Earnings summaries and quarterly performance for OSI SYSTEMS.

Executive leadership at OSI SYSTEMS.

Ajay Mehra

President and Chief Executive Officer

Alan Edrick

Executive Vice President and Chief Financial Officer

Cary Okawa

Chief Accounting Officer

Deepak Chopra

Executive Chairman of the Board

Glenn Grindstaff

Senior Vice President and Chief Human Resources Officer

Manoocher Mansouri

Chief Technology Officer, Optoelectronics and Manufacturing Division

Michael Tropeano

President, Rapiscan

Paul Morben

President, Optoelectronics and Manufacturing Division

Victor Sze

Executive Vice President, General Counsel and Secretary

Wilson Constantine

President, Spacelabs Healthcare

Board of directors at OSI SYSTEMS.

Research analysts who have asked questions during OSI SYSTEMS earnings calls.

Mariana Perez Mora

Bank of America

6 questions for OSIS

Christopher Glynn

Oppenheimer & Co. Inc.

5 questions for OSIS

Jeff Martin

ROTH Capital Partners

4 questions for OSIS

Josh Nichols

B. Riley Financial

4 questions for OSIS

Seth Seifman

JPMorgan Chase & Co.

4 questions for OSIS

Lawrence Solow

CJS Securities, Inc.

3 questions for OSIS

Matthew Akers

Wells Fargo & Company

3 questions for OSIS

Jeffrey Michael Martin

Roth MKM

2 questions for OSIS

Lawrence Scott Solow

CJS Securities

2 questions for OSIS

Michael Joshua Nichols

B. Riley Securities

2 questions for OSIS

Larry Solow

CJS Securities

1 question for OSIS

Recent press releases and 8-K filings for OSIS.

- OSI Systems anticipates a significant shift to stronger domestic growth in its Security division, driven by $1-$1.1 billion allocated for Non-Intrusive Inspection (NII) equipment under the "One Big Beautiful Bill" and expected substantial awards from the $151 billion Golden Dome IDIQ.

- The company expects substantial free cash flow generation in calendar 2026 and 2027, primarily from strong profits and the normalization of accounts receivable following the wind-down of Mexico product contracts.

- Operating margins are projected to expand in fiscal 2027 and beyond, fueled by accelerated growth in higher-margin service revenue (currently 30% of security revenue) and new domestic programs, as difficult comparisons from Mexico contracts conclude.

- The Optoelectronics division demonstrated strong growth, up 12% in the first couple of quarters, and the Healthcare division, while small, offers the highest contribution margins and is undergoing significant R&D investment for new platforms.

- OSI Systems (OSIS) anticipates a significant shift in its Security division's growth drivers from international to domestic, with substantial opportunities expected from CBP border initiatives (including the One Big Beautiful Bill with $1-$1.1 billion allocated for Non-Intrusive Inspection equipment) and Golden Dome (an RF technology acquisition positioned for a $151 billion IDIQ).

- The company expects substantial margin expansion in its Security division, driven by stronger service revenue growth (which carries north of 10 percentage points higher margin than product revenue) and the conclusion of difficult comparisons from Mexico contracts by March.

- OSIS is at an inflection point for free cash flow generation throughout calendar 2026 and into 2027, stemming from strong profits and the normalization of accounts receivable from Mexico contracts.

- The Optoelectronics business has demonstrated strong performance, with 12% revenue growth in the first couple of quarters, while the Healthcare division is investing significantly in R&D for new patient monitoring platforms.

- OSI Systems anticipates a shift in its Security division's growth drivers from past international contracts to stronger domestic opportunities in the U.S., including the "One Big Beautiful Bill" (allocating $1 to $1.1 billion for Non-Intrusive Inspection equipment) and Golden Dome (where the company is on a $151 billion IDIQ for RF technology).

- The company projects operating margin expansion driven by the accelerated growth of higher-margin service revenue (currently ~30% of security revenue with north of 10 percentage points higher margin) and the conclusion of challenging comparisons from Mexico contracts.

- OSI Systems expects substantial free cash flow generation throughout calendar 2026 and into 2027, stemming from strong profits and a release of working capital as Mexico contracts wind down and accounts receivable normalize.

- The Optoelectronics division demonstrated 12% revenue growth in the first two quarters (presumably fiscal 2026) and benefits from a diverse customer base and a global manufacturing footprint that has attracted customers seeking alternatives to China.

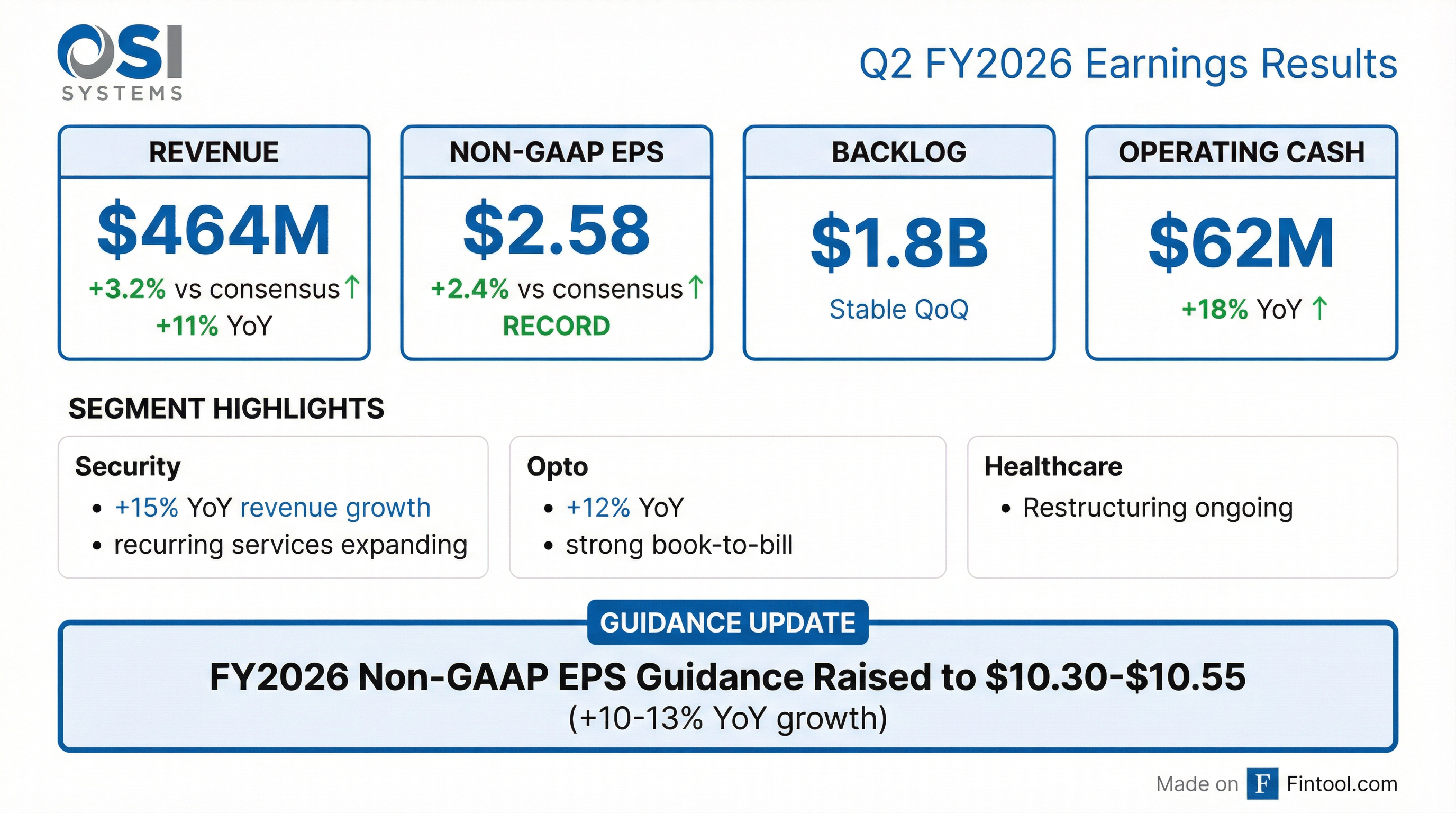

- OSI Systems reported strong Q2 fiscal 2026 financial results, with revenues increasing 11% year-over-year to a record $464 million and non-GAAP adjusted EPS reaching a record $2.58.

- The company raised its fiscal 2026 non-GAAP EPS guidance to a range of $10.30-$10.55, representing 10%-13% year-over-year growth, while maintaining revenue guidance.

- Revenue growth was driven by double-digit increases in the Security and Optoelectronics divisions, although revenue from large Mexico security contracts decreased 50% in Q2, creating an expected $50 million headwind for Q3.

- OSI Systems generated $62 million in operating cash flow and enhanced financial flexibility through a $575 million convertible notes transaction, which also facilitated the buyback of approximately 547,000 shares at an average price of $267 per share.

- Strategic wins for the Security division include a $20 million international award for radiological threat detection and selection for the U.S. Missile Defense Agency's $151 billion Shield IDIQ contract, prompting an expansion of the RF operational footprint.

- OSI Systems reported record Q2 fiscal 2026 revenues of $464 million, an 11% year-over-year increase, and record non-GAAP adjusted EPS of $2.58.

- The company raised its fiscal 2026 non-GAAP EPS guidance to a range of $10.30-$10.55, representing 10%-13% year-over-year growth, while maintaining its revenue guidance.

- The Security division grew 15% year-over-year to $335 million, and the Optoelectronics and Manufacturing division grew 12% to $113 million. Security bookings were softer than expected due to timing delays, but the company secured a $30 million international naval order and was selected for the $151 billion Shield contract.

- OSI Systems generated $62 million in operating cash flow and expects stronger cash flow in the second half of fiscal 2026 from Mexico receivables, alongside a $575 million convertible notes transaction and a buyback of approximately 547,000 shares.

- OSI Systems reported strong second quarter fiscal 2026 financial results, with revenues increasing 11% year-over-year to a record $464 million and non-GAAP adjusted EPS reaching a record $2.58.

- The company raised its fiscal 2026 non-GAAP earnings per diluted share guidance to a range of $10.30-$10.55, representing 10%-13% year-over-year growth.

- Both the Security and Optoelectronics and Manufacturing divisions achieved double-digit top-line growth, with Security revenues up 15% to $335 million and Opto revenues up 12% to $113 million, even as revenues from large Mexico security contracts decreased 50%.

- The company generated $62 million in operating cash flow and completed a $575 million convertible notes transaction, which included buying back approximately 547,000 shares at an average price of $267 per share.

- The RF business was selected to participate in the $151 billion Shield IDIQ contract for the U.S. Missile Defense Agency's Golden Dome initiative, leading to an expansion of its operational footprint in Texas.

- OSI Systems reported record Q2 fiscal 2026 revenues of $464 million, an 11% year-over-year increase, and record non-GAAP diluted earnings per share of $2.58.

- The company generated $62 million in operating cash flow during the quarter and maintained a backlog of $1.8 billion as of December 31, 2025.

- OSI Systems raised its fiscal 2026 non-GAAP diluted earnings per share guidance to a range of $10.30 - $10.55, indicating 10% - 13% year-over-year growth.

- In November 2025, the company issued $575 million of convertible senior notes and used a portion of the proceeds to repurchase $146 million of common stock.

- OSI Systems reported record second quarter fiscal 2026 revenues of $464 million, an 11% year-over-year growth, with non-GAAP diluted earnings per share of $2.58 and GAAP diluted earnings per share of $2.22 for the period ended December 31, 2025.

- The company generated $62 million in operating cash flow during the second quarter of fiscal 2026.

- OSI Systems increased its fiscal 2026 non-GAAP diluted earnings per share guidance to a range of $10.30 - $10.55, representing 10% - 13% year-over-year growth.

- The company's backlog was $1.8 billion as of December 31, 2025.

- In November 2025, OSI Systems issued $575 million of convertible senior notes and used part of the net proceeds to repurchase $146 million of its common stock.

- OSI Systems' Security division has been awarded a contract to deliver multiple screening technologies for an upcoming major global sporting event in Europe this winter.

- These systems will be utilized to screen people, baggage, and cargo to support a safe experience for attendees.

- Ajay Mehra, President and CEO of OSI Systems, stated that the company's security solutions are designed to meet the unique challenges of large-scale venues.

- OSI Systems' Security division announced an international order for approximately $30 million.

- The order is for the deployment of advanced radio frequency (RF)-based communication and surveillance systems for naval operations.

- The project will occur over a multi-year period and includes supporting the integration of transmission systems and related technologies to upgrade existing operations.

Quarterly earnings call transcripts for OSI SYSTEMS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more