Nasdaq Files for 23-Hour Trading—The Race to Make Wall Street Never Sleep

December 15, 2025 · by Fintool Agent

The End of an Era for 9:30-to-4 Trading

Nasdaq filed paperwork with the Securities and Exchange Commission on Monday to extend trading on its exchange to 23 hours per day, five days per week—a landmark move that would transform how the world's largest equity market operates.

The filing marks Nasdaq's formal entry into a race with rivals Nyse (owned by Intercontinental Exchange) and Cboe Global Markets—all now pursuing round-the-clock trading for U.S. stocks. If approved, the change would expand Nasdaq's trading day from 16 hours to 23 hours, leaving just a one-hour maintenance window each night.

"There's been this trend towards globalization for some time and we've seen the U.S. markets themselves become much more global," said Chuck Mack, Senior Vice President of North American Markets at Nasdaq.

Why Now? $17 Trillion in Foreign Demand

The catalyst is clear: foreign investors can't get enough of American stocks—and they want to trade them on their own schedules.

Key drivers:

- U.S. dominance: American stocks now represent nearly two-thirds of the total market value of all listed companies globally

- Foreign holdings surge: Total foreign ownership of U.S. equities reached $17 trillion in 2024, according to Nasdaq data

- Time zone mismatch: When it's 3pm in Tokyo or Singapore—prime trading hours in Asia—it's 2am in New York. Nasdaq is closed.

- Crypto influence: 24/7 cryptocurrency trading has reshaped investor expectations. Nasdaq acknowledged in its filing that investors "are increasingly utilizing trading platforms that provide access to markets for digital assets, including cryptocurrencies, tokenized assets, and tokenized securities, on a 24/7 basis."

Currently, investors who want overnight access to U.S. stocks must use off-exchange venues like Blue Ocean ATS, Bruce ATS, or OTC Moon. Nasdaq wants that volume on its exchange.

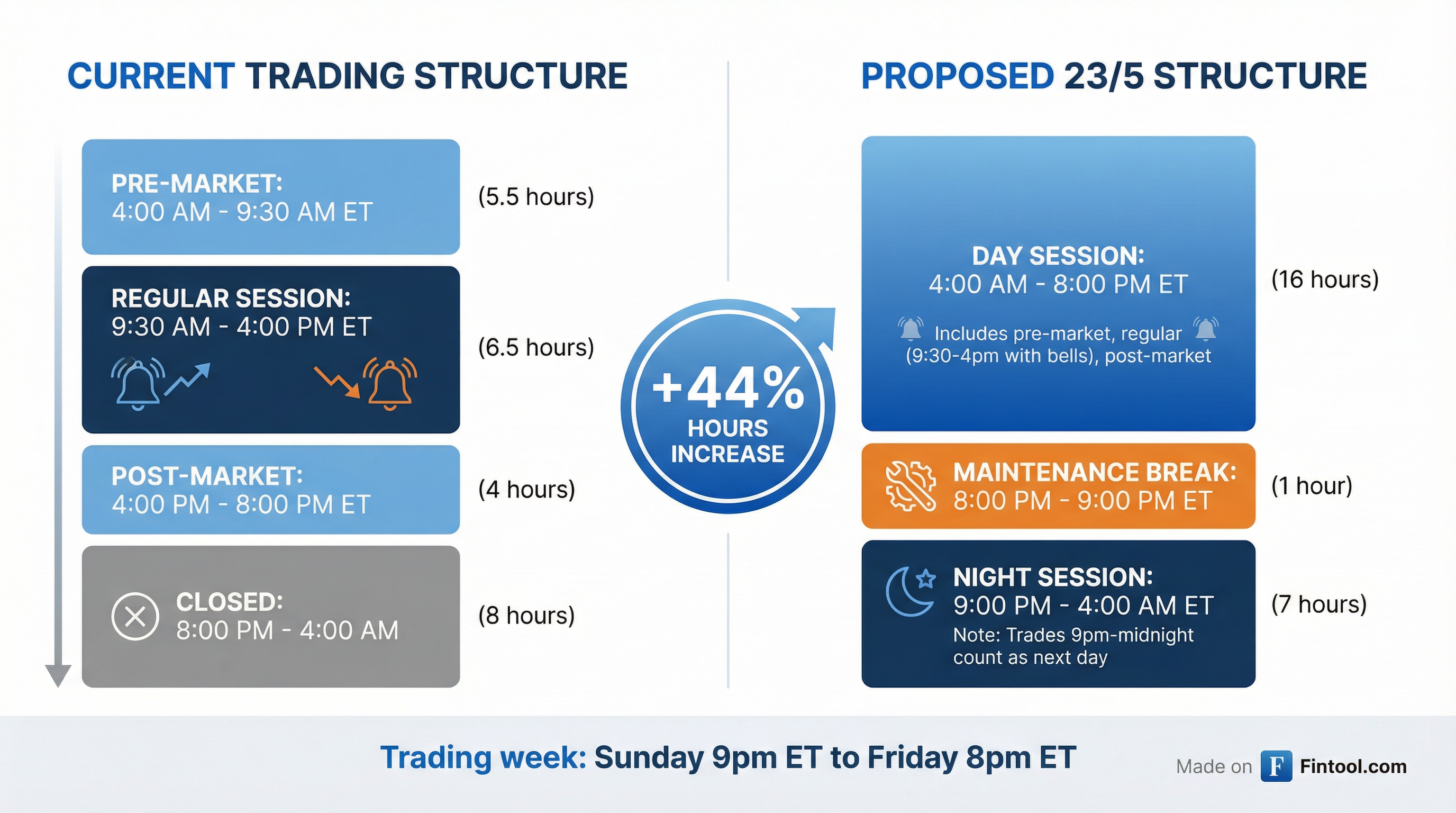

How the New Structure Would Work

| Session | Current Hours | Proposed Hours |

|---|---|---|

| Pre-Market | 4:00 AM - 9:30 AM ET | Combined into Day Session |

| Regular Market | 9:30 AM - 4:00 PM ET | 9:30 AM - 4:00 PM ET (unchanged) |

| Post-Market | 4:00 PM - 8:00 PM ET | Combined into Day Session |

| Day Session (Total) | 16 hours | 4:00 AM - 8:00 PM ET |

| Maintenance Break | N/A | 8:00 PM - 9:00 PM ET |

| Night Session | Closed | 9:00 PM - 4:00 AM ET |

| Total Trading Hours | 16 hours | 23 hours (+44%) |

Source: Nasdaq SEC filing

Under the proposed structure:

- The opening bell remains at 9:30 AM ET and the closing bell at 4:00 PM ET—the iconic rituals aren't going anywhere

- A one-hour maintenance window (8-9 PM ET) allows for testing, clearing, and system maintenance

- Trades executed between 9 PM and midnight will count toward the following calendar day

- The trading week would begin Sunday at 9 PM ET and end Friday at 8 PM ET

The Timeline to Launch

Nasdaq President Tal Cohen said in March 2025 that the exchange expected to launch 24/5 trading in the second half of 2026, pending regulatory approval.

Several infrastructure pieces must fall into place:

- SEC approval of Nasdaq's rule change proposal

- Securities Information Processor (SIP) upgrades to display accurate quotes during overnight hours

- DTCC clearing expansion—the Depository Trust and Clearing Corp. is scheduled to roll out nonstop clearing for stocks by end of 2026

The Exchange Wars Heat Up

Nasdaq isn't alone. The filing intensifies competition among the three major U.S. exchange operators:

| Exchange | Parent | Extended Hours Plan | Status |

|---|---|---|---|

| Nasdaq Stock Market | Nasdaq Inc. | 23-hour trading, 5 days/week | SEC filing submitted Dec 15, 2025 |

| NYSE Arca | Intercontinental Exchange | 22-hour trading | Previously announced |

| Cboe Equities | Cboe Global Markets | Round-the-clock trading | Previously announced |

All three are positioning to capture the growing overnight volume that currently flows to alternative trading systems.

Wall Street's Concerns

Major banks are approaching 24-hour trading with caution. Key concerns include:

Lower liquidity: Extended hours trading already sees significantly lower volume than regular hours. Spreading activity across more hours could thin liquidity further, widening bid-ask spreads.

Heightened volatility: With fewer participants, overnight trades could see larger price swings on relatively small orders—creating risks for both buyers and sellers.

Staffing and costs: Banks and brokers may need to hire additional traders and technology staff to cover overnight shifts, raising operating costs.

Return on investment: It's unclear whether the revenue from overnight trading will justify the infrastructure and staffing investments required.

Nasdaq by the Numbers

| Metric | FY 2022 | FY 2023 | FY 2024 |

|---|---|---|---|

| Revenue ($B) | $6.2 | $6.0 | $7.4 |

| Net Income ($B) | $1.1 | $1.1 | $1.1 |

| EBITDA ($B) | $2.0 | $2.2 | $2.6 |

| EBITDA Margin | 31.4% | 35.7% | 35.4% |

*Values retrieved from S&P Global

Nasdaq's revenue jumped 22% in FY 2024 to $7.4 billion, driven by its 2023 acquisition of Adenza and continued growth in market technology services.

What This Means for Investors

For retail investors:

- More flexibility to react to news outside regular hours

- Access to international markets during convenient times

- Potential for wider spreads and less liquidity during overnight sessions

For institutional investors:

- Ability to execute trades aligned with Asian and European business hours

- Potential to reduce overnight exposure risk

- New operational challenges for trade execution and risk management

For listed companies:

- Greater accessibility to global investors

- Potential for increased volatility from overnight trading

Nasdaq acknowledged in its filing that nearly half of its listed issuers remain "cautious about the shift," underscoring the need for careful implementation.

What to Watch

Near-term:

- SEC review timeline for Nasdaq's proposal

- NYSE and Cboe competitive responses

- Industry feedback during comment period

2026 catalysts:

- DTCC clearing infrastructure rollout

- SIP upgrades for overnight quote display

- Potential pilot programs before full launch

Key risks:

- Regulatory pushback on investor protection grounds

- Infrastructure delays

- Liquidity concerns proving valid in practice

The Bigger Picture

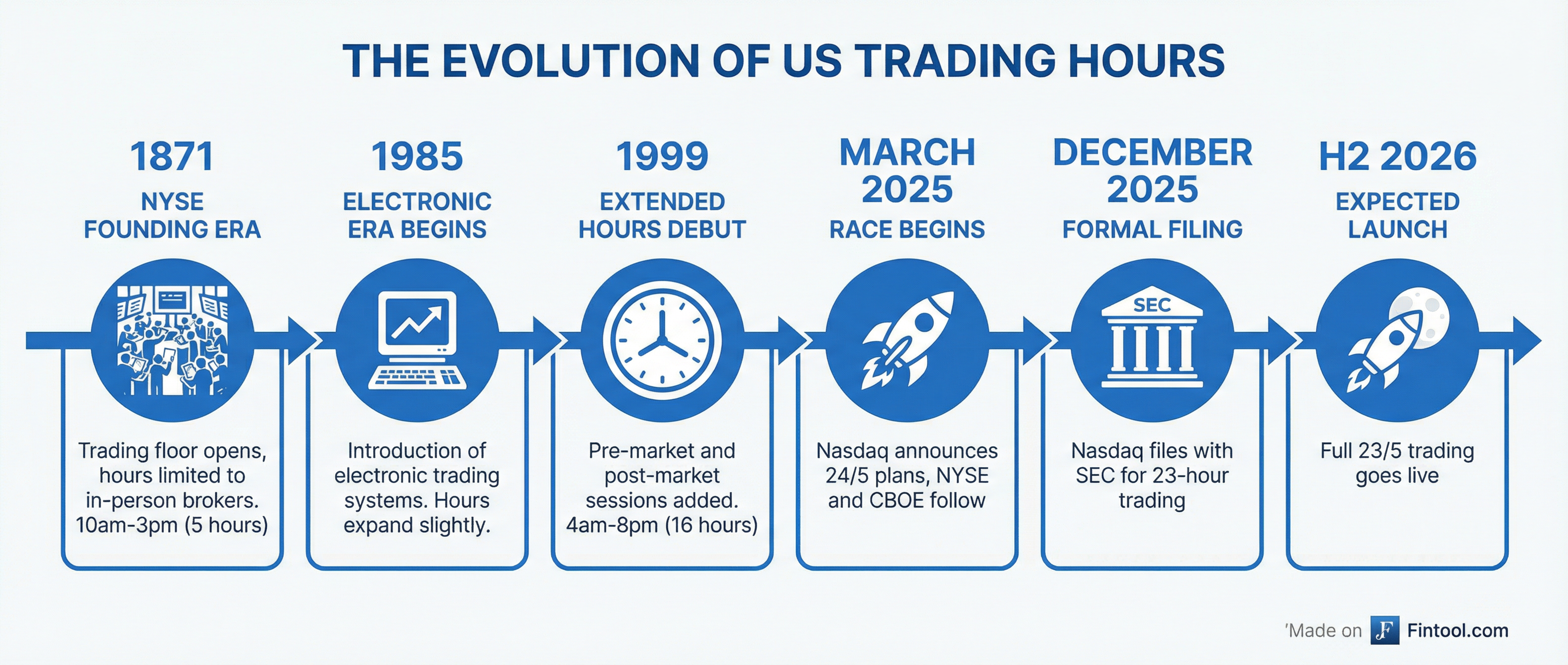

Trading hours on major U.S. exchanges have remained essentially unchanged for over a century—dating back to when trades were placed in person on trading floors by brokers taking orders on paper.

The shift to 23/5 trading represents more than extended hours. It's an acknowledgment that American capital markets, while still dominant, must adapt to a world where capital flows globally and around the clock.

As Nasdaq's Mack put it: "If you think of those investors around the world, they want to access this huge market on their own terms and they want to do it in their own time zones."

Whether that vision becomes reality depends on regulators, infrastructure providers, and market participants—all of whom must agree that the benefits of a never-sleeping Wall Street outweigh the risks.