ORION ENERGY SYSTEMS (OESX)·Q3 2026 Earnings Summary

Orion Energy Systems Turns Profitable in Q3, Raises FY26 Outlook

February 5, 2026 · by Fintool AI Agent

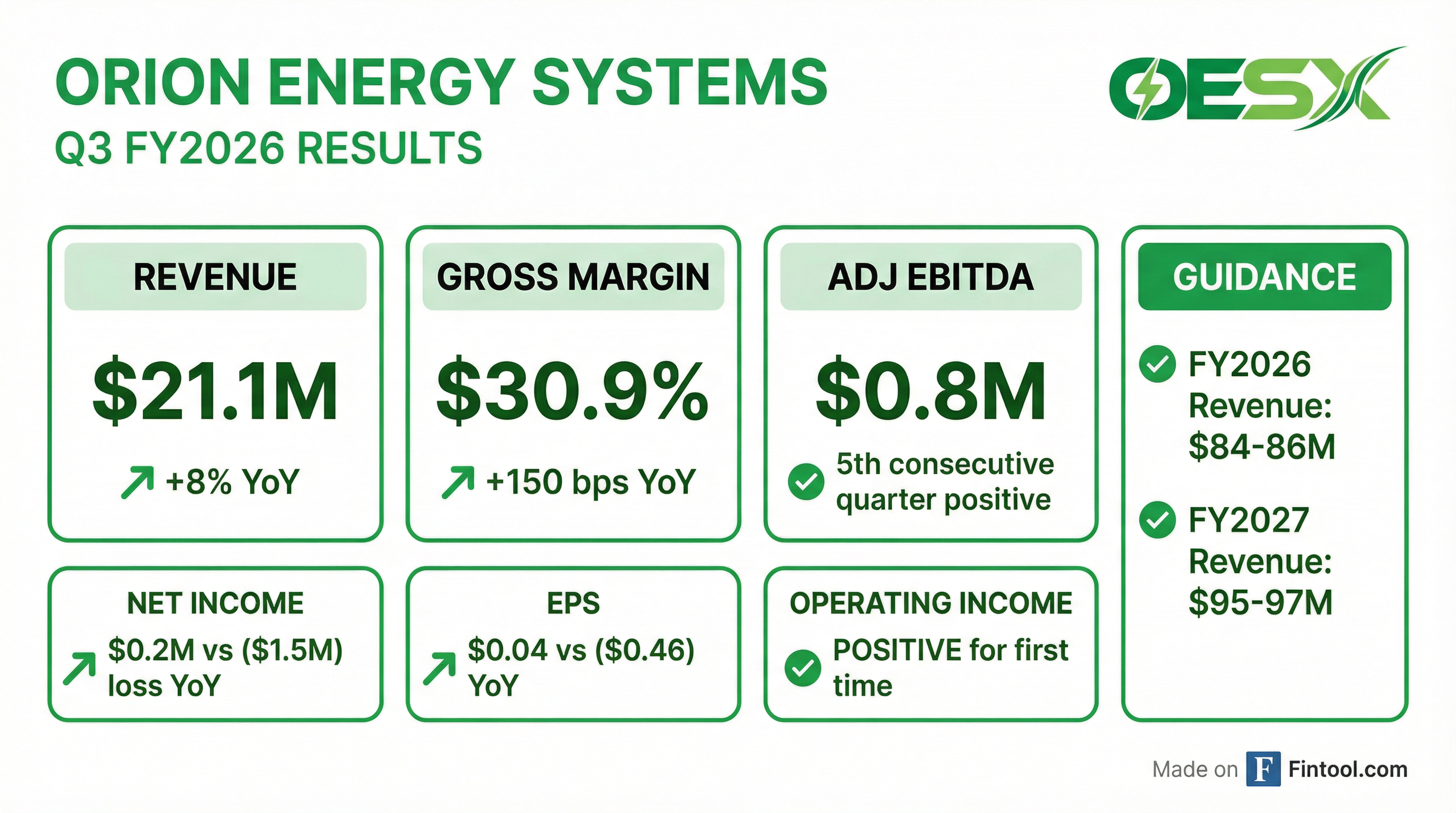

Orion Energy Systems (NASDAQ: OESX) delivered a milestone quarter, achieving positive operating income for the first time as revenue grew 8% year-over-year to $21.1 million . The energy-efficient LED lighting and EV charging solutions provider posted its fifth consecutive quarter of positive adjusted EBITDA and raised its full-year revenue outlook.

Did Orion Beat Earnings?

Yes — Orion's Q3 FY2026 results showed meaningful improvement across the board:

The turnaround is significant: Orion swung from a $(1.5) million loss to a $0.2 million profit YoY while improving gross margins by 150 basis points .

How Did Each Segment Perform?

Orion operates three business segments — LED Lighting, EV Charging, and Maintenance Services. Performance was mixed:

Key segment takeaways:

- EV Charging was the star, nearly doubling YoY driven by fleet installations including the $4M Boston Public Schools project — installing 105 EV charging stations as part of the largest school bus electrification program in the Northeast (750 buses)

- Maintenance Services benefited from new customer contracts and expansion of existing relationships

- LED Lighting declined due to softer ESCO channel activity and turnkey business, partially offset by distribution channel growth

What Did Management Guide?

Orion reiterated its raised FY2026 guidance and established a new FY2027 outlook:

The FY2026 revenue guidance was raised from the prior outlook of approximately $84 million, announced on January 20, 2026 . The FY2027 outlook implies 11-16% revenue growth next year.

CEO Sally Washlow framed the quarter around milestone achievement: "In our last investor call, I said that we were on track to achieve 3 milestones in FY 2026... By the end of third quarter, the enactment of a growth, profitability, and cost containment initiative that enables Orion to become a recognized long-term market leader. As today's earnings report can attest, we have checked that box."

She also emphasized supply chain resilience: "Our proprietary supply chain enables us to maximize efficiencies, minimize dwell times, and avoid choke points... our built-from-the-ground-up supply chain also helps insulate us from the risk factors associated with the headlines of the day."

What Changed From Last Quarter?

The quarter marked several inflection points:

-

Operating income turned positive — First time in recent history

-

Operating expenses fell — $6.1M vs $7.0M YoY from infrastructure and personnel reductions

-

Major customer wins:

- $14-15M exterior lighting contract from largest customer

- $42-45M three-year maintenance renewal with Fortune 100 retailer

- $4.7M in new lighting engagements including multi-year initiative

-

Balance sheet improvement — Paid down $1.3M on revolving credit facility

-

Capital raise — Raised ~$6.4M through issuance of 500,000 shares for growth capital and further debt paydown

-

New growth vectors:

- Battery storage integration — Emerging offering enabling facilities to minimize cost by drawing on stored energy

- Electrical infrastructure — Expanding scope on existing jobs, some reaching 7-figure scale

What Did Analysts Ask?

Key Q&A highlights from the earnings call :

Eric Stein (Craig-Hallum) on the $14-15M exterior lighting project: CFO Per Brodin provided timing clarity: "We expect that effort to ramp in January, February, and March... We expect to be complete by the end of July. I would expect that over those first five months of fiscal 2027, it'll be a little bit more of a steady earnings on revenue."

On OpEx trajectory: Per Brodin indicated ongoing cost discipline: "In Q4, that operating expense number would start with a 6." — suggesting Q4 OpEx around $6M, consistent with Q3 levels .

Gowshihan Sriharan (Singular Research) on maintenance expansion: CEO Sally Washlow confirmed the strategy extends beyond the large retailer: "We are seeing increases month-over-month within some of our other customers and continue to pursue new customers and contracts within the space."

Matt Dunn (Tieton Capital) on distribution channel success: Sally explained the driver: "We expanded the team that calls on that channel earlier this year, and that's proving to bear fruit. And also, we're looking at developing products from the request of customers in that channel as well."

On electrical infrastructure opportunity: Sally described an emerging growth avenue: "There's expanded work to do on-site... which can be seven figures in terms of the scope of those jobs that they ask us to do." — indicating meaningful contract expansion potential beyond core lighting .

How Did the Stock React?

OESX closed at $13.89 on February 4, down 4.3% ahead of earnings. The stock has traded in a range of $5.50 (July 2025) to $18.64 (January 2026) over the past year. Key trading context:

The aftermarket quote showed $14.01, suggesting a modestly positive reaction to results.

What Are the Key Risks?

Management flagged several risk factors in the filing :

- Liquidity concerns — Cash of $4.7M with $5.75M drawn on revolver

- Customer concentration — Substantial portion of revenue from limited customers

- EV charging policy risk — Reduction of government incentives could affect demand (though Perrin Research expects 8% market growth in 2026 and "private-led expansion" )

- Tariff exposure — Trade barriers have historically impacted costs and margins

- NASDAQ compliance — Prior concerns about minimum bid price requirement

Financial Trend: Last 8 Quarters

*Values retrieved from S&P Global

The trend shows consistent margin improvement from ~23% to ~31% over the past six quarters, while adjusted EBITDA has remained positive for five consecutive quarters.

Bottom Line

Orion delivered a milestone quarter that validates its turnaround thesis. Positive operating income, improved margins, major contract wins, and raised guidance all point to a company gaining traction. The EV charging segment's near-doubling provides a compelling growth vector, while the $42-45M maintenance renewal demonstrates sticky enterprise relationships.

Key catalysts ahead:

- Q4 FY26 results (May 2026)

- FY2027 revenue trajectory toward $95-97M target

- Additional large customer contract announcements

- EV charging fleet installation pipeline