NORFOLK SOUTHERN (NSC)·Q4 2025 Earnings Summary

Norfolk Southern Beats EPS by 17% as Cost Cuts Offset Soft Revenue

January 29, 2026 · by Fintool AI Agent

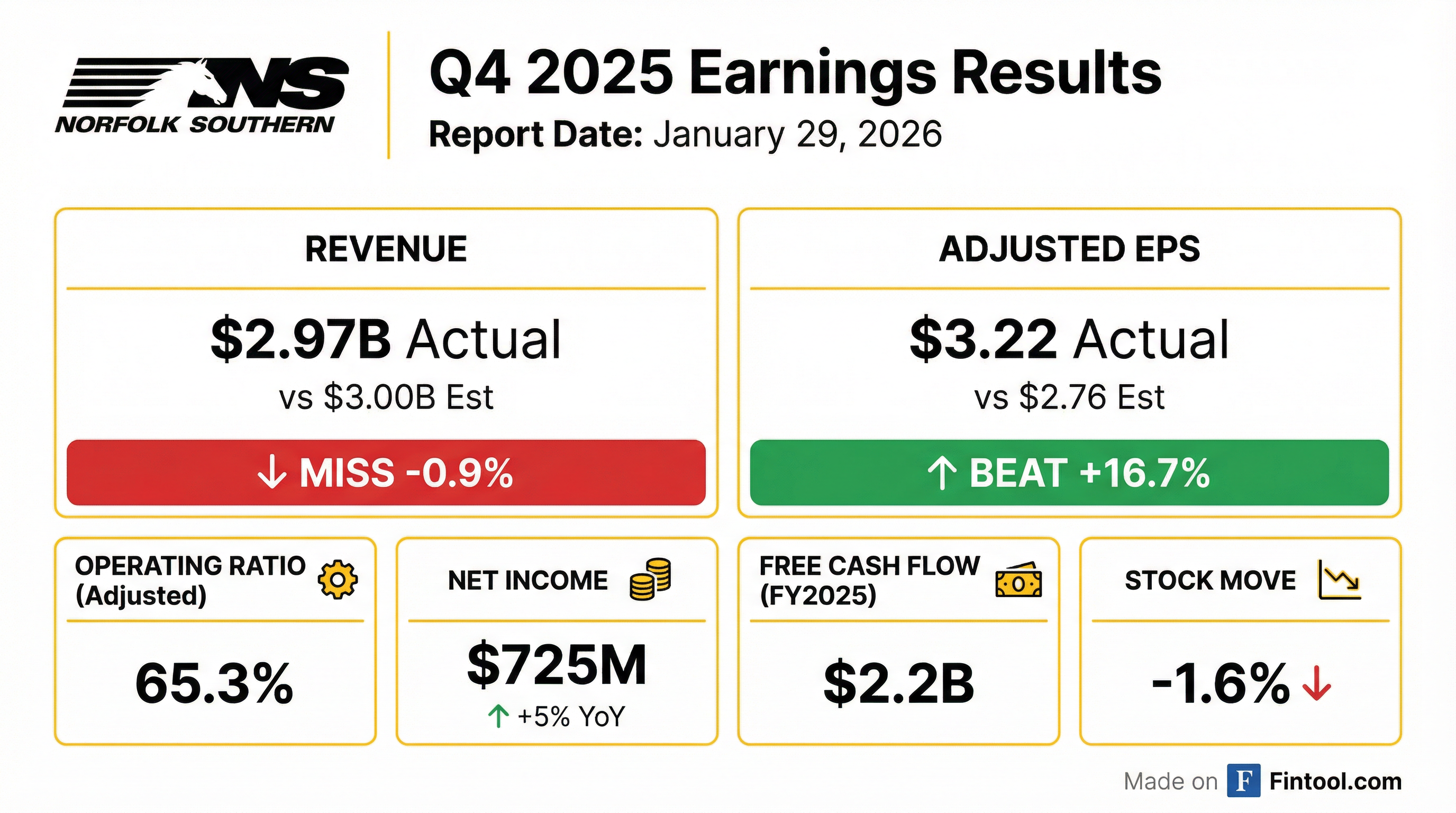

Norfolk Southern delivered a substantial earnings beat in Q4 2025, with adjusted EPS of $3.22 coming in 16.7% above consensus estimates of $2.76 . However, revenue of $2.97B missed expectations by 0.9%, pressured by soft intermodal volumes and weak coal pricing . The stock slipped ~1.6% following the release as investors weighed the strong cost execution against the cautious 2026 volume outlook tied to merger-related competitive pressures.

CEO Mark George highlighted the team's resilience: "2025 was dizzying. It started with a challenging winter, followed by persistent tariff uncertainty, and then competitive dynamics tied to the announced merger. In the back half, the macro softened further and freight flows shifted, but through it all, our operating foundation held."

Did Norfolk Southern Beat Earnings?

EPS: Beat by 16.7% — Adjusted EPS of $3.22 significantly exceeded the $2.76 consensus, driven by disciplined cost control and a ~$85M benefit from a major land sale .

Revenue: Miss by 0.9% — Total revenue of $2.97B came in below the $3.00B estimate, down 2% year-over-year .

The adjusted operating ratio of 65.3% widened 40 basis points year-over-year, though this includes $65M of merger-related expenses consisting primarily of legal, professional services, and employee retention accruals . Excluding these items and the Eastern Ohio incident impact, the underlying operational performance remained solid.

A standout achievement: zero reportable mainline derailments in Q4 — a testament to the company's digital inspection technology and safety investments .

What Drove the Quarter?

Segment Performance

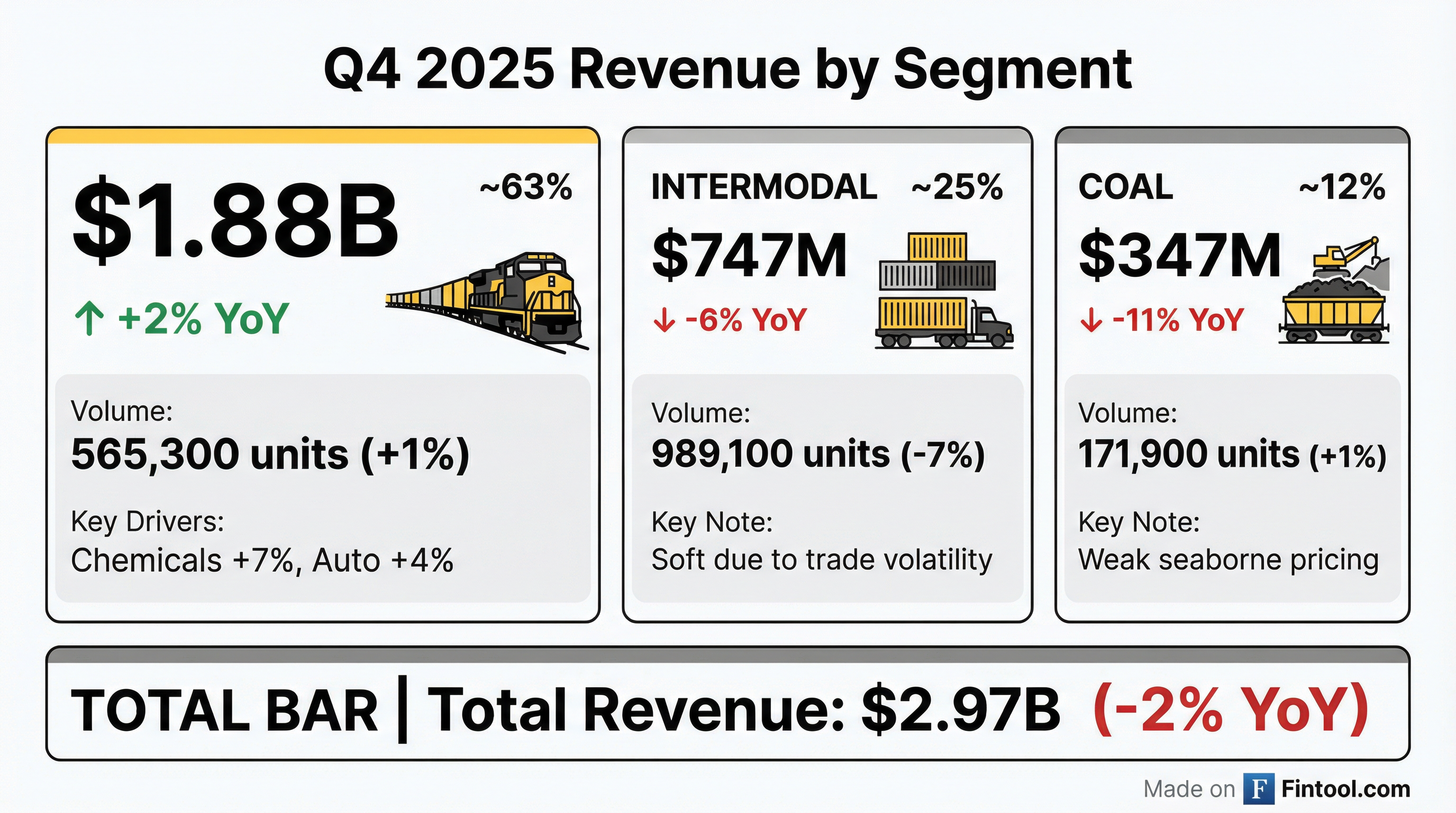

Merchandise (+2% revenue) — The bright spot of the quarter, with record annual revenue across all underlying business groups . Volume grew 1%, with pricing and mix tailwinds boosting revenue per unit. Auto delivered a record year enabled by 4% improvement in equipment cycle times and substantially greater terminal fluidity .

Intermodal (-6% revenue) — The weakest segment, with volumes down 7%. Management attributed softness to trade volatility, enhanced competition from the merger announcement, and the J.B. Hunt business shift to CSX . Ed Elkins noted: "We're four and a half years into a freight recession, and at some point, it's going to end if demand comes back, and we're ready for that."

Coal (-11% revenue) — Despite 1% volume growth, revenue declined sharply due to weak seaborne pricing. Revenue per unit dropped 12% year-over-year . A bright spot: the new Warrior Met Coal Blue Creek facility in Alabama just went operational, with NSC ramping up rail service for high-quality metallurgical coal exports .

Full Year 2025 Performance

Norfolk Southern closed out 2025 with solid full-year results despite the challenging environment :

The company delivered record annual merchandise revenue and achieved its highest-ever annual fuel efficiency. CEO Mark George summarized the year: "We moved 3% more GTMs in 2025 with 4% fewer employees. That's 7% productivity."

How Did the Stock React?

Norfolk Southern shares declined approximately 1.6% following the Q4 2025 earnings release, trading around $284 versus the prior close of $289. Despite the significant EPS beat, the market appears focused on:

- Soft revenue trends — The 2% year-over-year revenue decline and ongoing intermodal weakness

- 2026 volume headwinds — Management's explicit warning about merger-related competitive impacts

- Elevated expenses — Merger costs and Eastern Ohio incident expenses continue to weigh on results

The stock remains up significantly from its 52-week low of $201.63, currently trading about 6% below its 52-week high of $302.24.

What Did Management Guide?

2026 Outlook

CEO Mark George outlined the 2026 priorities :

Adjusted Operating Expenses: $8.2B – $8.4B

Capital Expenditures: $1.9B (down ~$300M or 14% from 2025)

Key strategic priorities:

- Safety and Service — Continued momentum on safety culture and delivering consistent, reliable service

- Disciplined Cost Control — The 2026 cost takeout commitment was raised from $100M to $150M, bringing the 3-year cumulative total to ~$650M

- Capital Discipline — Lowering capex while maintaining network reliability and safety

CFO Jason Zampi explained the expense outlook in detail :

- Wage inflation: 4% increase from July 2025 continues into H1, another 3.75% in H2

- Health & welfare costs: Up 12%+

- Insurance premiums: Up 25%

- Overall inflation: ~4% vs. 2.6% CPI, creating outsized headwinds

Volume Headwinds Ahead

Management was direct about near-term challenges. The company expects ~1% revenue headwind in 2026 from competitive losses related to the merger .

CEO George used the phrase "fight like hell for quality revenue" repeatedly on the call — a rallying cry to the organization :

"We're not sitting back and taking body blows. We're offering new products... We want to go get attractive car loads and try to optimize our revenue line as best as we can."

New competitive services announced:

- Louisville service in conjunction with Union Pacific

- Ayer, Massachusetts service to enhance competitive position in New England

Key market drivers to watch in 2026:

- Merchandise: Vehicle production mixed; elevated Marcellus/Utica gas drilling supporting chemicals

- Intermodal: Soft imports, elevated truck capacity, enhanced competition

- Coal: Utility demand strong; seaborne forwards declining through H1

What's the Merger Status?

The STB (Surface Transportation Board) returned Norfolk Southern's merger application, marking it incomplete . CEO George addressed this directly on the call:

"When an application is 7,000 pages and marked incomplete, you feel kind of bummed about it, but we shouldn't be too surprised. Nobody really gets this right the first time around. They've given us the path to completeness. We know exactly what we need to do."

Key points from management's merger commentary :

- Working with UP to submit an augmented application addressing STB's requests

- Not a merits rejection — purely a completeness issue; regulatory review hasn't started

- Vision unchanged: Creating "the nation's first transcontinental rail network" connecting East-West

- Competing railroads' opposition: George pushed back, noting BNSF and CSX "quickly joined up in various alliances and took business from us"

- Customer sentiment: "The customers I speak with... are rolling their eyes at a lot of the noise. They actually want deeper access into the watershed via rail."

What Changed From Last Quarter?

Sequential Trends (Q4 vs Q3)

The sequential decline in profitability reflects normal seasonality plus the impact of soft intermodal volumes and coal pricing. The ~$85M land sale provided a partial offset to underlying expense pressures .

PSR 2.0 Progress

Norfolk Southern exceeded its Precision Scheduled Railroading 2.0 productivity targets :

- Original 2025 Target: $150M → Raised to $200M mid-year → Delivered $216M

- 2026 Commitment: Raised from $100M to $150M, bringing 3-year cumulative to ~$650M

Operational productivity highlights from COO John Orr :

The company also unveiled its Zero-Based Terminal (ZBT) methodology for 2026 and Clarity Camps to train supervisors to "think like owners" .

Safety Improvements

Safety metrics improved significantly in 2025 — the best year in more than a decade for train accident rates :

Wheel Integrity System win: Norfolk Southern's internally-developed technology detected a critical casting flaw on a wheel set in service less than a week. The discovery led to an industry-wide recall of seven additional defective wheel sets across North America .

More than 75% of traffic is now scanned monthly by digital portal inspection technology .

Key Risks to Watch

-

Merger Uncertainty — The STB application rejection and ongoing regulatory process create near-term volume and pricing risks. Competitors have formed alliances and taken share

-

Eastern Ohio Overhang — The company continues to incur costs related to the 2023 derailment, with $29M net impact in Q4 2025 ($53M gross costs offset by $24M property insurance recoveries)

-

Intermodal Weakness — The -7% volume decline reflects cyclical softness, J.B. Hunt losses to CSX, and a "four and a half year freight recession"

-

Coal Structural Decline — Seaborne benchmark prices slid throughout 2025; forwards still declining through H1 2026 despite a January uptick

-

Outsized Inflation — ~4% overall inflation vs. 2.6% CPI, driven by wage agreements, 12%+ health/welfare costs, and 25% insurance premium increases

Q&A Highlights

On fighting for revenue (CEO George) :

"When I say fight for business, it's a rallying cry to this organization... We're going to remain disciplined. We actually had very good yield performance in the areas under our control."

On merger benefits (CEO George) :

"Ultimately, [competitors] know that to compete with seamless single-line service, they've got to compete harder, including likely lowering their prices. That's what customers should be excited about. And frankly, that's what scares the other railroads."

On reciprocal switching (COO Orr) :

"My job is to give no customer any reason to want to talk to Ed about going somewhere else. We're really pleased with the competitive service product we put out there."

On 2026 volume scenarios (CEO George) :

"Whatever revenue we get, it's going to come with really strong incrementals because we've got the capacity."

Bottom Line

Norfolk Southern delivered a strong EPS beat driven by disciplined cost execution and a one-time land sale, but the revenue miss and cautious 2026 volume outlook tempered investor enthusiasm. The company's PSR 2.0 productivity initiatives are clearly bearing fruit, with $216M in savings exceeding the original $150M target. However, the "enhanced competitive environment" from merger-related dynamics and soft intermodal trends present near-term headwinds.

The decision to cut 2026 capex by 14% while raising the productivity commitment to $150M signals management's focus on protecting margins in an uncertain volume environment. The STB application setback adds regulatory uncertainty, but management maintains this is a completeness issue rather than a merits rejection.

CEO George closed with the team's priorities for 2026: "Focus on the preservation of safety, protect the excellent service that our customers count on, maintain tight control of our cost structure, and compete hard for quality revenue."

Related Links: