Earnings summaries and quarterly performance for NORFOLK SOUTHERN.

Executive leadership at NORFOLK SOUTHERN.

Mark George

Chief Executive Officer

Anil Bhatt

Executive Vice President & Chief Information & Digital Officer

Claude Elkins

Executive Vice President & Chief Commercial Officer

Jason Zampi

Executive Vice President & Chief Financial Officer

John Orr

Executive Vice President & Chief Operating Officer

Board of directors at NORFOLK SOUTHERN.

Christopher Jones

Director

Francesca DeBiase

Director

Gilbert Lamphere

Director

Heidi Heitkamp

Director

John Huffard Jr.

Director

Lori Ryerkerk

Director

Philip Davidson

Director

Richard Anderson

Director

Sameh Fahmy

Director

William Clyburn Jr.

Director

Marcela Donadio

Director

Research analysts who have asked questions during NORFOLK SOUTHERN earnings calls.

Brandon Oglenski

Barclays

9 questions for NSC

Brian Ossenbeck

JPMorgan Chase & Co.

9 questions for NSC

Scott Group

Wolfe Research

9 questions for NSC

Christian Wetherbee

Wells Fargo

7 questions for NSC

David Vernon

Sanford C. Bernstein & Co., LLC

6 questions for NSC

Jonathan Chappell

Evercore ISI

6 questions for NSC

Walter Spracklin

RBC Capital Markets

6 questions for NSC

Bascome Majors

Susquehanna Financial Group

5 questions for NSC

Jason Seidl

TD Cowen

5 questions for NSC

Jordan Alliger

Goldman Sachs

5 questions for NSC

Ken Hoexter

BofA Securities

5 questions for NSC

Stephanie Moore

Jefferies

5 questions for NSC

Thomas Wadewitz

UBS

5 questions for NSC

Ravi Shanker

Morgan Stanley

3 questions for NSC

Chris Wetherbee

Wells Fargo & Company

2 questions for NSC

Daniel Imbro

Stephens Inc.

2 questions for NSC

Jeffrey Kauffman

Vertical Research Partners

2 questions for NSC

Richa Harnain

Deutsche Bank

2 questions for NSC

Richa Harned

Deutsche Bank

2 questions for NSC

Richard Hanan

Deutsche Bank

2 questions for NSC

Tom Wadewitz

UBS Group

2 questions for NSC

Tom Wadowitz

UBS

2 questions for NSC

Ariel Rosa

Citigroup

1 question for NSC

Benjamin Nolan

Stifel

1 question for NSC

Elliot Alper

TD Cowen

1 question for NSC

Joe Hafen

Jefferies

1 question for NSC

Recent press releases and 8-K filings for NSC.

- Norfolk Southern customers advanced 60+ industrial development projects in 2025, driving $7.7 billion in investment for new or expanded rail-served facilities.

- The company’s pipeline includes 500+ U.S. manufacturing projects in the site-selection phase, signaling sustained future growth opportunities.

- 15 Norfolk Southern sites earned REDI (Readiness Evaluation for Development and Investment) designations, streamlining site selection for rail-served industries.

- Norfolk Southern and Union Pacific proposed a merger to create a coast-to-coast freight network, backed by $5.6 billion in 2025 capital investment plus $2.1 billion for integration, pending STB review.

- Safety performance reached decade-best levels with 0 reportable mainline derailments in Q4 and digital inspections now covering over 75% of monthly traffic, yielding the lowest accident rates since 2015.

- Operational efficiency delivered a 7% productivity gain in 2025—moving 3% more GTMs with 4% fewer employees—alongside $216 million in cost savings, 5% fuel efficiency improvement, and 10% locomotive productivity increase.

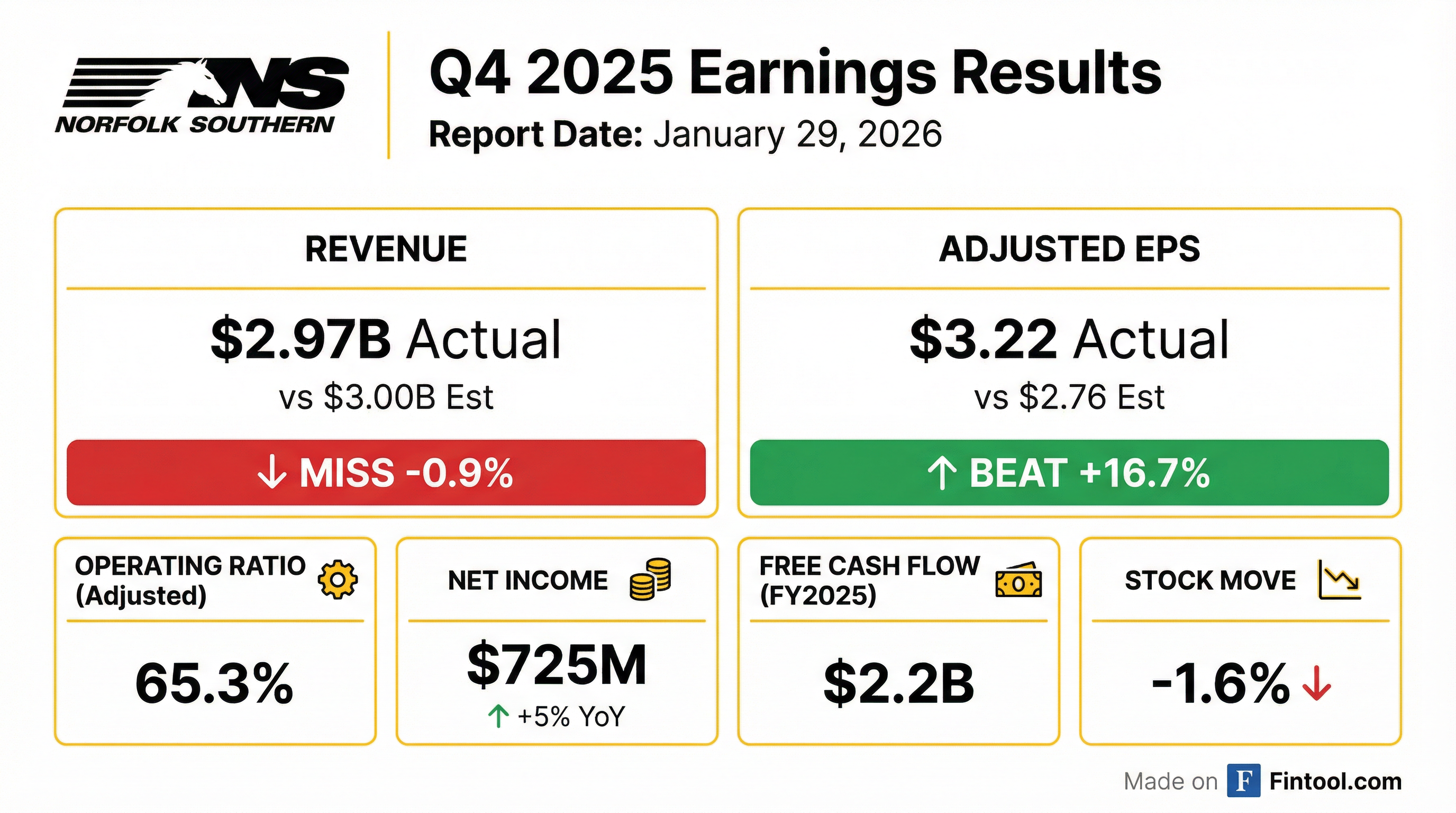

- Q4 adjusted operating ratio was 65.3% with EPS of $3.22; full-year net income rose 5%, free cash flow reached $2.2 billion, and 2026 CapEx is slated at $1.9 billion.

- For 2026, operating expenses are guided to $8.2–8.4 billion, accommodating a variety of volume scenarios despite an estimated 1% revenue headwind from intensified competition and expected H1 softness.

- The merger with Union Pacific advances after the STB’s completeness deferral; NSC and UP will submit an augmented application to ensure a thorough regulatory review.

- Achieved 0 reportable mainline derailments in Q4 and delivered the best full-year train accident rates in over a decade, with FRA reportable injury ratio down 15% to 1.0 and reportable accidents down 31% to 2.19 in 2025; Q4 mainline accident rate improved 71% year-over-year to 0.13.

- Drove 7% productivity, moving 3% more GTMs with 4% fewer employees, and delivered $216 million in full-year cost savings, prompting a raise of the 2026 cost-takeout target to $150 million (three-year total of ~$650 million).

- Intermodal volume fell 7% in Q4, leading to a 6% revenue decline; coal volume rose 1% but revenue, less fuel, declined 11%; merchandise revenue, less fuel, grew 4% driven by record automotive performance.

- Issued 2026 guidance of an $8.2–8.4 billion core expense base and reduced capital spending by ~$300 million to $1.9 billion, with flexibility for varying volume scenarios.

- Working with Union Pacific to file an augmented STB application for the proposed transcontinental merger, reaffirming belief in the strategic benefits of a single-line east-west network.

- Q4 volume fell 4% and total revenue declined 2% YoY, offset partially by 2% growth in RPU.

- Adjusted Q4 operating ratio was 65.3% and EPS came in at $3.22.

- FY2025 merchandise revenue ex-fuel grew 4% ($287 M) with record segment results; Intermodal revenue was flat; seaborne coal revenue declined $108 M and volatile fuel surcharges dragged $134 M.

- Safety and productivity advances: Q4 saw 0 reportable mainline derailments; 2025 FRA reportable accidents improved 31% to 2.19, mainline accident rate down 71% to 0.13; GTMs up 3% with 4% fewer employees (7% productivity gain); fuel efficiency +5%.

- 2026 guidance: cost base of $8.2–8.4 B, CapEx $1.9 B (down 14%), and cost takeout target raised to $150 M; merger application to STB to be augmented for completeness.

- Q4 2025 total volume of 1.726 M units, down 4% yoy; revenue $2,974 M, down 2%; adjusted operating ratio 65.3%; diluted EPS $3.22, up 6%

- Full-year 2025 revenue $12,180 M, up 0.5%; operating ratio 65.0%, improved; diluted EPS $12.49, up 5%

- Safety performance improved with FRA Personal Injury Index at 1.00 and FRA Accident Rate at 2.19 in 2025

- 2026 guidance calls for adjusted operating expenses of $8.2 B–$8.4 B and capital spending of $1.9 B, amid continued volume headwinds from merger dynamics

- In Q4 2025, Norfolk Southern reported $3.0 billion in revenue, $937 million of income from railway operations, a 68.5% operating ratio, and $2.87 diluted EPS.

- Adjusted for merger-related expenses and the Eastern Ohio incident, Q4 2025 income from railway operations was $1.03 billion, the operating ratio 65.3%, and diluted EPS $3.22.

- For the full year 2025, the company achieved $12.18 billion in revenue, $4.36 billion of income from railway operations, a 64.2% operating ratio, and $12.75 diluted EPS.

- Norfolk Southern exceeded its productivity targets, generating over $215 million in annual savings while improving safety and service performance.

- Reported Q4 2025 revenue of $3.0 billion (–2% YOY) on a 4% volume decline; diluted EPS of $2.87.

- Full-year 2025 revenue of $12.2 billion (+$57 million YOY) and diluted EPS of $12.75 (up 10%).

- GAAP operating ratios: 68.5% in Q4 and 64.2% for the year; adjusted ratios: 65.3% in Q4 and 65.0% for the year.

- Achieved over $215 million in productivity savings while delivering best safety and accident rates in a decade.

- CEO Mark George emphasized focus on safety, customer service, and further cost containment amid an uncertain demand environment.

- Norfolk Southern invested $64 million to launch the East Edge double-stack corridor, cutting transit times by up to 10 hours between Chicago and New England.

- The route supports 9,000-foot double-stack trains, boosting Ayer terminal capacity from ~80,000 annual lifts to as many as 200,000 loads.

- Infrastructure upgrades include 15 miles of track rebuilt, three bridges raised, and end-to-end safety and signal enhancements for high-capacity operations.

- The project strengthens the Pan Am Southern network—already seeing 22% year-over-year growth—and completes network-wide double-stack clearance by 2028.

- Warrior Met Coal completed its $1 billion Blue Creek Mine in Tuscaloosa County, a single longwall operation expected to produce 6.0 million short tons annually and boost nameplate capacity by 75%.

- Norfolk Southern is investing over $200 million in its 3B Corridor to enhance rail links between northern/central Alabama and the Port of Mobile.

- The Alabama Port Authority is allocating over $200 million (plus $20 million from the state legislature) to upgrade the McDuffie Coal Terminal, while Parker Towing has committed over $20 million to barge equipment.

- Blue Creek will create 300+ jobs locally and access a metallurgical coal reserve with a projected 40-year mine life.

- Norfolk Southern and Union Pacific submitted a nearly 7,000-page merger application to the Surface Transportation Board, following their July 29, 2025 agreement and 99% shareholder approval, to create America’s first transcontinental railroad.

- The combined network will span 50,000 route miles across 43 states, eliminate an estimated 2,400 daily rail car handlings (saving 60,000 car-miles per day) and shift 2 million truckloads annually from highways to rail, reducing emissions and congestion.

- All existing union jobs are guaranteed, with plans to add approximately 900 net new union jobs by year three, and the merger includes $2.1 billion of incremental capital investment and $133 million in annual capital synergies.

Quarterly earnings call transcripts for NORFOLK SOUTHERN.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more