NOVO NORDISK A S (NVO)·Q4 2025 Earnings Summary

Novo Nordisk Beats Q4 But Guides to Revenue Decline — Stock Crashes 15%

February 5, 2026 · by Fintool AI Agent

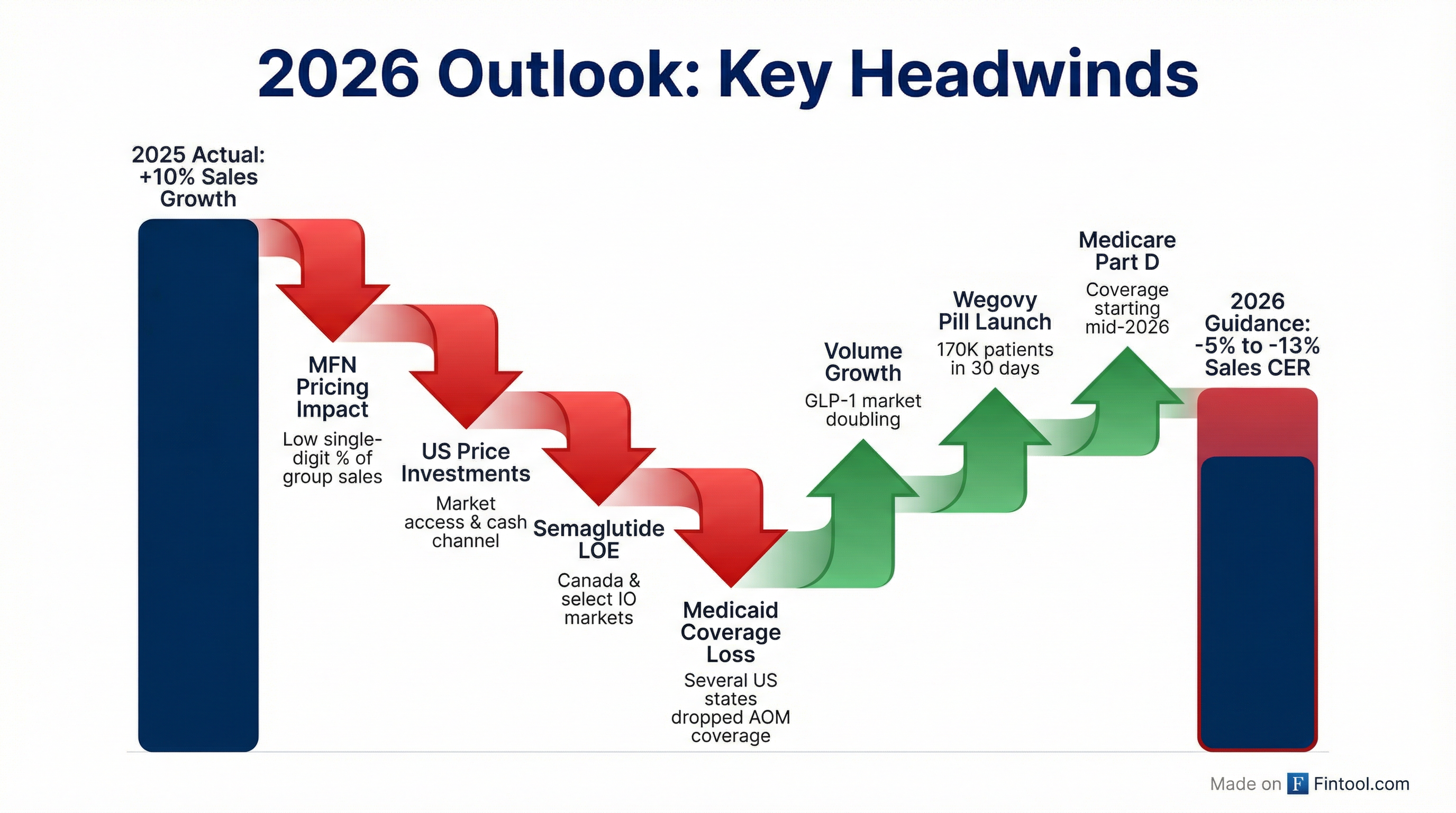

Novo Nordisk delivered a solid Q4 2025 with revenue and EPS beats, but the stock plunged 15% after management guided to a -5% to -13% sales decline for 2026 at constant exchange rates. The guidance reflects pricing headwinds from the US Most Favored Nations (MFN) agreement, semaglutide patent expiration in international markets, and Medicaid coverage losses — partially offset by strong Wegovy pill launch momentum and anticipated Medicare Part D coverage.

Did Novo Nordisk Beat Earnings?

Yes. Q4 2025 marked another beat on both revenue and EPS:

For full-year 2025, Novo Nordisk delivered 10% sales growth and 6% operating profit growth at constant exchange rates — capping off a strategic cycle that began in 2019 and more than doubled both sales and operating profit.

8-Quarter Financial Trend

*Values retrieved from S&P Global

Gross margin compression to ~81% reflects the Catalent manufacturing site acquisitions and company-wide restructuring costs of DKK 8 billion.

What Did Management Guide for 2026?

This is where the quarter turned ugly. Novo Nordisk guided to:

- Adjusted Sales Growth: -5% to -13% at constant exchange rates

- Adjusted Operating Profit Growth: -5% to -13% at constant exchange rates

- Free Cash Flow: DKK 35-45 billion

- CapEx: ~DKK 55 billion (declining in coming years)

The company introduced "adjusted" metrics for 2026 due to a $4.2 billion provision reversal for 340B rebates in Q1 2026 — a positive one-off accounting (non-cash) impact. CFO Knudsen explained: "It's not fair to look at the underlying business performance when we have such an effect in our numbers."

Why Is 2026 Guidance So Weak?

CFO Carsten Munk Knudsen broke down the US decline as "teens" level negative growth, driven by:

- MFN Pricing Impact: Low single-digit impact on group sales (roughly double on US)

- Market Access Investments: Lower prices to expand coverage

- Cash Channel Mix: Self-pay at lower price points ($199 initiation prices)

- Semaglutide LOE: Patent expiration in Canada and select international markets

- Medicaid Coverage Losses: Several US states dropped anti-obesity medication coverage, including California

International operations expected to deliver mid-single-digit growth, with Q4 2025 run rate of 8%.

How Did the Stock React?

NVO shares crashed 14.6% to $50.30 on earnings day, with after-hours trading pushing the stock down further to $47.90 (-18.7% from prior close).

The stock is now down 46% from its 52-week high, reflecting the market's repricing of growth expectations for the GLP-1 leader.

Wegovy Pill: A Bright Spot

Despite the guidance disappointment, the Wegovy pill launch is off to a historic start:

- 170,000+ patients on Wegovy pill as of February 2026

- 50,000 NBRxs (new prescriptions) — more than any other brand including Lilly's products

- 88% buying starter dose (1.5mg) — indicating almost all are new-to-therapy patients

- 15x better than first month of Wegovy injectable launch

- 2x better than first month of Zepbound launch

- $149 price point for starter dose, with $299 for higher doses

- Available at 70,000+ retail pharmacies plus NovoCare Pharmacy and telehealth partners

CEO Mike Doustdar highlighted the marketing push: "If you would walk into Boston or New York Grand Central Terminal over the last weekend, you would see probably no other ad than the Wegovy pill ad. And I literally mean no other ad." He emphasized the efficacy advantage: "This obesity market... has taught us it's first and foremost about the magnitude of weight loss. The pill does 16.6% weight loss while the competition only does 12.4%."

Commercial access is progressing with CVS, Prime, Optum, and Anthem covering the pill — just under half the covered lives of injectable Wegovy.

What Changed From Last Quarter?

Volume vs Price Dynamics

The obesity market is now firmly in "price for volume" mode:

CEO Doustdar on price elasticity: "If you just compare the launch of the Wegovy pill to previous launches where the price levels were very different... the 170,000 patients that I spoke to, that's 15 times more than the first month of Wegovy injectable launch at the higher price. And this is two times better than the first month of Zepbound launch."

Competitive Share Challenge

Management was candid about the current competitive dynamics in the US injectable market:

CEO Doustdar: "The preference share... in the US is anywhere between, you know, from 10 patients, 7 or 8 go to my competitor. And basically 2 on a good day, 3 comes to me."

This preference share is also spilling over internationally via social media: "Brits and Colombians and the likes go to the same YouTube and learn from the same digital opinion leaders that are based in the US. And in the US, everyone thinks that Tirzepatide is a better product."

China Underperformance

International operations delivered 14% growth, but China was notably weak due to regulatory constraints: "In [China's e-health channels], you're not allowed to promote a product that's solely for obesity. We have Wegovy and we are not allowed to sell directly in online channels Wegovy, while our competitor Mounjaro, being a single brand of diabetes and obesity, has a bit of an advantage over us."

Executive Departures

Two senior executives announced departures:

- Dave Moore (EVP US Operations) leaving for personal reasons after driving Ozempic's blockbuster launch and Wegovy pill commercialization

- Ludovic Helfgott (EVP Product & Portfolio Strategy) leaving to pursue new opportunities

New hires joining in February:

- Jamie Miller (from UnitedHealth/Optum) as EVP US Operations

- Hong Chow (from Merck Healthcare) as EVP Product & Portfolio Strategy

Pipeline Highlights

CagriSema (Next-Gen GLP-1/Amylin Combo)

REIMAGINE 2 trial in Type 2 Diabetes showed superior results vs semaglutide 2.4mg:

CagriSema was submitted to FDA in December 2025; decision expected "towards the turn of the year." REDEFINE 4 trial (vs tirzepatide) results expected Q1 2026.

Senagametide (Amycretin — Triple Agonist)

Phase 2 data showed:

- Subcutaneous: Up to 1.8% A1c reduction at week 36

- Oral: Up to 1.5% A1c reduction

- 89% of patients achieved A1c <7%

- Phase 3 programs (AMBITION, AMAZE) starting in 2026

Internal Triagonist (GLP-1/GIP/Amylin)

Phase 1 data showed -3.6% to -5.3% weight loss in just 4 weeks vs 0.5% for placebo. Phase 1b/2 trial in obesity initiated with readout expected 1H 2027.

Ozempic Brand Revitalization

Management revealed plans to revitalize the diabetes franchise: "If you read the news the last three days, there's been articles saying Novo Nordisk is launching Ozempic pill. And then that's going to happen. So we are going to actually revitalize a bit of the Ozempic brand around bringing Rybelsus in a different way into the market."

Additionally, the company is accelerating Ozempic 2.0 launches internationally and plans more aggressive rollout of Awiqli (weekly insulin) beyond its current three markets.

Upcoming Catalysts

Q&A Highlights

On Wegovy Pill vs Competition

CEO Mike Doustdar: "The last two years has taught us something very specific with the obesity market. It has taught us that the number one criteria for a patient picking up anti-obesity medication is the magnitude of weight loss." He emphasized the 17% vs 12% efficacy gap with competing oral (orforglipron).

On REDEFINE 4 Expectations

CSO Martin Holst Lange tempered expectations: "I still have a lot of optimism on REDEFINE 4, but I think the full weight loss potential we will only learn when we do the full trial duration and the flexible dosing that really will drive patients to use CagriSema in the optimized way [in REDEFINE 11]."

On Compounding Competition

Dave Moore: "The compounding market... is what we would consider relatively stable. We certainly expect that there could be some switching that's coming from compounding, but it's a little bit early to tell."

On Supply

CEO on Wegovy pill supply: "We feel incredibly confident that we will be able to supply the US market."

On Formulation IP and LOE

CEO Doustdar clarified that while compound LOE is the same for oral and injectable, the tablet formulation provides longer IP protection: "With the Wegovy pill we just launched, starting with 1.5 milligram, there we have longer IP, you know, into the late 30s."

Critically, he noted that compounded oral semaglutide wouldn't work: "If you swallow my injection, either in a liquid format or a pill format, your gut enzyme will basically get rid of it, and it will not get to your bloodstream... it just simply doesn't work."

On Market Segmentation Strategy

CEO Doustdar offered a revealing analogy on market segmentation: "You need to look at obesity as a diversified therapy area... Think about insulin just as a proxy — we have half of the world's insulin today. We do it with 11, 12 different types of insulin... The patient pickup price difference between one versus the other, I think, is 30 times. They both reduce your HbA1c pretty much the same."

Capital Allocation

Proposed dividend of DKK 7.95 per share would mark the 30th consecutive year of dividend increases.

Key Takeaways

The Good:

- Q4 beat on revenue (+3.3%) and EPS (+4.6%)

- Wegovy pill launch exceeding all expectations (170K patients in 30 days)

- CagriSema and Senagametide clinical data strong

- Supply concerns appear resolved

- Medicare Part D coverage coming mid-2026

The Bad:

- 2026 guidance of -5% to -13% sales decline shocked the market

- Gross margin compression to ~81%

- MFN pricing pressure just beginning

- Two key executives departing

- REDEFINE 4 expectations being managed down

The Ugly:

- Stock down 46% from 52-week highs

- After-hours trading pushing toward 52-week lows

- Price-for-volume trade-off unclear in its magnitude

Capital Markets Day scheduled for September 21, 2026 in London will introduce new strategic aspirations.