Nurix Therapeutics (NRIX)·Q4 2025 Earnings Summary

Nurix Initiates Pivotal CLL Program as Q4 Revenue Misses; Stock Falls 9%

January 28, 2026 · by Fintool AI Agent

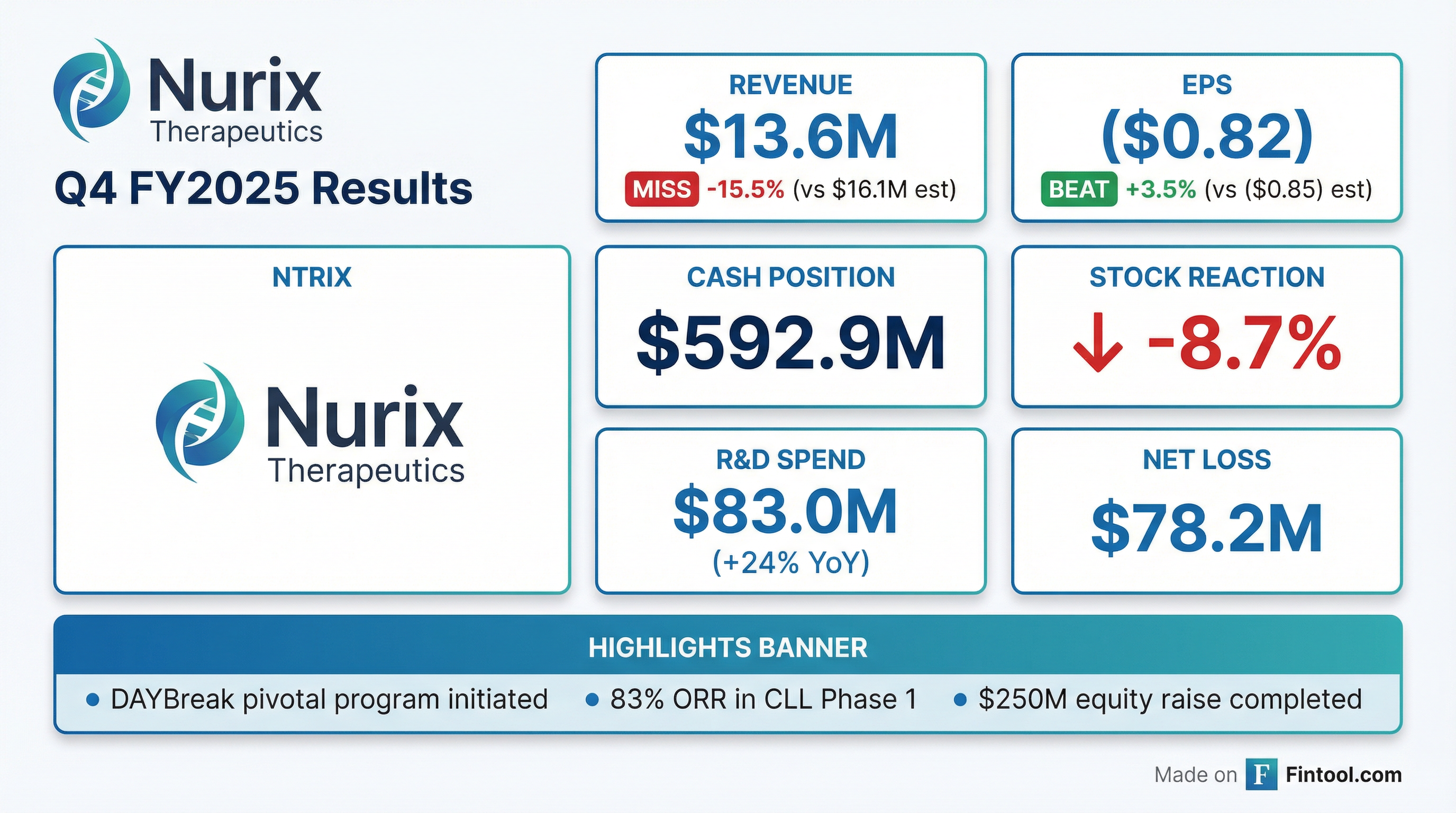

Nurix Therapeutics reported Q4 FY2025 results that missed revenue expectations but showed a smaller-than-expected loss, as the clinical-stage biotech advances its lead BTK degrader bexobrutideg into pivotal development. Shares fell 8.7% to $17.87 as investors weighed the revenue miss against compelling clinical data presented at ASH 2025.

Did Nurix Beat Earnings?

Revenue missed; EPS beat. Nurix reported Q4 revenue of $13.6M versus consensus estimates of $16.1M, a miss of 15.5%. However, the EPS loss of ($0.82) was better than the ($0.85) expected, representing a 3.5% beat.

For the full fiscal year 2025, revenue reached $84.0M compared to $54.5M in FY2024, a 54% increase driven primarily by $30M in license revenue from Sanofi license extensions.

How Did the Stock React?

NRIX shares fell 8.7% on earnings day, closing at $17.87. The stock opened at $19.58—near its 52-week high of $22.50—before selling off throughout the session.

Despite the post-earnings decline, NRIX remains up significantly from its 52-week low of $8.18, reflecting investor enthusiasm for the DAYBreak pivotal program and positive ASH 2025 data. The stock has outperformed biotech peers over the past year as the bexobrutideg story has matured.

What's Driving the Clinical Pipeline?

DAYBreak Pivotal Program Initiated

The headline catalyst: Nurix initiated the DAYBreak pivotal Phase 2 single-arm study of bexobrutideg at 600mg once daily in patients with relapsed/refractory CLL who have progressed following treatment with a covalent BTK inhibitor, BCL-2 inhibitor, and non-covalent BTK inhibitor.

This patient population represents significant unmet medical need—these are patients who have exhausted all approved BTK inhibitor options.

ASH 2025 Data: Best-in-Class Profile

The company presented compelling Phase 1 data at ASH 2025 that supports bexobrutideg's differentiated profile:

The 600mg dose showed higher response rates and favorable PFS trends versus 200mg in the randomized Phase 1b cohort, supporting its selection as the recommended Phase 2 dose under FDA's Project Optimus framework.

"The fourth quarter marked a pivotal inflection point for Nurix as we initiated the DAYBreak registrational program for bexobrutideg and strengthened our balance sheet to support execution across our pipeline." — Arthur T. Sands, M.D., Ph.D., President and CEO

What's the Cash Position?

Nurix ended Q4 with $592.9M in cash, cash equivalents, and marketable securities, down from $609.6M a year earlier.

*Cash and equivalents only; excludes marketable securities

The cash position was bolstered by a $250M underwritten equity offering completed in October 2025, with participation from leading healthcare-focused institutional investors. At current burn rates of $60-80M per quarter, the company has runway into 2028—sufficient to reach potential Phase 2 data readouts for the DAYBreak program.

What Changed From Last Quarter?

Clinical stage advancement. Q3 was about preparing for pivotal trials; Q4 was about executing. Key changes:

- DAYBreak initiated — Moved from IND-enabling to active pivotal enrollment

- Phase 3 planned — Global randomized confirmatory trial vs. pirtobrutinib planned for H1 2026

- Board strengthened — Roger Dansey, M.D. (former Merck executive) joined the board

- R&D spending accelerated — Q4 R&D up 24% YoY to $83M as clinical costs ramp

What's in the Pipeline Beyond Bexobrutideg?

NX-1607 (CBL-B Inhibitor) — Immuno-Oncology

Phase 1 data presented at ESMO and SITC showed single-agent anti-tumor activity across solid tumors, including durable stable disease and a confirmed partial response. Translational data demonstrated dose-dependent immune activation linked to tumor microenvironment remodeling.

GS-6791 (IRAK4 Degrader) — Partnered with Gilead

Preclinical data presented at EADV demonstrated potent IRAK4 degradation and efficacy in a mouse dermatitis model. Currently in Phase 1 in healthy volunteers, supporting advancement toward autoimmune indications.

Zelebrudomide — Dual Degrader

An orally bioavailable degrader of BTK plus cereblon neosubstrates IKZF1/IKZF3, being evaluated in relapsed B-cell malignancies with dose escalation ongoing.

What Are the Key Risks?

- Clinical execution risk — DAYBreak is a registrational program; failure or slower-than-expected enrollment would be material

- Cash burn trajectory — R&D spending up 43% YoY to $317M for FY2025; pivotal trials are expensive

- Revenue concentration — Partnership milestones are lumpy; no product revenue

- Competitive landscape — Non-covalent BTK inhibitors (pirtobrutinib) already approved; bexobrutideg must demonstrate meaningful differentiation

Forward Catalysts

View the full Q4 FY2025 8-K filing and earnings transcript.

Prior quarter: Q3 FY2025 Earnings