Earnings summaries and quarterly performance for NIQ Global Intelligence.

Research analysts who have asked questions during NIQ Global Intelligence earnings calls.

Alexander Hess

JPMorgan Chase & Co.

1 question for NIQ

Ashish Sabadra

RBC Capital Markets

1 question for NIQ

Jason Haas

Wells Fargo

1 question for NIQ

Jeffrey Silber

BMO Capital Markets

1 question for NIQ

Manav Patnaik

Barclays

1 question for NIQ

Shlomo Rosenbaum

Stifel Financial Corp.

1 question for NIQ

Tom Rashawn

William Blair & Company, L.L.C.

1 question for NIQ

Wahid Amin

Bank of America

1 question for NIQ

Zach Muller

Robert W. Baird & Co. Incorporated

1 question for NIQ

Recent press releases and 8-K filings for NIQ.

- NIQ, a global leader in consumer buying behavior, has achieved mid-single digit growth through client retention, price increases, innovation in e-commerce coverage and consumer panels, and expansion into new markets, including small and medium-sized businesses growing 20%. The company invested nearly $1 billion in technology to support this growth.

- The company delivered $224 million in free cash flow in Q3 2025 alone, increasing its full-year guidance to $280 million and reaching a break-even point, with an expected inflection in 2026 and 2027. This performance is driven by a 300 basis point improvement in EBITDA margins year-over-year in Q3 2025, with 200 basis points from GFK integration and 100 basis points from fixed cost base management.

- The GFK tech and durables business integration is progressing, now growing at a mid-single digit rate, closely aligning with overall company growth. NIQ views AI as an enabler, increasing engineer productivity by 40% and allowing expansion into new analytics areas.

- Capital allocation priorities focus on deleveraging, targeting less than 3.5 debt leverage by year-end and less than 3 by the end of 2026, while also pursuing accretive M&A.

- NIQ is leveraging AI to enhance its services, with engineers achieving 40% higher productivity, and has implemented contractual safeguards to prevent clients from using its proprietary data to develop competing AI models.

- The company has achieved mid-single-digit growth through a $1 billion technology investment, improved client retention, and expansion into new markets, including a 20% growth in its small and medium-sized business segment.

- NIQ reported robust financial performance, with $224 million in free cash flow in Q3 alone, leading to an increased full-year guidance of $280 million and an anticipated inflection point in 2026 and 2027.

- The GFK (Tech and Durables) business is nearing full integration and is now contributing to NIQ's overall growth, achieving mid-single-digit growth (4-6%).

- Capital allocation remains focused on deleveraging, targeting less than 3.5x by year-end and less than 3x by the end of 2026, while also considering accretive M&A opportunities.

- NIQ reported Q3 2025 revenue of $1,052.6 million, marking a 7.2% year-over-year increase, with organic constant currency revenue growth at 5.8%.

- Adjusted EBITDA for Q3 2025 reached $223.7 million, a 25% increase compared to Q3 2024, resulting in an Adjusted EBITDA Margin of 21.3%.

- The company generated Free Cash Flow of $224.4 million in Q3 2025, a substantial increase from $56.5 million in Q3 2024.

- Net Dollar Retention for Intelligence Subscription remained strong at 105% in Q3 2025.

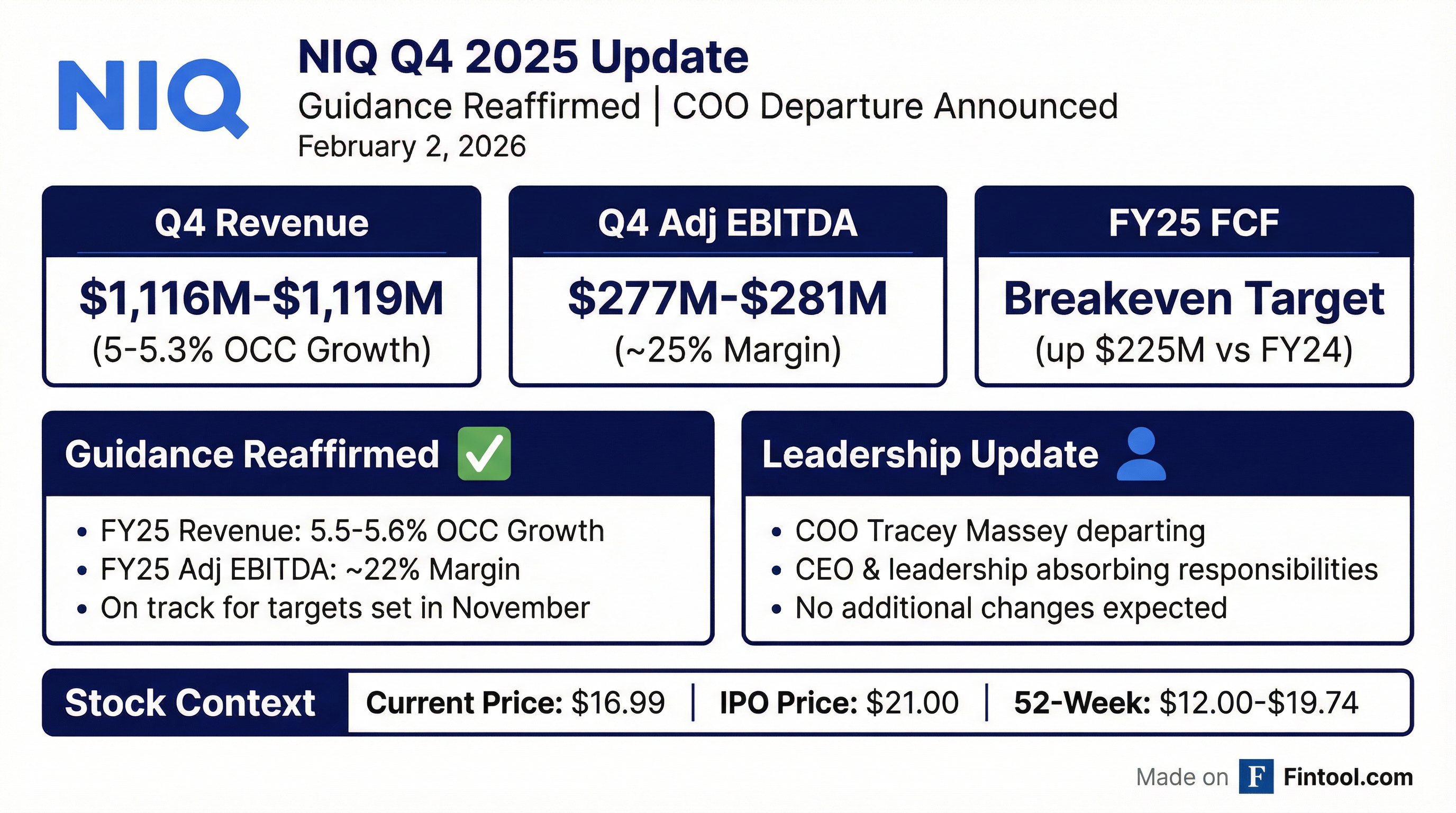

- For full-year 2025, NIQ anticipates revenue between $4,175 million and $4,178 million, and Adjusted EBITDA between $905 million and $909 million, with Free Cash Flow expected to be breakeven.

- NIQ reported strong Q3 2025 results, with 5.8% organic constant currency revenue growth, $223.7 million in adjusted EBITDA (a 25% increase), and $224 million in levered-free cash flow.

- The company expanded its adjusted EBITDA margin by 300 basis points to 21.3% in Q3 2025, attributing outperformance to AI-driven operating efficiencies and the GfK integration.

- NIQ raised its full-year 2025 guidance, now expecting to achieve free cash flow break-even on a levered basis, which is a $20 million improvement from the previous midpoint.

- For Q4 2025, the company projects 7-7.3% reported revenue growth and adjusted EBITDA growth of 25-26%, with adjusted EBITDA margins nearing 25%.

- NIQ reported strong Q3 2025 results, with 5.8% organic constant currency revenue growth, adjusted EBITDA margin expanding by 300 basis points to 21%, and $224 million in levered-free cash flow.

- The company raised its full-year 2025 guidance, now expecting to be free cash flow break-even on a levered basis, which is a $20 million improvement from its previous guidance midpoint.

- AI is identified as a key driver for both revenue growth and operating efficiencies, contributing to margin expansion and setting the stage for continued momentum and significantly increased free cash flow generation in 2026.

- NIQ Global Intelligence plc reported strong Q3 2025 results, with total revenue growing 7.2% year-over-year to $1,052.6 million, and organic constant currency revenue increasing 5.8%.

- Adjusted EBITDA accelerated 24.9% to $223.7 million in Q3 2025, with the Adjusted EBITDA margin expanding by 300 basis points year-over-year to 21.3%.

- The company generated $224.4 million in free cash flow for Q3 2025, a $167.9 million increase year-over-year.

- NIQ raised its full-year 2025 financial guidance, now expecting 5.5% - 5.6% organic constant currency revenue growth, approximately 22% Adjusted EBITDA margin, and breakeven free cash flow, which is an increase of $20 million versus the midpoint of the previous outlook.

Fintool News

In-depth analysis and coverage of NIQ Global Intelligence.

Quarterly earnings call transcripts for NIQ Global Intelligence.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more