Earnings summaries and quarterly performance for Match Group.

Executive leadership at Match Group.

Board of directors at Match Group.

Ann L. McDaniel

Director

Darrell Cavens

Director

Glenn H. Schiffman

Director

Kelly Campbell

Director

Laura Rachel Jones

Director

Melissa Brenner

Director

Pamela S. Seymon

Director

Sharmistha Dubey

Director

Stephen Bailey

Director

Thomas J. McInerney

Chairman of the Board

Research analysts who have asked questions during Match Group earnings calls.

Cory Carpenter

JPMorgan Chase & Co.

6 questions for MTCH

Jason Helfstein

Oppenheimer & Co. Inc.

6 questions for MTCH

Nathaniel Feather

Morgan Stanley

6 questions for MTCH

Shweta Khajuria

Wolfe Research, LLC

6 questions for MTCH

Benjamin Black

Deutsche Bank AG

5 questions for MTCH

Curtis Nagle

Bank of America

4 questions for MTCH

Daniel Salmon

New Street Research

4 questions for MTCH

John Blackledge

TD Cowen

4 questions for MTCH

Ross Sandler

Barclays

4 questions for MTCH

Ygal Arounian

Citigroup

4 questions for MTCH

Brad Erickson

RBC Capital Markets

3 questions for MTCH

Christopher Kuntarich

UBS

2 questions for MTCH

Bill Kerr

TD Cowen

1 question for MTCH

Chris Kuntarich

UBS Group

1 question for MTCH

James Heaney

Jefferies

1 question for MTCH

Jeff Seiner

Deutsche Bank

1 question for MTCH

Justin Patterson

KeyBanc Capital Markets

1 question for MTCH

Kenneth Gawrelski

Wells Fargo & Company

1 question for MTCH

Logan Wyllie

TD Cowen

1 question for MTCH

Mark Kelley

Stifel, Nicolaus & Company, Incorporated

1 question for MTCH

Robert Coolbrith

Evercore ISI

1 question for MTCH

Robert Zeller

Truist Securities

1 question for MTCH

Recent press releases and 8-K filings for MTCH.

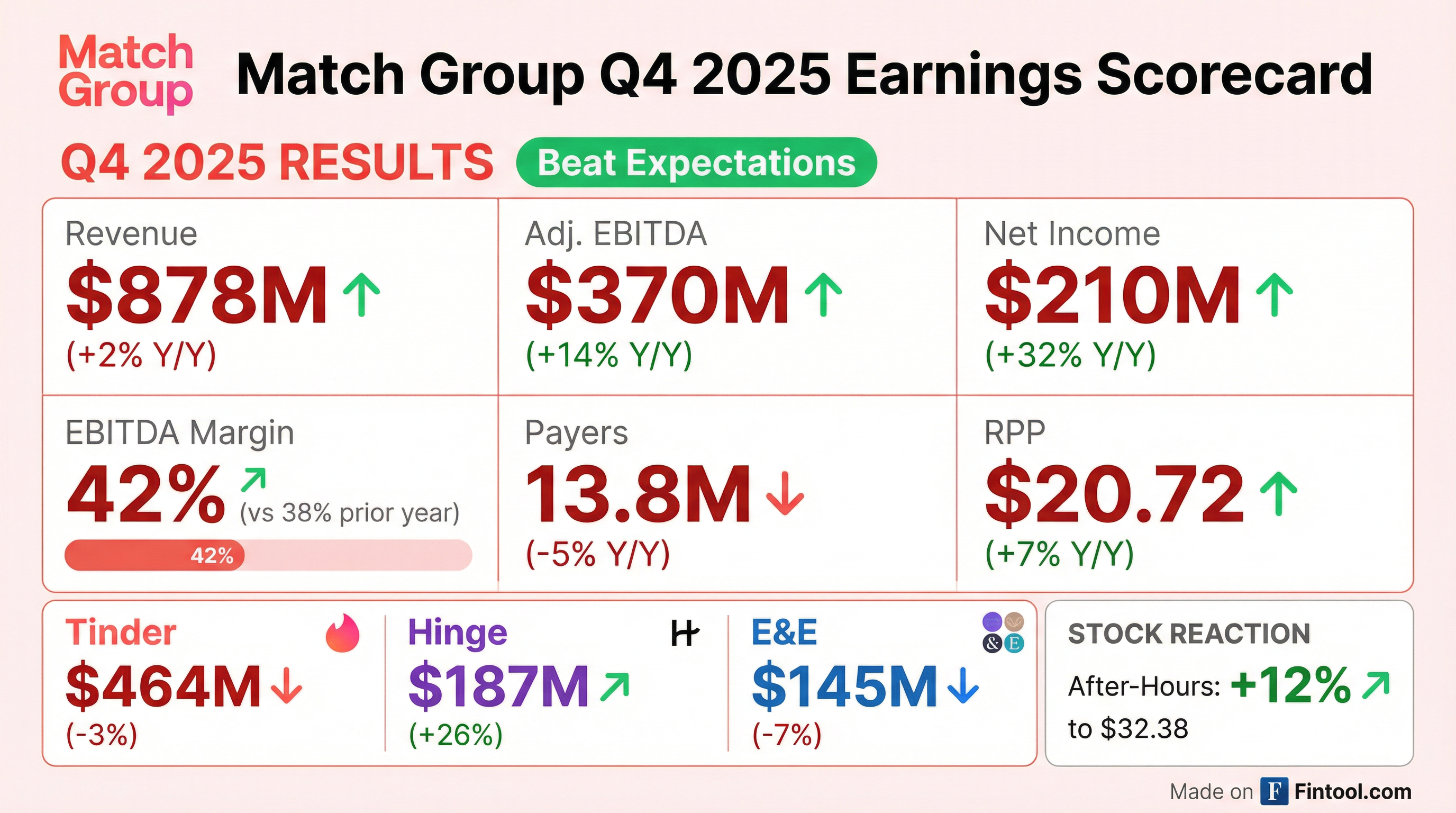

- Match Group reported Q4 revenue of $878 M (up 2%, FXN flat) and adjusted EBITDA of $370 M (42% margin), driven by Tinder ($464 M, down 3%) and Hinge ($186 M, up 26%) performance.

- Full-year 2025 revenue was $3.5 B (flat), adjusted EBITDA $1.2 B (35% margin; 38% ex-discrete items), with free cash flow of $1 B, share buybacks of $789 M, and a 7% reduction in diluted shares outstanding.

- 2026 guidance includes Q1 revenue of $850–860 M (up 2–3% as-reported, down 1%–flat FXN) and adjusted EBITDA of $315–320 M, and full-year revenue of $3.41–3.535 B (flat) with adjusted EBITDA of $1.28–1.325 B (37.5% margin).

- In Q4, Match Group repurchased 7.3 M shares for $239 M and paid $45 M in dividends; the board raised the quarterly dividend by 5% to $0.20 per share.

- Match Group delivered $878 million in Q4 revenue, up 2% (flat FX-neutral), and $370 million of adjusted EBITDA, up 14% with a 42% margin.

- In Q4, Tinder direct revenue was $464 million (–3%), Hinge revenue was $186 million (+26%), E&E brands generated $145 million (–7%), and Asia revenue was $66 million (–2%).

- Generated $1 billion of free cash flow in 2025, repurchased 7.3 million shares for $239 million, and paid $45 million in dividends in Q4.

- Q1 2026 revenue is guided to $850–860 million (+2%–3% YoY), and full-year 2026 revenue is expected at $3.41–3.535 billion (flat YoY) with adjusted EBITDA of $1.28–1.325 billion.

- Total revenue of $878 M in Q4, up 2% year-over-year (FXN flat).

- Net income of $210 M (24% margin), up 32% Y/Y, and Adjusted EBITDA of $370 M (42% margin), up 14% Y/Y.

- Free cash flow of $308 M in Q4; FY 2025 FCF of $1,024 M representing 83% conversion.

- Segment highlights: Tinder direct revenue $463.8 M (–3% Y/Y) with RPP $17.63 (+5%); Hinge direct revenue $186.5 M (+26% Y/Y) with payers of 1.886 M (+17% Y/Y).

- Q4 total revenue was $878 million, up 2% (flat FXN), with Adjusted EBITDA of $370 million (+14%) and a 42% margin.

- Tinder Q4 direct revenue of $464 million (−3%), payers down 8% to 8.8 million, RPP up 5% to $17.63, and Adjusted EBITDA margin of 55%.

- Hinge Q4 direct revenue grew 26% to $186 million, payers up 17% to 1.9 million, RPP up 8% to $32.96, and Adjusted EBITDA margin of 36%.

- 2026 guidance calls for flat total revenue of $3.41–$3.535 billion, Adjusted EBITDA of $1.28–$1.325 billion (37.5% margin), and free cash flow of $1.085–$1.135 billion.

- Q4 2025 total revenue was $878 million (up 2% Y/Y; flat FXN), with net income of $210 million (+32% Y/Y; 24% margin) and adjusted EBITDA of $370 million (+14% Y/Y; 42% margin).

- Full-year 2025 total revenue was $3.5 billion (flat Y/Y; FXN-neutral), net income $613 million (+11% Y/Y; 18% margin), adjusted EBITDA $1.2 billion (–1% Y/Y; 35% margin; +6% ex-discrete items), and free cash flow $1.0 billion, of which 108% was returned via share buybacks, dividends, and equity settlements, reducing diluted shares by 7% Y/Y .

- The Board declared a $0.20 per share quarterly dividend (5% increase), payable April 21, 2026, to holders of record as of April 7, 2026.

- 2026 outlook: Q1 revenue of $850–860 million (+2–3% Y/Y) and adjusted EBITDA of $315–320 million; full-year revenue of $3.41–3.535 billion (flat Y/Y) and adjusted EBITDA of $1.28–1.325 billion.

- In Q4 2025, Match Group delivered $878 million in revenue (up 2% Y/Y), $210 million in net income (up 32% Y/Y), and $370 million in adjusted EBITDA (up 14% Y/Y; 42% margin).

- For the full year 2025, the company posted $3.5 billion in total revenue (flat Y/Y), $613 million in net income (up 11% Y/Y), and $1.2 billion in adjusted EBITDA (down 1% Y/Y; 35% margin).

- Looking ahead, Match Group expects Q1 2026 revenue of $850–$860 million (2–3% Y/Y growth) and adjusted EBITDA of $315–$320 million (15% Y/Y increase), and full-year 2026 revenue of $3.41–$3.54 billion with adjusted EBITDA of $1.28–$1.33 billion.

- The Board declared a $0.20 per share quarterly dividend (5% increase) payable April 21, 2026, and the company repurchased 24.7 million shares for $789 million, deploying 108% of free cash flow on buybacks, dividends, and equity settlements.

- Apptopia’s MPI shows a material improvement in Tinder’s year-over-year growth in Q4 2025, suggesting performance may exceed consensus expectations.

- US Tinder downloads are down 4.2% YoY with sequential gains since Q2 2025; daily active users are down 7.5% YoY, but overall engagement is rising—average time per DAU up 5.1% YoY and +0.7% QoQ for female users.

- Among Gen Z users (17–25), Tinder’s average time per DAU increased 13.9% YoY, indicating stronger engagement from younger cohorts.

- Hinge faces headwinds: US downloads declined 4.1% YoY despite a 7.1% YoY rise in DAUs, with average time per DAU down 29.7% YoY for younger users and 25.4% YoY for male users.

- Match Group announced the spin-out of Overtone, an AI-first dating service led by Hinge founder Justin, and promoted Jackie to CEO of Hinge to ensure leadership continuity.

- Under CEO Spencer since February, Tinder cut 13 % of its workforce, reorganized into autonomous product pods, and shifted focus to user outcomes over short-term monetization, adopting the Sparks metric (six-message back-and-forth) as its primary performance indicator.

- The Face Check safety feature has reduced exposure to bad actors by 60 % and been rolled out across U.S. Tinder, with expected low-single-digit MAU headwinds deemed acceptable for long-term trust enhancement.

- A spring product event will update progress on Tinder’s revitalization phase ahead of a projected 2026–27 resurgence, featuring tests like Project Aurora in Australia and plans to reinvest $90–100 million in App Store fee savings into product and marketing.

- Match Group has spun out Overtone, an AI-first dating service led by Hinge founder Justin, and elevated Jackie to CEO of Hinge; Match will remain the largest shareholder with an option to reacquire if Overtone succeeds.

- Under new CEO Spencer, Tinder is shifting from lagging RPP metrics to the Sparks engagement metric (six-message exchanges) as a proxy for meaningful connections to drive retention, MAU growth, and word-of-mouth.

- The Face Check verification feature has reduced exposure to bad actors by 60% in early markets and is now rolling out across Tinder in the U.S., with a low-single-digit MAU/revenue headwind deemed acceptable for long-term safety gains.

- Project Aurora in Australia is testing new UI elements (Modes, Chemistry) alongside targeted marketing; insights will inform 2026 planning, supported by redeploying $90–100 million in app-store fee savings into product and customer acquisition.

- Match announced the spin-out of Overtone, an AI-first dating service led by Hinge founder Justin, while elevating Hinge’s president Jackie to CEO to ensure a smooth leadership transition and enable startup agility with shared VC risk.

- Under CEO Spencer since February, Tinder cut headcount by 13%, reorganized into autonomous product pods, and accelerated product releases from bi-weekly to weekly, shifting focus from lagging revenue metrics (RPP, payer growth) to the user-outcome “Sparks” metric—a six-way conversation proxy for meaningful connections.

- The Face Check identity-verification feature, now rolled out across the US at Tinder, has reduced exposure to bad actors by 60%, with an expected low-single-digit revenue impact, and will be tested on other brands without material company-wide effect.

- A dedicated spring event will showcase Project Aurora progress—augmenting Tinder with new Modes, the Chemistry AI feature, and targeted marketing—as part of the ongoing revitalization phase ahead of a 2026–27 resurgence.

- Hinge’s “app designed to be deleted” model and balanced roadmap of AI-driven innovations, monetization, and geographic expansion remain key tailwinds, with further growth initiatives planned for 2026 and beyond.

Quarterly earnings call transcripts for Match Group.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more