Earnings summaries and quarterly performance for NOMURA HOLDINGS.

Research analysts who have asked questions during NOMURA HOLDINGS earnings calls.

Kazuki Watanabe

Daiwa Securities Co. Ltd.

3 questions for NMR

Koichi Niwa

Citigroup Inc.

3 questions for NMR

Masao Muraki

SMBC Nikko Securities Inc.

3 questions for NMR

Wataru Otsuka

SBI SECURITIES Co., Ltd.

3 questions for NMR

Muraki

SMBC Nikko Securities Inc.

2 questions for NMR

Nagasaka

Morgan Stanley

2 questions for NMR

Natsumu Tsujino

BofA Securities

2 questions for NMR

Otsuka

ACBI Securities

2 questions for NMR

Tsujino

BofA Securities

2 questions for NMR

Watanabe

Daiwa Securities Group Inc.

2 questions for NMR

Koki Sato

JPMorgan Chase & Co.

1 question for NMR

Mia Nagasaka

Morgan Stanley MUFG Securities Co., Ltd.

1 question for NMR

Sato

JPMorgan Security

1 question for NMR

Recent press releases and 8-K filings for NMR.

- For the nine months ended December 31, 2025, Nomura Holdings, Inc. reported net revenue of 1,590.5 billion yen, an increase of 10.5% from the prior year, and net income attributable to NHI shareholders of 288.2 billion yen.

- As of December 31, 2025, total assets increased to 61.9 trillion yen and total NHI shareholders’ equity was 3.7 trillion yen. Preliminary capital ratios included a Common Equity Tier 1 Capital ratio of 12.8% and a Consolidated Capital Adequacy ratio of 15.8%.

- The Investment Management segment's net revenue increased by 15.3% to 172.3 billion yen, partly due to the acquisition of Macquarie Management Holdings, Inc. and related entities for approximately $1.8 billion on December 1, 2025. The Wholesale segment's net revenue grew by 6.9% to 854.2 billion yen, driven by strong performance in Equities.

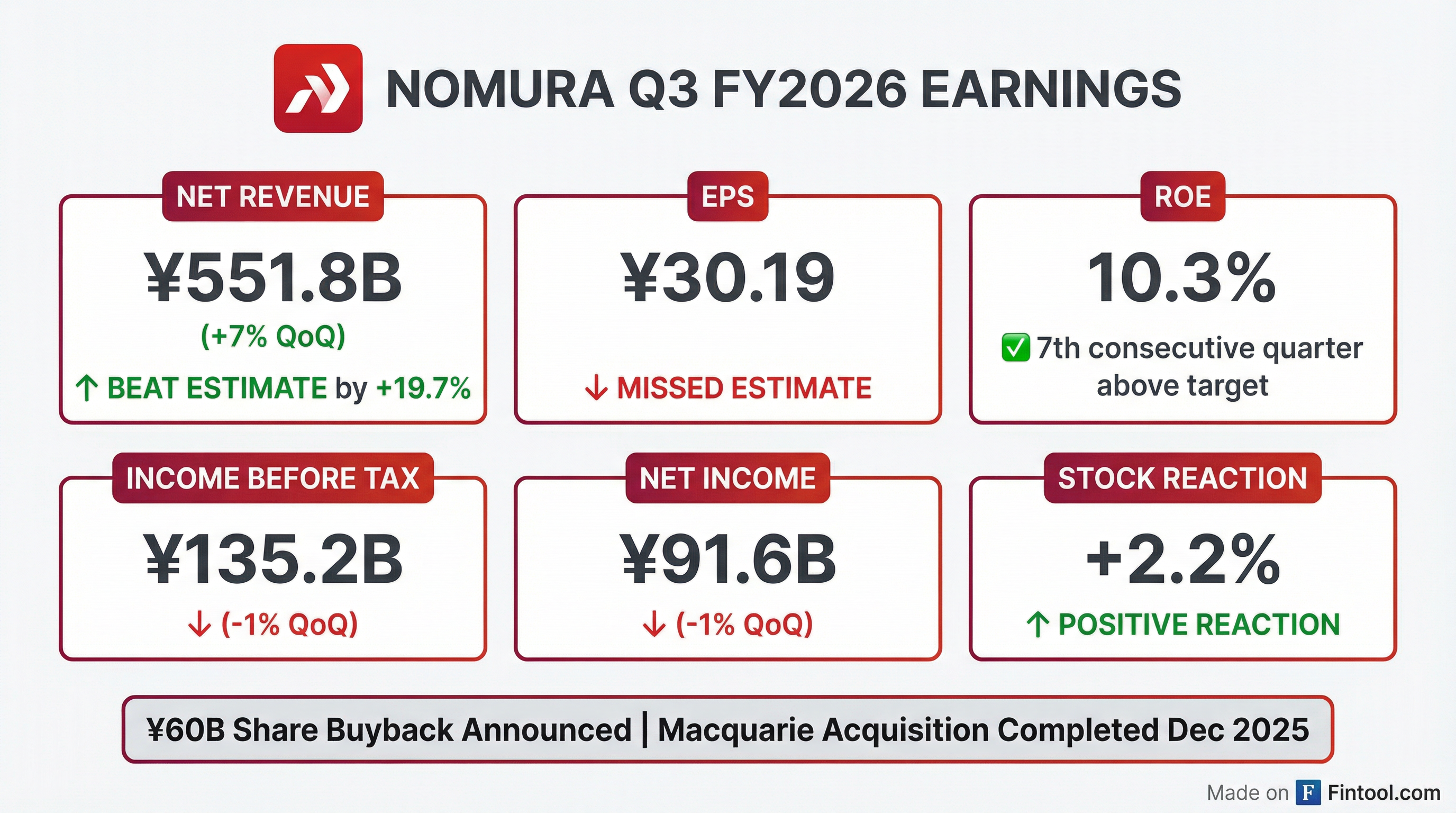

- Nomura Holdings Inc. reported net revenue of Y551.8 billion, income before income taxes of Y135.2 billion, and net income of Y91.6 billion for the third quarter of the fiscal year ending March 2026, achieving an ROE of 10.3%.

- The company's four segments recorded an income before income taxes of Y142.9 billion, marking the highest level in 18.5 years.

- Investment Management's assets under management increased substantially to Y134.7 trillion following the acquisition of Macquarie Group's public asset management business.

- Nomura Holdings Inc. announced a share buyback program for up to 100 million shares or Y60 billion, to be executed between February 17, 2026, and September 30, 2026.

- Nomura Holdings, Inc. reported net revenue of 551.8 billion yen and net income attributable to shareholders of 91.6 billion yen for the third quarter of the fiscal year ending March 31, 2026, achieving a 10.3% Return on Equity.

- The company's Board of Directors approved a share buyback program for up to 100 million shares or 60 billion yen, effective from February 17, 2026, to September 30, 2026.

- Nomura also resolved to cancel 75,000,000 shares (approximately 2.4% of issued shares) on March 2, 2026.

- Delaware Management Company became a specified subsidiary, with its consolidated results now reflected in Nomura's Q3 FY2026 consolidated results following the acquisition of Macquarie's U.S. and European public asset management business.

- Nomura Holdings reported net revenue of JPY 551.8 billion for Q3 FY2026, a 7% increase quarter-over-quarter, with net income of JPY 91.6 billion and EPS of JPY 30.19.

- The company announced a share buyback program of up to 100 million shares and JPY 60 billion, effective from February 17 to September 30.

- All four main divisions performed solidly, with Wealth Management income before income taxes rising 29% to JPY 58.5 billion and Wholesale net revenue increasing 12% to JPY 313.9 billion.

- Profits in Investment Management fell due to one-time expenses associated with the Macquarie Group acquisition and weaker investment gains, while the "Other" segment incurred losses from its digital asset-related businesses.

- Nomura Holdings reported Q3 2026 net revenue of JPY 551.8 billion, a 7% increase quarter-over-quarter, with net income of JPY 91.6 billion and EPS of JPY 30.19. The Return on Equity (ROE) for the quarter was 10.3%.

- The company announced a share buyback program with an upper limit of 100 million shares or JPY 60 billion, scheduled to run from February 17 to September 30.

- Wealth Management and Wholesale divisions demonstrated strong performance, while Investment Management profits decreased 42% due to one-time expenses from the Macquarie acquisition and weaker investment gains.

- The "segment other" incurred losses, primarily from Laser Digital, attributed to a downturn in digital asset market conditions in October and November.

- Nomura Holdings reported Q3 2026 net revenue of JPY 551.8 billion, a 7% increase quarter-on-quarter, with net income of JPY 91.6 billion and EPS of JPY 30.19.

- The company's Return on Equity (ROE) was 10.3% for the quarter, marking the seventh consecutive quarter of meeting its 2030 target of 8%-10% or more.

- All four main divisions (Wealth Management, Investment Management, Wholesale, and Banking) performed solidly, with their combined pre-tax income rising 8% to JPY 142.9 billion, the highest level in 18.5 years.

- A new share buyback program was announced, running from February 17 to September 30, with an upper limit of 100 million shares and JPY 60 billion.

- The "segment other" incurred losses, including JPY 10.6 billion red ink from Laser Digital in EMEA, due to a downturn in digital asset market conditions.

- Nova (Nasdaq: NVMI) announced the adoption of its Nova Metrion® platform by global leaders in Memory and Logic device production on January 29, 2026.

- The platform was purchased for Gate-All-Around (GAA) and advanced DRAM device production, which will enable customers to accelerate performance and yield.

- This adoption marks a significant milestone in Nova Metrion®'s market penetration, expanding Nova's materials metrology footprint in two critical technology inflections driving semiconductor growth.

- The Nova Metrion® is the first fully automated Secondary Ion Mass Spectrometry system validated for inline production process control, designed to identify process excursions in near-real time.

- Nomura Holdings aims for an ROE of 8 to 10 percent or higher toward 2030 and over 500 billion yen of income before income taxes. The company's PBR improved to 1.1 times as of December 31, 2025, and its ROE reached 10.0 percent for FY ended March 2025 and 11.3 percent for the first half of FY ended March 2026.

- The company operates with a Three Board Committees structure (Nomination, Audit, Compensation) to enhance oversight and transparency, with executive compensation determined by an independent Compensation Committee. Executive incentives include Restricted Stock Units (RSUs) and Performance Share Units (PSUs), with PSUs introduced in the fiscal year ended March 31, 2024, based on three-year performance targets.

- Nomura Group has set a target of 30% female managers by 2030 and aims to achieve net zero greenhouse gas (GHG) emissions for its own operations by 2030 and for its investment and loan portfolio by 2050.

- Net income attributable to NHI shareholders for the six months ended September 30, 2025, increased by 17.5% to ¥196,643 million.

- Net revenue for the six months ended September 30, 2025, rose by 10.8% to ¥1,038,777 million, primarily driven by strong performance in net gain on trading.

- The Wealth Management Division reported an 11.7% increase in recurring revenue assets to ¥26.2 trillion as of September 30, 2025.

- Total assets grew by 6.3% to ¥60,367.7 billion as of September 30, 2025, resulting in a rise in the leverage ratio to 17.3x.

- The company reported net cash provided by operating activities of ¥942.8 billion for the six months ended September 30, 2025, a significant improvement from a net cash outflow in the prior year.

- Genting Bhd's attempt to take its affiliate Genting Malaysia private failed, as it secured only a 73.13% stake, falling short of the 75% threshold required to delist the company from Bursa Malaysia.

- An independent adviser recommended shareholders reject the RM2.35 (US$0.56) per share offer, citing it as "not fair and not reasonable" despite being a nearly 10% premium over the stock's last traded price prior to the offer.

- As a result, Genting Malaysia will remain publicly listed, with its public shareholding spread staying above the mandated 25% level.

- In a significant development, Genting Malaysia's wholly owned subsidiary, Genting New York LLC, was selected to apply for a commercial casino gaming license in New York, with analysts projecting net profit from this expansion could peak at around 1.93 billion ringgit by 2030.

Quarterly earnings call transcripts for NOMURA HOLDINGS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more