Earnings summaries and quarterly performance for NBT BANCORP.

Executive leadership at NBT BANCORP.

Scott A. Kingsley

President and Chief Executive Officer

Amy C. Wiles

Executive Vice President, Chief Credit Officer and Chief Risk Officer

Annette L. Burns

Executive Vice President and Chief Financial Officer

Joseph R. Stagliano

Executive Vice President, President of NBT Bank, N.A. and Chief Information Officer

Ruth H. Mahoney

Executive Vice President and President of Wealth Management

Board of directors at NBT BANCORP.

Andrew S. Kowalczyk III

Director

David J. Nasca

Director

Heidi M. Hoeller

Audit Committee Chair

J. David Brown

Director

Johanna R. Ames

Director

John H. Watt, Jr.

Director

Martin A. Dietrich

Chair of the Board

Matthew J. Salanger

Lead Independent Director

Richard J. Cantele, Jr.

Director

Timothy E. Delaney

Director

V. Daniel Robinson II

Nominating and Corporate Governance Committee Chair

Research analysts who have asked questions during NBT BANCORP earnings calls.

Matthew Breese

Stephens Inc.

8 questions for NBTB

Feddie Strickland

Hovde Group

5 questions for NBTB

Mark Fitzgibbon

Piper Sandler & Co.

4 questions for NBTB

Christopher O'Connell

Keefe, Bruyette, & Woods, Inc.

3 questions for NBTB

Manuel Navas

D.A. Davidson & Co.

3 questions for NBTB

Daniel Cardenas

Janney Montgomery Scott LLC

2 questions for NBTB

David Conrad

KVW

2 questions for NBTB

David Konrad

Keefe, Bruyette & Woods (KBW)

2 questions for NBTB

Stephen Moss

Raymond James Financial, Inc.

2 questions for NBTB

Steve Moss

Raymond James

2 questions for NBTB

Feddie Justin Strickland

Hovde Group, Inc.

1 question for NBTB

Mark Thomas Fitzgibbon

Piper Sandler

1 question for NBTB

Stephen M. Moss

Raymond James & Associates

1 question for NBTB

Thomas Reid

Raymond James

1 question for NBTB

Recent press releases and 8-K filings for NBTB.

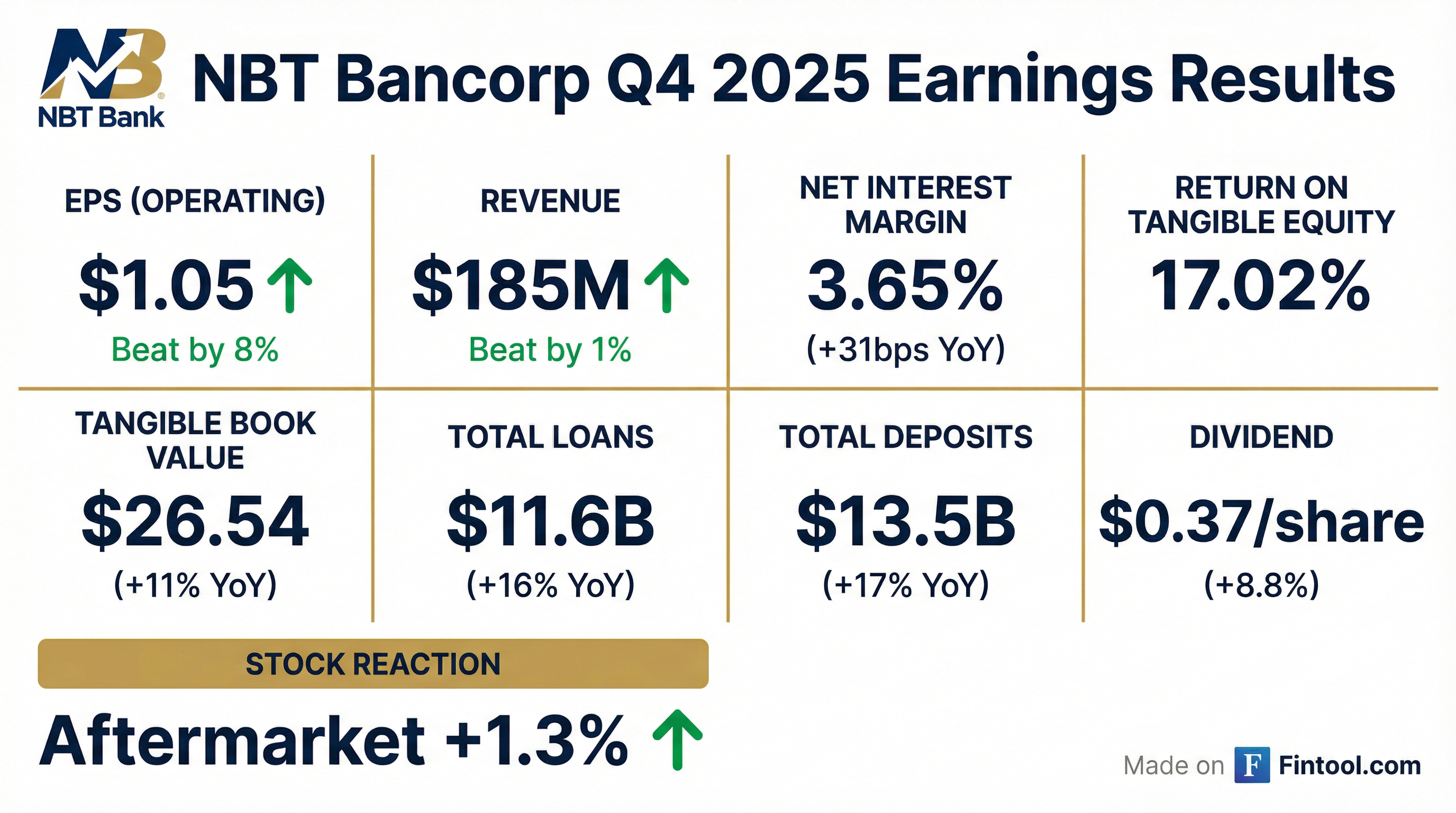

- NBTB reported diluted earnings per share of $1.06 and operating diluted earnings per share of $1.05 for Q4 2025.

- The company achieved revenue growth of 24.7% year-over-year, with total revenues reaching $185 million.

- Balance sheet growth was robust, with loans increasing 16.3% to $11.60 billion and deposits growing 16.9% to $13.50 billion from Q4 2024.

- NBTB announced a first-quarter cash dividend of $0.37 per share, an 8.8% increase over the prior year, and repurchased 250,000 shares of common stock during the quarter.

- The Evans acquisition, completed in May 2025, contributed to a 24.2% growth in stockholders' equity and added $2.22 billion in assets.

- NBT Bancorp reported net income of $55.5 million or $1.06 per diluted common share for the fourth quarter of 2025, with core operating earnings of $1.05 per share.

- The company's revenue grew 25% from the fourth quarter of 2024, driven by improvements in net interest income and non-interest income, including the impact of the Evans Bancorp merger.

- Operating return on assets was 1.37% for the second consecutive quarter, and return on tangible equity was 17.02%.

- Total loans increased by $1.63 billion (16.3%) and total deposits by $2 billion for the year, both including the impact of the Evans merger.

- NBTB repurchased 250,000 shares in the fourth quarter of 2025 and announced an 8.8% year-over-year improvement to its dividend in the third quarter of 2025.

- NBT Bancorp reported net income of $55.5 million or $1.06 per diluted common share for Q4 2025, with core operating earnings of $1.05 per share. The company achieved an operating return on assets of 1.37% and a return on tangible equity of 17.02%.

- Revenue grew 25% from Q4 2024, driven by improvements in net interest income and non-interest income, including the impact of the Evans merger. Non-interest income represented 27% of total revenues in Q4 2025.

- Total loans increased 16.3% and total deposits increased $2 billion year-over-year, including the impact of the Evans merger. Tangible book value per share reached $26.54, an 11% increase from a year ago.

- The net interest margin for Q4 2025 was 3.65%, a 1 basis point decrease from the prior quarter. Management expects the margin to be fairly stable in Q1 2026, with potential for 2-3 basis points of quarterly expansion.

- The company repurchased 250,000 shares in Q4 2025 and plans to self-fund this level of repurchases every quarter. Loan growth is projected to be in the mid- to lower single-digit range for 2026.

- NBT Bancorp reported strong financial results for the fourth quarter of 2025, with net income of $55.5 million or $1.06 per diluted common share, and core operating earnings of $1.05 per share. The company achieved an operating return on assets of 1.37% and a return on tangible equity of 17.02%.

- Revenue grew 25% from the fourth quarter of 2024, driven by improvements in both net interest income and non-interest income, including the impact of the Evans merger. Non-interest income, excluding securities gains, increased 17.4% from Q4 2024 and represented 27% of total revenues.

- The company's tangible book value per share reached $26.54 at year-end, an 11% increase year-over-year. NBT Bancorp repurchased 250,000 shares in the fourth quarter, totaling over $10 million, and expects to self-fund this level of repurchases quarterly.

- Total loans were up $1.63 billion or 16.3% for the year, and total deposits increased $2 billion from December 2024, both including the Evans acquisition. The net interest margin for Q4 was 3.65%, a 1 basis point decrease from the prior quarter but a 36 basis point improvement year-over-year.

- Asset quality remains stable, with provision expense at $3.8 million for Q4 2025. The company expects normalized charge-off rates to be in the 15-20 basis points range as its unsecured consumer and solar loan portfolios wind down.

- NBT Bancorp Inc. reported net income of $55.5 million and diluted earnings per share of $1.06 for the fourth quarter of 2025, and net income of $169.2 million and diluted earnings per share of $3.33 for the full year 2025.

- The company completed the acquisition of Evans Bancorp, Inc. on May 2, 2025, which added $1.67 billion in loans and $1.86 billion in deposits and significantly impacted the comparison to the fourth quarter of 2024.

- The Board of Directors approved a first-quarter cash dividend of $0.37 per share, representing an 8.8% increase over the dividend paid in the first quarter of 2025, marking the thirteenth consecutive year of dividend increases.

- During the fourth quarter of 2025, the company repurchased 250,000 shares of its common stock for $10.2 million at an average price of $40.74 per share.

- Key financial highlights for the fourth quarter of 2025 include an operating diluted earnings per share of $1.05, a return on average assets of 1.37%, and a return on average tangible common equity of 17.05%.

- NBT Bancorp Inc. reported net income of $55.5 million and diluted earnings per share of $1.06 for the fourth quarter of 2025, and net income of $169.2 million and diluted earnings per share of $3.33 for the full year 2025.

- The company completed the acquisition of Evans Bancorp, Inc. on May 2, 2025, adding $1.67 billion in loans and $1.86 billion in deposits.

- The Board of Directors approved a first-quarter cash dividend of $0.37 per share, representing an 8.8% increase and marking the thirteenth consecutive year of dividend increases.

- NBT Bancorp Inc. repurchased 250,000 shares of its common stock for $10.2 million in the fourth quarter of 2025, with 1,750,000 shares remaining under the authorized program as of December 31, 2025.

- Period end total loans increased 16.3% to $11.60 billion and deposits increased 16.9% from December 31, 2024.

- NBT Bancorp reported net income of $54.5 million and operating earnings per share of $1.05 for Q3 2025, with operating return on assets at 1.37%, return on equity at 12.1%, and ROTCE at 17.6%.

- Revenues grew approximately 9% from the prior quarter and 26% from Q3 2024, driven by improved net interest income and the additive impact of the Evans Bancorp merger. Net interest margin increased seven basis points to 3.66%.

- Non-interest income, excluding securities gains, reached $51.4 million, an increase of 9.8% from the previous quarter and 13.5% from Q3 2024.

- The company announced an 8.8% improvement to its dividend, marking the 13th consecutive year of increases, and renewed a 2 million share repurchase authorization through the end of 2027.

- Management expects a full-quarter operating expense run rate of $110 million for Q4 2025, with typical expense increases of 3.5% to 4.5% in 2026. They anticipate potential margin pressure in Q4 2025 but possible improvement in 2026, and project low to mid-single-digit loan growth for early to mid-2026.

- NBT Bancorp reported Q3 2025 net income of $54.5 million or $1.03 per diluted common share, with operating earnings per share of $1.05. Revenues grew 9% from the prior quarter and 26% from Q3 2024.

- The company's net interest margin increased for the sixth consecutive quarter, rising seven basis points to 3.66% in Q3 2025. However, future margin improvements may be challenged by expected Fed funds rate changes, with potential for "a little bit of margin pressure" in Q4 2025.

- Non-interest income, excluding securities gains, was $51.4 million, an increase of 9.8% from the previous quarter and 13.5% from Q3 2024, representing 28% of total revenues. Total operating expenses, excluding acquisition expenses, were $110 million for the quarter, which is considered an appropriate run rate for future quarters.

- NBT Bancorp increased its dividend to shareholders by 8.8%, marking the 13th consecutive year of increases, and renewed its 2 million share repurchase authorization through the end of 2027. The company maintains a strong capital position and is open to M&A opportunities with "like-minded smaller community banks".

- NBT Bancorp reported net income of $54.5 million and diluted earnings per share of $1.03 for Q3 2025. Operating return on assets was 1.37%, return on equity 12.1%, and return on tangible common equity (ROTCE) 17.6%.

- Revenues increased approximately 9% from the prior quarter and 26% from Q3 2024, driven by net interest income improvements and the Evans Bancorp merger. The net interest margin rose seven basis points to 3.66%.

- Total loans reached $11.6 billion and total deposits $13.7 billion at September 30, 2025. Tangible book value per share was $25.51, a 7% increase from a year ago.

- The company announced an 8.8% improvement to its dividend, marking its 13th consecutive year of increases, and renewed a 2 million share repurchase authorization through the end of 2027.

- Management anticipates operating expenses to be around $110 million for Q4 2025, with typical expense increases of 3.5% to 4.5% for 2026. They project low to mid-single-digit loan growth for early to mid-2026 and expect "a little bit of margin pressure" in Q4 2025.

- NBTB reported strong Q3 2025 financial results, with revenues growing 26.6% and net income increasing 43.0% compared to Q3 2024, leading to reported earnings per share of $1.03.

- The company's balance sheet expanded, with period-end loans reaching $11.60 billion and deposits totaling $13.66 billion in Q3 2025, representing year-over-year growth of 17.0% and 17.9%, respectively.

- Capital strength was demonstrated by a tangible book value per share of $25.51 in Q3 2025, an 8.8% increase in the fourth-quarter cash dividend to $0.37 per share, and the renewal of a stock repurchase program for up to 2,000,000 shares.

- The May 2, 2025, completion of the Evans acquisition significantly contributed to growth, adding $2.22 billion in assets, $1.67 billion in loans, and $1.86 billion in deposits.

Quarterly earnings call transcripts for NBT BANCORP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more