Earnings summaries and quarterly performance for NEXTERA ENERGY.

Executive leadership at NEXTERA ENERGY.

John W. Ketchum

Chairman, President and Chief Executive Officer

Armando Pimentel, Jr.

President and Chief Executive Officer, Florida Power & Light Company

Brian W. Bolster

President and Chief Executive Officer, NextEra Energy Resources, LLC

Charles E. Sieving

Executive Vice President, Chief Legal, Environmental and Federal Regulatory Affairs Officer

Michael H. Dunne

Executive Vice President, Finance and Chief Financial Officer

Terrell Kirk Crews II

Executive Vice President, Chief Risk Officer

Board of directors at NEXTERA ENERGY.

Amy B. Lane

Lead Independent Director

Darryl L. Wilson

Director

David L. Porges

Director

Dev Stahlkopf

Director

Geoffrey S. Martha

Director

James L. Camaren

Director

John A. Stall

Director

Kirk S. Hachigian

Director

Maria G. Henry

Director

Naren K. Gursahaney

Director

Nicole S. Arnaboldi

Director

Research analysts who have asked questions during NEXTERA ENERGY earnings calls.

Julien Dumoulin-Smith

Jefferies

8 questions for NEE

Nicholas Campanella

Barclays

8 questions for NEE

Carly Davenport

Goldman Sachs

7 questions for NEE

Jeremy Tonet

JPMorgan Chase & Co.

7 questions for NEE

Steve Fleishman

Wolfe Research, LLC

5 questions for NEE

Shahriar Pourreza

Guggenheim Partners

4 questions for NEE

David Arcaro

Morgan Stanley

3 questions for NEE

Steven Fleishman

Wolfe Research

3 questions for NEE

Bill Appicelli

UBS

2 questions for NEE

Nick Amicucci

Evercore ISI

2 questions for NEE

Andrew Weisel

Scotiabank

1 question for NEE

Anthony Crowdell

Mizuho Financial Group

1 question for NEE

Charles Sieving

Wells Fargo

1 question for NEE

Ryan Levine

Citigroup

1 question for NEE

William Appicelli

UBS

1 question for NEE

Recent press releases and 8-K filings for NEE.

- On March 3, 2026, NextEra Energy, Inc. sold $2.3 billion of equity units (including the underwriters’ overallotment) under Registration Statements Nos. 333-278184, 333-278184-01 and 333-278184-02.

- Each equity unit consists of a stock purchase contract and a 2.5% undivided beneficial interest in both Series P Debentures (due Feb 15, 2031) and Series Q Debentures (due Feb 15, 2034), with total annual distributions at 7.375%.

- Holders must complete the stock purchase by no later than Feb 15, 2029, at a per-share price range of $91.99 to $115.00, which may be funded through remarketing of the Debentures.

- The Debentures are guaranteed by NEE and issued by NextEra Energy Capital Holdings, Inc.; upon settlement, NEE will receive cash and issue the underlying common stock.

- NextEra Energy priced a $2.00 billion public offering of equity units, with expected closing on March 3, 2026, and an underwriters’ option to purchase an additional $0.30 billion for over-allotments.

- The net proceeds are expected to be approximately $1.97 billion (or $2.27 billion if the over-allotment is fully exercised) to fund energy and power projects and repay commercial paper.

- Each $50 equity unit comprises a stock purchase contract and interests in two series of debentures (due 2031 and 2034), guaranteed by NextEra Energy, with total annual distributions of 7.375%.

- In about three years, holders must purchase NextEra Energy common stock at $91.99–$115.00 per share—a 25% premium over the Feb. 26, 2026 closing price—and contracts will affect diluted EPS via the treasury stock method.

- On February 26, 2026, NextEra Energy Capital Holdings, Inc. sold €1.0 billion of Series X and €750 million of Series Y Junior Subordinated Debentures due February 26, 2056.

- Series X debentures bear interest at 4.20% until February 26, 2032 (reset every five years thereafter plus a margin), and Series Y bear 4.75% until February 26, 2036 with similar five-year resets.

- Both series are subordinated obligations guaranteed by NextEra Energy, Inc., and are redeemable at the issuer’s option beginning in 2031 (Series X) and 2035 (Series Y).

- NextEra Energy plans to sell $2.00 billion of equity units, with an underwriter option for an additional $0.30 billion.

- Net proceeds will fund energy and power project investments and repay part of NextEra Energy Capital Holdings’ commercial paper obligations.

- Each unit, at a $50 stated amount, includes a contract to purchase common stock and undivided interests in Series P (due 2031) and Series Q (due 2034) debentures guaranteed by NextEra Energy.

- Holders must purchase common stock by Feb. 15, 2029, at a 0%–25% premium over the Feb. 26, 2026 NYSE closing price, with price set by the 20-day average ending Feb. 12, 2029.

- Wells Fargo Securities, BofA Securities, Citigroup and Mizuho are joint book-running managers for the offering.

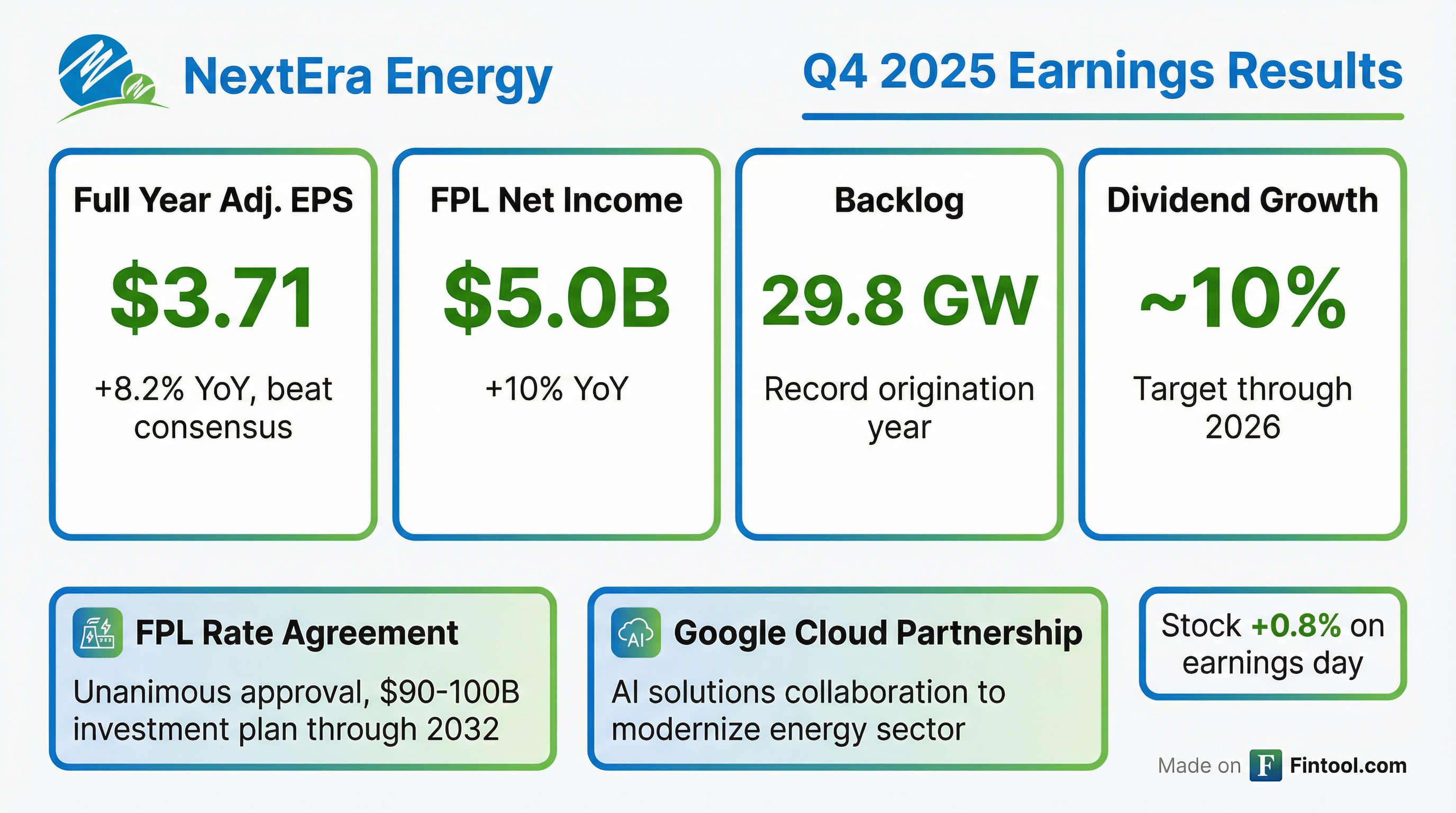

- The board declared a regular quarterly common stock dividend of $0.6232 per share, a 10% increase versus the prior-year quarter.

- The increase aligns with NextEra Energy’s plan for ~10% annual dividend growth through 2026 (off a 2024 base) and 6% per year growth from year-end 2026 through 2028.

- The dividend is payable on March 16, 2026, to shareholders of record on Feb. 27, 2026.

- On February 10, 2026, NextEra Energy Capital Holdings, Inc., a wholly-owned subsidiary of NextEra Energy, Inc., sold €650 million of 2.989% Debentures due February 10, 2030 and €650 million of 3.624% Debentures due February 10, 2034, each guaranteed by NextEra Energy.

- The Debentures were registered under the Securities Act pursuant to Registration Statement Nos. 333-278184, 333-278184-01 and 333-278184-02 and were issued under the Indenture dated June 1, 1999, as amended.

- Legal opinions from Squire Patton Boggs (US) LLP and Morgan, Lewis & Bockius LLP confirmed that the Debentures and related guarantees are legally valid and binding obligations under applicable Florida, New York and federal law.

- On February 5, 2026, NextEra Energy Capital Holdings, Inc. sold $700 million of 4.40% Debentures due March 1, 2031 and $600 million of 5.85% Debentures due March 1, 2056.

- The Debentures are unconditionally guaranteed by NextEra Energy, Inc. and were registered under SEC Registration Statement Nos. 333-278184, 333-278184-01 and 333-278184-02.

- The Form 8-K filing attaches legal opinions from Squire Patton Boggs (US) LLP and Morgan, Lewis & Bockius LLP affirming the validity and binding nature of the Debentures and Guarantee as exhibits 5(a) and 5(b).

- Charlie Nelson was appointed President and COO of New Era, effective January 28, 2026, after serving on the board since December 2024 and as executive director since July 2025, bringing extensive digital infrastructure and power asset experience.

- The Board granted 1,221,345 time-vesting RSUs and 3,664,036 performance-vesting PSUs to Nelson as inducement awards, aligning compensation with shareholder interests.

- The RSUs vest monthly over four years based on continued employment; the PSUs also vest over four years but require meeting performance criteria through December 31, 2030.

- PSU milestones include: (1) securing a hyperscaler agreement for 200 MW, (2) financial close on a 200 MW data center campus, and (3) commencing operations of a fully leased 200 MW campus with $100 million annual revenue and a $15 average stock price over 90 days.

- NextEra is accelerating plans to add up to 6 GW of nuclear capacity at existing sites and is evaluating greenfield and advanced reactor projects to serve hyperscale data centers.

- The company has ~20 GW of data-center customer interest (with ~9 GW in advanced discussions) and aims for 15 GW of new generation by 2035 through its “15 by 35” origination channel, developing about 20 hubs (targeting 40).

- It is recommissioning the Duane Arnold plant—a 621.9 MWe boiling-water reactor—with a targeted restart by 2029, backed by a host community agreement and unanimous rezoning approval in Linn County.

- In 2025, NextEra added 8.7 GW of new generation (including a Q4 record 3.6 GW), reported a 30 GW backlog (one-third BESS), and placed 2 GW of battery storage into service (a 220% YoY increase).

- NextEra delivered full-year adjusted EPS of $3.71, up over 8% from 2024, and maintains 2026 guidance of $3.92–$4.02 per share.

- FPL secured a 4-year rate agreement through 2029, plans $90–$100 billion of investments through 2032, and holds an allowed midpoint ROE of 10.95%, while targeting bills ~2% annual increases—below inflation.

- In Q4 2025, FPL invested $2.1 billion in capex ( $8.9 billion full year), delivered a regulatory ROE of 11.7%, saw 1.7% weather-normalized retail sales growth, and added ~90,000 customers.

- Energy Resources added ~13.5 GW to its backlog in 2025 (including a 3.6 GW record quarter), bringing total backlog to ~30 GW, and placed 7.2 GW of generation and storage into service.

Quarterly earnings call transcripts for NEXTERA ENERGY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more