Earnings summaries and quarterly performance for Northfield Bancorp.

Executive leadership at Northfield Bancorp.

Steven M. Klein

Detailed

Chief Executive Officer

CEO

DV

David V. Fasanella

Detailed

Executive Vice President and Chief Lending Officer

RL

Robin Lefkowitz

Detailed

Executive Vice President and Chief Branch Administration, Deposit Operations and Business Development Officer

VT

Vickie Tomasello

Detailed

Executive Vice President and Chief Risk Officer

WR

William R. Jacobs

Detailed

Executive Vice President and Chief Financial Officer

Board of directors at Northfield Bancorp.

Research analysts covering Northfield Bancorp.

Recent press releases and 8-K filings for NFBK.

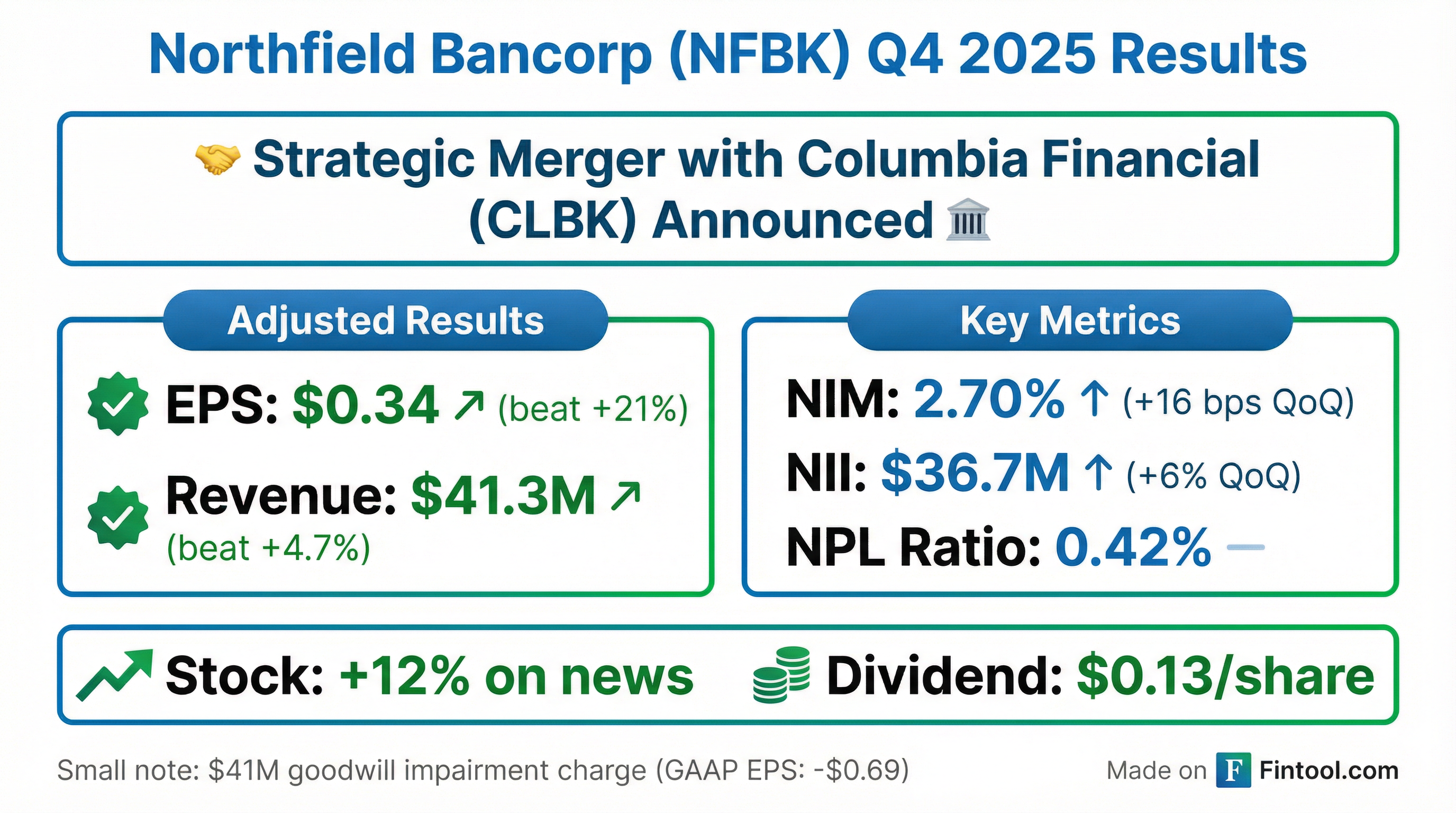

Northfield Bancorp, Inc. Reports Q4 2025 Net Loss Driven by Goodwill Impairment and Announces Merger

NFBK

Earnings

M&A

Dividends

- Northfield Bancorp, Inc. has agreed to merge with Columbia Financial Inc..

- The company reported a net loss of $27.4 million, or $0.69 per share, for the fourth quarter of 2025, primarily due to a $41.0 million non-cash goodwill impairment charge. For the full year ended December 31, 2025, net income totaled $796,000, or $0.02 per diluted share, also impacted by this charge.

- Despite the net loss, Net Interest Income for Q4 2025 increased by $7.0 million to $36.7 million compared to Q4 2024, and the Net Interest Margin increased by 52 basis points to 2.70%.

- The Board declared a cash dividend of $0.13 per share, payable February 25, 2026 , and the company repurchased 1.3 million shares for $15.0 million during 2025.

3 days ago

Northfield Bancorp Transaction Under Investigation

NFBK

Legal Proceedings

M&A

Takeover Bid

- Northfield (NFBK) is under investigation by Ademi LLP for potential breaches of fiduciary duty and other legal violations concerning its recently announced transaction with Columbia Financial.

- Northfield stockholders will receive either shares of the new holding company or cash, with the consideration varying based on an independent valuation: 1.425 shares or $14.25 cash if the valuation is less than $2.3 billion; 1.450 shares or $14.50 cash for valuations between $2.3 billion and $2.6 billion; and 1.465 shares or $14.65 cash for valuations of $2.6 billion or higher.

- The transaction agreement includes a significant penalty if Northfield accepts a competing bid, and Northfield insiders are expected to receive substantial benefits from change of control arrangements.

4 days ago

Northfield Bancorp, Inc. and Columbia Financial, Inc. Announce Merger Plans

NFBK

M&A

Board Change

Guidance Update

- Columbia Financial, Inc. and Northfield Bancorp, Inc. jointly announced plans for Columbia to acquire Northfield in a transaction valued at approximately $597 million.

- The merger, which includes Columbia undertaking a second-step conversion, is expected to create the third largest regional bank headquartered in New Jersey, with pro forma total assets of $18 billion based on financial data as of December 31, 2025.

- On a pro forma basis, the merger is anticipated to be 50% accretive to Columbia's 2027 earnings per share.

- Steven M. Klein, Northfield's Chairman, President, and CEO, will become Senior Executive Vice President and Chief Operating Officer of the combined Holding Company and Columbia Bank, and will join the Board of Directors along with three other Northfield directors.

4 days ago

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more