OSI SYSTEMS (OSIS)·Q2 2026 Earnings Summary

OSI Systems Posts Record Q2 as Security Division Surges 15%

January 29, 2026 · by Fintool AI Agent

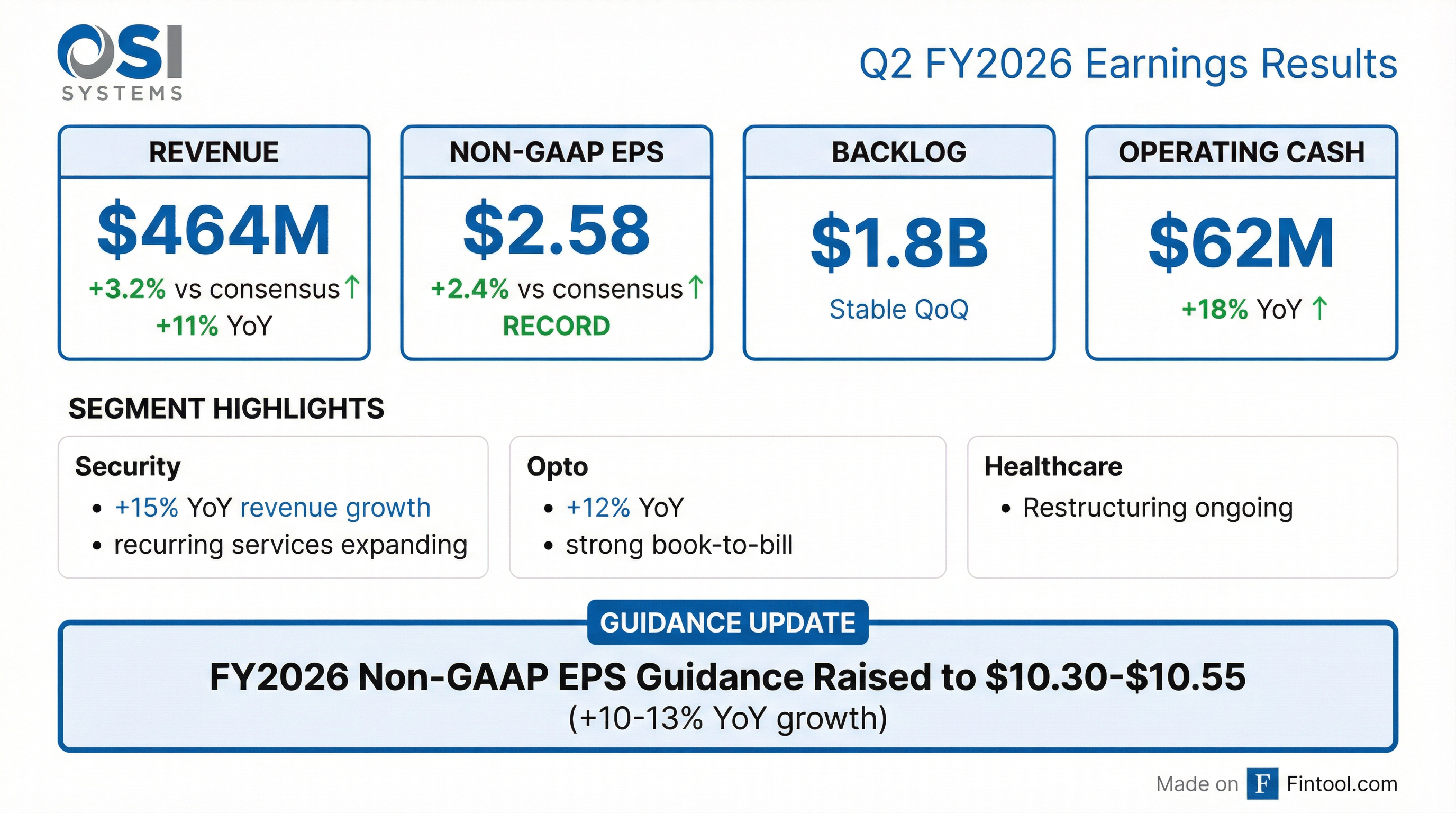

OSI Systems delivered record second quarter results, beating both revenue and EPS estimates while raising full-year guidance. The Security division led the way with 15% revenue growth as services revenue expanded meaningfully. The company also completed a $575 million convertible note offering at favorable terms, providing capital for growth initiatives.

Did OSI Systems Beat Earnings?

Yes. OSI Systems beat on both revenue and earnings:

This marks the company's record Q2 revenues and record Non-GAAP EPS for the December quarter.

Historical Beat/Miss Trend

Values retrieved from S&P Global

OSI Systems has consistently beaten estimates for the past 8 quarters, demonstrating reliable execution.

What Did Management Guide?

OSI raised its FY2026 guidance, signaling confidence in the business trajectory:

The guidance raise reflects strong H1 execution and confidence in second-half bookings. CEO Ajay Mehra noted: "We expect our significant backlog, opportunity pipeline, and anticipated strong bookings in the second half of the fiscal year to position us well for continued growth."

How Did the Stock React?

OSIS closed at $269.74, down 0.6% on the earnings release day. The muted reaction likely reflects:

- Results were solid but not dramatically above expectations

- Softer-than-expected bookings due to U.S. government shutdown delays

- Healthcare segment weakness (-19% YoY revenue)

The stock has appreciated 76% over the past 12 months (from ~$153 52-week low to current levels), reflecting strong execution and defense sector tailwinds.

What Changed From Last Quarter?

Positive Developments

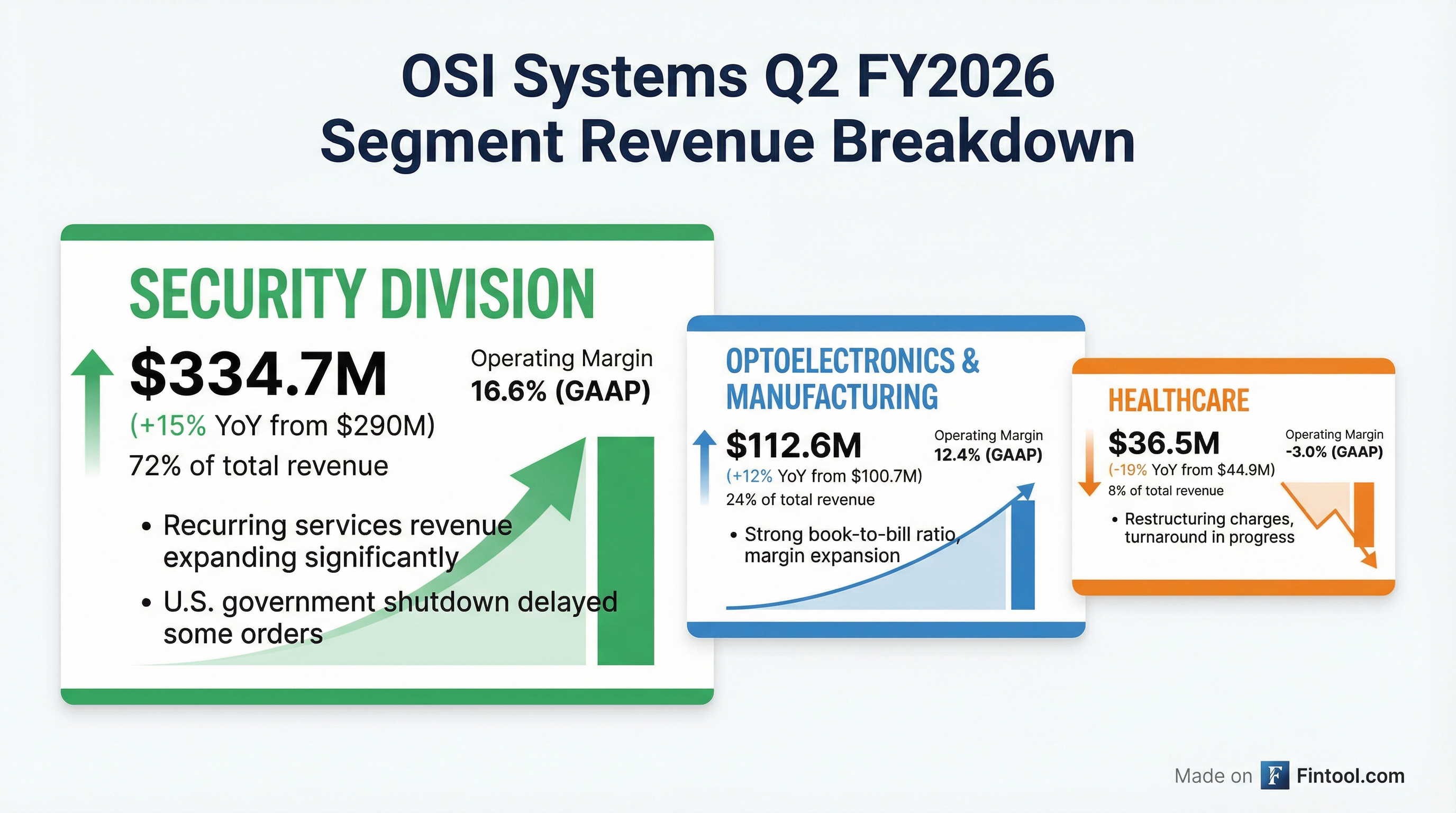

1. Security Division Accelerated (+15% YoY vs +13% in Q1)

- Services revenue continuing to expand as installed base generates recurring revenue

- Aviation, cargo, and RF detection products drove growth

- Backlog remains at $1.8 billion

- New contract wins: $20M radiological threat detection solution, selected for Shield IDIQ (Golden Dome), European winter sporting event

2. Convertible Notes Financing

- Issued $575M of 0.50% convertible senior notes due 2031

- Paid off revolving credit facility

- Repurchased $146M of common stock

- CFO Alan Edrick: "This financing positions us to capture additional growth opportunities while lowering our overall cost of capital."

3. Cash Flow Improved

- Q2 Operating cash flow: $62M vs $52.5M prior year (+18%)

Concerns to Monitor

1. Bookings Softer Than Expected

- Management acknowledged bookings were "softer than expected" partly due to the U.S. government shutdown delaying certain anticipated orders

2. Healthcare Division Weakness

- Revenue down 19% YoY ($36.5M vs $44.9M)

- Operating loss of $1.1M (GAAP) vs $1.7M profit prior year

- Restructuring charges of $1.4M in the quarter

3. Security Margins Compressed

- Security GAAP operating margin: 16.6% vs 18.6% prior year

- Mix shift and difficult Mexico contract comparisons cited

Segment Performance Deep Dive

Security Division (72% of Revenue)

The margin compression reflects:

- Less favorable revenue mix compared to high-margin Mexico contracts in prior year

- Continued R&D investments

- Growth in lower-margin product categories offsetting service margin gains

Optoelectronics & Manufacturing (24% of Revenue)

Strong book-to-bill ratio and margin expansion highlight the division's competitive positioning in precision manufacturing.

Healthcare (8% of Revenue)

Healthcare remains the problem child. Restructuring charges of $1.4M impacted results, and the segment is still in turnaround mode under new leadership.

Capital Allocation Update

The $575M convertible notes offering was a significant Q2 event:

Balance Sheet Snapshot (Dec 31, 2025):

The net leverage increase reflects the convertible offering, partially offset by aggressive share repurchases.

Forward Catalysts

Near-Term (1-2 Quarters):

- Government funding resumption should unlock delayed Security orders

- Mexico receivables collection continuing—DSO expected to decrease by fiscal year-end

- $30M RF naval order announced post-quarter

- European winter sporting event deployment

- Q4 revenue ramp as Mexico headwind subsides

Medium-Term (FY2027+):

- Golden Dome / Shield IDIQ: $151B contract ceiling over 10 years; management characterizes this as a "substantial opportunity that's gonna be meaningful overall to the company"

- FIFA World Cup and Olympics security screening pipeline

- International scanning demand increasing as countries seek trade facilitation with U.S.

- New Texas RF facility expansion to capture Golden Dome orders

- Mexico contracts headwind fully lapping after Q3 FY26

Q&A Highlights

On Golden Dome Opportunity: CEO Mehra confirmed OSI was selected for the Shield IDIQ contract—one of the largest in DoD history at $151B over 10 years—with 2,400 total awardees. OSI is expanding into new Texas facilities to capture this opportunity. When pressed on timing, Mehra noted delivery orders could come "in the foreseeable future" but cautioned that "timing dealing with the government sometimes takes longer."

On Revenue Phasing: CFO Edrick explained Q3 will face a $50M+ revenue headwind from Mexico contract comparisons—the largest quarterly variance of FY26. Q4 growth is expected to be "significantly stronger" as this headwind subsides and backlog converts.

On Security Bookings: Management acknowledged bookings were "softer than expected" due to the government shutdown and international delays, but emphasized these are timing issues: "All those are very much alive in our pipeline, and we expect strong next six months."

On Cash Flow Outlook: Mexico receivables remain OSI's largest receivable. Management expects "outsized free cash flow conversion" as these normalize through FY26 and FY27, potentially resulting in free cash flow exceeding net income.

On Major Events Pipeline: OSI was selected for a major European winter sporting event (announced post-quarter) and expressed confidence in FIFA World Cup and Olympics opportunities. CEO Mehra: "We are uniquely qualified because we've done it so many times...we have a breadth of technology that is really unmatched."

Key Risks

- Government Shutdown Impact: Continued shutdowns could delay bookings and revenue recognition

- Healthcare Turnaround Execution: Division remains unprofitable and subscale

- Security Margin Pressure: Product mix normalization may take several quarters

- Leverage Increase: Net debt increased significantly with convertible offering

- Q3 Headwind: Mexico contract comps create >$50M revenue headwind specifically in Q3

The Bottom Line

OSI Systems delivered another solid quarter, beating estimates and raising guidance despite government shutdown headwinds. The Security division's 15% growth and expanding services revenue support the long-term thesis, while the convertible financing provides strategic flexibility. Healthcare remains a drag, but it's small enough (8% of revenue) that it doesn't derail the overall story.

The stock's muted reaction (-0.6%) suggests the beat was largely in line with buy-side expectations, and investors are waiting for bookings momentum to confirm the H2 ramp management is guiding toward.