Earnings summaries and quarterly performance for NEWELL BRANDS.

Executive leadership at NEWELL BRANDS.

Christopher H. Peterson

President and Chief Executive Officer

Bradford R. Turner

Chief Legal and Administrative Officer and Corporate Secretary

Kristine K. Malkoski

Segment CEO, Learning and Development

Mark J. Erceg

Chief Financial Officer

Tracy L. Platt

Chief Human Resources Officer

Board of directors at NEWELL BRANDS.

Anthony Terry

Director

Bridget Ryan Berman

Independent Chairperson of the Board

Gary H. Pilnick

Director

Gerardo I. Lopez

Director

James P. Keane

Director

Judith A. Sprieser

Director

Patrick D. Campbell

Director

Stephanie P. Stahl

Director

Research analysts who have asked questions during NEWELL BRANDS earnings calls.

Andrea Teixeira

JPMorgan Chase & Co.

6 questions for NWL

Brian McNamara

Canaccord Genuity - Global Capital Markets

6 questions for NWL

Lauren Lieberman

Barclays

5 questions for NWL

Peter Grom

UBS Group

4 questions for NWL

Filippo Falorni

Citigroup Inc.

3 questions for NWL

Olivia Tong Cheang

Raymond James Financial, Inc.

3 questions for NWL

William Chappell

Truist Securities

3 questions for NWL

Christopher Carey

Wells Fargo & Company

2 questions for NWL

Olivia Tong

Raymond James

2 questions for NWL

Bill Chappell

Truist Securities

1 question for NWL

Stephen Robert Powers

Deutsche Bank

1 question for NWL

Recent press releases and 8-K filings for NWL.

- Newell Brands is undergoing a multi-year, capability-based turnaround, which remains on track, with expectations for accelerated trends in 2026. The company has significantly simplified its portfolio, reducing active SKUs by over 80% and rationalizing brands from 80 to slightly more than 50.

- In 2025, the company faced a $174 million incremental tariff cost, leading to a $114 million P&L headwind or $0.23 per share, which impacted top-line sales but still resulted in a 10 basis point increase in gross margin and a 20 basis point increase in operating margin compared to 2024.

- The "Quantum Leap" AI program, with early and deep executive sponsorship, is strengthening capabilities, accelerating innovation, and driving distribution wins, including a 500% increase in digital content creation in 2025 vs. 2024 without additional investment.

- Newell Brands expects to gain distribution in 2026 for the first time since the Jarden acquisition, supported by its strongest innovation pipeline in modern history, with 25 Tier One and Tier Two innovations launching this year.

- For 2026, the company guides for normalized operating margin to expand by about 50 basis points to roughly 8.9%, representing an increase of more than 50% versus 2023, and expects operating cash flow to be up roughly 40% versus 2025, leading to a reduction in the year-end leverage ratio by about half a turn. Long-term targets include normalized operating margin in the 12%-15% range.

- Newell Brands' multi-year turnaround is on track, with trends expected to accelerate in 2026, including significant improvement in core sales growth, continued operating margin growth, EBITDA growth, and a reduction in the net leverage ratio.

- In 2025, the company faced $174 million in incremental tariff costs, resulting in a $114 million or $0.23 per share P&L headwind; however, it still managed to increase gross margin by 10 basis points and operating margin by 20 basis points compared to 2024.

- Strategic initiatives include a radical simplification agenda and the Quantum Leap AI program, which has led to a 500% increase in digital content creation in 2025 vs. 2024 without additional investment and the strongest innovation pipeline in company history for 2026.

- The company expects to gain distribution in 2026 for the first time since the Jarden acquisition, leveraging its strong domestic manufacturing footprint where 57% of products are self-manufactured and China-sourced product is now less than 10% of total COGS.

- For 2026, normalized operating margin is projected to expand by about 50 basis points to roughly 8.9%, and operating cash flow is expected to be up roughly 40% versus 2025, contributing to a reduction in the year-end leverage ratio by about half a turn.

- Newell Brands is executing a multi-year, capability-based turnaround, anticipating accelerated trends in 2026 and the first distribution gains since the Jarden acquisition.

- Despite facing $174 million in incremental tariff costs in 2025 (a $114 million P&L headwind or $0.23 per share), the company increased its gross margin by 10 basis points and operating margin by 20 basis points compared to 2024.

- The company has implemented a significant simplification agenda, reducing SKUs by over 80% and brands from 80 to slightly more than 50, alongside deep integration of AI, which boosted digital content creation by 500% in 2025 without additional investment.

- For 2026, Newell Brands projects significant improvement in core sales growth, a return to EBITDA growth, and a reduction in its net leverage ratio, with normalized operating margin expected to expand by approximately 50 basis points to 8.9%.

- Long-term financial targets include low single-digit core sales growth, 50 basis points of annual operating margin improvement, and 90% free cash flow productivity, with an aspiration for normalized operating margin in the 12%-15% range.

- Newell Brands reported a normalized operating margin of 8.4% in 2025, an increase from 8.2% in 2024, with normalized earnings per share (EPS) of $0.57.

- For 2026, the company initiated net sales guidance of down 1% to up 1% and core sales guidance of down 2% to flat, expecting to outperform an anticipated category decline of approximately 2%.

- Normalized operating margin for 2026 is projected to be between 8.6% and 9.2%, a 50 basis point improvement at the midpoint over 2025, despite an estimated gross P&L tariff impact of $150 million.

- The company plans over 25 Tier 1 or 2 innovation launches in 2026, the strongest lineup since the Jarden acquisition, and expects distribution to turn positive for the first time since the acquisition. Q1 2026 net sales are projected to be down 4% at the midpoint, with a rebound anticipated in Q2 through Q4, implying +1% net sales growth for those quarters.

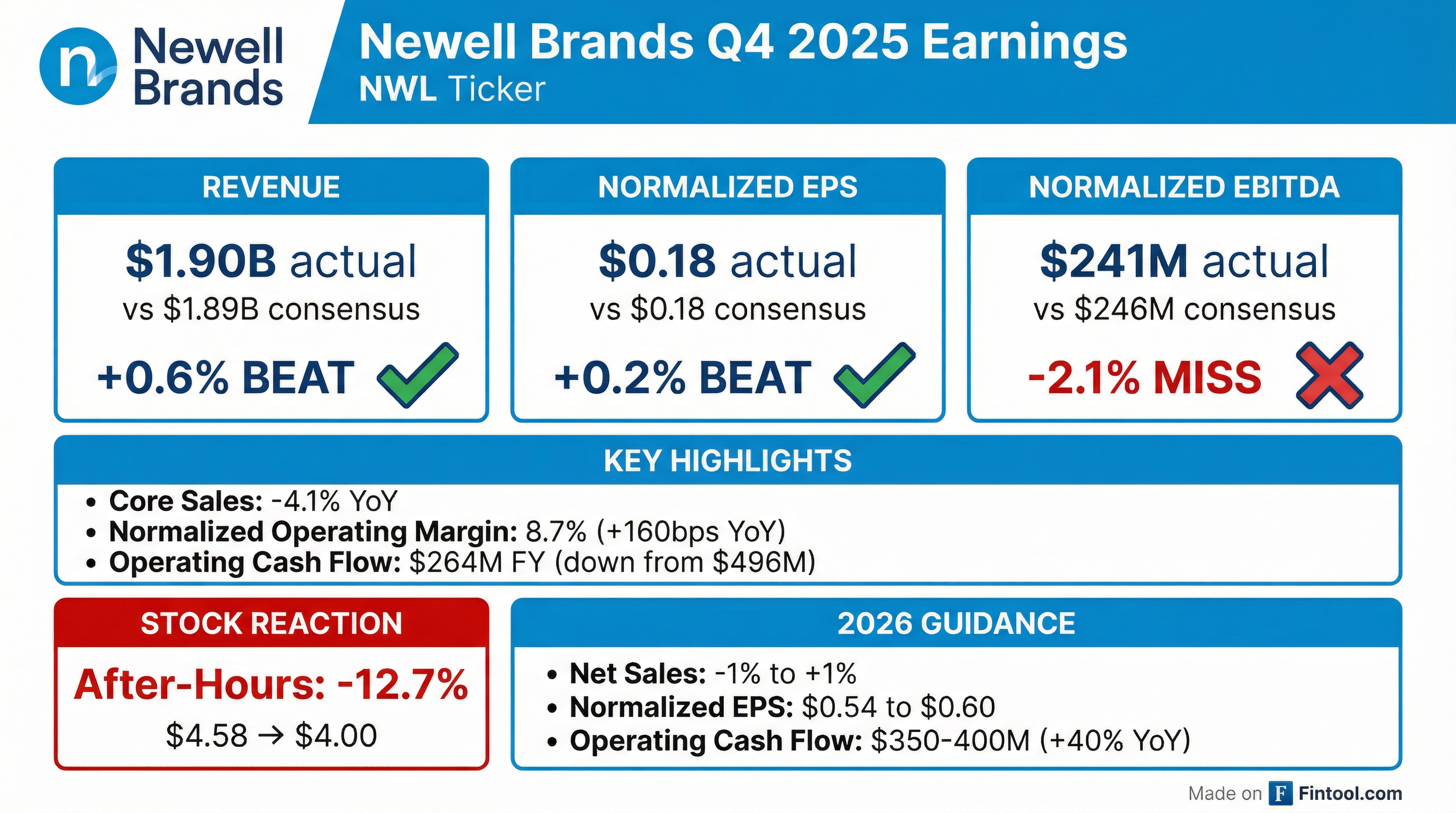

- Newell Brands reported Q4 2025 net sales of $1.9 billion, a 2.7% decline year-over-year, and full-year net sales of $7.2 billion, down 5%. Normalized diluted earnings per share (EPS) for Q4 was $0.18, with full-year normalized EPS at $0.57.

- Despite significant tariff-related headwinds, the company expanded its normalized operating margin by 20 basis points to 8.4% for the full year 2025, supported by a 50 basis point increase in advertising and promotion (A&P) support and the announcement of a global productivity plan in Q4.

- For 2026, Newell Brands forecasts full-year net sales to be down 1% to up 1% and core sales to be down 2% to flat, anticipating market share growth for the first time since the Jarden acquisition. Normalized operating margin is projected between 8.6% and 9.2%, and normalized EPS in the range of $0.54-$0.60.

- The company plans over 25 Tier 1 or 2 innovation launches in 2026, its strongest lineup to date, and expects positive distribution trends. Q1 2026 is projected to be an anomaly with core sales declining 7%-5% and normalized EPS between -$0.12 and -$0.08, due to seasonality and retailer shipment timing.

- Newell Brands reported Q4 2025 net sales of $1.9 billion, a 2.7% decline, and full-year 2025 net sales of $7.2 billion, a 5% decline. Normalized diluted EPS was $0.18 for Q4 2025 and $0.57 for the full year.

- For 2026, the company projects full-year net sales to be down 1% to up 1% and core sales to be down 2% to flat. Normalized EPS is expected in the range of $0.54-$0.60, with normalized operating margin between 8.6% and 9.2%.

- Operating cash flow guidance for 2026 is $350-$400 million, representing a 40% increase at the midpoint over 2025. This is supported by a global productivity plan expected to generate over $75 million in year-over-year savings.

- Tariffs continue to be a significant factor, with an estimated total gross P&L impact of $150 million in 2026, representing an incremental $0.07 headwind to EPS compared to 2025.

- The company is focusing on innovation, with over 25 Tier 1 or 2 launches planned for 2026, and expects to grow market share and see performance improve significantly from Q2 2026 after a challenging Q1.

- Newell Brands reported Q4 2025 net sales of $1.9 billion, a 2.7% decline compared to the prior year period, and a net loss of $315 million. Normalized diluted EPS was $0.18, and normalized EBITDA increased 11.6% to $241 million.

- For the full year 2025, net sales were $7.2 billion, a 5.0% decrease compared to the prior year, with a net loss of $285 million and normalized diluted EPS of $0.57. Full year operating cash flow was $264 million.

- The company initiated its full year 2026 outlook, projecting net sales in the range of (1%) to 1%, normalized EPS between $0.54 and $0.60, and operating cash flow of $350 million to $400 million. This outlook anticipates a meaningful sequential improvement in net sales and an increase of over 40% in operating cash flow at the midpoint compared to 2025.

- Newell Brands reported fourth quarter 2025 net sales of $1.9 billion, a 2.7% decline compared to the prior year, with normalized diluted EPS of $0.18 and normalized EBITDA increasing 11.6% to $241 million.

- For the full year 2025, net sales were $7.2 billion, a 5.0% decline from the prior year, and normalized diluted EPS was $0.57. Full year operating cash flow was $264 million.

- The company initiated its full year 2026 outlook, projecting net sales in the range of (1%) to 1% and normalized EPS between $0.54 and $0.60. Operating cash flow for 2026 is expected to be $350 million to $400 million.

- As of the end of 2025, Newell Brands had $4.7 billion in debt outstanding and $203 million in cash and cash equivalents.

- Newell Brands anticipates its operating margin to grow by approximately 50 basis points in 2026, aiming for a long-term target of 12%-15% from 6% in 2023, supported by a projected 100 basis point reduction in overhead as a percentage of sales by 2026.

- The company expects to finish 2025 with a gross margin of around 34.5%, an improvement from 29.5% in 2023, with a long-term goal of 37%-38%.

- Newell Brands projects a $0.28 tariff-related headwind to its P&L in 2026, an increase of $0.05 from 2025, but expects a lower cash tariff impact of $120 million in 2026 compared to $180 million in 2025.

- The company plans its highest-ever advertising and promotion (A&P) spending in 2026 to support a robust innovation pipeline, which includes over 20 Tier 1 and Tier 2 innovations, and expects a substantively better operating cash flow in 2026 compared to the $250-$300 million guided for 2025.

- Newell Brands is leveraging AI across its operations, resulting in a 500% increase in digital marketing assets with fewer personnel, a reduction in customer service response time from three hours to 15 minutes, and a shortened product development cycle from four months to two to three weeks on the front end.

- Newell Brands announced a new productivity plan, including a 10% reduction in professional clerical employees, targeting $110-$130 million in pre-tax cost savings, largely implemented in the U.S. by December 2025.

- This plan is expected to reduce 2026 overhead as a percentage of sales by approximately 100 basis points, supporting the long-term operating margin goal of 12%-15%.

- The company updated its outlook, expecting general merchandise categories to be down 2%-3% this year, and international core sales declined 6% in Q3 2025, with Brazil down 25%. As a result, core sales and net sales guidance are expected to be toward the lower end of the previously announced range.

- Operating cash flow for 2026 is projected to be significantly stronger than the $250-$300 million guided for 2025, driven by reduced tariff cash impacts, improved cash conversion, and lower CapEx. The company remains committed to debt reduction, aiming for investment grade, with leverage at 5x by the end of 2025.

Quarterly earnings call transcripts for NEWELL BRANDS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more