Earnings summaries and quarterly performance for Otis Worldwide.

Executive leadership at Otis Worldwide.

Board of directors at Otis Worldwide.

Christopher Kearney

Director

Jeffrey Black

Director

Jill Brannon

Director

John Walker

Lead Independent Director

Kathy Hannan

Director

Margaret Preston

Director

Nelda Connors

Director

Shelley Stewart Jr.

Director

Thomas Bartlett

Director

Research analysts who have asked questions during Otis Worldwide earnings calls.

Christopher Snyder

Morgan Stanley

9 questions for OTIS

Julian Mitchell

Barclays Investment Bank

9 questions for OTIS

Nigel Coe

Wolfe Research, LLC

9 questions for OTIS

Jeffrey Sprague

Vertical Research Partners

7 questions for OTIS

Amit Mehrotra

UBS

6 questions for OTIS

Steve Tusa

JPMorgan Chase & Co.

6 questions for OTIS

Joseph O'Dea

Wells Fargo & Company

5 questions for OTIS

Joe O'Dea

Wells Fargo

4 questions for OTIS

Nicole DeBlase

BofA Securities

4 questions for OTIS

Rob Wertheimer

Melius Research LLC

4 questions for OTIS

C. Stephen Tusa

JPMorgan Chase & Co.

2 questions for OTIS

Jeff Sprague

Vertical Research

2 questions for OTIS

Nicholas Housden

RBC Capital Markets

2 questions for OTIS

Nick Housden

RBC Capital Markets

2 questions for OTIS

Philip Buller

Berenberg

2 questions for OTIS

Miguel Borrega

BNP Paribas

1 question for OTIS

Patrick Baumann

JPMorgan Chase & Co.

1 question for OTIS

Robert Wertheimer

Melius Research

1 question for OTIS

Recent press releases and 8-K filings for OTIS.

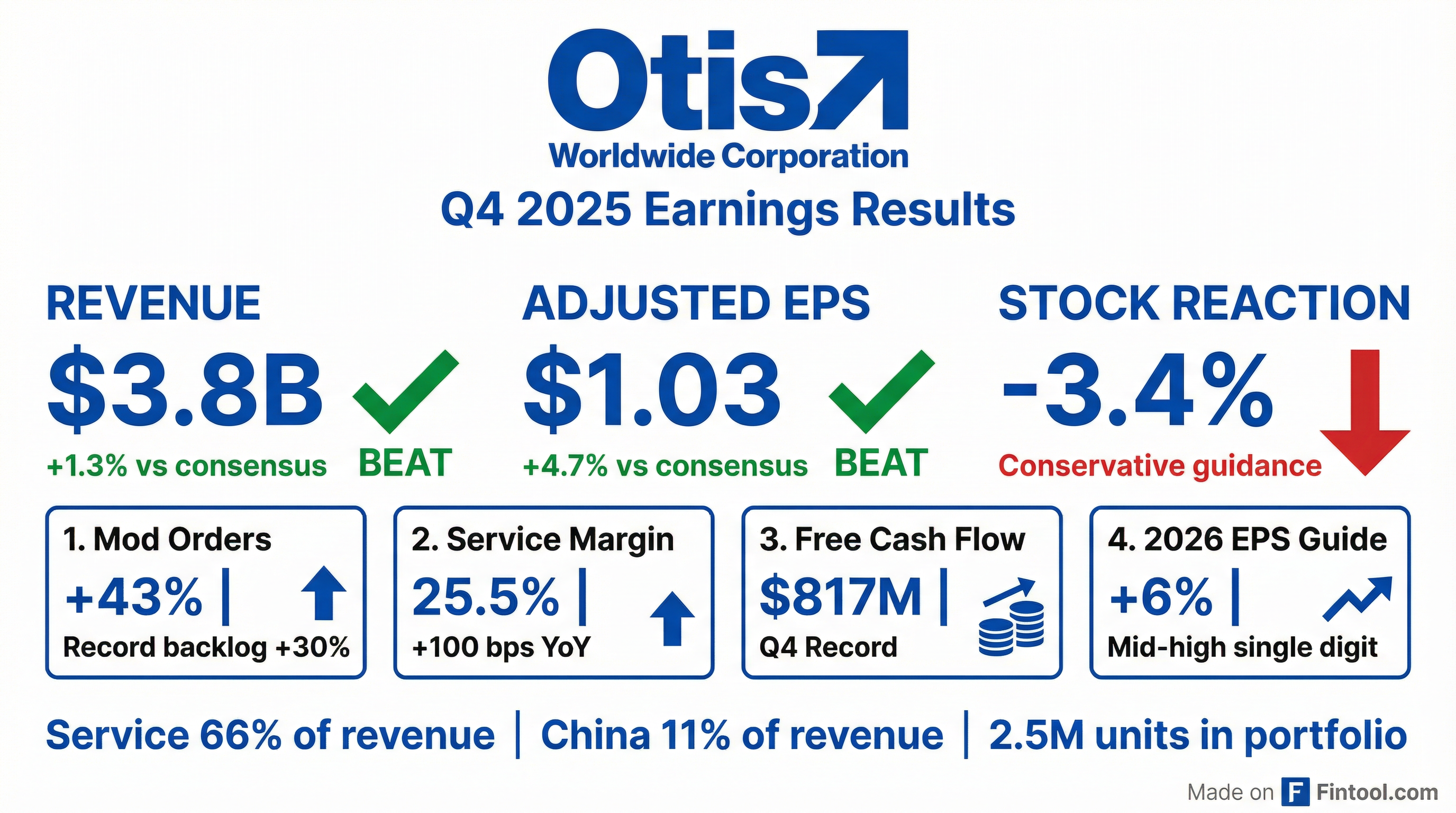

- Otis delivered $3.8 billion in Q4 net sales (organic +1%), 16.6% adjusted operating profit margin (+70 bps), and 11% adjusted EPS growth, while generating a record Q4 adjusted free cash flow of $817 million and $1.6 billion for the year.

- Service segment organic sales grew 5% (maintenance & repair +4%, modernization +9%), with service operating profit margin expanding 100 bps to 25.5%, supported by a 4% maintenance portfolio increase to 2.5 million units.

- Modernization orders jumped 43%, lifting the backlog 30% at constant currency; total new equipment backlog rose 2% (and 9% ex-China), positioning the company for 2026 growth.

- Returned $1.5 billion to shareholders through dividends and buybacks and invested $100 million in bolt-on acquisitions; 2026 outlook calls for total organic sales up low- to mid-single digits and mid- to high-single-digit EPS growth on $15–15.3 billion revenue.

- Otis reported net sales of $3.8 billion in Q4 2025, with organic sales up 1% year-over-year.

- Adjusted operating profit margin expanded by 70 basis points to 16.6%, driven by a 100 bps improvement in service margin; adjusted EPS grew 11% in the quarter.

- Achieved a record quarterly adjusted free cash flow of $817 million, contributing to $1.6 billion of free cash flow for the full year 2025.

- Modernization backlog increased 30% at constant currency, total backlog rose 8%, while the service portfolio reached 2.5 million units, up 4%.

- For 2026, Otis guides organic sales growth of low- to mid-single digits, service growth of mid- to high-single digits, new equipment sales down low-single digits to flat, and expects $1.6 billion–$1.7 billion in adjusted free cash flow.

- Record adjusted free cash flow of $817 million in Q4 and $1.6 billion for FY 2025; returned $1.5 billion to shareholders through dividends and share repurchases.

- Net sales of $3.8 billion in Q4 (+1% organic), with service sales up 5% (maintenance & repair +4%, modernization +9%); adjusted operating profit margin expanded 70 bps to 16.6%, and adjusted EPS rose 11%.

- Maintenance portfolio grew 4% to approximately 2.5 million units, while modernization backlog increased 30% at constant currency, underscoring strong service demand.

- 2026 guidance: total net sales of $15.0–15.3 billion, organic sales growth in low- to mid-single digits, and adjusted EPS expected to grow mid- to high-single digits.

- In Q4, net sales rose 3% to $3.8 billion and GAAP EPS increased 13% to $0.95; organic sales up 1% and service sales up 8% (organic +5%).

- Full year net sales reached $14.4 billion (flat organic growth); GAAP EPS fell 14% to $3.50 while adjusted EPS rose 6% to $4.05.

- Returned $800 million via share repurchases and generated $1.6 billion of operating cash flow in 2025.

- 2026 outlook: organic sales up low- to mid-single digits, adjusted EPS up mid- to high-single digits, and adjusted free cash flow of $1.6–1.7 billion.

- Q4 net sales of $3.796 B (+3% YoY; organic +1%), service net sales $2.503 B (+8% YoY; organic +5%), GAAP EPS $0.95 (+13%) and adjusted EPS $1.03 (+11%)

- Full year net sales of $14.431 B (+1% YoY; organic flat), GAAP EPS $3.50 (–14%) and adjusted EPS $4.05 (+6%); share repurchases of $800 M in 2025

- Q4 operating cash flow $817 M and adjusted free cash flow $817 M; full-year operating cash flow $1.596 B and adjusted free cash flow $1.583 B

- Outlook for 2026: organic sales up low to mid-single digits, adjusted EPS up mid to high single digits, and adjusted free cash flow of $1.6–$1.7 B

- Modernization orders up 43% at constant currency; modernization backlog up 30% at constant currency

- Otis has been chosen by Transport for London (TfL) to service and modernize 172 escalators on the London Underground starting April 2026, raising its total network units to over 300.

- The contract covers maintenance, refurbishment, or full replacement of escalators to enhance reliability, safety, energy efficiency, and the overall passenger experience.

- TfL escalators operate up to 20 hours daily and handle 1.2 billion passenger journeys annually, highlighting the importance of this modernization program.

- Globally, Otis maintains approximately 2.4 million customer units and moves 2.4 billion people each day, underpinning its service scale and expertise.

- Otis delivered $3.7 billion in Q3 net sales with 2% organic growth, achieved an adjusted operating margin of 17.1%, and saw adjusted EPS increase 9% (up $0.09) year-over-year.

- Service segment organic sales grew 6%, service operating profit reached $621 million, and service margins expanded to 25.5%, driven by higher volume and pricing.

- New equipment organic sales declined 5%, with new equipment operating profit of $59 million and margins contracting to 4.7% amid lower volumes and mix headwinds.

- Total backlog rose 22%, new equipment orders were up 4% (7% ex-China), and modernization orders increased 27%, supported by broad regional strength.

- Otis generated $337 million of adjusted free cash flow in Q3 ($766 million YTD) and completed its full-year share repurchase target of ~$800 million.

- Otis reported Q3 net sales of $3.7 billion, with organic sales up 2%—driven by 6% service and 14% modernization growth—and achieved an adjusted operating profit margin of 17.1% (+20 bps); adjusted EPS rose 9% (+$0.09).

- Service segment performance: organic service sales grew 6% (maintenance +4%, repair +7%, modernization +14%), service operating profit was $621 million (+$49 million), and margin expanded 70 bps to 25.5%.

- New equipment segment saw organic sales decline 5% due to China (–20%) and Americas (–7%); new equipment operating profit was $59 million (–$24 million) with margin at 4.7% (–170 bps).

- Backlogs remained robust: Q3 modernization orders +27%, combined new equipment and modernization orders +9%, total backlog +22%, and service portfolio approaching 2.5 million units (+4%).

- Guidance reaffirmed: full-year net sales of $14.5–14.6 billion (+1% organic), adjusted operating profit of $2.4–2.5 billion, adjusted EPS of $4.04–4.08 (+5–7%), and adjusted free cash flow of ~$1.45 billion; YTD share repurchases totaled ~$800 million.

- Otis delivered net sales of $3.7 billion, with organic sales up 2%, adjusted operating profit margin of 17.1% (+20 bps), adjusted EPS up 9%, and adjusted free cash flow of $337 million in Q3 2025.

- Service segment outperformed: organic service sales grew 6%, driven by maintenance & repair (+4% and +7%, respectively) and modernization up 14%, with service margins expanding 70 bps to 25.5%, the highest since spin.

- Order activity remained strong: combined new equipment and modernization orders grew 9%, modernization orders accelerated 27%, and total backlog rose 22% year-over-year.

- Reinforcing guidance and capital allocation, full-year net sales are projected at $14.5 – 14.6 billion (organic ~1%), adjusted EPS at $4.04 – 4.08 (+5 – 7%), and adjusted free cash flow of $1.45 billion, while completing $250 million of share repurchases in Q3 ($800 million YTD).

- Third quarter net sales of $3.7 billion (+4% YoY; organic +2%), driven by Service net sales up 9% (organic +6%)

- GAAP EPS of $0.95 (-29% YoY) and adjusted EPS of $1.05 (+9% YoY)

- Service operating profit margin expanded 70 bps to 25.5%, while modernization orders grew 27% and backlog increased 22% YoY

- Year-to-date operating cash flow of $779 million and share repurchases of approximately $800 million

- Increased the midpoint of 2025 adjusted EPS outlook to $4.06 (range $4.04–$4.08)

Quarterly earnings call transcripts for Otis Worldwide.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more