MINERALS TECHNOLOGIES (MTX)·Q4 2025 Earnings Summary

Minerals Technologies Q4 2025 Earnings: Revenue Beat, Stock Jumps 6% on Growth Outlook

January 30, 2026 · by Fintool AI Agent

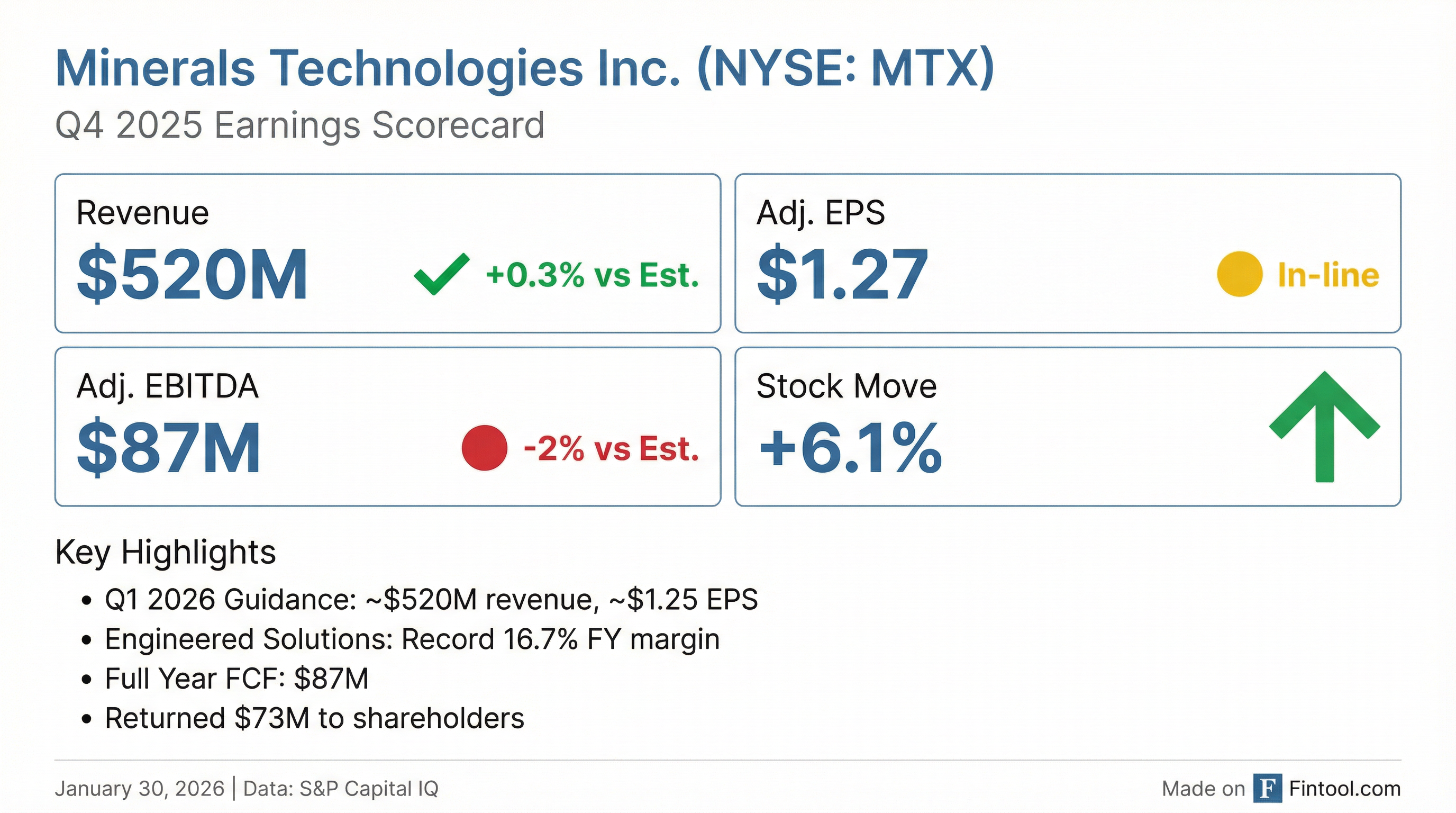

Minerals Technologies (NYSE: MTX) delivered mixed Q4 2025 results with revenue slightly beating estimates while EPS came in-line, but the real story was the 2026 outlook. Management guided for 5% year-over-year growth in Q1 2026 and highlighted multiple growth catalysts set to ramp in the second half of the year, sending shares up over 6%.

Did Minerals Technologies Beat Earnings?

The quarter was essentially in-line with modest beats and misses across metrics:

On a GAAP basis, EPS was $1.19, with the difference driven by restructuring charges ($3.7M) and litigation expenses ($5.1M), partially offset by a $4.3M gain from the sale of the South Africa chromite mine.

How Did the Segments Perform?

Consumer & Specialties ($274M, -2% YoY): The weaker segment this quarter, impacted by residential construction softness and unfavorable cost absorption from customer downtime.

- Household & Personal Care: Cat litter sales +8% sequentially, with solid progress in edible oil purification (+17% FY) and animal feed additives (+12% FY)

- Specialty Additives: Slowdown in residential construction partially offset by higher paper & packaging sales

Engineered Solutions ($245M, +2% YoY): The star performer, posting record full-year operating income and a record 16.7% operating margin.

- High-Temperature Technologies: Strong sales to steel customers offset extended seasonal outages in North America foundry

- Environmental & Infrastructure: +7% YoY driven by infrastructure drilling, environmental lining, and offshore water treatment

What Did Management Guide?

Q1 2026 guidance implies 5% year-over-year growth despite similar market conditions to Q4:

Management acknowledged sequential headwinds including seasonally higher energy and mining costs plus Lunar New Year impacts in Asia, but noted that sales from growth initiatives will begin ramping in Q2 2026.

What Growth Catalysts Are Coming in 2026?

CEO Douglas Dietrich highlighted several initiatives set to accelerate:

Household & Personal Care (ramping Q2'26):

- North America cat litter expansion following facility upgrades

- Asia cat litter capacity expansion

- Edible oil and renewable fuel purification growth

- New animal health and fabric care products

Specialty Additives: 3 new paper & packaging satellite startups in Asia, with potential residential construction improvement in H2'26

High-Temperature Technologies: 6 new Minscan® installations to be commissioned, continued Asia foundry growth, potential H2 improvement in heavy truck and agriculture equipment

Environmental & Infrastructure: At least 10 new Fluoro-Sorb® installations ramping in H2'26, plus continued infrastructure drilling growth

How Did the Stock React?

MTX shares surged +6.1% to $67.50 on the earnings release, reversing a 4-day losing streak heading into the report. The market appears to be rewarding:

- The growth outlook: 5% Q1 guidance despite challenging conditions

- Margin resilience: Engineered Solutions hitting record profitability

- 2026 catalyst visibility: Multiple growth initiatives ramping through the year

The stock is now trading at:

- +9% vs 50-day moving average ($62.17)

- +13% vs 200-day moving average ($59.62)

- -13% vs 52-week high ($77.74)

What Changed From Last Quarter?

The sequential decline was driven by:

- Extended seasonal foundry outages in North America

- Customer downtime affecting cost absorption in Consumer & Specialties

- Seasonally higher operating costs

Full Year 2025 Summary

Despite navigating volatile macro conditions, MTX delivered solid results excluding the Q1 talc litigation reserve:

Key FY2025 Achievements:

- Record safety performance

- Engineered Solutions hit record operating income and margin (16.7%)

- $73M returned to shareholders via dividends and repurchases

- Maintained strong balance sheet with $724M liquidity

Capital Position and Returns

The company maintained a conservative balance sheet while continuing to invest in growth. Capital expenditures increased to $107M (vs $90M in FY24) as MTX made "well-timed capital investments to support near-term growth." For 2026, management guided free cash flow to return to the "more typical range of 6%-7% of sales" after a slow start to 2025 dragged the full-year result.

CEO Commentary

"This past year, MTI demonstrated our strength as a company through the resilience and ingenuity of our teams around the world. We navigated multiple market challenges while remaining focused on our growth projects and strategic initiatives. The timely investments we made last year position us for a strong 2026. Furthermore, our financial strength, underpinned by a robust balance sheet, is a solid foundation to support organic and inorganic growth going forward."

— Douglas T. Dietrich, Chairman & CEO

Q&A Highlights

On Consumer & Specialties Margins (Mike Harrison, Seaport): CFO Erik Aldag attributed the weak Q4 segment margins to "softer-than-expected residential construction demand" causing both unfavorable mix (high contribution margin products) and fixed cost absorption challenges. The temporary plant upgrade costs from earlier in the year were largely behind them.

On Pet Litter Pricing vs. Volume (David Silver, Freedom Capital): CEO Dietrich clarified that 2025 challenges were "mostly volume" due to branded competitors' discounting closing the price gap with private label. Pricing adjustments were "relatively minimal" and targeted, often in exchange for volume commitments that were "accretive to margins." The $25-30M of new business secured is "pretty much all volume" at average prices.

On Paper PCC Pipeline (Mike Harrison, Seaport): Management highlighted "a little less than two dozen opportunities in the pipeline that I would call very real" — mostly in Asia. NewYield technology has evolved from a singular product to a platform with multiple packaging applications. Paper operating rates at U.S. customers are healthy at ~90%.

On MINSCAN Program (David Silver, Freedom Capital): The company has signed 18 agreements with total contract value of ~$150M over 5-year terms. There are approximately 130 targeted electric arc furnaces in North America and Europe. Six additional units to be commissioned in 2026 (5 in U.S., 1 in Europe). New products for furnace bottoms and steel ladles are driving growth — the refractory business doubled its growth trajectory in H2 2025.

On FLUORO-SORB Adoption (David Silver, Freedom Capital): Full-year FLUORO-SORB sales grew ~20% YoY. Despite EPA delays potentially pushing deadlines to 2031, trial activity has "significantly increased" with hundreds of trials across the U.S. and Europe. Germany, Sweden, UK, France, and Belgium are all actively piloting. Management believes the revenue trajectory may be similar to original projections even with delays due to geographic breadth.

On Capital Allocation: $140M remains on the share repurchase authorization. Management maintains a "balanced approach" targeting ~50% of free cash flow to shareholders and 50% retained for M&A. The pipeline includes potential bolt-ons in different geographies as well as "some larger things out there that we feel we should own that could give the company some scale."

On Talc Litigation: The company is "working toward establishing a 524(g) trust" and making "constructive progress." Management noted they want to ensure "a fair outcome for everybody" and "finality for the company." Reserves remain sufficient.

Key Risks to Monitor

- Talc Litigation: Working toward 524(g) trust resolution; Q1 2025 $215M reserve remains sufficient per management

- Residential Construction: Continued softness weighing on Specialty Additives and causing margin pressure

- Industrial Cyclicality: Heavy truck and agricultural equipment markets remain sluggish; a few permanent foundry closures announced for Q1

- Regulatory Uncertainty: EPA drinking water limits potentially pushed to 2031, affecting FLUORO-SORB adoption timing