Earnings summaries and quarterly performance for Origin Bancorp.

Executive leadership at Origin Bancorp.

Board of directors at Origin Bancorp.

A. La’Verne Edney

Director

Cecil Jones

Director

Gary Luffey

Director

James D’Agostino, Jr.

Lead Independent Director

James Davison, Jr.

Director

Meryl Farr

Director

Michael Jones

Director

Richard Gallot, Jr.

Director

Stacey Goff

Director

Research analysts who have asked questions during Origin Bancorp earnings calls.

Matt Olney

Stephens Inc.

4 questions for OBK

Manuel Navas

D.A. Davidson & Co.

3 questions for OBK

Woody Lay

Keefe, Bruyette & Woods (KBW)

3 questions for OBK

Gary

D.A. Davidson

2 questions for OBK

Matt

Western Standard

2 questions for OBK

Michael

TD Cowen

2 questions for OBK

Michael Rose

Raymond James Financial, Inc.

2 questions for OBK

Stephen

TD Cowen

2 questions for OBK

Mark Fitzgibbon

Piper Sandler & Co.

1 question for OBK

Timothy Mitchell

Raymond James

1 question for OBK

Wood Lay

Keefe, Bruyette & Woods

1 question for OBK

Recent press releases and 8-K filings for OBK.

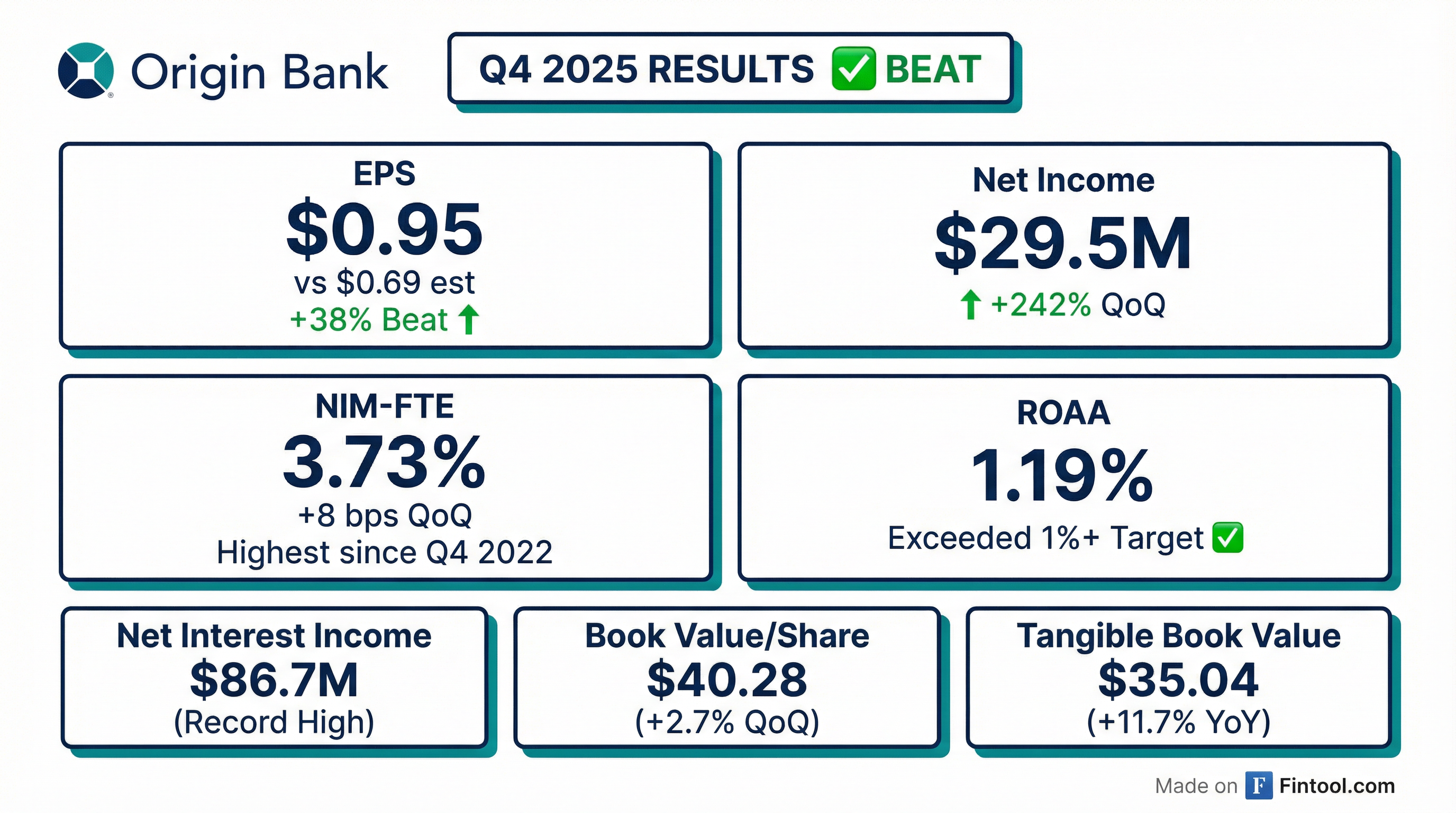

- Origin Bancorp Inc. (OBK) reported diluted earnings per share of $0.95 and net income of $29.5 million for Q4 2025, achieving a run rate on average assets of 1.19%, surpassing its 1% target. The net interest margin (NIM) expanded 8 basis points to 3.73%.

- For 2026, OBK is targeting mid to high single-digit loan and deposit growth, with NIM anticipated to be in the 3.70%-3.80% range by Q4 2026.

- The company plans to invest approximately $10 million in new bankers and banking teams in 2026 to leverage market disruption, projecting mid-single-digit non-interest expense growth and an expected run rate ROA of at least 1.15% by Q4 2026.

- During 2025, OBK redeemed approximately $145 million in subdebt and repurchased about $16 million worth of common stock, while maintaining a tangible common equity (TCE) ratio of 11.3% at year-end.

- Origin Bancorp Inc. reported diluted earnings per share of $0.95 and net income of $29.5 million for Q4 2025, achieving a run rate on average assets of 1.19%.

- The "Optimize Origin" initiative contributed to a nearly 7% reduction in FTEs, a 10.2% increase in Net Interest Income, and an 8.8% increase in revenue (excluding notable items) for the year.

- For 2026, the company forecasts mid to high single-digit loan and deposit growth and expects Net Interest Margin (NIM) to be in the 3.70%-3.80% range by Q4, targeting a run rate ROA of at least 1.15% in Q4.

- Origin Bancorp plans to invest approximately $10 million in new bankers and banking teams in 2026 to leverage market disruption, projecting mid-single-digit expense growth for the year.

- Origin Bancorp (OBK) reported diluted earnings per share of $0.95 and net income of $29.5 million for Q4 2025, achieving a run rate on average assets of 1.19%, which surpassed its near-term target of 1%.

- The company's Net Interest Margin (NIM) expanded 8 basis points to 3.73% in Q4 2025, and it expects full-year Net Interest Income (NII) growth in the mid to high single digits for 2026, with NIM anticipated to be in the 3.70%-3.80% range by Q4 2026.

- OBK plans to invest approximately $10 million in new bankers and banking teams in 2026 to capitalize on market disruption, targeting mid to high single-digit loan and deposit growth for the year, with loan growth weighted to the second half. Non-interest expense is projected to be around $64 million ± $1 million for Q1 2026, with ongoing efforts to reduce expenses.

- Credit quality remained sound in Q4 2025, with total past dues at 0.96% of total loans, net charge-offs of $3.2 million (0.17% annualized rate), and non-performing assets declining to 1.07%.

- Origin Bancorp, Inc. reported a substantial increase in net income for Q4 2025, reaching $29.5 million, a 242.3% increase compared to Q3 2025, with diluted earnings per share rising to $0.95.

- The company's fully tax-equivalent net interest margin (NIM-FTE) expanded to 3.73% in Q4 2025, marking its highest level since Q4 2022, while the cost of total deposits decreased to 2.20% from 2.46% in Q3 2025.

- Total Loans Held for Investment grew to $7.67 billion at December 31, 2025, an increase of 1.8% from September 30, 2025, and nonperforming loans held for investment as a percentage of total loans held for investment improved to 1.06% in Q4 2025 from 1.17% in Q3 2025.

- During Q4 2025, Origin Bancorp repurchased 49,358 shares of its common stock at an average price of $38.77 per share.

- Origin Bancorp, Inc. reported net income of $29.5 million and diluted earnings per share of $0.95 for the fourth quarter ended December 31, 2025, contributing to a full-year 2025 net income of $75.2 million and diluted EPS of $2.40.

- The company achieved an annualized Return on Average Assets (ROAA) of 1.19% for Q4 2025, exceeding its original goal, and its fully tax equivalent net interest margin (NIM-FTE) expanded to 3.73%, the highest level since Q4 2022. Net interest income reached a historical high of $86.7 million for the quarter.

- At December 31, 2025, total loans held for investment were $7.67 billion and total deposits were $8.31 billion.

- Origin Bancorp repurchased 49,358 shares of its common stock during Q4 2025 at an average price of $38.77 per share, and has updated its near-term ROAA run rate target to 1.15% or higher by 4Q26.

- Origin Bancorp reported diluted earnings per share of $0.27 for Q3 2025, which included a $28.4 million charge-off related to Tricolor due to fraud allegations and a full reserve of $1.5 million in unfunded letters of credit.

- Excluding notable items, the company's pre-tax pre-provision ROA increased 48 basis points to 1.63% in Q3 2025 compared to Q2 2024, with total revenue up 10% and noninterest expense down 3%.

- The company updated its guidance, reducing loan growth to essentially flat for the year and tightening net interest margin guidance to 3.65% for Q4 2025 and 3.60% for the full year (+/-3 basis points).

- Capital management actions included the repurchase of 265,248 shares at an average price of $35.85 during the quarter and the anticipated full redemption of $74 million of subordinated debt on November 1st.

- Origin Bancorp reported diluted earnings per share of $0.27 for Q3 2025, significantly impacted by $0.59 in EPS pressure from notable items.

- The company recorded a $28.4 million charge-off for the outstanding Tricolor debt and reserved $1.5 million for unfunded letters of credit due to fraud allegations, leading to total net charge-offs of $31.4 million for the quarter.

- Despite the charge-off, pre-tax pre-provision ROA (excluding notable items) increased 48 basis points to 1.63%, and Net Interest Margin (NIM) expanded four basis points to 3.65% in Q3 2025.

- Loan growth guidance for the full year was reduced to essentially flat, though the company expects 2% growth ex-warehouse in Q4 2025 and mid to high single-digit growth for 2026. Deposit growth guidance remains low single digits for the year.

- The company repurchased 265,248 shares at an average price of $35.85 and plans to redeem $74 million in subordinated debt on November 1.

- Origin Bancorp Inc. reported diluted earnings per share of $0.47 for Q2 2025.

- The company's "Optimize Origin" plan has led to approximately $34 million in annual pretax, pre-provision earnings improvement and aims for a 1% ROA run rate by 2025.

- Net interest margin (NIM) expanded 17 basis points to 3.61% in Q2 2025, and the company increased its 4Q 2025 margin guidance to 3.7% and full-year 2025 guidance to 3.55%.

- Origin Bancorp Inc. reduced its 2025 loan and deposit growth guidance to low single digits and authorized a new $50 million share repurchase plan effective through July 2028.

- The company increased its ownership in Argent Financial to 20% on July 1, which is anticipated to drive approximately $6 million in additional income next year and will result in a $7 million write-up in Q3 financials.

- Origin Bancorp, Inc. reported net income of $14.6 million and diluted earnings per share of $0.47 for the second quarter of 2025, compared to $22.4 million and $0.71 respectively for the prior quarter.

- The company's "Optimize Origin" initiative is projected to yield an annual pre-tax pre-provision earnings improvement of approximately $34.2 million.

- Net interest income increased by 4.7% to $82.1 million for Q2 2025, and the fully tax equivalent net interest margin (NIM-FTE expanded 17 basis points to 3.61%) compared to the linked quarter.

- During Q2 2025, the company repurchased 136,399 shares of common stock at an average price of $31.84 per share and approved a new $50.0 million stock repurchase program.

- A bond portfolio optimization strategy resulted in a $14.4 million loss on sales of securities, which negatively impacted diluted EPS by $0.35 for the quarter, but is expected to generate an estimated annual increase in net interest income of $5.6 million.

- Optimize Origin Strategy: The company is advancing its Optimize Origin plan, targeting an ROA run rate of 1% or greater by Q4 2025 and expecting annual pretax earnings improvement of about $1.5 million from the restructured mortgage business ( ).

- Financial Performance Highlights: Q1 2025 diluted EPS was $0.71, net interest margin expanded to 3.44%, and deposits showed modest growth alongside a decline in noninterest expense, reflecting effective cost management ( ).

- Capital Strength and Share Repurchase: The company reported a tangible book value growth with a TCE ratio at 10.6% and expressed plans for share buybacks and a potential sub-debt call of approximately $75 million to further enhance capital efficiency ( , ).

- Operational and Talent Initiatives: Emphasis was placed on strategic hiring, effective cost trimming, and maintaining strong loan and deposit growth despite macroeconomic headwinds ( , ).

Quarterly earnings call transcripts for Origin Bancorp.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more