Mueller Water Products (MWA)·Q1 2026 Earnings Summary

Mueller Water Products Beats Q1 as Infrastructure Demand Holds Strong, Raises Full-Year Outlook

February 4, 2026 · by Fintool AI Agent

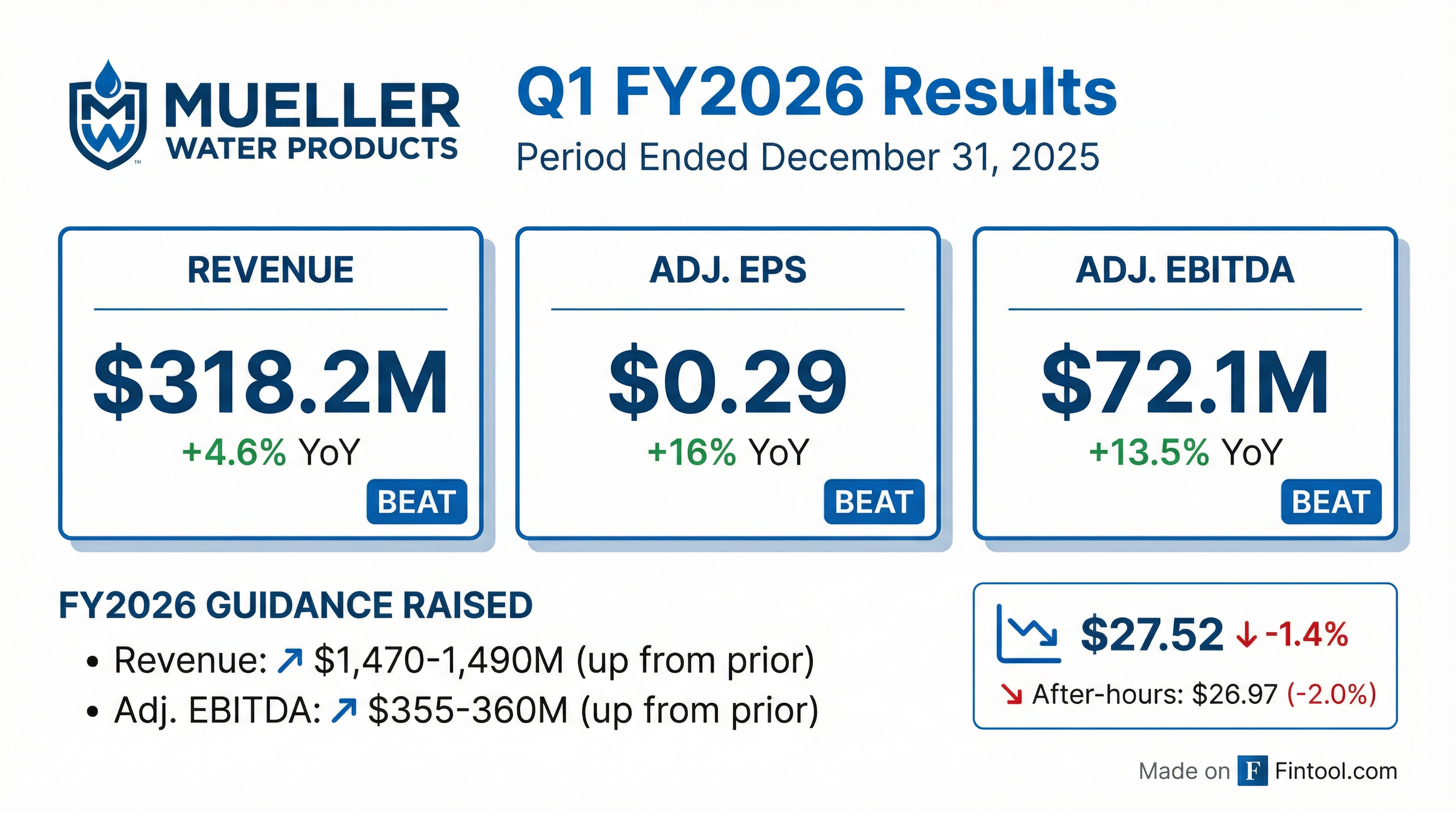

Mueller Water Products (NYSE: MWA) delivered a strong start to fiscal 2026, posting record Q1 results across revenue, adjusted EBITDA, and adjusted EBITDA margin. The water infrastructure specialist raised full-year guidance, citing resilient end-market demand and successful price realization across most product lines.

Did Mueller Water Products Beat Earnings?

Yes — MWA beat on all key metrics.

The quarter marked first-quarter records for net sales, adjusted EBITDA, and adjusted EBITDA margin.

Key drivers of the beat:

- Higher pricing across most product lines

- Manufacturing efficiencies

- Prior year had $3.3M inventory write-downs from brass foundry closure

Headwinds absorbed:

- Increased tariffs

- Inflationary pressures

- Higher SG&A expenses (+10.9% YoY to $59.8M)

What Did Management Guide?

Mueller raised FY2026 guidance on both revenue and adjusted EBITDA.

Additional FY2026 expectations:

- SG&A: $243-247M

- Net interest expense: $5-6M

- Effective tax rate: 25-27%

- D&A: $47-49M

- CapEx: $60-65M

CEO Martie Edmunds Zakas emphasized the company is "raising fiscal 2026 guidance based on our first quarter performance, current expectations for end market demand, orders and price realization, including the expected benefits from our recently announced price actions across most product lines."

What Changed From Last Quarter?

Margin expansion accelerated — Gross margin improved 380 bps YoY to 37.6%, the best Q1 performance in company history.

Segment divergence emerged:

Water Flow Solutions saw slight revenue decline (-0.9%) on lower service brass volumes, but margins expanded dramatically (+650 bps to 28.6%) on manufacturing efficiencies and pricing. The largest impact came from the closure of the legacy brass foundry last year, with benefits expected to continue through Q2.

Water Management Solutions delivered strong top-line growth (+12.0%) driven by hydrant volumes, but margins compressed (-440 bps to 16.9%) from tariffs, manufacturing inefficiencies, and unfavorable FX.

How Did the Stock React?

Stock down despite the beat — MWA shares fell 1.4% to $27.52 on the release date, with after-hours trading down further to $26.97 (-2.0%). The negative reaction suggests expectations were already elevated heading into the print.

Context: MWA stock is trading near 52-week highs ($28.58) and has outperformed significantly over the past year, up from the 52-week low of $22.01. The stock trades at a premium to historical levels, reflecting optimism around U.S. water infrastructure investment.

Key Management Commentary

CEO Transition: This was Martie Zakas' final earnings call as CEO. She will step down after nearly two decades of service and remain as a senior advisor through the end of the calendar year. Paul McAndrew, President and COO, is taking over as CEO.

Outgoing CEO Martie Zakas on market positioning:

"Our continued focus on delivering outstanding customer service and operational excellence, along with resilient end-market demand, led to first-quarter records for net sales, adjusted EBITDA and adjusted EBITDA margin."

"With our continued commitment to superior customer service and operational excellence, we are well-positioned to capture the benefits from the investments needed to address the aging North American water infrastructure."

President and COO Paul McAndrew on margin trajectory:

"We are on track to deliver another year of gross and adjusted EBITDA margin expansion supported by our operational and commercial initiatives... We expect that our ongoing investments in our commercial and operational capabilities, together with strategic capital expenditures, will enable us to increase capacity, achieve sustained margin expansion and deliver long-term value creation."

Cash Flow and Balance Sheet

Balance sheet remains fortress-like:

- Cash and equivalents: $459.6M

- Total debt: $452.3M ($450M of 4.0% Senior Notes maturing June 2029)

- Net debt: Approximately zero

- Total liquidity: $623.3M (including $163.7M ABL availability)

- Credit ratings: Moody's Ba1 (Stable), S&P BB+ (Stable)

The company resumed share repurchases in Q1, buying back $5.5M of stock.

Q&A Highlights

On pricing vs. demand (Goldman Sachs): Management confirmed the majority of the increased revenue guidance is price-driven. The annual price increase was recently announced and will see the main benefit in fiscal Q3.

On tariff impact sizing (RBC Capital): CFO Melissa Rasmussen quantified the tariff headwind at approximately 3% impact to costs, after netting out efficiencies gained. Inflation that was typically low single-digits has "more than doubled" since tariffs went into effect.

On residential outlook (RBC Capital): Management maintained expectations for high single-digit decline in residential construction. However, Paul McAndrew noted "given the low inventory on homes, the population demographics, we could see land and housing activity increase, particularly if rates lower, and we are ready to support that activity."

On end-market breakdown (TD Cowen): For FY2026, management expects:

- Municipal repair & replacement: low to mid-single digit growth

- Specialty valves (project-related): mid to high-single digit growth

- Residential construction: high single-digit decline

On transformation and M&A (Oppenheimer): Paul McAndrew stated Mueller is in "the early stages of our transformation" with significant runway ahead. On capital deployment, he confirmed "acquisitions are more of a priority for us" with a "strong focus on drinking water and wastewater and infrastructure exposure, where we can drive synergies."

On CapEx trajectory: CFO confirmed capital expenditures will increase to 4-5% of net sales in the next couple of years, focused on iron foundries and domestic capabilities to drive efficiencies and increase capacity.

Risks and Concerns

Tariff exposure: The company called out "increased tariffs" multiple times as a headwind, particularly impacting the Krausz business (Section 232 tariffs).

Water Management Solutions margin pressure: While revenue grew 12%, margins contracted 440 bps on manufacturing inefficiencies, tariffs, and FX. Management will need to address this divergence.

Leadership transition costs: The company incurred $3.3M in strategic reorganization charges, primarily severance related to leadership transition.

Stock at premium valuation: With shares near 52-week highs and the beat not moving the stock higher, there may be limited upside until expectations reset.

Forward Catalysts

- Price realization: Recently announced price actions across most product lines should benefit coming quarters

- Infrastructure spending: Federal and municipal water infrastructure investment provides secular tailwind

- Capacity expansion: Strategic capital investments in iron foundries to increase production capacity

- Margin expansion runway: Management committed to "sustained margin expansion" through operational initiatives

Analyst Estimates Going Forward

*Values retrieved from S&P Global

Earnings Call: February 5, 2026

Related Links: