Earnings summaries and quarterly performance for Oric Pharmaceuticals.

Executive leadership at Oric Pharmaceuticals.

Board of directors at Oric Pharmaceuticals.

Research analysts who have asked questions during Oric Pharmaceuticals earnings calls.

AR

Anupam Rama

JPMorgan Chase & Co.

1 question for ORIC

Also covers: APLS, BBIO, BOLD +18 more

CK

Colleen Kusy

Robert W. Baird & Co.

1 question for ORIC

Also covers: APLS, BPMC, CHRS +6 more

KD

Kevin DeGeeter

Ladenburg Thalmann & Co. Inc.

1 question for ORIC

Also covers: IDXG, NVCR, RVMD +2 more

MR

Maury Raycroft

Jefferies

1 question for ORIC

Also covers: ABEO, ALNY, ARWR +14 more

Michael Schmidt

Guggenheim Securities

1 question for ORIC

Also covers: ADAP, ADCT, ARVN +20 more

YN

Yigal Nochomovitz

Citigroup Inc.

1 question for ORIC

Also covers: ALDX, APLS, ARCT +22 more

Recent press releases and 8-K filings for ORIC.

Oric Pharmaceuticals Provides Update on Clinical Programs and Upcoming Milestones

ORIC

New Projects/Investments

Guidance Update

- Oric Pharmaceuticals is advancing two clinical-stage oncology programs: rinzimetostat (ORIC-944) for prostate cancer and enosertinib (ORIC-114) for lung cancer.

- For rinzimetostat, the company aims to start its first Phase III study in the first half of 2026, with a Q1 2026 data update expected for 20-25 patients, focusing on PSA50, PSA90, safety, and early durability.

- Oric believes rinzimetostat offers a more favorable safety profile and a significantly longer half-life (20-24 hours) compared to competitor mevrometostat.

- The company anticipates a significant de-risking catalyst with Pfizer's MEVPRO-1 Phase III study readout for mevrometostat in 2026.

- Enosertinib has demonstrated best-in-class CNS activity with a 100% overall response rate in first-line EGFR exon 20 and PAK mutations, including patients with active brain metastases, with an update on its development strategy expected in the second half of 2026.

3 days ago

Oric Pharmaceuticals Provides Updates on Rinzimetostat and Enosertinib Clinical Programs

ORIC

New Projects/Investments

Guidance Update

- Oric Pharmaceuticals plans to initiate the first Phase III study for rinzimetostat (PRC2 inhibitor for prostate cancer) in the first half of 2026.

- A Q1 2026 update for rinzimetostat will include data from 20-25 patients on PSA50, PSA90, safety, tolerability, and early durability.

- The company views Pfizer's MEVPRO-1 study readout in 2026 as a significant catalyst, potentially de-risking the PRC2 mechanism for prostate cancer.

- For enosertinib (eGFR inhibitor), Oric reported best-in-class CNS activity with a 100% overall response rate in first-line eGFR exon 20 and PAK mutations, including patients with brain metastases.

- Oric expects a second-half 2026 update for enosertinib to finalize its Phase III strategy for first-line eGFR exon 20 and PAK mutations.

3 days ago

ORIC Pharmaceuticals Reports Q4 and Full Year 2025 Financial Results and Operational Updates

ORIC

Earnings

Guidance Update

New Projects/Investments

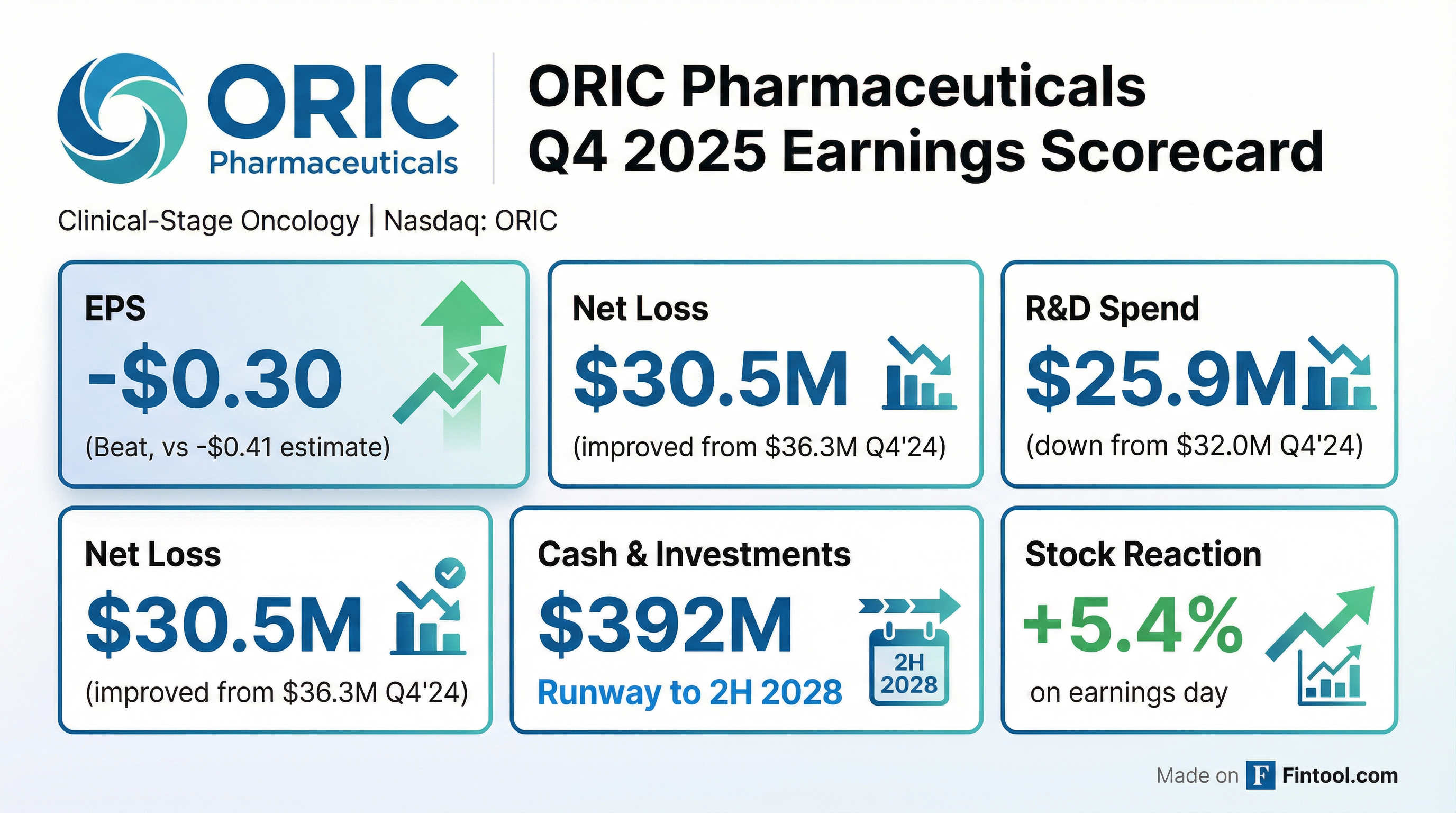

- ORIC Pharmaceuticals reported a net loss of $129.5 million for the full year ended December 31, 2025, with Research and development expenses of $109.8 million and General and administrative expenses of $33.2 million for the same period.

- As of December 31, 2025, cash, cash equivalents, and investments totaled $392.3 million, with an additional $20.0 million raised subsequently, providing a cash runway into 2H 2028.

- The company reported positive Phase 1b data for rinzimetostat in mCRPC and enozertinib in NSCLC, demonstrating potential best-in-class efficacy and safety profiles.

- ORIC anticipates multiple clinical data readouts for rinzimetostat and enozertinib in 2026, including the initiation of the first global Phase 3 registrational trial for rinzimetostat in 1H 2026.

4 days ago

ORIC Pharmaceuticals Reports Q4 and Full Year 2025 Financial Results and Operational Updates

ORIC

Earnings

Guidance Update

New Projects/Investments

- ORIC Pharmaceuticals reported a net loss of $129.468 million for the full year ended December 31, 2025, with a net loss per share of $1.47.

- The company concluded 2025 with cash, cash equivalents, and investments totaling $392.3 million as of December 31, 2025, which is projected to fund operations into the second half of 2028.

- In 2025, ORIC reported potential best-in-class efficacy and safety data from Phase 1b trials for rinzimetostat in metastatic castration-resistant prostate cancer (mCRPC) and enozertinib in NSCLC patients with EGFR exon 20 and EGFR PACC mutations.

- The company anticipates multiple clinical data readouts for rinzimetostat and enozertinib in 2026, preceding the potential initiation of multiple registrational trials.

4 days ago

ORIC Pharmaceuticals Provides Update on Lead Oncology Programs and Financial Position

ORIC

New Projects/Investments

Guidance Update

- ORIC Pharmaceuticals plans to initiate the first Phase III study for ORIC-944 (allosteric PRC2 inhibitor for prostate cancer) in the first half of 2026.

- The company expects to provide an update on ORIC-944 dose optimization data in Q1 2026 and an additional update for enozertinib (EGFR inhibitor for lung cancer) in the second half of 2026.

- Early data for ORIC-944 showed numerically higher PSA 50 and PSA 90 responses and a more favorable safety profile compared to Pfizer's mevrometostat, targeting a significant prostate cancer market with an estimated $3.5 billion opportunity in the post-abiraterone setting alone.

- The company reported a cash runway into the second half of 2028, which extends beyond the expected top-line data readout for the ORIC-944 Phase III study in the second half of 2027.

Feb 12, 2026, 3:30 PM

ORIC Pharmaceuticals Outlines Key Program Milestones and Financial Position

ORIC

New Projects/Investments

Guidance Update

- ORIC Pharmaceuticals, a clinical-stage oncology company, is advancing two lead programs: rinzimetostat for prostate cancer and enozertinib for lung cancer.

- For rinzimetostat, the company expects to present dose optimization data in Q1 2026 and initiate its first Phase III study in the first half of 2026. Top-line data from this study is anticipated in the second half of 2027.

- For enozertinib, additional updates are expected in the second half of 2026, including data from three cohorts (first-line EGFR exon 20 monotherapy, combination with amivantamab, and first-line EGFR PACC mutations monotherapy), with a potential Phase III study to follow.

- ORIC Pharmaceuticals is well-capitalized with a cash runway into the second half of 2028, fully funding the first Phase III studies for both lead programs.

Feb 12, 2026, 3:30 PM

ORIC Pharmaceuticals Outlines Development Priorities and Phase III Plans

ORIC

New Projects/Investments

Guidance Update

- ORIC Pharmaceuticals plans to initiate a Phase III study for ORIC-944 (PRC2 inhibitor for prostate cancer) in the first half of 2026, with dose optimization data expected in Q1 2026.

- The company has a cash runway into the second half of 2028, which extends beyond the expected top-line data readout for the ORIC-944 Phase III study in the second half of 2027.

- Early proof of concept data for ORIC-944 demonstrated a 40% confirmed PSA 50 and 20% PSA 90, numerically surpassing Pfizer's mevrometostat, alongside a more favorable safety profile.

- For enozertinib (EGFR inhibitor for lung cancer), an update is anticipated in the second half of 2026, with potential for a Phase III study soon after, highlighted by a 100% CNS response rate in specific first-line patient populations.

- The market opportunity for ORIC-944 in the post-abiraterone setting alone is estimated at $3.5 billion in the US, while enozertinib targets a 9,000-10,000 patient annual market in the US.

Feb 12, 2026, 3:30 PM

ORIC Pharmaceuticals Provides Pipeline Update at JPMorgan Healthcare Conference

ORIC

New Projects/Investments

Guidance Update

- ORIC Pharmaceuticals is advancing two late-stage oncology assets: Rinsey-Metastat for prostate cancer and Enosertinib for lung cancer.

- The company has a cash runway into the second half of 2028, which extends beyond the anticipated Phase 3 data readout for Rinsey-Metastat in the second half of 2027.

- The first Phase 3 study for Rinsey-Metastat is expected to initiate in the first half of 2026, with dose optimization data anticipated in Q1 2026. This drug has shown a differentiated safety profile compared to its main competitor.

- Enosertinib has demonstrated 100% intracranial ORRs in patients with measurable disease, highlighting its brain-penetrant capabilities, with substantial new data expected in the second half of 2026.

Jan 13, 2026, 5:45 PM

ORIC Pharmaceuticals Updates on Late-Stage Oncology Pipeline and Financial Runway at J.P. Morgan Healthcare Conference

ORIC

New Projects/Investments

Guidance Update

- ORIC Pharmaceuticals is advancing two late-stage oncology assets: rinzimetostat for prostate cancer and enozertinib for lung cancer.

- Rinzimetostat (prostate cancer) has shown a differentiated safety profile and favorable PSA response rates compared to competitors, with a Phase III data readout anticipated in H2 2027.

- Enozertinib (lung cancer), a brain-penetrant TKI, demonstrated 100% intracranial objective response rates (ORRs) in patients with measurable disease, addressing a significant unmet need in EGFR exon 20 and PACC mutations.

- The company plans to initiate its first Phase III study for rinzimetostat in H1 2026 and expects to report dose optimization data in Q1 2026.

- ORIC Pharmaceuticals maintains a cash runway into H2 2028, extending beyond the first Phase III data readout for rinzimetostat.

Jan 13, 2026, 5:45 PM

ORIC Pharmaceuticals Provides Pipeline Update and Financial Runway at JPMorgan Healthcare Conference

ORIC

New Projects/Investments

Guidance Update

- ORIC Pharmaceuticals presented its late-stage pipeline, featuring Rinsey-Metastat for prostate cancer and Enosertinib for lung cancer, at the 44th Annual JPMorgan Healthcare Conference.

- The company has a cash runway into the second half of 2028, which extends beyond the expected second half of 2027 Phase 3 data readout for Rinsey-Metastat.

- ORIC anticipates initiating its first Phase 3 study for Rinsey-Metastat in the first half of 2026, with dose optimization data expected in Q1 2026.

- Enosertinib, a brain-penetrant TKI for lung cancer, showed 100% intracranial objective response rates (ORRs) in patients with measurable disease.

- ORIC notes it is approximately 18 to 24 months behind Pfizer in the prostate cancer PRC2 inhibitor market, as Pfizer's competitor is expected to have its first Phase 3 readout in 2026.

Jan 13, 2026, 5:45 PM

Quarterly earnings call transcripts for Oric Pharmaceuticals.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more