NIQ Global Intelligence (NIQ)·Q4 2025 Earnings Summary

NIQ Reaffirms Q4 Guidance, COO Departs Amid Transformation

February 2, 2026 · by Fintool AI Agent

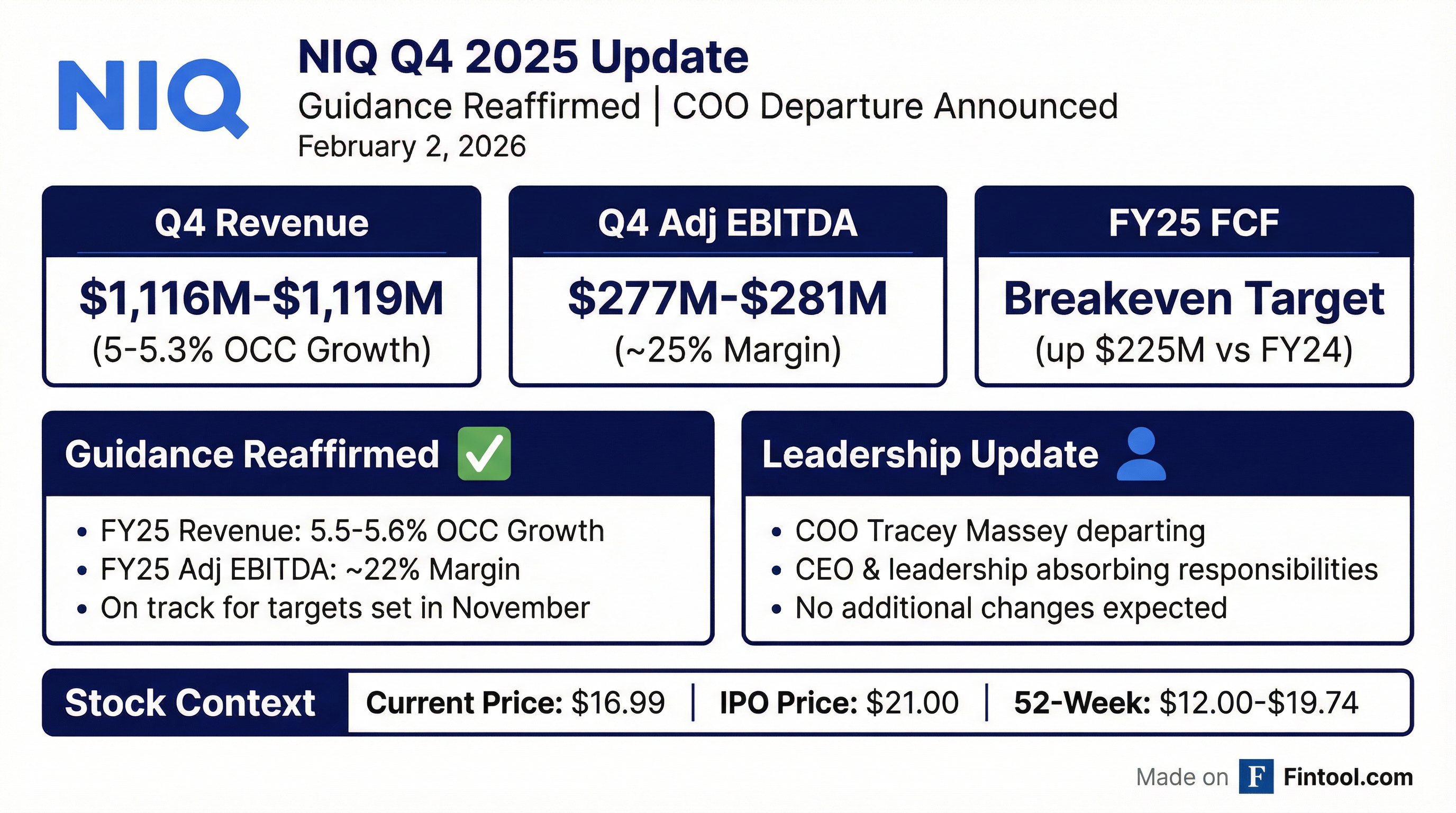

NIQ Global Intelligence (NYSE: NIQ) filed an 8-K on February 2, 2026 reaffirming its Q4 and full-year 2025 financial guidance while announcing the departure of COO Tracey Massey . This is not the company's actual Q4 earnings release—full results are expected in late February 2026—but signals management's confidence heading into year-end reporting.

What Did NIQ Announce?

Guidance Reaffirmed: NIQ confirmed the financial outlook provided during its Q3 2025 earnings call on November 13, 2025 :

COO Departure: Tracey Massey resigned as COO on January 30, 2026 for personal reasons—explicitly not due to disagreement with the company or its policies . Key details:

- Will serve as Advisor to CEO through September 30, 2026

- NIQ will not replace the COO role

- CEO and executive team will absorb COO responsibilities

- No additional leadership changes anticipated

How Did the Stock React?

NIQ shares closed at $16.99 on January 30, 2026, essentially flat on the day (+0.18%). The stock trades 19% below its July 2025 IPO price of $21.00 but has recovered 42% from its 52-week low of $12.00.

The muted reaction suggests the market was not surprised by either the guidance reaffirmation or COO departure, viewing the latter as an orderly transition.

What Changed From Last Quarter?

Q3 2025 delivered a strong beat that set high expectations for Q4 :

Management raised 2025 guidance after Q3, and today's filing confirms they expect to hit those elevated targets.

What Did Management Say About 2026?

During the Q3 earnings call, CFO Mike Burwell outlined 2026 expectations :

"We're in the midst of finalizing our plans for 2026, which we expect to be another year of mid-single-digit growth, strong margin expansion, and significantly increased free cash flow generation."

Key 2026 themes from management commentary:

- Continued AI investment: NextIQ engine driving both revenue growth and margin expansion

- GfK synergies continuing: Integration on track, contributing to margin improvement

- Margin expansion: Targeting mid-20% Adjusted EBITDA margin at midterm

- Free cash flow inflection: Significant improvement expected as IPO-related debt reductions flow through

Key Business Drivers to Watch

Regional Performance

EMEA has been the standout performer, driven by panel on demand and GfK turnaround :

AI-Driven Products

NIQ's BASES AI solutions are gaining traction :

- BASES AI Screener: Live in 11 markets, 129 categories; 18 new large clients since launch

- BASES AI Product Developer: 31 clients tested 500+ product concepts in Q3

- Unilever case study: 65% reduction in product development time

- Brown-Forman case study: 350% sales increase on Jack and Coke

Revenue Algorithm

Management expects the growth algorithm to persist :

- ~2.5% from pricing: Value-based pricing continues

- ~2.5% from innovation: Cross-sell, up-sell, new capabilities

- Additional upside: SMB segment growing 20%+

What Are the Risks?

Leadership transition: While management emphasized an orderly transition, losing a COO during a multi-year transformation creates execution risk .

CPG client headwinds: Several large CPG clients are facing internal changes (CEO transitions, restructurings) that temporarily reduce spending .

Debt load: Despite IPO deleveraging, NIQ still carries ~$3.5B in debt against ~$1.2B in available liquidity .

AI competitive risk: Management acknowledged competitors could "slap AI on public data" but believes their proprietary data moat is defensible .

Stock below IPO: Trading 19% below IPO creates potential overhang if early investors seek exits.

What to Watch in the Actual Q4 Report

When NIQ reports full Q4 2025 results (expected late February), focus on:

- Revenue vs. guidance: Did organic CC come in at 5.0–5.3%?

- Margin trajectory: Q4 guidance implied ~360bps YoY margin expansion—did they deliver?

- Free cash flow: $55M–$60M Q4 target would confirm full-year breakeven

- 2026 guidance: First formal outlook for the new year

- GfK integration update: Progress on back-office consolidation

- AI traction metrics: BASES AI client additions, Discover platform engagement

The Bottom Line

NIQ's guidance reaffirmation is a positive signal heading into year-end reporting. The company appears on track for ~5.5% organic growth, significant margin expansion, and a critical free cash flow inflection. The COO departure adds some uncertainty but management has positioned it as an orderly transition with no disruption to strategy.

With the stock trading meaningfully below its IPO price, the actual Q4 results in late February will be pivotal for investor confidence. Key questions: Can NIQ sustain its growth algorithm? Will AI investments translate to durable competitive advantage? Is the free cash flow inflection real?

Data sources: NIQ 8-K (Feb 2, 2026), Q3 2025 earnings release and call transcript (Nov 13, 2025). Market data as of January 30, 2026.