executive Vice President and Chief Financial Officer

Tal Cohen

President

Board of directors at NASDAQ.

Alfred Zollar

Director

Charlene Begley

Director

Essa Kazim

Director

Holden Spaht

Director

Jeffery Yabuki

Director

Johan Torgeby

Director

Kathryn Koch

Director

Melissa Arnoldi

Director

Michael Splinter

Lead Independent Director

Thomas Kloet

Director

Toni Townes-Whitley

Director

Research analysts who have asked questions during NASDAQ earnings calls.

Alexander Blostein

Goldman Sachs

8 questions for NDAQ

Brian Bedell

Deutsche Bank

7 questions for NDAQ

Michael Cyprys

Morgan Stanley

7 questions for NDAQ

Ashish Sabadra

RBC Capital Markets

6 questions for NDAQ

Benjamin Budish

Barclays PLC

6 questions for NDAQ

Owen Lau

Oppenheimer & Co. Inc.

6 questions for NDAQ

Patrick Moley

Piper Sandler & Co.

6 questions for NDAQ

Alex Kramm

UBS Group AG

5 questions for NDAQ

Dan Fannon

Jefferies & Company Inc.

5 questions for NDAQ

Jeff Schmitt

William Blair & Company, L.L.C.

5 questions for NDAQ

Michael Cho

JPMorgan Chase & Co.

5 questions for NDAQ

Eli Abboud

Bank of America

4 questions for NDAQ

Simon Clinch

Redburn Atlantic

4 questions for NDAQ

Craig Siegenthaler

Bank of America

3 questions for NDAQ

Daniel Fannon

Jefferies Financial Group Inc.

3 questions for NDAQ

Kyle Voigt

Keefe, Bruyette & Woods

3 questions for NDAQ

Alexander Kramm

UBS Group AG

2 questions for NDAQ

William Katz

TD Cowen

2 questions for NDAQ

Y. Cho

JPMorgan Chase & Co.

2 questions for NDAQ

Ben Budish

Barclays PLC

1 question for NDAQ

Brian Bertram Bedell

Deutsche Bank AG

1 question for NDAQ

Christopher Allen

Citigroup

1 question for NDAQ

Jeffrey Schmitt

William Blair

1 question for NDAQ

Kwun Sum Lau

Oppenheimer

1 question for NDAQ

Simon Alistair Clinch

Redburn Atlantic

1 question for NDAQ

Recent press releases and 8-K filings for NDAQ.

- SVF Vaccines’s portfolio company Novakand Pharma will acquire all SVF shares via issuance of new shares valued at SEK 55 million, subject to extraordinary general meeting approval, Nasdaq listing continuation and regulatory approval.

- Post-transaction, SVF shareholders will own 66.7% and Novakand shareholders 33.3% of the combined entity, which is targeted to list on Nasdaq First North in Q1 2026.

- The merged company will focus on SVF’s vaccine therapies, retain Novakand’s fractalkine program, and expects sufficient working capital for 12 months plus a planned SEK 30 million capital raise for a Phase 1 study.

- Nasdaq proposed a “Fast Entry” rule to speed inclusion of newly listed large-cap companies into the Nasdaq-100, allowing eligible firms to join after 15 trading days with at least five trading days’ notice and waiving seasoning and some liquidity tests.

- Eligibility is based on a company’s market-capitalization ranking (roughly the top 40 of current constituents), with fast entrants temporarily expanding the index until the next annual reconstitution.

- The proposal includes technical tweaks to market-cap calculations, low-float weighting, and quarterly maintenance to enhance replicability for passive managers.

- Advisers for high-profile IPO candidates, including SpaceX (last valued at $800 billion) and AI startups like Anthropic, have engaged index providers about earlier entry, underscoring industry pressure for real-time market alignment.

- If approved, the changes could take effect after the March quarterly rebalance, prompting quicker rebalancing by index-tracking funds such as Invesco’s QQQ.

- Bond (legal name Tg-17, Inc.) began trading on Nasdaq under the ticker OBAI, marking its public debut of the AI-powered Preventative Personal Security platform.

- The platform has handled over 1.4 million security service requests, including more than 10,000 emergencies and life-saving situations.

- With over $100 million invested in technology and operations, Bond targets a $438 billion global private security market as demand for proactive safety accelerates.

- The listing is positioned as a catalyst for long-term global growth and infrastructure expansion, rather than an exit event.

- Operating in 28 countries, Bond is already adopted by leading corporations, municipalities, and academic institutions worldwide.

- The Osaka Exchange selected Nasdaq Eqlipse Trading and Market Surveillance platforms to upgrade its derivatives infrastructure for enhanced performance and scalability.

- The deployment offers ultra-low latency, multi-asset trading support, robust risk management tools, and AI-driven market abuse detection to bolster market integrity.

- This expansion builds on Nasdaq’s longstanding technology partnerships across Japan’s financial ecosystem, including Calypso, AxiomSL, and Trade Surveillance solutions.

- The initiative aims to strengthen Japan’s position in the global derivatives market by future-proofing operations and enabling rapid product deployment.

- Brodsky & Smith is investigating whether the Northfield Bancorp Board breached fiduciary duties in its $597 million stock-and-cash deal with Columbia Financial.

- An inquiry targets the Coterra Energy merger into Devon Energy at a 0.70 exchange ratio, implying a $58 billion enterprise value.

- The Exact Sciences Board’s approval of Abbott’s $105 per share cash offer (≈$21 billion equity value) is under review.

- The Semrush acquisition by Adobe for $12 per share (≈$1.9 billion) is examined, noting the deal price is below its 52-week high of $18.74.

- Registration statement declared effective by the SEC; trading on Nasdaq expected to begin February 4, 2026 under the ticker OBAI.

- Bond’s AI-powered Preventative Personal Security platform has handled 1.4 million service requests, including over 10,000 emergencies and life-saving interventions.

- The private security market is projected to reach $438 billion, positioning Bond as a potential category leader.

- Bond has invested more than $100 million to date in its technology, operations, and global expansion.

- Omdia forecasts retailers will control 47% of the North American TV operating system market by 2029, up from 27% in 2025, driven by shifts in retail media ad strategies on smart TVs.

- In China, local platform Anesis maintains a 96% market share, with Omdia expecting this dominance to remain stable through the forecast period.

- Walmart’s CastOS shipments are projected to grow from 4.8 million units in 2024 to 6.6 million in 2025 (+37.5%) and reach 14 million units by 2027, reflecting momentum from its Vizio acquisition.

- Amazon’s Fire TV shipments rose from 6.1 million in 2024 to an expected 6.8 million in 2025 (+11.5%) and are forecast to hit 8.8 million by 2029, with total retail device shipments reaching 50 million units by 2029.

- SpaceX represents 13.64% of Private Shares Fund’s portfolio as of December 31, 2025, maintaining its position as the Fund’s largest holding

- The Fund’s top 10 positions account for 47.60% of total assets as of December 31, 2025, including SpaceX, GrubMarket, Nanotronics, Tradeshift, Dataminr, Motive Technologies, Databricks, xAI, EquipmentShare, and Upgrade

- Motive Technologies (3.79% weighting) confidentially filed for an IPO in September 2025 and publicly on January 5, 2026, with JPMorgan leading after a $150 million pre-IPO round

- EquipmentShare (2.82% weighting) filed its Form S-1 in December 2025 and debuted on Nasdaq under ticker EQPT on January 23, 2026

- Filed Form F-1 registering shares for an equity line with ARC Group, enabling up to $30 million in discretionary growth capital.

- Furnished audited MBody AI financials for the year ended December 31, 2024 and six months ended June 30, 2025, reflecting a platform-building phase and commercial inflection in H2 2025 as deployments scaled.

- Returned to compliance with Nasdaq listing requirements and advanced the merger, expected to close in the first half of 2026, positioning the combined company as a leader in embodied AI.

- The EMA’s CHMP adopted a positive opinion recommending EU marketing authorization of EURneffy® 1 mg for emergency treatment of Type I allergic reactions, including anaphylaxis, in children weighing ≥15 kg to <30 kg.

- This follows the 2 mg dose approved in August 2024 for patients ≥30 kg; upon EC approval, ALK-Abelló A/S will distribute EURneffy across the EU, Iceland, Liechtenstein, and Norway.

- The needle-free nasal spray addresses barriers to timely treatment in younger children—who account for one-quarter of epinephrine auto-injector use in Europe—potentially expanding market reach.

Fintool News

In-depth analysis and coverage of NASDAQ.

Quarterly earnings call transcripts for NASDAQ.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more