Earnings summaries and quarterly performance for MGIC INVESTMENT.

Executive leadership at MGIC INVESTMENT.

Board of directors at MGIC INVESTMENT.

Analisa M. Allen

Director

C. Edward Chaplin

Director

Curt S. Culver

Chairman of the Board

Daniela O’Leary-Gill

Director

Jay C. Hartzell

Director

Jodeen A. Kozlak

Lead Independent Director

Mark M. Zandi

Director

Martin P. Klein

Director

Michael L. Thompson

Director

Sheryl L. Sculley

Director

Teresita M. Lowman

Director

Research analysts who have asked questions during MGIC INVESTMENT earnings calls.

Bose George

Keefe, Bruyette & Woods

7 questions for MTG

Terry Ma

Barclays

5 questions for MTG

Douglas Harter

UBS

4 questions for MTG

Mihir Bhatia

Bank of America

3 questions for MTG

Doug Harter

UBS Group AG

2 questions for MTG

Geoffrey Dunn

Dowling & Partners

2 questions for MTG

Giuliano Bologna

Compass Point Research & Trading LLC

2 questions for MTG

Scott Heleniak

RBC Capital Markets

2 questions for MTG

Neha Tahita

Bank of America

1 question for MTG

Recent press releases and 8-K filings for MTG.

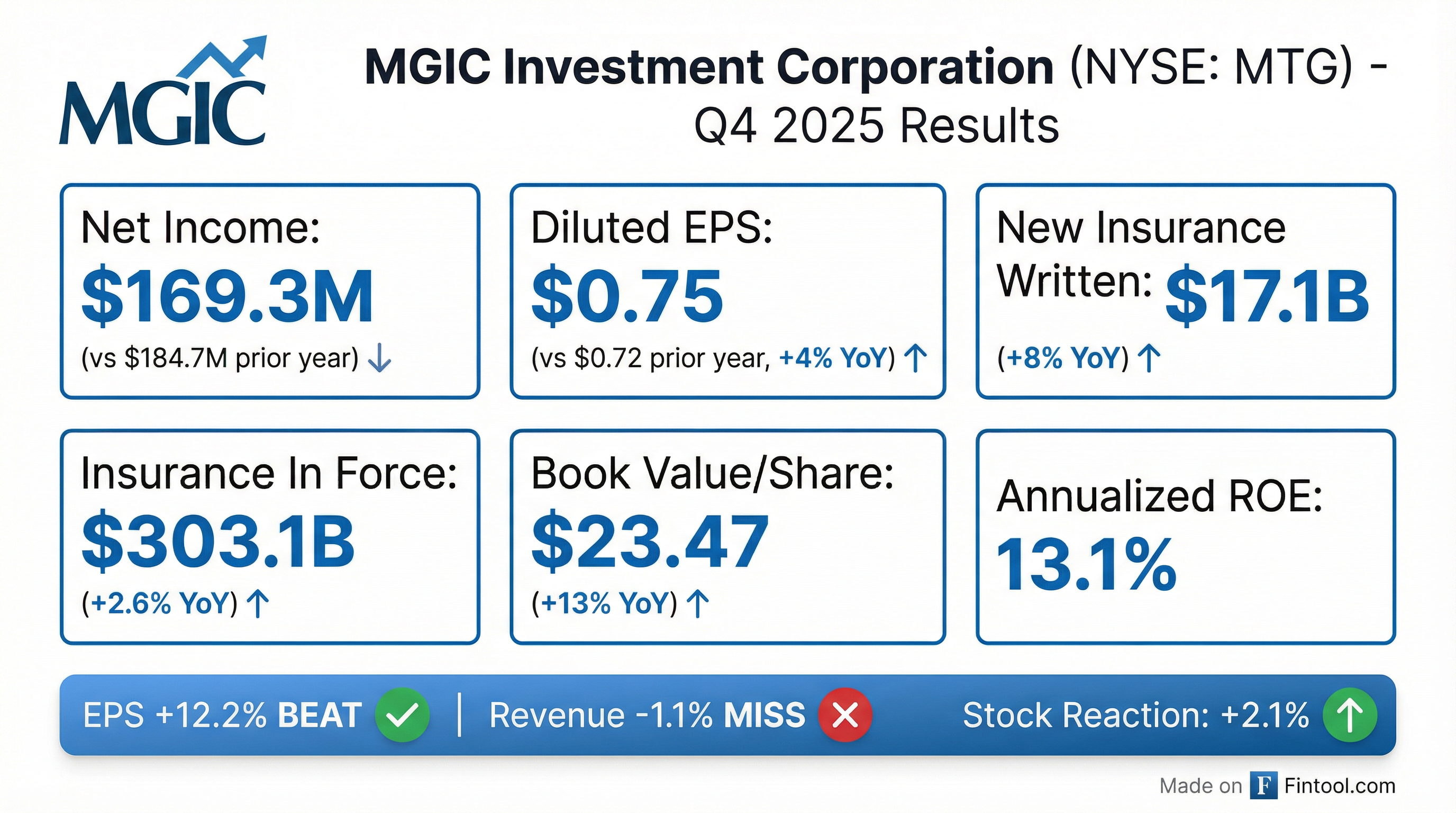

- MTG reported net income of $169,310 thousand and diluted EPS of $0.75 for Q4 2025, with total revenues reaching $298,652 thousand.

- The company demonstrated strong shareholder returns in 2025, increasing shareholder dividends by 15% and repurchasing $782 million in shares, contributing to an 11% year-over-year increase in tangible book value per share to $24.08 as of December 31, 2025.

- MTG maintained robust capital adequacy, with PMIERs excess with reinsurance at $2.5 billion and a net sufficiency of 178% as of Q4 2025.

- Ending insurance in force grew to $303.1 billion and ending risk in force reached $81.2 billion in Q4 2025.

- Losses incurred, net, for Q4 2025 were $31 million, with 14,489 new notices received during the quarter.

- MGIC Investment Corporation reported net income of $169 million for Q4 2025 and $738 million for the full year 2025, achieving a full year return on equity of 14.3%. Diluted earnings per share were $0.75 for Q4 2025 and $3.14 for the full year.

- The company's insurance in force reached over $303 billion by the end of 2025, marking a 3% increase from the prior year, and it wrote $60 billion in new business for the full year, an 8% increase from 2024. Annual persistency remained stable at 85%.

- MGIC returned $915 million to shareholders in 2025 through a combination of share repurchases and dividends, which reduced shares outstanding by 12%. The company ended the year with $1 billion of liquidity at the holding company and $2.5 billion in excess of PMIERs at the operating company.

- For 2026, the company anticipates insurance in force to remain relatively flat and expects operating expenses to decline to a range of $190 million-$200 million. The in-force premium yield is also projected to remain near 38 basis points.

- MGIC Investment Corporation (MTG) reported Q4 2025 net income of $169 million and full-year 2025 net income of $738 million, with diluted EPS of $0.75 for Q4 and $3.14 for the full year. The company achieved an annualized 13% return on equity in Q4 and 14.3% for the full year.

- Book value per share grew to $23.47, a 13% increase year-over-year, and insurance in force reached $303 billion, up 3% from a year ago. New business written for the full year was $60 billion, an 8% increase from the prior year.

- MTG returned $915 million to shareholders in 2025 through share repurchases and dividends, reducing shares outstanding by 12%. This included $189 million for 6.8 million shares repurchased in Q4 2025 and an additional $73 million for 2.7 million shares in January 2026.

- For 2026, the company expects operating expenses to decline to a range of $190 million-$200 million , and insurance in force is projected to remain relatively flat, with the in-force premium yield near 38 basis points. The reinsurance program reduced PMIERs required assets by $2.8 billion, or approximately 47%.

- MGIC Investment Corporation reported net income of $169 million for Q4 2025 and $738 million for the full year 2025, achieving a full year return on equity of 14.3%. Diluted EPS was $0.75 for Q4 and $3.14 for the full year.

- The company's insurance in force grew to over $303 billion by year-end 2025, a 3% increase year-over-year, and it wrote $60 billion in new business for the full year, up 8% from the prior year. Insurance in force is projected to remain relatively flat in 2026.

- MGIC returned $915 million to shareholders in 2025 through share repurchases and dividends, reducing shares outstanding by 12% and representing a 124% payout ratio of net income. The quarterly dividend increased by 15% in Q3, marking five consecutive years of dividend growth.

- Operating expenses for 2025 were $201 million and are expected to decline to a range of $190 million-$200 million in 2026. The reinsurance program significantly reduced PMIERs required assets by $2.8 billion, or approximately 47%.

- Book value per share increased 13% year-over-year to $23.47. The in-force premium yield was 38 basis points in Q4 2025 and is anticipated to remain near this level in 2026.

- MGIC Investment Corporation reported Fourth Quarter 2025 Net Income of $169.3 million (or $0.75 per Diluted Share) and Adjusted Net Operating Income of $168.4 million (or $0.75 per Diluted Share). For the Full Year 2025, Net Income was $738.3 million (or $3.14 per Diluted Share) and Adjusted Net Operating Income was $738.4 million (or $3.14 per Diluted Share).

- The company ended 2025 with $303.1 billion of insurance in-force and returned $915 million of capital to shareholders during the year.

- Key highlights include the appointment of Martin P. Klein and Daniela A. O'Leary-Gill to the Board of Directors, the execution of reinsurance transactions providing $250 million of coverage on 2021 New Insurance Written and a 40% quota share for 2027 New Insurance Written, and S&P revising its outlook to positive from stable on October 27, 2025. In January 2026, the company repurchased an additional 2.7 million shares for $73.2 million.

- MGIC Investment Corporation reported Q4 2025 net income of $169.3 million or $0.75 per diluted share, and full-year 2025 net income of $738.3 million or $3.14 per diluted share.

- The company concluded 2025 with $303.1 billion of insurance in-force and $17.1 billion in new insurance written (NIW) for Q4 2025.

- MGIC returned $915 million in capital to shareholders during 2025, including repurchasing 6.8 million shares for $189.1 million in Q4 2025 and declaring a $0.15 per common share dividend.

- As of December 31, 2025, the company maintained a strong capital position with $2.5 billion in PMIERs excess and $1,074 million in holding company liquidity.

- S&P revised its outlook to positive from stable on MGIC Investment Corporation and its core operating subsidiaries on October 27, 2025.

- MGIC Investment Corporation reported net income of $191 million and $0.83 per diluted share for Q3 2025, achieving an annualized return on equity of 14.8%.

- The company returned $918 million of capital to shareholders over the prior four quarters through dividends and share repurchases, representing a 122% payout of net income. In Q3 2025, share repurchases totaled $188 million for 7 million shares, and a quarterly common stock dividend of $0.15 per share was paid.

- Book value per share grew to $22.87, an 11% increase year-over-year, and insurance in force surpassed $300 billion. New Insurance Written (NIW) for the quarter was $16.5 billion.

- The delinquency rate increased 11 basis points in the quarter to 2.32%, and the company recognized $47 million in favorable loss reserve development.

- Operating expenses for Q3 were $50 million, and full-year operating expenses are now expected to be toward the higher end of the $195 million to $205 million range.

- MGIC Investment Corporation (MTG) reported net income of $191 million and an annualized return on equity of 14.8% for Q3 2025.

- The company's book value per share grew 11% year-over-year to $22.87, and it achieved over $300 billion of insurance in force.

- MTG returned $918 million of capital to shareholders over the prior four quarters through dividends and share repurchases, representing a 122% payout of net income, and paid a $400 million dividend to the holding company in Q3 2025.

- Diluted earnings per share for Q3 2025 were $0.83, and the company recorded $47 million in favorable loss reserve development.

- Operating expenses for Q3 2025 were $50 million, with full-year operating expenses now expected to be at the higher end of the $195 million-$205 million range.

- MGIC Investment Corporation reported net income of $191 million and $0.83 per diluted share for Q3 2025, achieving an annualized return on equity of 14.8%.

- The company returned $918 million of capital to shareholders over the past four quarters through dividends and share repurchases, reducing outstanding shares by 12%, with a 122% payout of net income during that period. In Q3 2025 alone, $188 million was used for share repurchases and $34 million for common stock dividends.

- MGIC reached $300 billion of insurance in force and generated $16.5 billion in new insurance written (NIW) in Q3 2025. The delinquency rate increased 11 basis points to 2.32%.

- Operating expenses for Q3 2025 were $50 million, and the company anticipates full-year operating expenses to be towards the higher end of the $195 million to $205 million range.

- The company bolstered its reinsurance program with new transactions, including a $250 million seasoned excess of loss transaction and a 40% quota share transaction, and amended existing treaties to reduce costs by approximately 40% starting in 2026.

- MGIC reported net losses incurred of $11 million for Q3 2025.

- The company's delinquency inventory as of September 30, 2025, was 25,747 loans.

- Statutory capital for Q3 2025 included a surplus of $1,075 million and contingency reserves of $4,905 million, with $338 million in contingency reserve releases.

- For 2025 originations, $11.3 billion in original risk was written, characterized by a weighted average FICO of 755 and LTV of 93.1.

Quarterly earnings call transcripts for MGIC INVESTMENT.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more