MGIC INVESTMENT (MTG)·Q4 2025 Earnings Summary

MGIC Delivers 8th Straight EPS Beat, Returns $915M to Shareholders in 2025

February 3, 2026 · by Fintool AI Agent

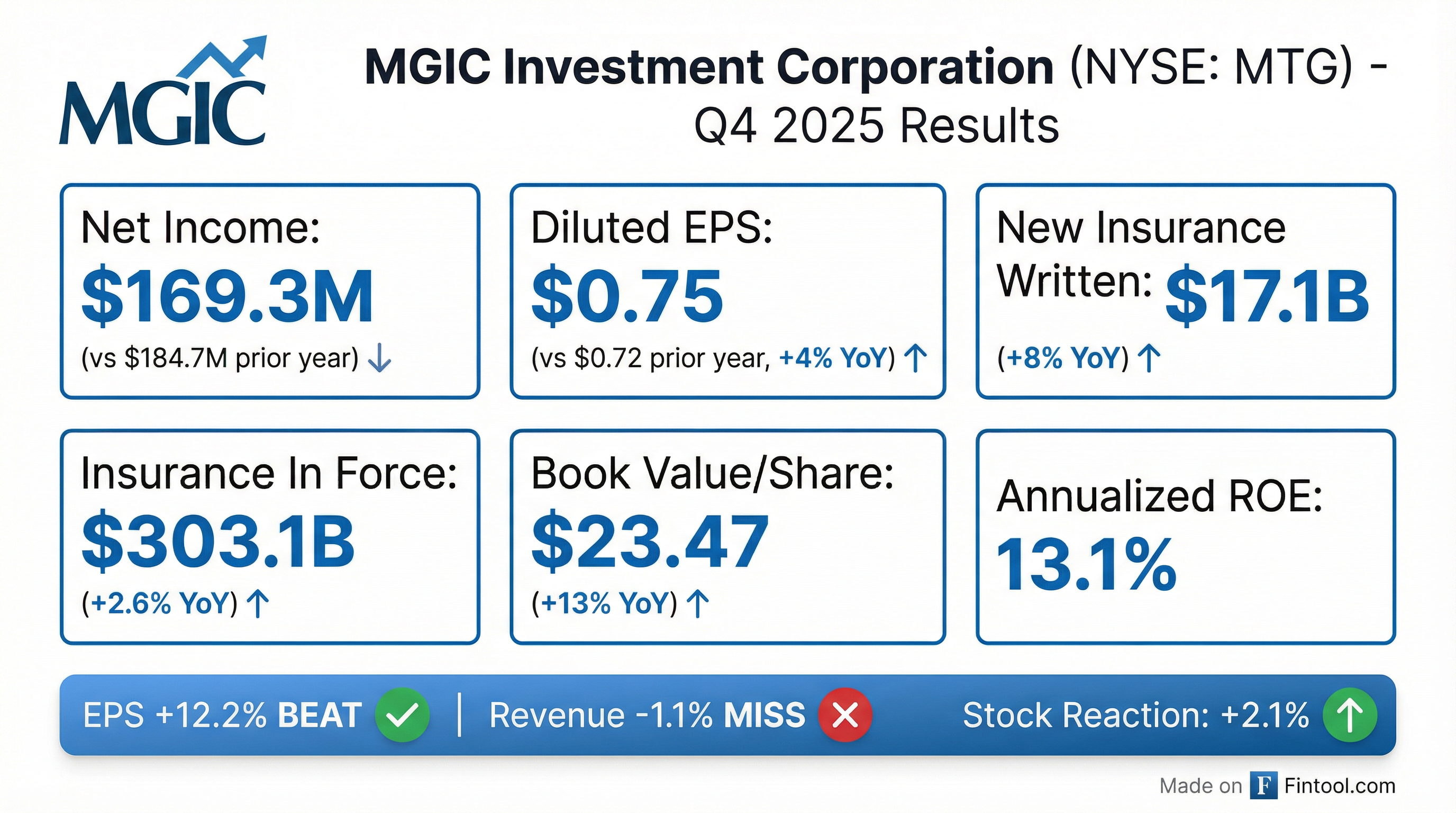

MGIC Investment Corporation (NYSE: MTG) reported Q4 2025 results that extended its earnings beat streak to eight consecutive quarters. The mortgage insurer posted diluted EPS of $0.75, beating consensus estimates by 12.2%, while revenue came in slightly below expectations . The stock rose 2.1% on the news, closing at $27.55.

CEO Tim Mattke struck a confident tone on the call: "Our performance stems from being grounded in decades of experience across a wide range of market cycles, disciplined risk management, and a thoughtful, measured approach to the market. We pair our expertise with a customer-centric mindset, continually evolving to meet the changing needs of our customers and the broader market."

On housing policy, Mattke highlighted a recent win: "The passage of the Working Families Tax Cut restored the tax deductibility of MI premiums, providing meaningful tax relief to homeowners without increasing risk to the housing finance system."

Did MGIC Beat Earnings?

EPS: Beat by +12.2% | Revenue: Slight miss by -1.1%

The EPS beat was driven by solid underwriting performance despite a higher loss ratio. Revenue came in slightly light as net premium yields continued their gradual compression — a trend management has consistently flagged as competitive pricing pressures work through the in-force book.

How Did the Stock React?

MTG shares rose +2.1% on the day, closing at $27.55 on elevated volume of 3.4M shares (vs. ~2.4M average). The stock is trading near the middle of its 52-week range of $21.94 - $29.97.

The muted positive reaction reflects a market that has come to expect consistent execution from MGIC. The company has beaten EPS estimates for eight straight quarters while maintaining disciplined capital management.

What Changed From Last Quarter?

Key shifts:

-

Loss ratio jumped to 13.2% from 4.5% in Q3 — still historically low but the highest in several quarters. Losses incurred were $31.2M vs. $10.9M last quarter and $8.7M in Q4 2024 . Total direct loss reserves stood at $475M with an average claim rate of 22.7% and average severity of $66,862. Notably, 103% of Q4 prior period development was due to claim rate improvement — a positive signal for reserve adequacy .

-

Primary delinquency inventory increased to 27,072 loans (2.1% of risk in force) from 25,747 in Q3 . The aging breakdown: 38% at 3 months or less, 35% at 4-11 months, and 27% at 12+ months — a stable distribution suggesting no acceleration in chronic delinquencies.

-

NIW momentum continued at $17B in Q4 and $60B for the full year, up 8% YoY. Credit quality remains high with an average credit score at origination of 748 .

-

Premium yields continued compressing — net premium yield declined to 31.2 bps from 32.3 bps in Q3, reflecting competitive pricing on newer vintages .

Capital Return: The Real Story

MGIC's capital return program remains the highlight for shareholders. In 2025, the company returned $915 million to shareholders — a remarkable figure against a ~$6.2B market cap .

The holding company ended the quarter with $1.074B in liquidity after MGIC paid a $400M dividend upstream . This provides substantial flexibility for continued buybacks and the ability to weather any credit deterioration.

Buybacks continued into Q1 2026: In January, MGIC repurchased an additional 2.7M shares for $73.2M .

Balance Sheet and Capital Position

MGIC maintains a fortress balance sheet with significant excess capital above regulatory requirements:

Tangible book value per share grew 11% YoY to $24.08, representing a 14% annualized growth rate since 2015 — a testament to MGIC's consistent capital compounding . This growth has been driven by retained earnings and the reduction in shares outstanding from buybacks.

Credit Ratings :

Insurance Portfolio Quality

MGIC's in-force book remains high quality, dominated by strong credit profiles:

Risk in Force by FICO Score :

- FICO 760+: 45%

- FICO 740-759: 18%

- FICO 720-739: 14%

- FICO 700-719: 10%

- FICO 680-699: 7%

- Below 680: 6%

77% of the portfolio has FICO scores of 720 or higher — a testament to the disciplined underwriting maintained since the post-GFC era.

Persistency remained stable at 84.8%, consistent with elevated mortgage rates keeping refinancing activity low. Average loan size in force increased to $272,400 from $264,100 a year ago .

Reinsurance Strategy Update

MGIC continued expanding its reinsurance footprint to optimize capital efficiency:

New transactions announced :

- December 2025: Executed traditional excess of loss reinsurance providing $250M coverage on 2021 NIW

- December 2025: Executed 40% quota share reinsurance covering eligible 2027 NIW

- January 2026: Completed $324M insurance-linked note transaction covering policies written January 2022 - March 2025

These transactions reduce tail risk and improve capital efficiency under PMIERs, allowing MGIC to continue its aggressive capital return program while maintaining a strong cushion.

Contingency Reserve Releases: MGIC has released $457M in contingency reserves to date, with $462-495M in scheduled annual releases through 2035 . These reserves, established at 50% of earned premiums, release to surplus after 10 years on a FIFO basis — providing a steady capital tailwind.

What Did Management Guide?

Management provided more explicit 2026 guidance during the earnings call:

Key guidance points from the call:

-

Insurance in force expected flat in 2026: CEO Tim Mattke noted that consensus forecasts project the MI market will be relatively similar to 2025 with elevated mortgage rates. If rates decrease more than expected, NIW would benefit from refinance volume but insurance in force growth would be offset by lower persistency .

-

Premium yields stable: CFO Nathan Colson expects in-force premium yield to remain near 38 bps in 2026 .

-

Expense reduction: Operating expenses expected to decline to $190-200M range, down from $201M in 2025, "due primarily to higher expected ceding commissions" from renegotiated quota share treaties .

-

Initial claim rate unchanged: MGIC continues applying 7.5% initial claim rate assumption for new delinquency notices .

S&P upgraded outlook to Positive in October 2025, reflecting the company's strong capital position and consistent performance .

Q&A Highlights: What Analysts Asked

On FHA Premium Reduction Risk (Bose George, KBW):

Asked if there's any indication the administration is considering FHA premium cuts. CEO Tim Mattke responded: "I always view it as a possibility... I don't get the sense that there is any, you know, increasing sort of discussion of people we've talked with about it... haven't seen anything just to believe that that is imminent. But that can change quickly in this world, right?"

On Credit Trends by Region (Terry Ma, Barclays):

CFO Nathan Colson noted there's been "not much in the way of movement on a geographic basis" for delinquencies. "Not seeing states that are really standing out or areas of concern for us right now."

On Reserve Releases (Terry Ma, Barclays):

The magnitude of Q4 reserve development ($31M) was lower than recent quarters. Colson explained this is due to the aging of notices — Q4 development came from notices received in the first half of 2025, whereas earlier quarters reflected older cohorts with more history. Cure rates continue to exceed initial 7.5% assumptions, driving reductions "down into the lower single digits."

On Vintage Delinquency Trends (Doug Harter, UBS):

Colson acknowledged 2022 vintage is "running modestly higher" than 2021 or even 2019, but "all within a pretty tight band, and much better than pre-COVID levels." He noted this reflects "normalization in credit conditions coming off of... very, very low losses for those vintages."

On Levers to Improve Returns (Giuliano Bologna, Compass):

Colson highlighted reinsurance as the primary lever: "The reinsurance at the cost that we're able to procure it does provide us better returns on equity than we earn on a return on capital basis." He noted 2026 and 2027 NIW is now covered under forward commitment quota shares .

On Insurance In Force Outlook (Mihir Bhatia, Bank of America):

Asked why IIF didn't decline despite strong refi activity in Q4. Mattke clarified: "If there's more NIW volume, it doesn't just inure to a total increase in insurance in force... even if interest rates fall, and the majority of the pickup in volume is from refi activity, that has downward pressure on persistency."

Key Risks to Monitor

Management's risk factor disclosures and earnings call commentary highlight several areas to watch :

-

Economic downturn risk: Mortgage insurance is highly sensitive to unemployment and home price declines. A recession would likely increase delinquencies and claims.

-

GSE dependency: Substantially all NIW is for loans purchased by Fannie Mae and Freddie Mac. Changes in GSE policies, pricing, or the potential for privatization could disrupt the business.

-

FHA competition: The FHA's market share was 33.5% in 2024, and government programs don't face the same capital constraints as private insurers.

-

Premium rate pressure: Competitive dynamics have driven rate compression, and management expects in-force portfolio yield to continue declining.

-

Housing affordability: Elevated home prices and mortgage rates have constrained affordability, which could impact origination volumes.

The Bottom Line

MGIC delivered another solid quarter that extended its beat streak while returning nearly $1 billion to shareholders in 2025. The elevated loss ratio bears watching, but remains low by historical standards. The company's high-quality book, fortress capital position, and disciplined management provide confidence in the durability of returns.

Key numbers to remember:

- $0.75 EPS (beat by 12.2%)

- $303.1B insurance in force (record high)

- $915M returned to shareholders in 2025

- $2.5B PMIERs excess capital cushion

- 13.1% annualized ROE

Management will be participating in the UBS and Bank of America Financial Services conferences next week .