INSIGHT ENTERPRISES (NSIT)·Q4 2025 Earnings Summary

Insight Enterprises Beats on EPS Despite Revenue Miss; Services Momentum Accelerates

February 5, 2026 · by Fintool AI Agent

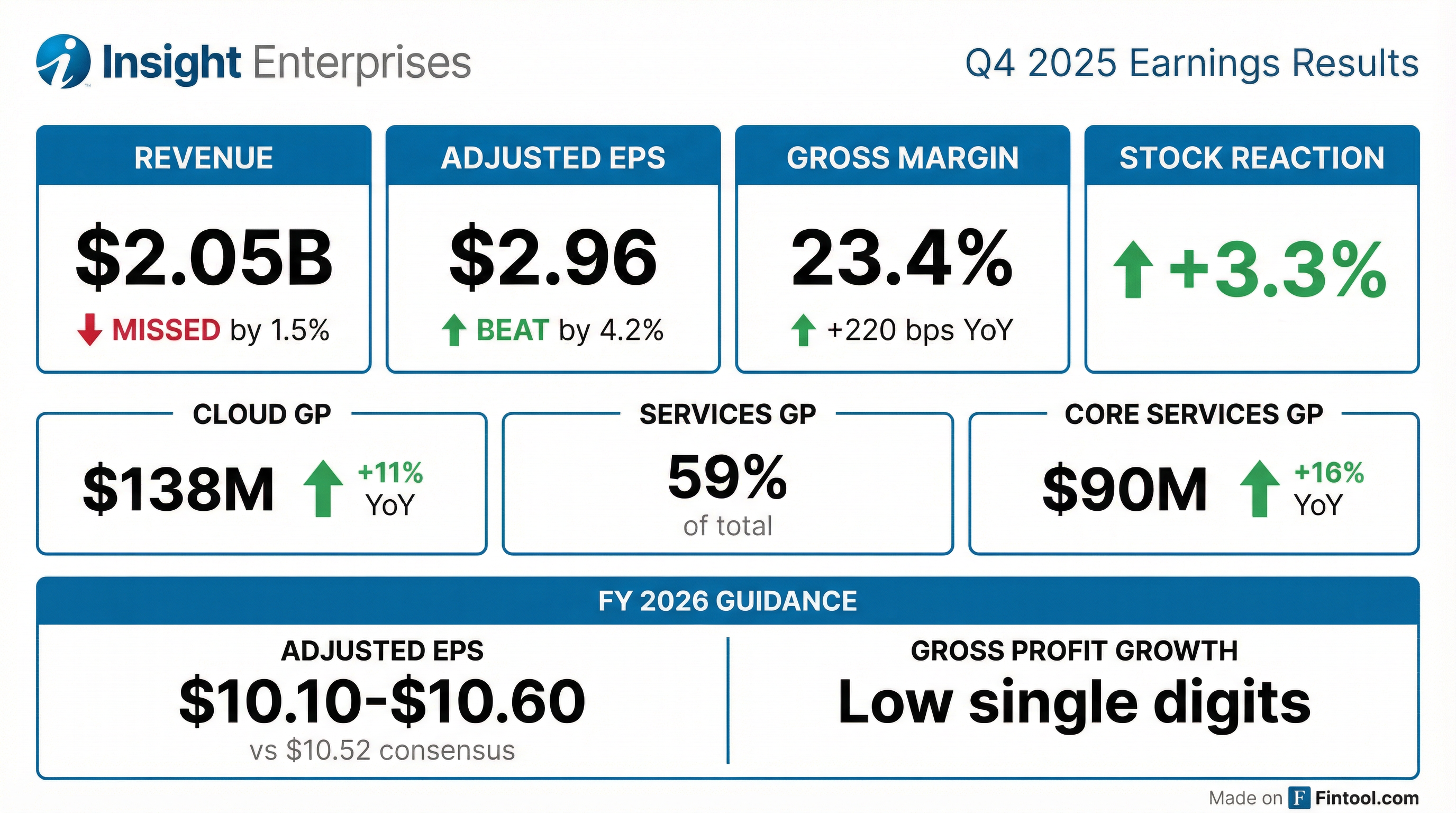

Insight Enterprises (NSIT) delivered Q4 2025 results that beat on profitability but missed on the top line, as the IT solutions integrator continues its strategic pivot toward higher-margin services and cloud. Adjusted EPS of $2.96 exceeded consensus by 4.2%, while revenue of $2.05B came in 1.5% below expectations. However, after an initial rally, the stock reversed and closed down 3.2% as investors focused on conservative FY 2026 guidance and memory pricing headwinds.

Did Insight Enterprises Beat Earnings?

The bottom line: EPS beat, revenue miss, record margins.

The Q4 EPS beat was driven by record gross margin of 23.4% (+220 bps YoY) and disciplined expense management. Revenue declined 1% YoY as product sales continued to contract, but this was more than offset by services growth and mix shift toward higher-margin offerings.

For the full year, adjusted EPS came in at $9.87, up 2% YoY despite revenue declining 5% to $8.2B. This demonstrates the company's successful execution on margin expansion even in a challenging demand environment.

What Did Management Guide?

FY 2026 guidance: Conservative, slightly below Street.

Key assumptions in guidance:

- Interest and other expenses of ~$85 million

- Effective tax rate of 25.5% - 26.5%

- Capital expenditures of $20-30 million

- Average share count of ~31 million

- Cash flow from operations of $300-400 million

- Share repurchases of $75 million beginning Q1 2026

- Excludes ~$83 million of acquisition-related intangibles amortization

Segment-level guidance:

- Hardware gross profit: Approximately flat (revenue to grow faster than GP due to customer mix)

- Core services gross profit: High single-digit growth from organic recovery plus acquisitions

- Cloud gross profit: Low double-digit growth as partner program changes are largely behind

The guidance assumes no significant change in debt instruments or macroeconomic environment.

What Changed From Last Quarter?

Several key shifts from Q3 2025:

Improvements:

- Cloud gross profit accelerated to +11% YoY (vs +7% in Q3)

- Insight Core Services returned to growth at +16% YoY gross profit (vs -3% in Q3)

- Services revenue grew 11% YoY in Q4 (vs +3% in Q3)

- Gross margin expanded to record 23.4% (vs 21.7% in Q3)

Continued Challenges:

- Net sales still declining, though rate of decline moderating (-1% vs -4% in Q3)

- Large enterprise spending remains muted

- Product revenue down 7% for full year

The $70M partner program changes impact "landed very close to that number" for 2025, and management confirmed the internal pivot is complete.

How Did the Stock React?

NSIT shares initially rallied on the Q4 results but reversed course during the session as investors digested the cautious FY 2026 guidance. After opening higher at $80.06, the stock gave up gains and closed down 3.2% at $79.00.

The intraday reversal suggests the market appreciated the Q4 beat but was concerned about the muted 2026 outlook. The stock is now trading near 52-week lows, down ~57% from the high of $181.92.

Services and Cloud: The Growth Engines

The Q4 results highlight NSIT's ongoing transformation toward a services-led model:

Services now represent 59% of total gross profit and 28% comes from cloud. The full year showed cloud gross profit of $495M (+2%) and services gross profit of $1.05B (+4%), despite the partner program headwinds.

The company's AI-first solutions integrator strategy is gaining traction. CEO Joyce Mullen highlighted that Insight has "completed hundreds of AI assessments, developed roadmap recommendations, and begun implementations" through its Client Zero approach, using AI internally to build reference cases for clients.

Geographic Performance

*Constant currency for EMEA/APAC

EMEA and APAC showed strong gross profit growth despite modest revenue performance, reflecting the margin expansion theme across all geographies.

2027 KPIs: The Long-Term Roadmap

Management reiterated their 2027 targets:

The gap between current performance and 2027 targets implies a significant acceleration is expected as AI projects scale and the services retooling takes hold.

Q&A Highlights

Key takeaways from the analyst Q&A session:

On 2026 Guidance Approach (Adam Tindle, Raymond James): CFO James Morgado explained the conservative guidance reflects "greater emphasis on potential disruptions" and past performance patterns. "The last couple of years have had twists and turns, and FY 26 has them as well... we're trying to balance the internal ambitions we have as a company with the market realities we see."

On IT Budget Outlook (Adam Tindle, Raymond James): CEO Joyce Mullen: "Uncertainty persists, especially with large enterprise and large corporations... They're very excited about and worried about making sure they preserve some of their IT budgets to support the transition to AI." Commercial spending has been strong with "seven quarters of growth in a row" but is expected to moderate.

On First Half vs Second Half Dynamics (Joseph Cardoso, J.P. Morgan): EPS growth will be "more heavily weighted toward the first half" with Q1-Q2 closer to the upper end of guidance range and H2 "a little bit below the midpoint to the lower end." Cloud and hardware will be stronger in H1, while core services will be "more of an equalizer through the year."

On Partner Program Changes Tail (Adam Tindle, Raymond James): The ~$70M impact landed "very close to that number." While the internal pivot is complete, there's still a financial tail into 2026, particularly in H2 due to Google/SADA seasonality. "By the time we exit the second half... these dynamics would go away completely in 2027."

On AI Data Center Opportunity (Luke Morrison, Canaccord): Mullen: "We believe we are primed for broader enterprise adoption as enterprises consider their opportunities... We were the first partner to launch the Cisco Secure AI Factory with NVIDIA." She noted GPU availability, cost optimization, and AI skills as key factors in the timeline.

Memory Pricing and Supply Chain

A significant new risk factor discussed on the call was memory pricing pressure:

"Memory price expectations will result in something somewhere between 10% and probably 20%-25% increases in PCs this year... Historically, as prices go above kind of 15%, elasticity kicks in and volume is impacted." — Joyce Mullen

Management expects:

- PC prices: Up 10-25% due to memory constraints

- Device volume: Low single-digit decline as elasticity kicks in

- Infrastructure prices: Also increasing, but less elastic given cloud cost comparisons

- Supply chain: Opportunity for Insight to add value helping clients navigate constraints, similar to COVID period

This creates a mixed dynamic for 2026: higher ASPs but lower units, with uncertainty around the elasticity curve.

AI Initiatives: Prism Platform Launch

In Q4, Insight launched Prism, its new AI platform for clients:

"Prism is a business transformation platform designed to help our clients simplify AI adoption by identifying and prioritizing high-impact use cases through a proprietary data-driven transformation index." — Joyce Mullen

The platform evaluates AI initiatives across value, feasibility, data access, and risk to provide actionable roadmaps. It enables clients to manage the entire AI project lifecycle from assessment to measurable outcomes.

Insight has also built significant IP with 200+ patent applications globally and 70+ patents issued, covering AI, machine learning, and other innovations.

CEO Succession Update

The board's search for Joyce Mullen's successor is progressing:

"Our public external search is progressing as planned, and I remain committed to ensuring a smooth handoff... We expect to name a successor in the next few months." — Joyce Mullen

Key Risks and Watch Items

-

Large Enterprise Spending: Corporate and large enterprise clients continue to delay spending decisions amid macro and AI-related uncertainty. Management is "not assuming any kind of massive improvement in spend in the large enterprise."

-

CEO Transition: Expect successor announcement "in the next few months." Leadership transition during strategic transformation adds execution risk.

-

Memory Pricing/Supply Chain: 10-25% PC price increases expected; elasticity concerns above 15% increases could pressure device volumes.

-

Google/SADA Tail Effect: Partner program change impacts will be more pronounced in H2 due to SADA seasonality before fully normalizing in 2027.

-

Revenue Decline: Five consecutive years of net sales decline (2023-2025), though the rate is moderating.

-

Integration Risk: Recent acquisitions of Inspire11 and Sekuro need to deliver on expected synergies and growth.

The Bottom Line

Insight Enterprises delivered a solid Q4 with record margins and an EPS beat, validating its services-led transformation strategy. The company achieved record gross margin of 23.4% and record adjusted earnings from operations of $504M for full year 2025. However, the stock's intraday reversal signals investor concern about multiple headwinds:

- Cautious 2026 guidance: Low single-digit gross profit growth with subdued enterprise spending

- Memory pricing pressure: 10-25% PC price increases creating demand elasticity risk

- Partner program tail: Google/SADA impact lingers into H2 before normalizing in 2027

- CEO transition: Successor expected "in the next few months"

The CFO's comment that guidance placed "greater emphasis on past performance" and "potential disruptions" reflects hard-won realism after two challenging years.

For investors, the key question is whether AI infrastructure and services can scale fast enough to offset device volume pressure and justify the significant gap to 2027 targets. The Prism platform launch and first-mover position on Cisco Secure AI Factory with NVIDIA are encouraging, but execution risk is elevated with leadership transition looming.

Sources: Insight Enterprises Q4 2025 Earnings Call Transcript , Insight Enterprises Q4 2025 Earnings Slide Presentation , S&P Global estimates