Earnings summaries and quarterly performance for ORION ENERGY SYSTEMS.

Executive leadership at ORION ENERGY SYSTEMS.

Board of directors at ORION ENERGY SYSTEMS.

Research analysts who have asked questions during ORION ENERGY SYSTEMS earnings calls.

Eric Stine

Craig-Hallum Capital Group LLC

5 questions for OESX

Amit Dayal

H.C. Wainwright & Co., LLC

3 questions for OESX

Bill Dezellem

Tieton Capital Management

3 questions for OESX

Gowshihan Sriharan

Singular Research

3 questions for OESX

Gaucci Siri

Singular Research

2 questions for OESX

Matthew Dunn

Hanover Investors Management

2 questions for OESX

William Dezellem

Tieton Capital Management

2 questions for OESX

Andrew Shapiro

Lawndale Capital Management

1 question for OESX

Sameer Joshi

H.C. Wainwright & Co.

1 question for OESX

Steve Redd

Blackwater

1 question for OESX

Unknown Analyst

Morgan Stanley

1 question for OESX

Recent press releases and 8-K filings for OESX.

- Orion Energy Systems (OESX) provides energy efficiency and clean tech solutions, including LED lighting, EV charging, and maintenance services, primarily for commercial and industrial clients.

- The company announced the rollout of a localized battery energy storage system (BESS) with initial deployments in California and secured a $3.1 million electrical contracting engagement, signaling new growth areas.

- Key contracts include a three-year renewal for $45 million in maintenance services with a major customer and a project to deploy exterior lighting at 250 big box retailer locations over the next six months.

- For the last twelve months (LTM), revenue was just above $80 million, with a gross margin a little under 30%, and $1.7 million in adjusted EBITDA through Q3 2024. The company anticipates positive adjusted EBITDA for the full year and projects FY27 revenue in the mid-nineties.

- Orion Energy Systems (OESX) provides energy efficiency and clean tech solutions, including LED lighting and controls, electrical vehicle charging solutions, and maintenance services.

- The company recently launched a Battery Energy Storage System (BESS), with inaugural deployments at 3 sites in California and plans to expand to over 10 sites within the initial project in the next 9 months.

- OESX announced a $3.1 million electrical contracting and infrastructure engagement, highlighting electrical contracting as an emerging growth area.

- For the past 12 months, revenue was just above $80 million, with a gross margin around 30%, and adjusted EBITDA of $1.7 million through Q3 2026. The company expects FY27 revenue guidance within the mid-nineties.

- Recurring maintenance revenue is a little north of $15 million every year, with EV charging revenue being approximately the same.

- Orion Energy Systems (OESX) recently launched a localized battery energy storage system (BESS), with initial deployments in California and plans to expand to over 10 sites within the next 9 months.

- The company announced a $3.1 million electrical contracting and infrastructure engagement, identifying electrical contracting as an emerging growth area, and secured a three-year renewal for $45 million of maintenance services with a major customer.

- OESX reported LTM revenue of just above $80 million, a gross margin of around 30%, and $1.7 million in adjusted EBITDA through Q3 2026, with expectations for positive adjusted EBITDA for the full year.

- The company has implemented $6.5 million in operational efficiencies over the past year and provided FY27 revenue guidance in the mid-nineties, indicating expected growth.

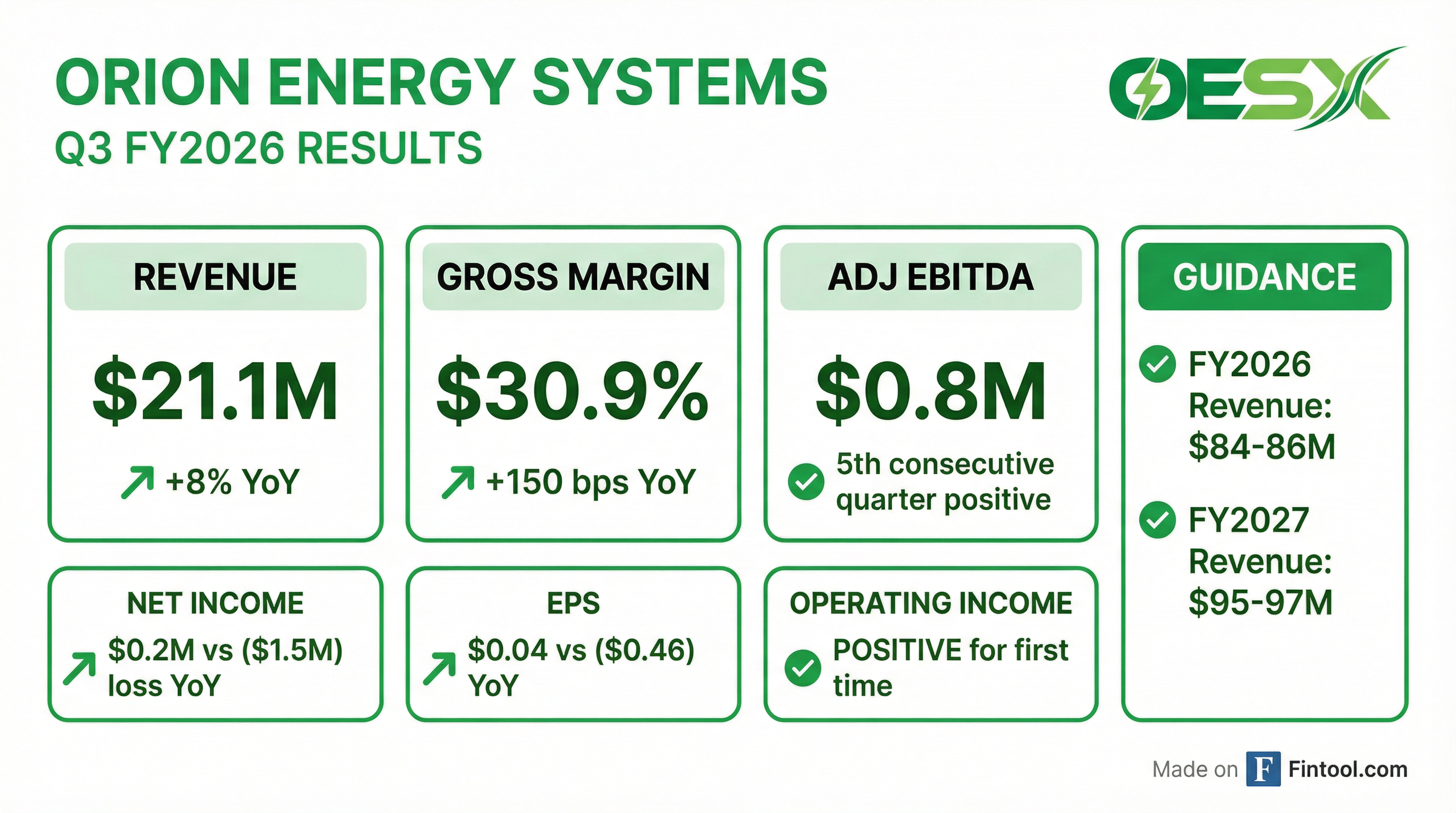

- Orion Energy Systems (OESX) reported Q3 2026 revenue of $21.1 million, net income of $160,000 or $0.04 per share, and positive Adjusted EBITDA of $761,000, marking its fifth consecutive quarter of positive Adjusted EBITDA.

- The company raised its FY 2026 revenue outlook to a range of $84 million to $86 million with positive Adjusted EBITDA, and expects FY 2027 revenue between $95 million and $97 million also with positive Adjusted EBITDA.

- Key drivers include an exterior lighting project valued between $14 million-$15 million and a $4 million installation of 105 EV charging stations for Boston Public Schools.

- Operational improvements contributed to an increased overall gross profit margin of 30.9% and a decline in total operating expenses to $6.1 million in Q3 2026.

- The company also raised approximately $6.4 million in net proceeds through the issuance of 500,000 shares of common stock.

- Orion Energy Systems reported Q3 2026 revenue of $21.1 million, a net income of $160,000, or $0.04 per share, and positive Adjusted EBITDA of $761,000, marking its fifth consecutive quarter of positive Adjusted EBITDA.

- The company raised its FY 2026 revenue outlook to between $84 million and $86 million with expected positive Adjusted EBITDA, and anticipates FY 2027 revenue between $95 million and $97 million with continued positive Adjusted EBITDA.

- Key business developments include an exterior lighting project valued at $14 million-$15 million and a $4 million installation of 105 EV charging stations for Boston Public Schools.

- Total operating expenses declined to $6.1 million in Q3 2026 from $7 million in Q3 2025, reflecting ongoing cost reductions.

- Orion Energy Systems reported Q3 2026 revenue of $21.1 million, net income of $160,000 or $0.04 per share, and Adjusted EBITDA of $761,000, marking its fifth consecutive quarter of positive Adjusted EBITDA.

- The company raised its FY 2026 revenue outlook to between $84 million and $86 million with positive Adjusted EBITDA, and set FY 2027 revenue expectations between $95 million and $97 million with positive Adjusted EBITDA.

- Total operating expenses declined to $6.1 million in Q3 2026 from $7 million in Q3 2025, contributing to an improved overall gross profit margin of 30.9%.

- Significant new projects include an exterior lighting project valued at $14 million-$15 million starting in Q4 2026 and a $4 million EV charging station installation for Boston Public Schools, alongside the recent raising of $6.4 million in net proceeds from stock issuance.

- Orion Energy Systems, Inc. (OESX) reported Q3 2026 revenue of $21.1 million, an increase from $19.6 million in Q3 2025.

- The company achieved positive operating income and a net income of $0.2 million (or $0.04 per diluted share) in Q3 2026, a significant improvement from a net loss of $(1.5) million (or $(0.46) per diluted share) in Q3 2025.

- Adjusted EBITDA improved to $0.8 million in Q3 2026, marking its fifth consecutive quarter of positive adjusted EBITDA, compared to $0.0 million in Q3 2025. The gross profit percentage increased to 30.9% from 29.4% in Q3 2025, driven by pricing and cost improvements, while total operating expenses declined.

- OESX reiterated its FY 2026 revenue outlook to a range of $84 million to $86 million and established a FY 2027 revenue outlook of $95 million to $97 million with positive adjusted EBITDA for the full year.

- Orion Energy Systems reported Q3 FY26 revenue of $21.1 million, a gross margin of 30.9%, and Adjusted EBITDA of $0.8 million, marking a return to net income of $160 thousand for the quarter.

- The company's business segments include LED lighting systems, maintenance and technical services, and EV charging systems, with the EV segment managing over 7,300 charging ports.

- As of Q3 FY26, Orion's liquidity was $11.8 million.

- Despite recent positive results, the company has experienced substantial net losses and negative cash flow over the past several years, and may require additional capital to fund operations and meet obligations.

- Orion Energy Systems (OESX) reported Q3 FY2026 revenue of $21.1 million, an increase from $19.6 million in Q3 FY2025, with a gross profit percentage of 30.9%. The company achieved positive operating income and adjusted EBITDA of 3.6% for the quarter, marking its fifth consecutive quarter of positive adjusted EBITDA.

- The company reiterated its increased FY 2026 revenue outlook to a range of $84 million to $86 million and established a FY 2027 revenue outlook of $95 million to $97 million with positive adjusted EBITDA for the full year.

- Key business developments in Q3 FY2026 included a $14 million to $15 million contract for exterior lighting and a three-year maintenance renewal valued at $42 million to $45 million with its largest customer.

- Orion Energy Systems (OESX) announced the pricing of a public offering of 500,000 shares of its common stock at $14.00 per share.

- The offering is expected to generate approximately $7.0 million in gross proceeds.

- Net proceeds are intended for reducing amounts outstanding under its existing credit agreement, with the remainder for working capital and general corporate purposes.

- The offering is expected to close on or about February 2, 2026.

Quarterly earnings call transcripts for ORION ENERGY SYSTEMS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more