Earnings summaries and quarterly performance for MINERALS TECHNOLOGIES.

Executive leadership at MINERALS TECHNOLOGIES.

Board of directors at MINERALS TECHNOLOGIES.

Alison Deans

Director

Carolyn Pittman

Director

Franklin Feder

Director

John Carmola

Director

Joseph Breunig

Director

Kristina Johnson

Director

Marc Robinson

Director

Robert Clark

Lead Independent Director

Rocky Motwani

Director

Research analysts who have asked questions during MINERALS TECHNOLOGIES earnings calls.

David Silver

CL King & Associates

6 questions for MTX

Michael Harrison

Seaport Research Partners

5 questions for MTX

Peter Osterland

Truist Securities

5 questions for MTX

Dan Moore

B. Riley Securities

4 questions for MTX

Daniel Moore

CJS Securities, Inc.

3 questions for MTX

Mike Harrison

Seaport Research Partners

3 questions for MTX

Steve Ferazani

Sidoti & Company

2 questions for MTX

Pete Osterlund

Truist Securities

1 question for MTX

Will Gildea

CJS Securities

1 question for MTX

Recent press releases and 8-K filings for MTX.

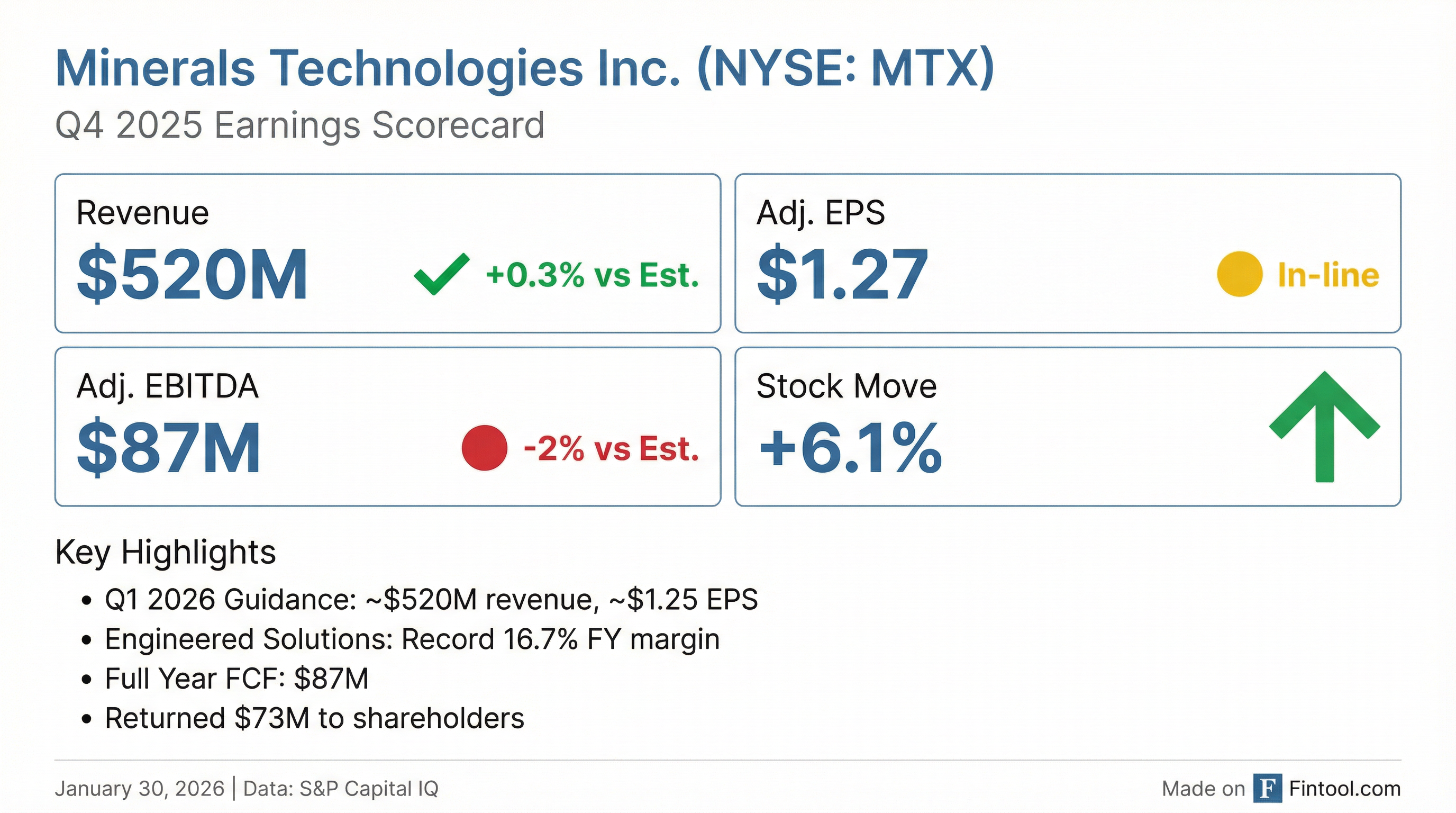

- Minerals Technologies (MTX) reported full year 2025 sales of $2.1 billion, operating income of $287 million, and EPS of $5.52, with Q4 2025 sales at $520 million and EPS of $1.27.

- The company returned $73 million to investors in 2025 through dividends and share repurchases, ending the year with $700 million in liquidity and a net leverage ratio of 1.7x EBITDA.

- For Q1 2026, MTX anticipates sales and operating income similar to Q4 2025, projecting approximately 5% growth over the prior year, and expects full-year 2026 free cash flow to be in the 6%-7% of sales range.

- Strategic investments in pet litter facilities, natural oil purification, and new paper and packaging satellite plants in Asia are set to drive significant sales growth in 2026, with expectations for overall sales and margins to improve and return to a 15% operating margin.

- For the full year 2025, Minerals Technologies reported $2.1 billion in sales, $287 million in operating income, and $5.52 in diluted earnings per share.

- The company returned $73 million to shareholders in 2025 through dividends and share repurchases , and ended the year with total liquidity of $724 million and net debt of $629 million.

- New product revenue accounted for 19% of total sales in 2025 , with growth initiatives in Household & Personal Care and Environmental & Infrastructure expected to ramp up starting in Q2 2026.

- For the first quarter of 2026, Minerals Technologies anticipates approximately $520 million in sales, $65 million to $67 million in operating income, and approximately $1.25 in diluted earnings per share, representing 5% year-over-year growth in sales and operating income.

- Minerals Technologies reported full year 2025 sales of $2.1 billion, operating income of $287 million, and earnings per share of $5.52. For the fourth quarter of 2025, sales were $520 million, operating income was $67 million, and earnings per share (excluding special items) was $1.27.

- The company anticipates Q1 2026 sales and operating income to be similar to Q4 2025, representing approximately 5% growth over the prior year. For the full year 2026, Minerals Technologies expects mid-single-digit sales growth, driven by approximately $50 million in new revenue from growth investments and $20 million from pricing.

- Minerals Technologies returned $73 million to shareholders in 2025 through dividends and share repurchases, maintaining a balanced approach to capital deployment. The company has approximately $140 million remaining on its share repurchase program and expects full-year free cash flow in the 6%-7% of sales range for 2026.

- MTX reported full year 2025 sales of $2.1 billion and earnings per share of $5.52, with Q4 2025 sales at $520 million and EPS at $1.27 (excluding special items).

- The company experienced a challenging 2025 due to geopolitical uncertainty, changing tariffs, and softer market demand, particularly in residential construction and foundry volumes, resulting in a full year operating margin of 13.9%.

- MTX returned $73 million to investors through dividends and share repurchases in 2025, maintaining a strong balance sheet with over $700 million in liquidity and a net leverage ratio of 1.7x EBITDA.

- For Q1 2026, MTX anticipates sales and operating income to be similar to Q4 2025, representing approximately 5% growth over the prior year, driven by new business from strategic investments and pricing initiatives.

- Minerals Technologies Inc. reported Q4 2025 earnings per share of $1.19 (or $1.27 excluding special items) and a full year 2025 loss per share of $0.59 (or $5.52 excluding special items), with the full year loss primarily due to a $215 million provision for talc-related claims.

- Worldwide net sales were $520 million in Q4 2025 and $2.07 billion for the full year 2025.

- Operating income for Q4 2025 was $62 million (or $67 million excluding special items), and for the full year 2025, it was $47 million (or $287 million excluding special items).

- The company generated cash flow from operations of $64 million in Q4 2025 and $194 million for the full year, with free cash flow of $32 million and $87 million, respectively.

- Minerals Technologies Inc. reported fourth quarter 2025 earnings per share of $1.19, or $1.27 excluding special items, on worldwide net sales of $519.5 million.

- For the full year 2025, the company reported a loss per share of $0.59, primarily due to a $215 million provision for talc-related claims in the first quarter, while earnings per share excluding special items were $5.52. Full year worldwide net sales were $2.07 billion.

- The company generated $64.3 million in cash flow from operations and $31.9 million in free cash flow in the fourth quarter of 2025, with full year figures of $193.7 million and $86.6 million, respectively.

- In 2025, Minerals Technologies returned $73 million to shareholders through dividends and share repurchases.

- Minerals Technologies Inc. (MTX) announced an expansion of its paper and packaging business in Asia, including the startup of three new satellite plants in 2025 in China and India, and the doubling of capacity at an existing site in India.

- An additional new satellite in China is expected to be commissioned in early 2026, contributing to the company's global network of 56 satellite plants (operating or under construction).

- These expansions are strategically focused, with 50% of Asia expansions in 2025 and 2026 dedicated to packaging applications, building on a 30% volume growth in Asia since 2022.

- AMERMIN, operating as MELT Technologies, L.P., has been awarded a $11.5 million grant from the U.S. Department of Energy’s (DOE) Office of Fossil Energy and Carbon Management.

- The grant is designated to sustainably refine and produce critical materials and minerals in the United States, with a primary focus on tungsten carbide.

- This funding is expected to enable AMERMIN to increase its tungsten carbide output by 300 percent through the expansion of its reclamation facility, aiming to reduce the country's reliance on foreign tungsten suppliers.

- The expansion of AMERMIN's campus in Briggs, Texas, is expected to be complete in the second quarter of 2026.

- MTX reported Q3 2025 sales of $532 million, representing a 1% increase sequentially and year-over-year, and achieved record third-quarter earnings per share of $1.55.

- The company announced a 9% increase to its regular quarterly dividend, marking the third consecutive year of dividend increases, and returned $20 million to shareholders during the quarter.

- Strategic investments include a $9 million to $10 million expansion at its Turkey plant for natural oil purification, which will increase capacity by 30%. These and other investments are projected to generate $100 million in incremental revenue over the next 12 to 18 months.

- Despite facing mixed market conditions in areas like residential construction and heavy equipment, MTX experienced strong growth in natural oil purification, with sales up 18% this year, and animal health products, with sales up 12% this year.

- Litigation expenses for Q3 2025 were $7.5 million, which is higher than the typical $3 million to $4 million per quarter, as the company continues efforts to establish a 524G trust.

- MTX reported Q3 2025 sales of $532,000,000, a 1% increase sequentially and year-over-year, with earnings per share of $1.55, marking a record for the third quarter.

- The company is navigating mixed market conditions, experiencing sluggish sales growth in residential and commercial construction, heavy truck, agricultural equipment, and Europe, which was offset by strong demand in natural oil purification, animal health products, and Asian markets for pet litter and paper/packaging.

- MTX announced a 9% increase in its regular quarterly dividend and returned $20,000,000 to shareholders in Q3 2025 through share repurchases and dividends.

- Strategic investments in pet litter (North America and China), natural oil purification (Turkey), and Paper and Packaging (Asia) are expected to generate $100,000,000 in incremental revenue over the next 12 to 18 months.

- For Q4 2025, MTX anticipates sales to be 2% to 4% lower sequentially, ranging from $510,000,000 to $525,000,000, with operating income projected between $65,000,000 and $70,000,000 and EPS between $1.20 and $1.30.

Quarterly earnings call transcripts for MINERALS TECHNOLOGIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more