Earnings summaries and quarterly performance for Mueller Water Products.

Research analysts who have asked questions during Mueller Water Products earnings calls.

Deane Dray

RBC Capital Markets

6 questions for MWA

Also covers: AME, ATKR, CARR +21 more

Bryan Blair

Oppenheimer

4 questions for MWA

Also covers: AMRZ, AOS, CSL +13 more

JG

Joseph Giordano

TD Cowen

4 questions for MWA

Also covers: ABLZF, AME, APH +22 more

BL

Brian Lee

Goldman Sachs Group, Inc.

3 questions for MWA

Also covers: ARRY, AYI, CCJ +22 more

WL

Walter Liptak

Seaport Research Partners

3 questions for MWA

Also covers: CMCO, FELE, FSS +13 more

ME

Michael Elias

TD Cowen

2 questions for MWA

Also covers: DBRG, DLR, EQIX +3 more

MH

Michael Halloran

Baird

2 questions for MWA

Also covers: AOS, CXT, DOV +19 more

TB

Tyler Bisset

Goldman Sachs

2 questions for MWA

Also covers: HASI, HAYW, JKS +4 more

MH

Mike Helen

Robert W. Baird & Co.

1 question for MWA

PS

Pez Saini

Robert W. Baird & Co.

1 question for MWA

Also covers: HAYW, ZWS

Recent press releases and 8-K filings for MWA.

Mueller Water Products, Inc. Reports Record Q1 FY2026 Results and Raises FY2026 Guidance

MWA

Earnings

Guidance Update

Share Buyback

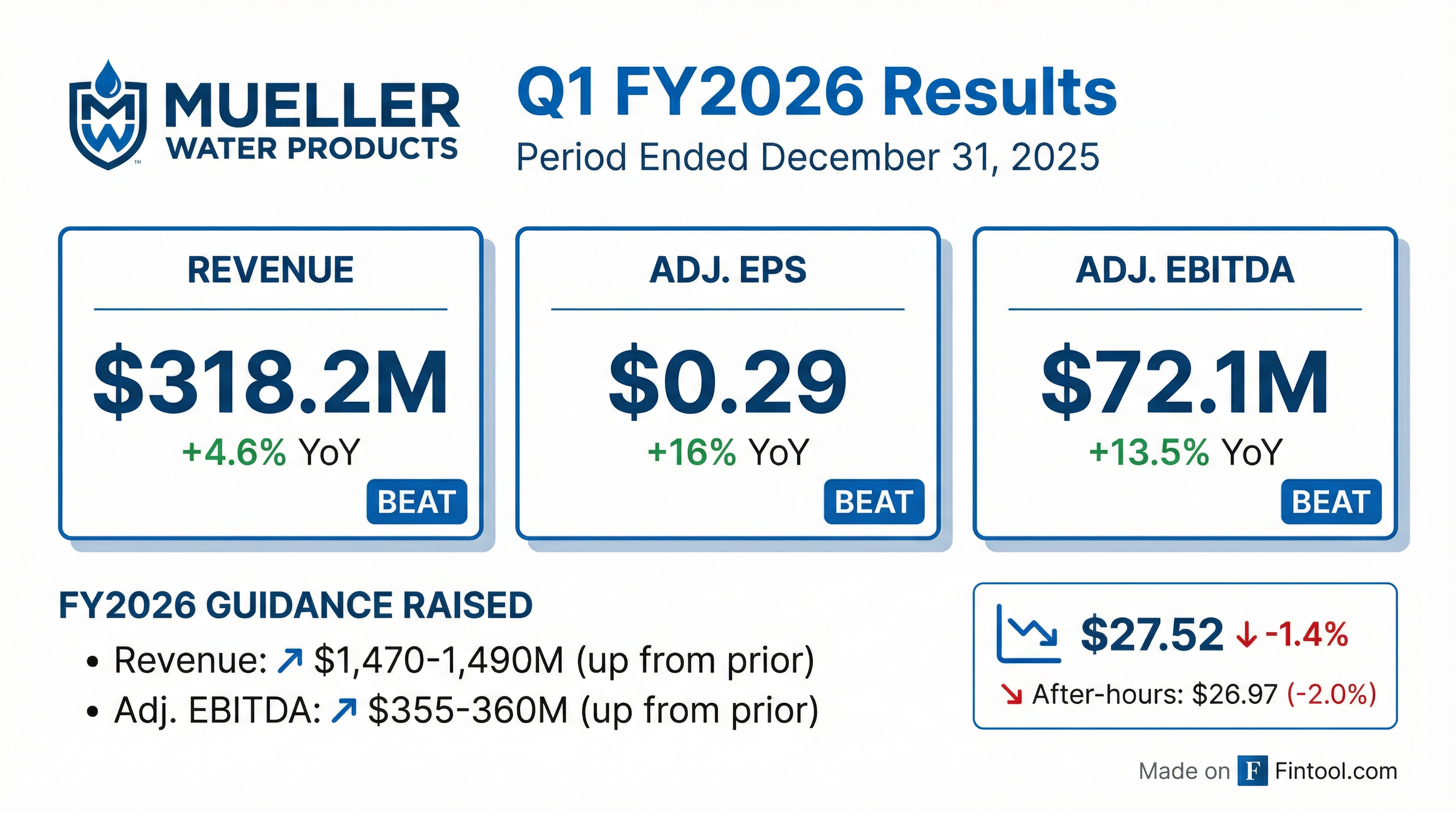

- Mueller Water Products, Inc. reported record Q1 FY2026 results, with net sales of $318.2 million and adjusted net income per diluted share of $0.29, marking year-over-year increases of 4.6% and 16.0%, respectively.

- The company raised its fiscal 2026 guidance, now projecting net sales between $1,470 million and $1,490 million and adjusted EBITDA between $355 million and $360 million.

- As of December 31, 2025, MWA maintained a strong balance sheet with $459.6 million in total cash and $623.3 million in total liquidity, supporting a capital allocation strategy that includes accelerating capital investments and returning cash to shareholders through dividends and share repurchases, with $59.5 million remaining authorization for share repurchases.

2 days ago

Mueller Water Products Reports Record Q1 2026 Results and Raises Full-Year Guidance

MWA

Earnings

Guidance Update

Management Change

- Mueller Water Products reported record Q1 2026 results, with consolidated net sales increasing 4.6% to $318.2 million and Adjusted EBITDA reaching $72.1 million, up 13.5% year-over-year.

- The company raised its full-year FY 2026 guidance, now expecting net sales growth between 2.8% and 4.2% and Adjusted EBITDA in the range of $355 million to $360 million.

- Performance was driven by higher pricing and manufacturing efficiencies, particularly from the closure of a legacy brass foundry, which more than offset higher tariffs and inflationary pressures.

- The outlook anticipates healthy municipal repair and replacement activity and strong growth in specialty valves to offset a projected high single-digit decrease in residential construction.

- Martie Zakas is stepping down as CEO, with Paul McAndrew, President and COO, taking over.

Feb 5, 2026, 4:00 PM

Mueller Water Products Reports Record Q1 2026 Results and Raises Full-Year Guidance

MWA

Earnings

Guidance Update

Share Buyback

- Mueller Water Products (MWA) reported record first-quarter results for fiscal year 2026, with consolidated net sales increasing by 4.6% to $318.2 million and adjusted net income per diluted share rising by 16% to $0.29.

- Adjusted EBITDA reached a first-quarter record of $72.1 million, up 13.5% year-over-year, with gross margin expanding 380 basis points to 37.6% due to higher pricing and manufacturing efficiencies.

- The company raised its full-year fiscal 2026 guidance, now expecting consolidated net sales growth between 2.8% and 4.2% and Adjusted EBITDA in the range of $355 million to $360 million, primarily driven by strong Q1 performance and recent price actions.

- MWA generated $44 million in free cash flow during Q1 2026, investing $17 million in capital expenditures and returning $16 million to shareholders through dividends and share repurchases, maintaining a strong liquidity position with $460 million in cash and cash equivalents.

Feb 5, 2026, 4:00 PM

Mueller Water Products Announces Strong Q1 2026 Results and Raises Fiscal 2026 Guidance

MWA

Earnings

Guidance Update

Revenue Acceleration/Inflection

- Mueller Water Products (MWA) achieved new first-quarter records for net sales ($318.2 million), gross margin (37.6%), adjusted EBITDA ($72.1 million), and adjusted net income per diluted share ($0.29) in Q1 2026.

- Net sales increased 4.6% year-over-year, primarily driven by higher pricing, while adjusted EBITDA grew 13.5% year-over-year, with margin expanding 180 basis points to 22.7%.

- The company generated $44.0 million in free cash flow during the quarter.

- Fiscal 2026 guidance was raised, with net sales now expected to be between $1,470 million and $1,490 million and adjusted EBITDA between $355 million and $360 million.

Feb 5, 2026, 4:00 PM

Mueller Water Products Reports Record Q1 2026 Results and Raises Full-Year Guidance

MWA

Earnings

Guidance Update

CEO Change

- Mueller Water Products (MWA) reported strong Q1 2026 results, with net sales increasing 4.6% to $318.2 million and Adjusted EBITDA growing 13.5% to a record $72.1 million.

- The company raised its full-year fiscal 2026 guidance, now expecting consolidated net sales growth of 2.8% to 4.2% and Adjusted EBITDA between $355 million and $360 million, primarily driven by price increases.

- Gross margin expanded 380 basis points to 37.6%, largely due to higher pricing and manufacturing efficiencies from the closure of the legacy brass foundry, despite inflationary pressures and tariffs.

- The company generated $44 million in free cash flow and returned $16 million to shareholders in Q1 2026, while also announcing a CEO transition from Martie Zakas to Paul McAndrew.

Feb 5, 2026, 4:00 PM

Mueller Water Products, Inc. Reports Strong Q1 2026 Results and Raises Fiscal 2026 Guidance

MWA

Earnings

Guidance Update

Share Buyback

- Mueller Water Products, Inc. reported net sales of $318.2 million for the first quarter of fiscal 2026, an increase of 4.6% compared to the prior year quarter.

- The company achieved net income per diluted share of $0.27 and adjusted net income per diluted share of $0.29 for Q1 2026.

- Adjusted EBITDA increased 13.5% to $72.1 million in the first quarter of fiscal 2026.

- Mueller Water Products, Inc. raised its fiscal 2026 guidance for consolidated net sales to between $1,470 million and $1,490 million and adjusted EBITDA to between $355 million and $360 million.

- The company repurchased $5.5 million of common stock during the first quarter.

Feb 4, 2026, 9:21 PM

Mueller Water Products Reports Strong Fiscal Q1 2026 Results and Raises Annual Guidance

MWA

Earnings

Guidance Update

Share Buyback

- Mueller Water Products reported net sales of $318.2 million for the first quarter of fiscal 2026, an increase of 4.6% compared to the prior year quarter.

- The company achieved adjusted net income per diluted share of $0.29 and reported net income per diluted share of $0.27 for the first quarter ended December 31, 2025.

- Adjusted EBITDA increased 13.5% to $72.1 million in Q1 2026.

- Mueller Water Products raised its fiscal 2026 guidance, now expecting consolidated net sales between $1,470 million and $1,490 million and adjusted EBITDA between $355 million and $360 million.

- The company generated free cash flow of $44.0 million and repurchased $5.5 million of common stock during the first quarter.

Feb 4, 2026, 9:14 PM

Mueller Water Products Announces CEO Succession, Strong FY2025 Results, and Strategic Initiatives

MWA

CEO Change

New Projects/Investments

Share Buyback

- Mueller Water Products announced a CEO succession, with Paul McAndrew, current President and COO, named as the next CEO, effective after Marty Zakas's tenure ends on February 9th.

- The company reported a record-breaking fiscal year 2025 (September fiscal year-end), achieving over 8% organic net sales growth and 22.8% EBITDA. Free cash flow was approximately 84% of adjusted net income.

- Strategic investments include the completion of a new brass foundry (the old one closed in January 2025) and consolidation of specialty valve manufacturing, with plans to modernize two iron foundries for increased capacity and productivity. A new "hydrant renewal" product, offering faster and cheaper hydrant replacement with optional leak detection, was also soft-launched.

- Capital allocation priorities include a dividend increase for 11 consecutive years, share repurchases ($15 million in 2025, with $65 million remaining at the end of September), and a high priority on acquisitions. The company expects to benefit from cost elimination and anticipates about 100 basis points of year-over-year margin expansion at the midpoint of its 2026 guidance.

Nov 11, 2025, 4:50 PM

Mueller Water Products Reports Record FY2025 Results and Provides FY2026 Outlook

MWA

Earnings

Guidance Update

New Projects/Investments

- Mueller Water Products reported record FY2025 financial results, with net sales of $1,429.7 million and Adjusted EBITDA of $326.2 million, reflecting 5-year CAGRs of 8.2% and 11.3% respectively.

- The company demonstrated strong profitability and financial health in FY2025, achieving a 22.8% Adjusted EBITDA margin and $172.0 million in Free Cash Flow, with net debt of $20.1 million and a 0.1x net debt to Adjusted EBITDA ratio as of September 30, 2025.

- For FY2026, Mueller Water Products forecasts net sales between $1,450 million and $1,470 million and Adjusted EBITDA between $345 million and $350 million, targeting a 23.8% Adjusted EBITDA margin at the midpoint.

- The company plans to accelerate strategic capital investments, with $60 million to $65 million allocated for capital expenditures in FY2026 to expand capacity and drive efficiencies, while also returning capital to shareholders, including $15 million in share repurchases in FY2025.

Nov 10, 2025, 10:10 PM

Mueller Water Products Reports Record FY2025 Results and Provides FY2026 Outlook

MWA

Earnings

Guidance Update

New Projects/Investments

- Mueller Water Products achieved record consolidated net sales of $1,430 million and adjusted EBITDA of $326 million in FY2025, marking its second consecutive year of record results.

- The company projects FY2026 net sales between $1,450 million and $1,470 million and adjusted EBITDA between $345 million and $350 million, representing year-over-year growth of 1.4% to 2.8% and 5.8% to 7.1% respectively.

- As of September 30, 2025, Mueller Water Products maintained a strong balance sheet with net debt leverage at 0.1x and total liquidity of $595.2 million.

- The company has a sustainability vision, having identified an estimated 7.7 billion gallons in water loss savings for clients through EchoShore® leak detection since 2020 and setting a new goal of 18 billion gallons by 2029.

Nov 10, 2025, 12:00 PM

Quarterly earnings call transcripts for Mueller Water Products.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more