NBT BANCORP (NBTB)·Q4 2025 Earnings Summary

NBT Bancorp Beats Q4 on Positive Operating Leverage, Evans Integration

January 26, 2026 · by Fintool AI Agent

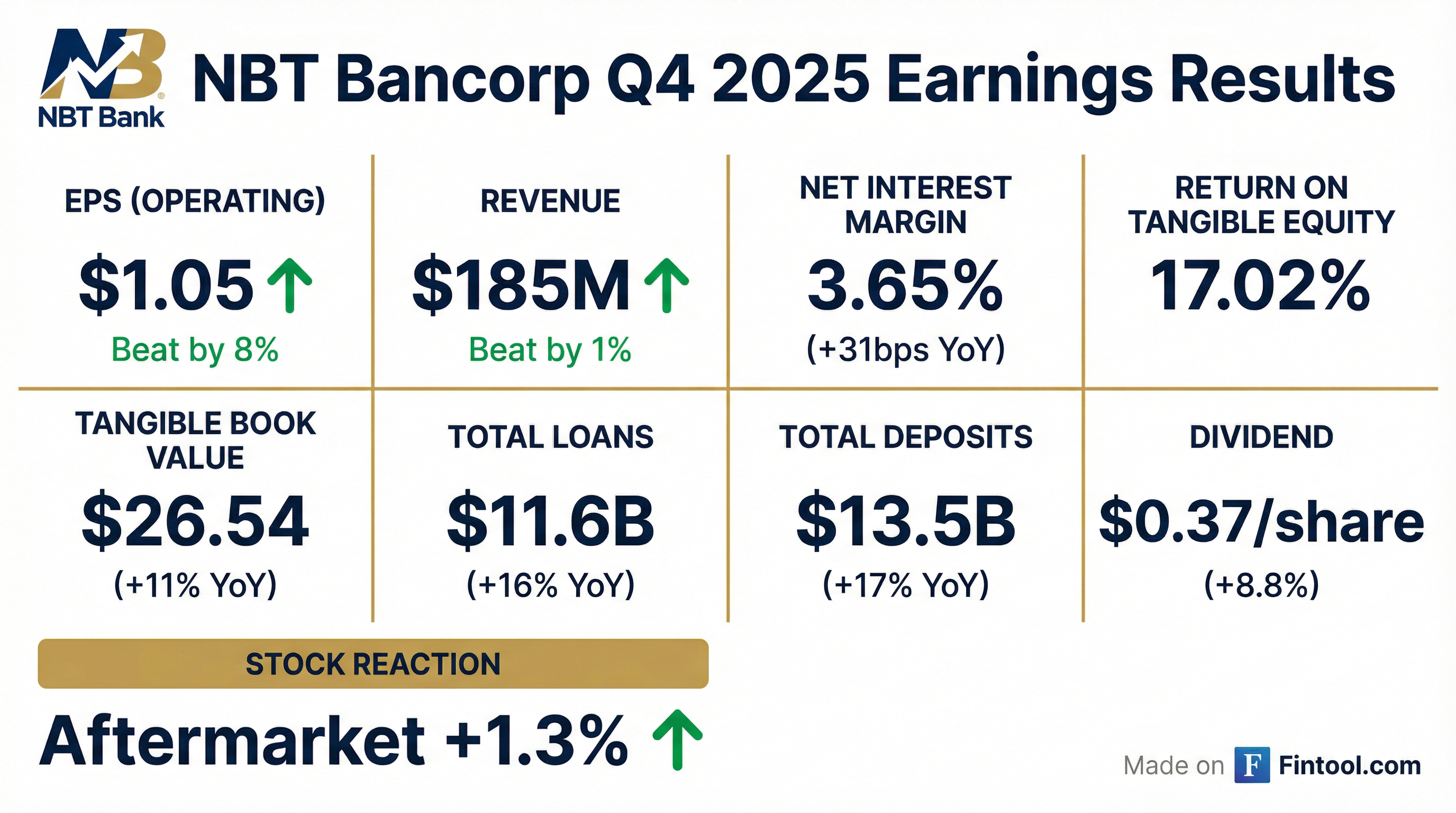

NBT Bancorp (NASDAQ: NBTB) delivered a strong fourth quarter, with operating EPS of $1.05 beating consensus estimates of $0.97 by 8.2% and total revenue of $185 million topping expectations of $183.6 million . The regional bank generated positive operating leverage for the quarter and full year as the Evans Bancorp acquisition, completed in May 2025, continues to drive growth .

CEO Scott Kingsley highlighted the improved earnings capacity on the call: "The construct around combination of the Evans transaction and us improving our net interest margin 35 or almost 40 basis points last year has shifted the plateau of our earnings capacity from somewhere close to $0.80 a quarter to $1."

Did NBT Bancorp Beat Earnings?

Yes — NBT beat on both EPS and revenue. The bank reported diluted EPS of $1.06 on a GAAP basis and $1.05 on an operating basis, significantly above the Street's $0.97 estimate .

The beat was driven by better-than-expected net interest income of $136 million, up $29.3 million or 27.5% from Q4 2024, and noninterest income of $49.6 million, up $7.4 million or 17% year-over-year .

This marks NBT's fourth consecutive quarterly EPS beat, continuing a strong execution track record.

What Drove the Operating Leverage?

The standout metric this quarter was NBT's positive operating leverage. Revenues grew 24.7% while expenses grew only 11.9% year-over-year . For the full year, revenues increased 21.4% versus expense growth of 13.1%.

Net interest margin expanded to 3.65%, up 31 basis points from 3.34% in Q4 2024 . Sequentially, NIM was essentially flat (down 1 bp) as a 10 bp decline in asset yields was nearly offset by a 9 bp decline in funding costs .

How Is the Evans Integration Progressing?

The Evans Bancorp acquisition, completed May 2, 2025, is the key catalyst driving NBT's growth . The deal added:

- $2.22 billion in assets

- $1.67 billion in loans

- $1.86 billion in deposits

- 18 branches and 200 employees

- Entry into Buffalo and Rochester, Upstate New York's two largest markets by population

NBT completed a simultaneous conversion of all operating systems at closing. Net accretion of acquired loans and borrowings contributed $7.4 million to Q4 results .

CEO Kingsley emphasized the integration success: "The Evans transaction went as good as we could have hoped for. Their folks are really engaged. We've had to put them through some changes to some of our systems, but they've really been good at bringing that alive."

What Are the Balance Sheet Trends?

NBT's balance sheet showed strong growth across all key metrics:

The loan portfolio is well-diversified with a 56% commercial / 44% consumer mix, and 58% fixed / 42% adjustable rate composition . Deposits remain granular with an average balance of $22,014 per account across 613,213 accounts .

Low-cost deposits represented 58% of total deposits with a cost of only 80 basis points .

How Is Asset Quality Holding Up?

Asset quality remains strong with net charge-offs declining to 0.15% of average loans on an annualized basis, down from 0.27% in Q3 2025 and 0.30% in Q4 2024 .

The allowance for credit losses stands at $138 million, representing 1.16% of total loans .

What About Capital and Shareholder Returns?

NBT's capital position remains robust:

Stockholders' equity grew $370 million or 24.2% year-over-year, including the issuance of 5.1 million shares for the Evans acquisition valued at $221.8 million .

Shareholder returns:

- Q1 2026 dividend of $0.37 per share, up 8.8% from prior year

- Repurchased 250,000 shares at an average price of $40.74 in Q4 2025

How Did the Stock React?

NBT shares closed regular trading at $43.91, up 0.6% on the day. In after-hours trading following the earnings release, the stock traded at $44.50, suggesting a modest positive reaction of approximately +1.3%.

*Values retrieved from S&P Global

The stock has outperformed over the past year, trading well above its 50-day moving average of $42.46 and 200-day average of $42.16.

What Did Management Guide?

CEO Scott Kingsley provided detailed outlook during the Q&A:

Loan Growth: Management expects mid- to lower single-digit loan growth for 2026, factoring in the ~$800M solar loan portfolio that's running off at approximately $100M per year .

NIM Outlook: CFO Annette Burns expects margin expansion of 2-3 basis points per quarter going forward. The biggest repricing opportunities are:

- Residential mortgage book: 125-130 bps of room

- CD book: 77% reprices in the next two quarters

- Investment securities: ~$25M in monthly cash flows available for reinvestment

Q1 Expense Seasonality: Expect an additional $0.04-$0.05 per share in Q1 operating costs due to higher payroll costs, stock-based compensation timing, and seasonal factors (snow removal vs. air conditioning) .

Credit Quality: Normalized charge-off rate expected at 15-20 basis points going forward, down from historical 25-30 bps as the LendingClub/Springstone unsecured consumer book runs off .

What's the M&A Strategy?

Management addressed M&A appetite directly on the call. CEO Kingsley outlined clear hurdle rates:

"We're a $16 billion bank now. So it's not so much what transaction is large enough for us to be interested in, is that do we put our folks through an M&A opportunity that can't at least generate $0.05 of accretion or 5% accretion? If we're running off a base of four dollars a share, does something have to be north of twenty cents a share for us to really take a hard run at that?"

The Evans integration has gone "as good as we could have hoped for," giving management confidence in future deals. They continue to have "lots of conversations" with high-quality community banks across their 7-state footprint .

Q&A Highlights

On CRE Payoffs: NBT experienced $150-175M of unscheduled commercial real estate payoffs in 2025, driven by agency money and private equity/funding in larger urban areas (southern Hudson Valley, near Boston). Management expects this could remain a risk for 2026 growth .

On Canada-US Trade Tensions: CEO Kingsley acknowledged this is impacting border markets: "The Canadian customers are just frustrated... What I have heard from people is a sense of 'Can we trust you still?' And I think that's caused hesitation in future investments." Northern New York markets near Plattsburgh and Western New York/Buffalo have meaningful cross-border commerce .

On Deposit Pricing: With deposit costs down to 2%, management acknowledges "the bad news is your deposit costs are down to 2%." But approximately $6 billion in deposits remain price-sensitive, with the CD book being the biggest opportunity for further repricing .

On Competition: Highly-rated borrowers are demanding lower spreads. Maintaining 200-225 bps above SOFR "has been more difficult in recent months" for the best credits .

On Share Repurchases: Management expects to continue the Q4 pace of ~$10M per quarter, which is self-funded through earnings without impacting capital ratios .

What's the Market Expansion Strategy?

Management highlighted aggressive expansion plans during the Q&A:

Maine: Added C&I-focused bankers, committed to a branch site "off the wharf" on Marginal Way in Portland (Bayside), and signed a letter of intent for a second branch in Scarborough .

Western New York: Looking at sites in Rochester, including a signed letter of intent for a downtown Rochester location. "Really good quality hires across all parts of the bank, including insurance and mortgage" .

New Hampshire: Targeting the greater Manchester market for growth opportunities with new branches .

Micron Catalyst: The official groundbreaking of Micron's semiconductor complex outside Syracuse occurred in Q4. Site development and construction of the first fabrication facility is expected to commence immediately, with completion targeted in 2030 .

What Changed From Last Quarter?

Positive changes:

- Operating leverage accelerated: revenue growth outpaced expense growth by ~13 percentage points

- Net charge-offs dropped sharply from 0.27% to 0.15%

- Tangible book value per share grew 4% sequentially

- Dividend increased 8.8%

- Loan pipelines "stronger than they were at this point last year"

Areas to watch:

- NIM ticked down 1 bp sequentially as loan yields declined 10 bps

- NPAs/Assets increased slightly from 0.33% to 0.35%

- Commercial loan rates near market — less repricing opportunity ahead

- Canada-US trade tensions impacting northern border markets

Forward Catalysts

- Continued Evans integration synergies — Full year of combined operations in 2026; team members "really engaged"

- Rochester/Buffalo market expansion — New branch sites and quality banker hires

- Micron semiconductor facility — Multi-year construction project near Syracuse starting 2026

- CD repricing opportunity — 77% of CD book reprices in next two quarters

- Potential M&A — 5% accretion threshold, active conversations with community banks

View more: NBTB Company Profile | Q3 2025 Earnings | Earnings Transcript