Northfield Bancorp (NFBK)·Q4 2025 Earnings Summary

Northfield Bancorp Announces Columbia Merger, Beats Estimates Despite $41M Goodwill Charge

February 3, 2026 · by Fintool AI Agent

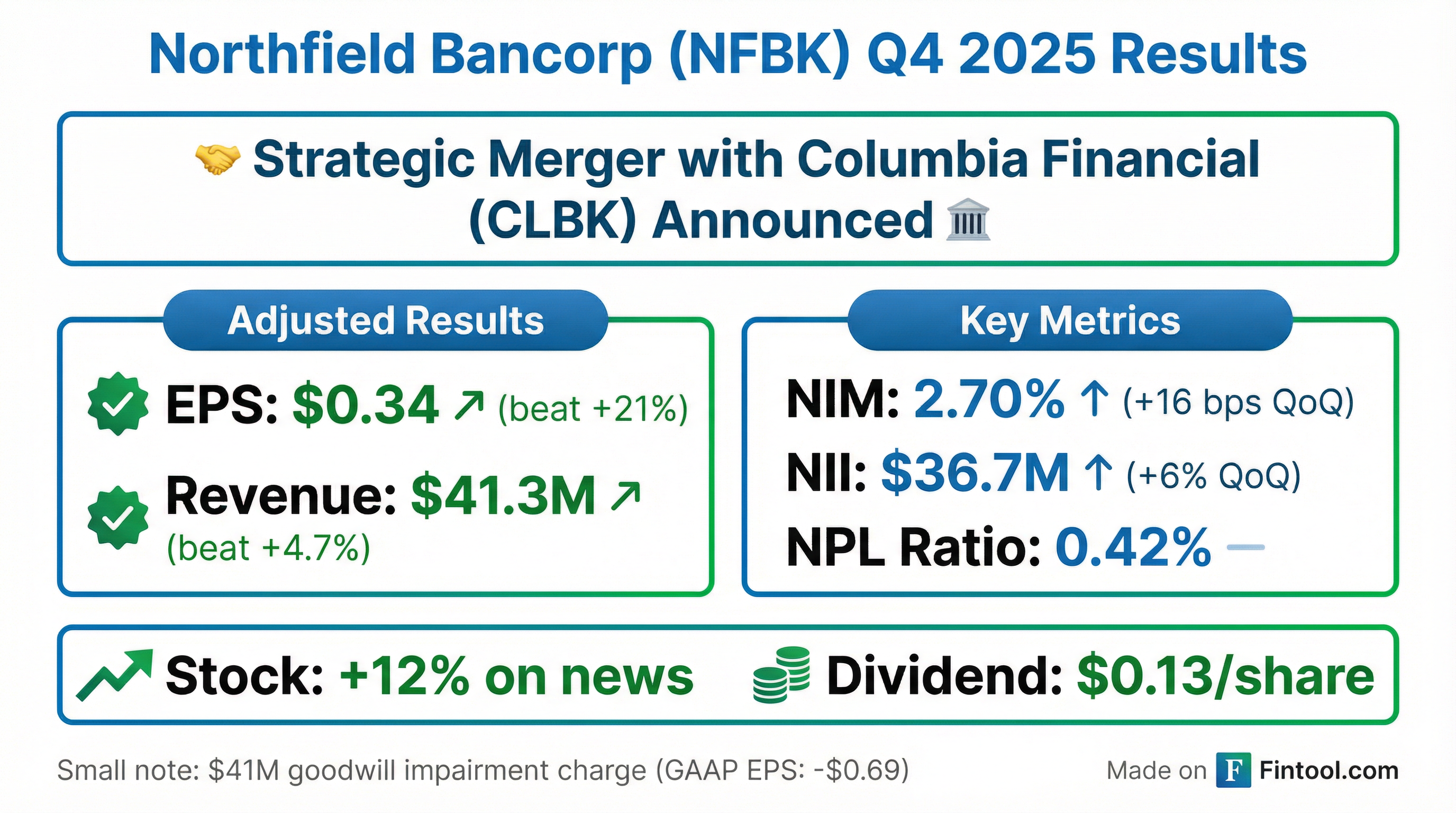

Northfield Bancorp (NASDAQ: NFBK) delivered a double catalyst in its Q4 2025 report: a strategic merger with Columbia Financial Inc. (NASDAQ: CLBK) and adjusted earnings that beat consensus by over 20%. The headline GAAP loss of $0.69 per share was driven entirely by a $41.0 million non-cash goodwill impairment charge—excluding this, the quarter showed continued fundamental improvement with net interest margin expanding to 2.70%.

The stock responded emphatically, surging ~12% on the announcement to hit a 52-week high.

Did Northfield Beat Earnings?

Yes—convincingly on an adjusted basis. Q4 2025 results exceeded expectations on both EPS and revenue:

GAAP EPS was $(0.69) due to the $41.0 million goodwill impairment charge ($1.03 per share), which is non-cash and non-tax deductible. This impairment resulted from the annual goodwill testing and included "market related considerations." The company now has zero goodwill on its books.

The underlying business performed well: net interest income increased $2.2 million (25.0% annualized) from Q3 2025, and $7.0 million (94.1% annualized) from Q4 2024.

What's Driving the Margin Expansion?

Net interest margin expansion has been the key story for Northfield over the past year. NIM expanded 52 basis points year-over-year and 16 basis points sequentially:

The margin improvement was driven by two factors:

- Lower funding costs: Cost of interest-bearing deposits fell 38 bps YoY to 2.23% (from 2.61%)

- Higher asset yields: Yield on interest-earning assets rose 30 bps YoY to 4.69% (from 4.39%)

Management has strategically reduced reliance on brokered deposits—down 84.6% YoY to just $40.5 million from $263.4 million—while growing core deposits.

How Did the Stock React?

The stock surged on the merger and earnings news:

The stock reached its 52-week high on the announcement day, reflecting investor enthusiasm for the Columbia Financial merger.

What Changed From Last Quarter?

Strategic Direction: The biggest change is the announced merger with Columbia Financial Inc. (CLBK). This represents a transformational event for the 137-year-old Woodbridge, NJ-based community bank.

Balance Sheet:

- Total assets: $5.75B (+1.5% YoY)

- Loans held-for-investment: Down $165.5M YoY to $3.86B, primarily from reducing multifamily exposure

- Securities portfolio: Up $311.6M (+28.3%) as the bank purchased higher-yielding MBS

- Goodwill: Reduced to $0 from $41.0M

Asset Quality: NPL ratio improved to 0.42% from 0.49% QoQ and 0.51% YoY.

What Did Management Say?

CEO Steven M. Klein emphasized the strategic focus on diversifying the loan book while maintaining strong asset quality:

"Excluding the impact of the goodwill impairment charge, our financial results for the fourth quarter were strong, and reflect our continued commitment to, and execution on, the fundamentals of community-based banking. Our strategic focus is on growing our non-multifamily loan portfolios and low-cost deposits which has increased our net interest margin while maintaining strong asset quality due to our prudent lending standards."

The bank also maintained its dividend at $0.13 per share, payable February 25, 2026, to shareholders of record on February 12, 2026.

Capital Position and Valuation

Despite the goodwill impairment, the capital position remains strong:

With the stock trading around $13.65, NFBK is trading at approximately 0.83x tangible book value—typical of regional bank valuations but potentially leaving upside if the merger offers a premium.

Risk Factors to Watch

-

Merger Execution: Integration with Columbia Financial will be the key focus going forward. Terms of the deal are in a separate joint press release.

-

CRE Concentration: Non-owner occupied commercial real estate loans to total risk-based capital is estimated at ~380%, which regulators monitor closely.

-

Rent-Regulated Multifamily: $418.8M (10.9% of loans) are rent-regulated properties in New York with limited rent increase potential. However, weighted average LTV is conservative at 50% with 1.60x DSCR.

-

Office Exposure: $174.7M in office-related loans (4.5% of portfolio) with 58% weighted average LTV.

Forward Catalysts

- Merger Details: Watch for the joint press release with Columbia Financial (CLBK) for deal terms and expected close timeline

- Regulatory Approval: Merger will require banking regulatory approvals

- Continued NIM Expansion: Management expects to benefit from continued deposit repricing

Report generated by Fintool AI Agent based on Northfield Bancorp's 8-K filed February 3, 2026, covering Q4 2025 results.