Earnings summaries and quarterly performance for NRG ENERGY.

Executive leadership at NRG ENERGY.

Lawrence S. Coben

President and Chief Executive Officer

Al Spencer

Senior Vice President and Chief Accounting Officer

Brian Curci

Executive Vice President and General Counsel

Bruce Chung

Executive Vice President and Chief Financial Officer

Dak Liyanearachchi

Executive Vice President and Chief Technology Officer

Gin Kirkland Kinney

Executive Vice President and Chief Administrative Officer

Robert Gaudette

Executive Vice President, President of NRG Business and Wholesale Operations

Board of directors at NRG ENERGY.

Alexander Pourbaix

Director

Alexandra Pruner

Director

Antonio Carrillo

Lead Independent Director

E. Spencer Abraham

Director

Elisabeth B. Donohue

Director

Heather Cox

Director

Kevin T. Howell

Director

Marwan Fawaz

Director

Matthew Carter, Jr.

Director

Marcie C. Zlotnik

Director

Research analysts who have asked questions during NRG ENERGY earnings calls.

David Arcaro

Morgan Stanley

8 questions for NRG

Julien Dumoulin-Smith

Jefferies

8 questions for NRG

Carly Davenport

Goldman Sachs

6 questions for NRG

Nicholas Campanella

Barclays

5 questions for NRG

Shahriar Pourreza

Guggenheim Partners

5 questions for NRG

Andrew Weisel

Scotiabank

4 questions for NRG

Angie Storozynski

Seaport Research Partners

4 questions for NRG

Agnieszka Storozynski

BofA Securities

2 questions for NRG

Bill Appicelli

UBS

2 questions for NRG

James West

Evercore ISI

2 questions for NRG

Michael Sullivan

Wolfe

2 questions for NRG

Nick Amicucci

Evercore ISI

2 questions for NRG

Ryan Levine

Citigroup

2 questions for NRG

Shar Pourreza

Wells Fargo

2 questions for NRG

Angie Storozinski

Seaport

1 question for NRG

Durgesh Chopra

Evercore ISI

1 question for NRG

Steven Fleishman

Wolfe Research

1 question for NRG

Recent press releases and 8-K filings for NRG.

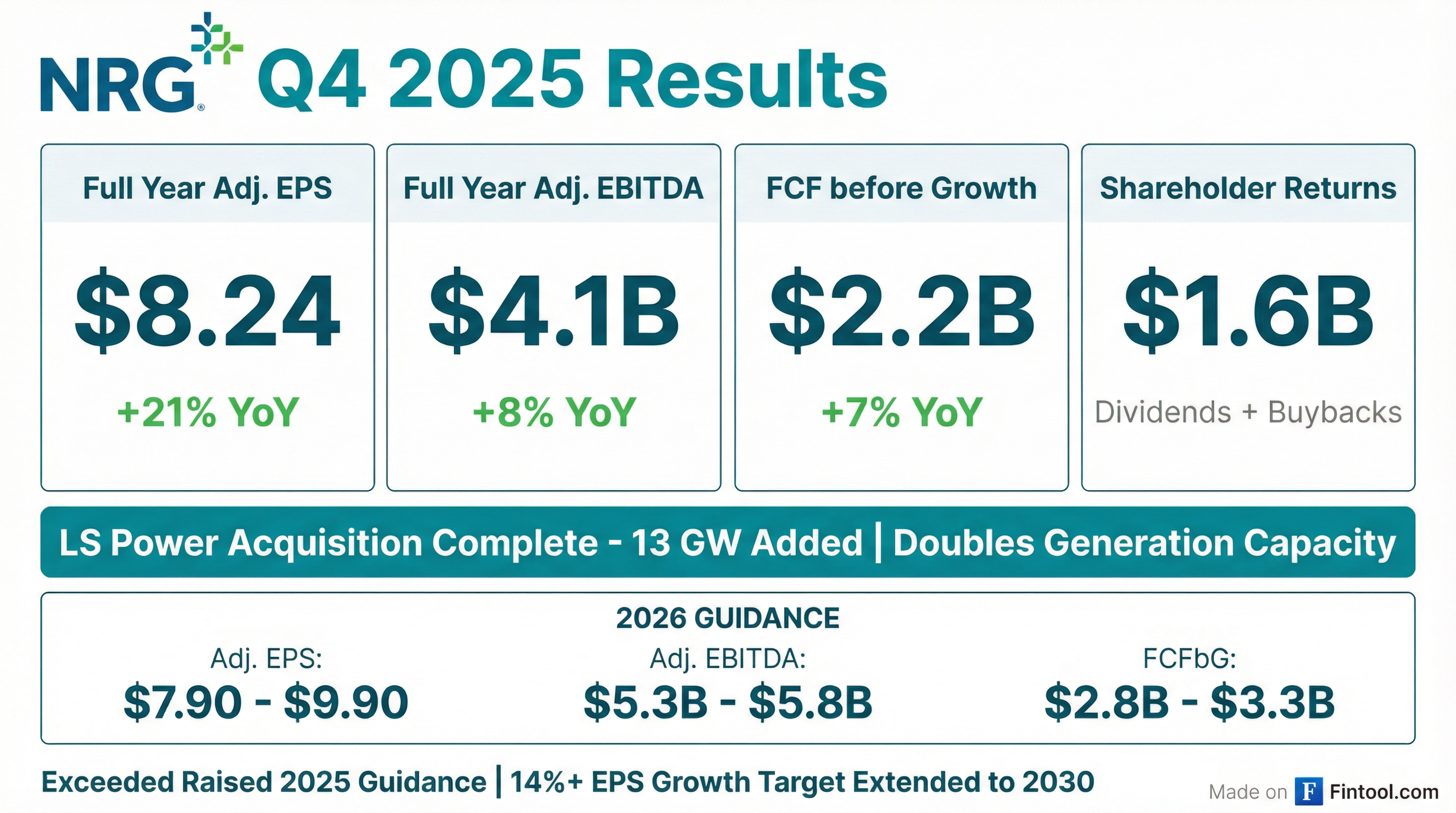

- NRG delivered record 2025 results with adjusted EPS of $8.24 (+21%), adjusted EBITDA of $4.087 B (+8%), and free cash flow before growth of $2.21 B (+7%), surpassing the high end of guidance.

- Completed the LS Power acquisition at end-Jan 2026, doubling generation capacity to 25 GW (~75% natural gas), with integration performance already exceeding underwriting assumptions.

- Reaffirmed 2026 guidance including 11 months of LS Power contributions: adjusted EBITDA of $5.575 B, adjusted net income of $1.9 B, adjusted EPS of $8.90, and free cash flow before growth of $3.05 B.

- Rolled forward the five-year outlook through 2030, targeting >14% annual growth in adjusted EPS to >$14 and free cash flow per share to >$22, with $18.3 B total capital available and $13.2 B earmarked for dividends and share repurchases.

- Record 2025 performance: Adjusted EPS of $8.24, Adjusted EBITDA of $4.087 billion, and Free Cash Flow Before Growth of $2.210 billion, all above guidance.

- LS Power acquisition closed at end-January, doubling generation capacity to 25 GW (75% natural gas), with integration already exceeding underwriting assumptions.

- 2026 guidance reaffirmed, with midpoints of Adjusted EBITDA $5.575 billion, Adjusted Net Income $1.9 billion, Adjusted EPS $8.90, and Free Cash Flow Before Growth $3.05 billion.

- Long-term outlook rolled forward, targeting ≥14% annual growth in Adjusted EPS and Free Cash Flow per share from 2026 through 2030, incorporating all three Texas Energy Fund projects and no new data center or price increase assumptions.

- Shareholder returns: returned $1.6 billion via repurchases and dividends in 2025 (dividend up 8%), and plans to deploy $18.3 billion of capital through 2030, returning $13.2 billion (including $11 billion in repurchases and $2.2 billion in dividends).

- Record 2025 performance: Adjusted EPS of $8.24, Adjusted EBITDA of $4.087 billion, and Free Cash Flow Before Growth of $2.210 billion, all above the high end of raised guidance.

- LS Power acquisition closed at end-January, doubling generation fleet to 25 GW (>75% natural gas); integration is outperforming underwriting assumptions and immediately accretive.

- 2026 guidance reaffirmed (11 months of LS Power): midpoints of Adjusted EBITDA $5.575 billion, Adjusted EPS $8.90, and Free Cash Flow Before Growth $3.05 billion.

- Long-term outlook rolled forward: targeting at least 14% annual growth in Adjusted EPS and Free Cash Flow Before Growth per share from 2026 through 2030, with 2030 targets above $14 EPS and $22 FCFBG per share.

- Exceeded raised 2025 guidance with full-year Adjusted EPS of $8.24 and Adjusted EBITDA of $4,087 million, generating FCF before Growth of $2,210 million

- Closed the LS Power portfolio acquisition, doubling competitive generation capacity to ~25 GW and shifting to 76% natural gas fuel mix post-acquisition

- Initiated 2026 guidance (inclusive of LS Power) targeting Adj EPS of $7.90–$9.90, Adj EBITDA of $5,325–$5,825 million, and FCF before Growth of $2,800–$3,300 million

- Extended long-term outlook, targeting a 14%+ Adj EPS CAGR through 2030 with pro forma 2030 Adj EPS above $14.00

- Returned $1.6 billion to shareholders in 2025 and plans to return $1.4 billion in 2026 through dividends and buybacks

- Reported GAAP Net Income of $864 million, GAAP EPS basic of $4.09, Adjusted Net Income of $1.606 billion, Adjusted EPS of $8.24, Adjusted EBITDA of $4.087 billion, and Free Cash Flow before Growth of $2.210 billion, exceeding its raised 2025 guidance ranges.

- Completed acquisition of 13 GW of power generation assets and CPower from LS Power, doubling its generation footprint and expanding demand response capabilities.

- Returned $1.6 billion of capital to shareholders in 2025 through $1.3 billion in share repurchases and $344 million in common stock dividends.

- Extended its adjusted EPS growth rate target of 14%+ through 2030 and closed a $1.15 billion Texas Energy Fund loan for 1.5 GW of CCGT capacity, with the first project expected online in June 2026.

- Q4 GAAP Net Income of $66 M and FY GAAP Net Income of $864 M; Adjusted EPS of $1.04 (Q4) and $8.24 (FY) with FY FCFbG of $2.2 B.

- Completed acquisition of 13 GW of power generation assets and CPower from LS Power on January 30, 2026, doubling its generation footprint and expanding demand response capabilities.

- Reaffirmed 2026 guidance: Adjusted Net Income $1.685–2.115 B, Adjusted EPS $7.90–9.90, Adjusted EBITDA $5.325–5.825 B, and FCFbG $2.8–3.3 B.

- Returned $1.6 B to shareholders in 2025, comprising $1.3 B in share repurchases and $344 M in dividends.

- Secured $1.15 B of low-interest TEF financing for 1.5 GW of new Texas generation, with Greens Bayou (443 MW) expected online June 2026.

- On February 2, 2026, NRG announced updated 2026 financial guidance following the closing of its LS Power asset portfolio acquisition on January 30, 2026.

- 2026 guidance includes Adjusted EBITDA of $5,325–$5,825 M, Adjusted EPS of $7.90–$9.90, and Free Cash Flow before Growth of $2,800–$3,300 M.

- The update reflects approximately 11 months (90%) of contribution from the acquired portfolio in 2026.

- NRG will report its Full Year and Q4 2025 results on February 24, 2026, with a conference call at 9:00 a.m. EST.

- NRG completed the acquisition of a portfolio from LS Power on January 30, 2026 and updated its 2026 guidance to reflect approximately 11 months of ownership of these assets.

- 2026 guidance ranges: Adjusted Net Income of $1,685 – $2,115 M (midpoint $1,900 M); Adjusted EPS of $7.90 – $9.90 ($8.90); Adjusted EBITDA of $5,325 – $5,825 M ($5,575 M); and FCFbG of $2,800 – $3,300 M ($3,050 M).

- The updated outlook incorporates approximately 90% of the acquired portfolio’s estimated full-year 2026 contribution, consistent with NRG’s long-term growth framework.

- NRG will report Full Year and Q4 2025 financial results on February 24, 2026, with a conference call/webcast at 9:00 a.m. EST.

- NRG Energy entered into a Registration Rights Agreement with the Selling Stockholders, granting customary piggy-back and shelf registration rights for the shares issued as Stock Consideration in the Transaction.

- The Selling Stockholders also executed a Voting Trust Agreement with Wilmington Savings Fund Society, FSB, as Trustee, limiting their voting power to below 10% of the Company’s common stock until July 30, 2026, to satisfy FERC requirements.

- Lightning Power (an indirect subsidiary) remains issuer of $1,500 million aggregate principal amount of 7.250% Senior Secured Notes due 2032, with interest payable semi-annually and specified redemption provisions through 2032.

- NRG issued a press release announcing the closing of the Transaction and will file the acquired businesses’ financial statements and pro forma financial information as amendments within 71 days.

- NRG Energy finalized the acquisition of 18 natural-gas-fired generation facilities totaling 13 GW of capacity, plus CPower’s commercial and industrial virtual power plant platform, from LS Power.

- The deal doubles NRG’s generation fleet to approximately 25 GW and expands its demand response and VPP capabilities.

- Aimed at bolstering reliability and affordability, the transaction enhances NRG’s ability to serve its eight million customers amid rising power demand.

Quarterly earnings call transcripts for NRG ENERGY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more