Earnings summaries and quarterly performance for INSIGHT ENTERPRISES.

Executive leadership at INSIGHT ENTERPRISES.

Joyce Mullen

President and Chief Executive Officer

Adrian Gregory

President, EMEA

Dee Burger

President, North America

James Morgado

Chief Financial Officer

Rachael Crump

Chief Accounting Officer

Samuel Cowley

Senior Vice President, General Counsel and Secretary

Board of directors at INSIGHT ENTERPRISES.

Research analysts who have asked questions during INSIGHT ENTERPRISES earnings calls.

Adam Tindle

Raymond James

6 questions for NSIT

Joseph Cardoso

JPMorgan Chase & Co.

6 questions for NSIT

Vincent Colicchio

Barrington Research Associates

4 questions for NSIT

Anthony Lebiedzinski

Sidoti & Company, LLC

2 questions for NSIT

Luke Morrison

Canaccord Genuity Group Inc.

2 questions for NSIT

Harry Read

Redburn Atlantic

1 question for NSIT

Matthew Sheerin

Stifel

1 question for NSIT

Recent press releases and 8-K filings for NSIT.

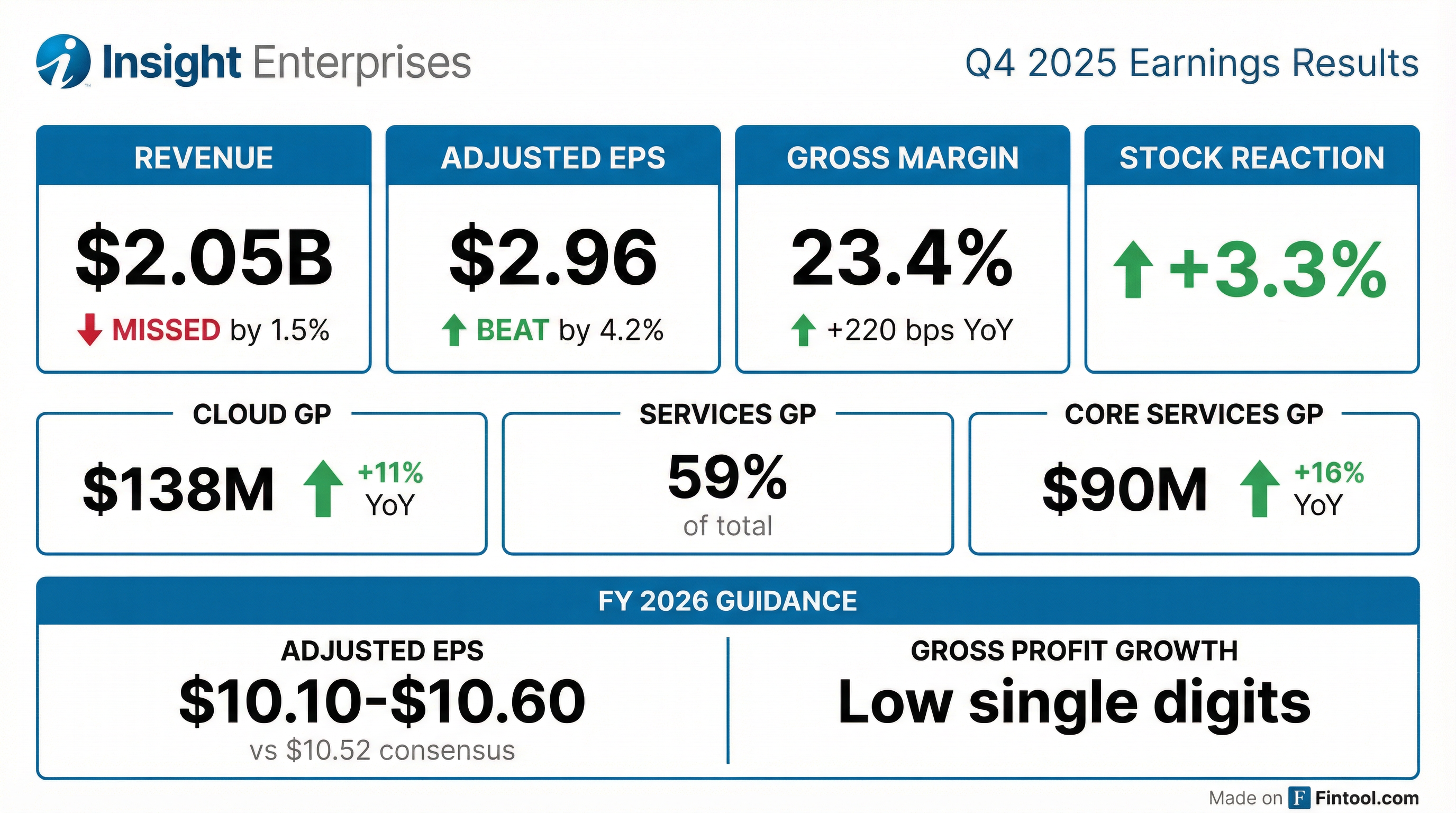

- Net Sales for Q4 2025 were $2.0 billion, representing a 1% decrease year-over-year, and for the full year 2025, they totaled $8.2 billion, a 5% decrease year-over-year.

- Gross Profit for Q4 2025 increased by 9% year-over-year to $478 million, while for the full year 2025, it was $1.8 billion, remaining flat year-over-year.

- Diluted Earnings Per Share for Q4 2025 increased by 69% year-over-year to $1.67, and Adjusted Diluted Earnings Per Share grew by 11% year-over-year to $2.96. For the full year 2025, Diluted EPS decreased by 26% to $4.86, while Adjusted Diluted EPS increased by 2% to $9.87.

- Net Cash from Operations for the full year 2025 was $304 million.

- Insight Enterprises reported Q4 2025 results with a 1% decrease in overall revenue, while total gross profit grew 9% and adjusted diluted EPS increased 11% to $2.96. For the full year 2025, net revenue was $8.2 billion, down 5%, with gross profit flat and adjusted diluted EPS of $9.87.

- The company achieved record gross margin of 23.4% in Q4 2025 and 21.4% for the full year, driven by 11% growth in cloud gross profit and 16% growth in core services gross profit in Q4.

- For fiscal year 2026, Insight Enterprises provided guidance for low single-digit gross profit growth and adjusted diluted EPS (excluding stock-based compensation) between $11 and $11.50, reflecting approximately 5% growth at the midpoint. This outlook is based on cautious optimism and anticipated subdued industry spending.

- Strategically, Insight is positioning itself as an AI-first solutions integrator, expanding capabilities in cloud, data, AI, and cybersecurity through acquisitions and the launch of its AI platform, Prism. The company also increased its share repurchase authorization to $299 million and plans to repurchase $75 million in shares in Q1 2026. A successor for the CEO is expected in the next few months.

- NSIT reported a 1% decrease in overall revenue for Q4 2025, but achieved 9% growth in total gross profit and an 11% increase in adjusted diluted earnings per share to $2.96. For the full year 2025, net revenue was $8.2 billion (down 5%), with gross profit remaining flat and adjusted diluted EPS growing 2% to $9.87.

- Cloud gross profit increased 11% to $138 million in Q4 2025, and core services gross profit grew 16% to $90 million. For the full year 2025, cloud gross profit was $495 million (up 2%) and core services gross profit was $320 million.

- For the full year 2026, NSIT expects low single-digit gross profit growth and adjusted diluted EPS (excluding stock-based compensation) between $11-$11.50, representing approximately 5% growth at the midpoint compared to 2025. Cloud gross profit is anticipated to grow in the low double digits, and core services gross profit in the high single digits.

- The company plans to repurchase $75 million in shares beginning in Q1 2026, following an increase in its share repurchase authorization by $150 million in Q4 2025.

- NSIT is focused on becoming an AI-first solutions integrator, having launched its Prism AI platform and integrated acquisitions like Inspire11 and Sekuro. A search for a successor to the current CEO is underway, with an announcement expected in the next few months.

- Insight Enterprises reported Q4 2025 net revenue of $2 billion, a 1% decrease, with total gross profit growing 9% and adjusted diluted EPS increasing 11% to $2.96. For the full year 2025, net revenue was $8.2 billion, a 5% decrease, and adjusted diluted EPS was $9.87, up 2%.

- Cloud gross profit increased 11% in Q4 2025 to $138 million, and core services gross profit grew 16% to $90 million, contributing to a total gross margin of 23.4%. Full-year cloud gross profit was $495 million, up 2%.

- The company anticipates subdued industry spending and expects low single-digit growth for 2026, with stronger EPS growth projected for the first half due to cloud and hardware performance.

- PC prices are expected to increase by 10% to 20-25% in 2026 due to memory costs, potentially impacting volume. The search for a new CEO is progressing, with a successor expected to be named in the next few months.

- Insight Enterprises reported Q4 2025 net sales decreased 1% year-to-year to $2.0 billion, with gross profit increasing 9% to $478.4 million and diluted earnings per share rising 69% to $1.67.

- For the full year 2025, net sales decreased 5% to $8.2 billion, while gross profit remained flat at $1.8 billion and diluted earnings per share decreased 26% to $4.86.

- The company achieved gross margin expansion of 220 basis points to 23.4% in Q4 2025 and 110 basis points to 21.4% for the full year 2025.

- Cash flows provided by operating activities were $153.8 million for Q4 2025 and $303.8 million for the full year 2025.

- For full year 2026, the company forecasts Adjusted diluted earnings per share between $10.10 and $10.60 (including stock-based compensation) and expects gross profit growth in the low single digits with a gross margin of approximately 21%.

- Insight Enterprises reported that for the fourth quarter of 2025, consolidated net sales decreased 1% year-over-year, while gross profit increased 9% to $478.4 million and Adjusted diluted earnings per share rose 11% to $2.96.

- For the full year 2025, consolidated net sales decreased 5% to $8.2 billion, gross profit was relatively flat at $1.8 billion, and Adjusted diluted earnings per share increased 2% to $9.87.

- The company provided full year 2026 guidance for Adjusted diluted earnings per share (excluding stock-based compensation expense) to be between $11.00 and $11.50, representing 5% growth at the midpoint compared to the 2025 Adjusted diluted EPS of $10.75 (excluding stock-based compensation expense). Gross profit is expected to be in the low single digits and gross margin around 21%.

- Insight Enterprises has expanded its global partnership with Stripe to modernize enterprise financial infrastructure, improve checkout conversion, and leverage AI-driven commerce.

- Insight is an exclusive launch partner for Stripe’s next generation of AI-driven commerce and one of three EMEA launch partners for the Agentic Commerce Protocol (ACP), which allows purchases directly within platforms like ChatGPT.

- The collaboration is supported by Insight's Stripe Center of Excellence, featuring over 100 Stripe-certified architects and payment engineers, to deliver solutions for modern checkout, complex billing, and agentic commerce experiences for large organizations.

- Insight is focused on improving its financial profile, targeting a reduction in OPEX as a percentage of gross profit from the low 70s% to the lower 60s% long-term, building on its gross margin expansion from under 15% in 2022 to over 20%.

- The company faced a $70 million impact to gross profit (over $1.50 of EPS) in 2025 due to hyperscaler partner program changes, with the majority of this headwind expected to be resolved by year-end, though some tail effects may impact 2026 cloud growth.

- CEO Joyce is retiring, and the board is seeking a new CEO with expertise in services and channel business, aiming for an appointment by Q1 2026.

- Insight anticipates enterprise AI spending to accelerate in 2026, having strategically acquired Inspire11 to enhance its AI capabilities and engage business buyers.

- Long-term capital allocation prioritizes M&A, while share repurchases are a short-term priority given the current stock price, and the company expects to be free of convertible bond and warrant effects by the end of 2025.

- Insight (NSIT) has significantly improved its gross margin profile, rising from under 15% in 2022 to over 20%, and targets a long-term free cash flow conversion of 90% or greater of net income. The company also aims to reduce OPEX as a percentage of gross profit from the low 70s% to the lower 60s%.

- The company experienced a $70 million impact to gross profit in 2025, translating to over $1.50 of EPS, due to partner program changes with Microsoft and Google. The majority of this impact is expected to be resolved by the end of 2025, though some tail effects will temper cloud growth in 2026.

- CEO Joyce is retiring, with a new CEO targeted by Q1, focusing on candidates with strong services and channel expertise, as services now account for more than half of gross profit.

- Capital allocation prioritizes M&A long-term and opportunistic share repurchases in the short term, with the majority of convertible warrants settled by year-end 2025.

- Demand for 2026 is expected to see increased budgets, driven by the acceleration of AI prototyping and early engagement projects, though significant enterprise AI spending is still in its early stages.

- Insight's CEO, Joyce, is retiring, with the board targeting a new CEO appointment by Q1. The new CEO will need expertise in both the channel and services business, as services now account for more than half of the company's gross profit.

- The company experienced a $70 million impact to gross profit in 2025 (over $1.50 of EPS) due to hyperscaler program changes with Microsoft and Google, which required a pivot away from enterprise cloud resale. The vast majority of this impact is now behind the company, with some tail effects expected into 2026.

- For 2026, Insight anticipates budgets to be up, driven by AI prototyping and early engagement projects, though not a dramatic increase. The CFO plans to be prudent in providing guidance for the upcoming year, expecting a return to top-level growth.

- Insight aims for 90% or greater net income to free cash flow conversion. While M&A remains the long-term capital allocation priority, share repurchases may take priority in the shorter term given the current stock price.

Quarterly earnings call transcripts for INSIGHT ENTERPRISES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more