Earnings summaries and quarterly performance for Orthofix Medical.

Executive leadership at Orthofix Medical.

Massimo Calafiore

Chief Executive Officer

J. Andrés Cedrón

Chief Legal Officer

Julie Andrews

Chief Financial Officer

Lucas Vitale

Chief People and Business Operations Officer

Max Reinhardt

President, Global Spine

Patrick Fisher

President, Global Orthopedics

Board of directors at Orthofix Medical.

Alan L. Bazaar

Director

Charles R. Kummeth

Director

Jason M. Hannon

Director

John B. Henneman, III

Director

Michael E. Paolucci

Director

Michael M. Finegan

Chair of the Board

Shweta Singh Maniar

Director

Vickie L. Capps

Director

Wayne Burris

Director

Research analysts who have asked questions during Orthofix Medical earnings calls.

Mathew Blackman

Stifel

5 questions for OFIX

Caitlin Cronin

Canaccord Genuity

3 questions for OFIX

Jason Wittes

Roth Capital Partners, LLC

2 questions for OFIX

Michaela Smith

Canaccord Genuity

2 questions for OFIX

Mike Petusky

Barrington Research

2 questions for OFIX

Tom Stephan

Stifel

2 questions for OFIX

Michael Petusky

Barrington Research

1 question for OFIX

Ryan Zimmerman

BTIG

1 question for OFIX

Recent press releases and 8-K filings for OFIX.

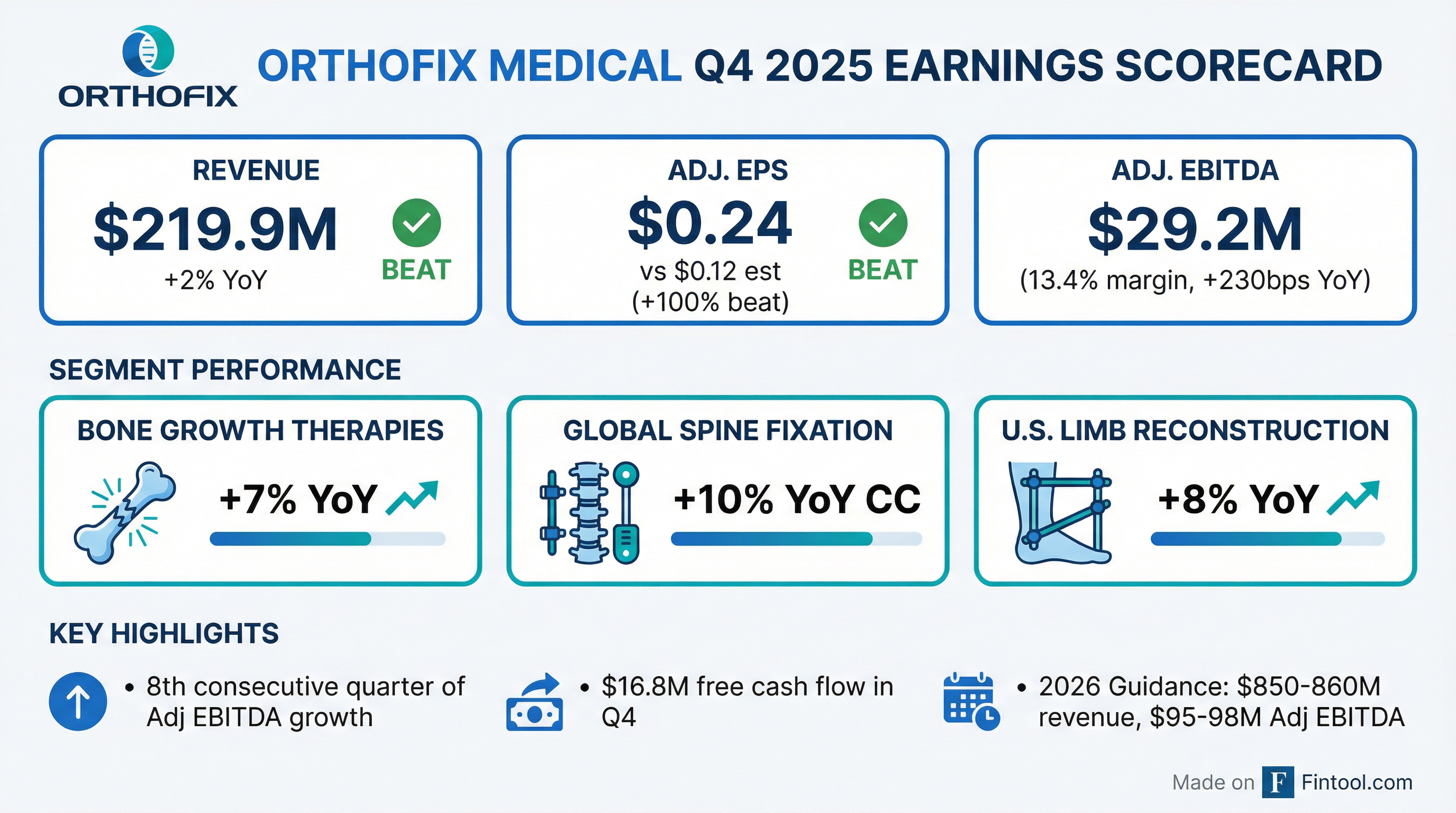

- Orthofix reported Q4 2025 global net sales of $218.6 million, a 3% increase on a pro forma constant currency basis, with Adjusted EBITDA of $29.2 million (13.4% of net sales) and $16.8 million in free cash flow.

- For the full year 2026, the company expects net sales between $850 million and $860 million (midpoint $855 million), representing approximately 5.5% year-over-year growth, and non-GAAP Adjusted EBITDA of $95 million to $98 million.

- The company has recalibrated its long-range plan, extending the timeline by one year to 2028, with new targets including a 6.5%-7.5% net sales CAGR from 2026 through 2028, mid-teens non-GAAP Adjusted EBITDA as a % of net sales for 2028, and positive free cash flow generation from 2026 through 2028.

- Operational highlights include 10% global spine fixation net sales growth in Q4 and for the full year, 7% growth in Bone Growth Therapies, and 8% U.S. Limb Reconstruction growth in Q4, driven by commercial channel optimization and anticipated new product launches like the VIRATA Spinal Fixation System in the second half of 2026.

- Orthofix reported Q4 2025 total global net sales of $218.6 million, a 3% increase, with adjusted EBITDA of $29.2 million (13.4% of net sales) and $16.8 million in free cash flow, contributing to $3.1 million in full-year 2025 free cash flow (excluding M6 restructuring).

- The company issued 2026 full-year guidance projecting net sales of $850 million-$860 million (midpoint $855 million, approximately 5.5% growth) and adjusted EBITDA of $95 million-$98 million, anticipating positive free cash flow.

- Orthofix recalibrated its long-range plan, extending the timeline to 2028, with refreshed targets including a 6.5%-7.5% net sales CAGR from 2026 through 2028, mid-teens adjusted EBITDA margin by 2028, and positive free cash flow generation.

- Performance was supported by strong growth in Bone Growth Therapies (7% in Q4) and U.S. limb reconstruction (8% in Q4, 16% for full year), with 75% of U.S. net sales now from top 30 distributor partners, and the VIRATA Spinal Fixation System expected for full market release in H2 2026.

- Orthofix reported Q4 2025 global net sales of $218.6 million, a 3% increase on a pro forma constant currency basis, with adjusted EBITDA of $29.2 million (13.4% of net sales) and $16.8 million in free cash flow.

- For the full year 2026, the company expects net sales between $850 million and $860 million (midpoint $855 million), representing approximately 5.5% year-over-year growth, and adjusted EBITDA between $95 million and $98 million.

- The company is extending its three-year financial targets by one year to 2028, now aiming for a 6.5%-7.5% net sales CAGR from 2026-2028 and mid-teens non-GAAP adjusted EBITDA as a % of net sales for full year 2028, to fully capture benefits from spine commercial channel optimization.

- Operational highlights include 10% growth in global spine fixation for Q4 and the full year, 7% growth in Bone Growth Therapies in Q4, and 8% U.S. growth in limb reconstruction in Q4. The VIRATA Spinal Fixation System is expected for full market release in the second half of 2026.

- Orthofix Medical Inc. reported Q4 2025 net sales of $219.9 million (reported) and $218.6 million (non-GAAP pro forma), representing increases of 2% and 3% on a constant currency basis, respectively, compared to Q4 2024. The company posted a Q4 2025 net loss of $(2.2) million and non-GAAP pro forma adjusted EBITDA of $29.2 million.

- For the full-year 2025, net sales were $822.3 million (reported) and $811.9 million (non-GAAP pro forma), with increases of 2.9% and 4.1% on a constant currency basis, respectively, compared to full-year 2024. The company generated positive full-year 2025 free cash flow of $3.1 million, excluding M6-related restructuring charges.

- The company issued full-year 2026 guidance, projecting net sales between $850 million to $860 million and non-GAAP adjusted EBITDA between $95 million to $98 million, along with positive free cash flow.

- Orthofix updated its three-year financial targets for 2026-2028, aiming for a 6.5% to 7.5% net sales CAGR, mid-teens non-GAAP adjusted EBITDA as a percent of net sales by full-year 2028, and positive free cash flow generation.

- Orthofix Medical Inc. reported Q4 2025 net sales of $219.9 million and full-year 2025 net sales of $822.3 million, with a full-year 2025 net loss of $(92.2) million or $(2.33) per share.

- The company achieved non-GAAP pro forma adjusted EBITDA of $29.2 million in Q4 2025 and $85.9 million for the full-year 2025.

- Orthofix generated $16.8 million in free cash flow in Q4 2025, contributing to positive full-year 2025 free cash flow of $3.1 million (excluding M6-related restructuring charges).

- For full-year 2026, the company expects net sales between $850 million to $860 million and non-GAAP adjusted EBITDA between $95 million to $98 million.

- Orthofix updated its three-year financial targets (2026-2028), projecting a 6.5% to 7.5% net sales CAGR and mid-teens non-GAAP adjusted EBITDA as a percent of net sales by 2028.

- SMAIO reported €9.2 million in revenue for 2025, representing a +67% increase compared to 2024.

- Revenue in the United States grew by +138% to €7.0 million (or $7.9 million excluding exchange rate effects), driven by the adoption of the Kheiron system and increased activity in existing North American centers.

- The company's cash position stood at €5.8 million as of December 31, 2025, an increase from €3.2 million at the end of 2024.

- SMAIO signed two major industrial partnerships in 2025 for its KEOPS-4ME platform with Highridge Medical and Orthofix, aiming to expand the distribution of patient-specific K-rods starting in Q2 2026.

- SMAIO reported 2025 sales of €9.2 million, marking a +67% increase compared to 2024.

- U.S. sales rose by +138% to €7.0 million (or $7.9 million excluding currency effects), now comprising over 75% of total Group sales.

- The company signed two major initial industrial partnerships in 2025 for its KEOPS-4ME open platform, with the rollout of patient-specific K-Rods expected to begin in Q2 2026.

- SMAIO maintained a strong cash position of €5.8 million as of December 31, 2025.

- Orthofix reported a strong Q3 2025, exceeding consensus on revenue and EBITDA, with 6% revenue growth and its seventh consecutive quarter of EBITDA margin expansion. The revenue beat was primarily attributed to the timing of international stocking orders shifting from Q4 to Q3, which led the company to maintain its full-year guidance.

- The company is focused on profitable growth, aiming for above-market growth in its US Spine business, which saw +10% procedure growth in Q3 2025. Ongoing distributor transitions are expected to continue driving incremental growth and improve working capital efficiency.

- Orthofix is launching Verata, a new product designed for its 7D enabling technology, with an alpha launch closing at the end of 2025 and a full launch targeted for 2H 2026. Verata is expected to drive incremental growth in 2026 and accelerate into 2027.

- The company targets 300 basis points of gross margin expansion by 2027 through initiatives like supplier consolidation and insourcing. It also aims for mid-teens adjusted EBITDA margin by 2027, up from an implied 10.5% for full-year 2025, with the expansion weighted more towards 2027.

- Orthofix reported a strong Q3 2025, exceeding consensus on revenue and EBITDA, with 6% revenue growth and 230 basis points of EBITDA margin expansion, marking its seventh consecutive quarter of such expansion.

- The company maintained its Q4 2025 guidance midpoint, attributing the Q3 beat to the earlier-than-expected timing of international stocking orders.

- Management is targeting mid-teens adjusted EBITDA margin by 2027 and 300 basis points of gross margin expansion by 2027, driven by supplier consolidation and insourcing.

- The Virata product line is anticipated to drive growth in H2 2026 and accelerate into 2027, with additional versions planned for future years.

- A new CMS pilot program for Bone Growth Therapy (BGT) starting in January 2026 is projected to have an immaterial annual impact and no change in physician prescribing behavior.

- Orthofix Medical has achieved a significant financial turnaround, reporting seven consecutive quarters of positive EBITDA and moving from over $100 million in free cash flow losses to positive generation.

- The company delivered a solid Q3 performance, including 86% growth in international spine fixation, and is focused on key product launches like Virata (spine) and TruLock Elevate (orthopedics) as growth drivers for 2026 and beyond.

- With an 8% annual R&D investment, Orthofix leverages its 7D Flash Navigation platform, which has led to accounts being 50% ahead of volume commitment in its earn-out program.

- Long-term targets include a 6.5-7.5% net sales CAGR through 2025-2027 and mid-teens adjusted EBITDA by 2027, alongside sustained positive free cash flow.

Quarterly earnings call transcripts for Orthofix Medical.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more