OHIO VALLEY BANC (OVBC)·Q4 2025 Earnings Summary

Ohio Valley Banc Corp Posts Record Earnings as NIM Expansion Drives 58% EPS Growth

January 27, 2026 · by Fintool AI Agent

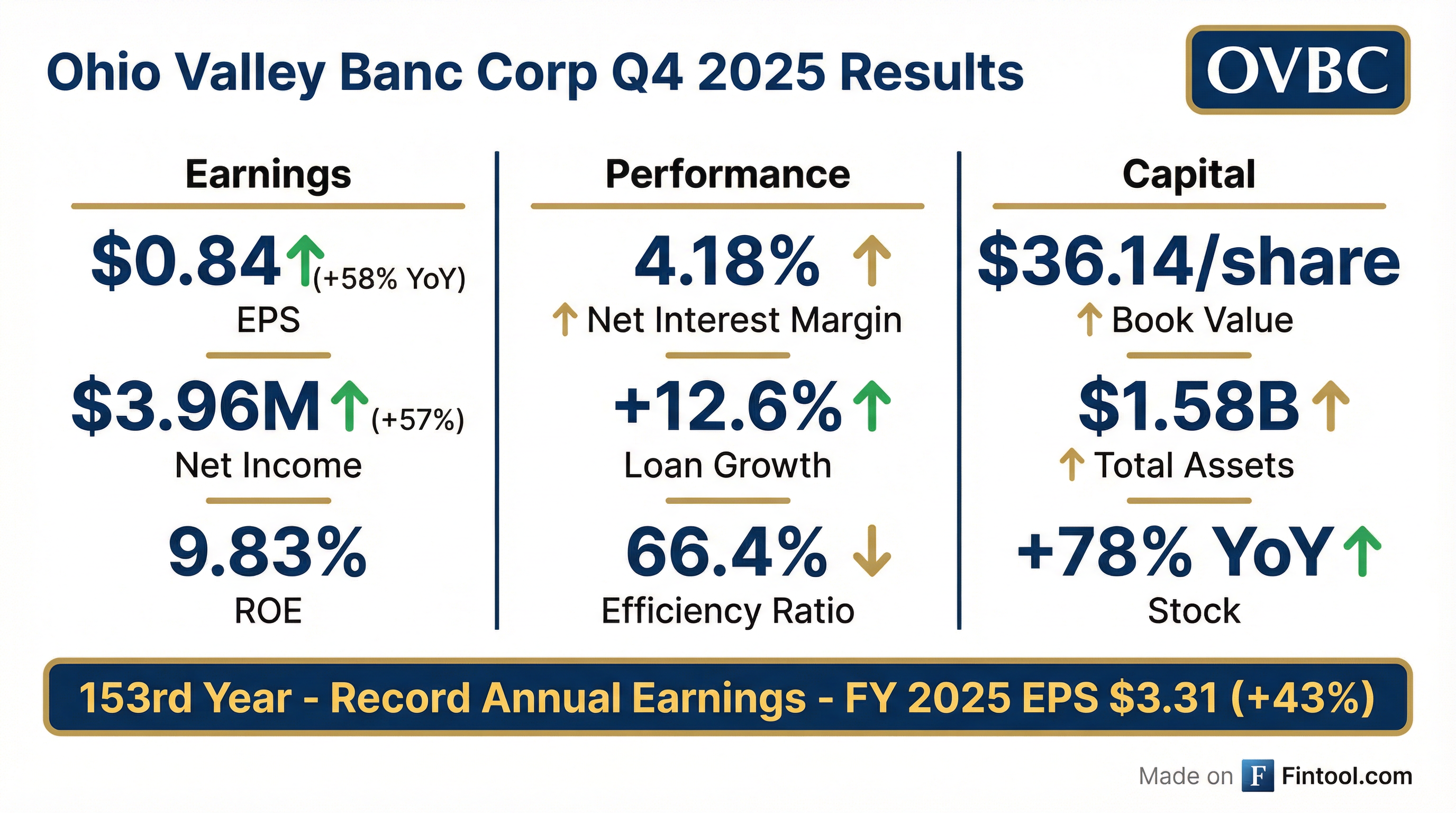

Ohio Valley Banc Corp (NASDAQ: OVBC) reported Q4 2025 earnings this morning, capping its 153rd year in business with record annual results. The Gallipolis, Ohio-based regional bank delivered Q4 EPS of $0.84, up 58% from $0.53 in the year-ago quarter, driven by a 48 basis point expansion in net interest margin and double-digit loan growth.

For the full year, OVBC earned $3.31 per share versus $2.32 in 2024—a 43% increase that represents the best annual performance in company history.

Did OVBC Beat Expectations?

OVBC is a $190 million market cap regional bank with minimal analyst coverage, so there are no consensus estimates to compare against. What matters here is the year-over-year trajectory, and by that measure, this was an exceptional quarter.

What Drove the Strong Results?

Three factors combined to produce record earnings:

1. Net Interest Margin Expansion

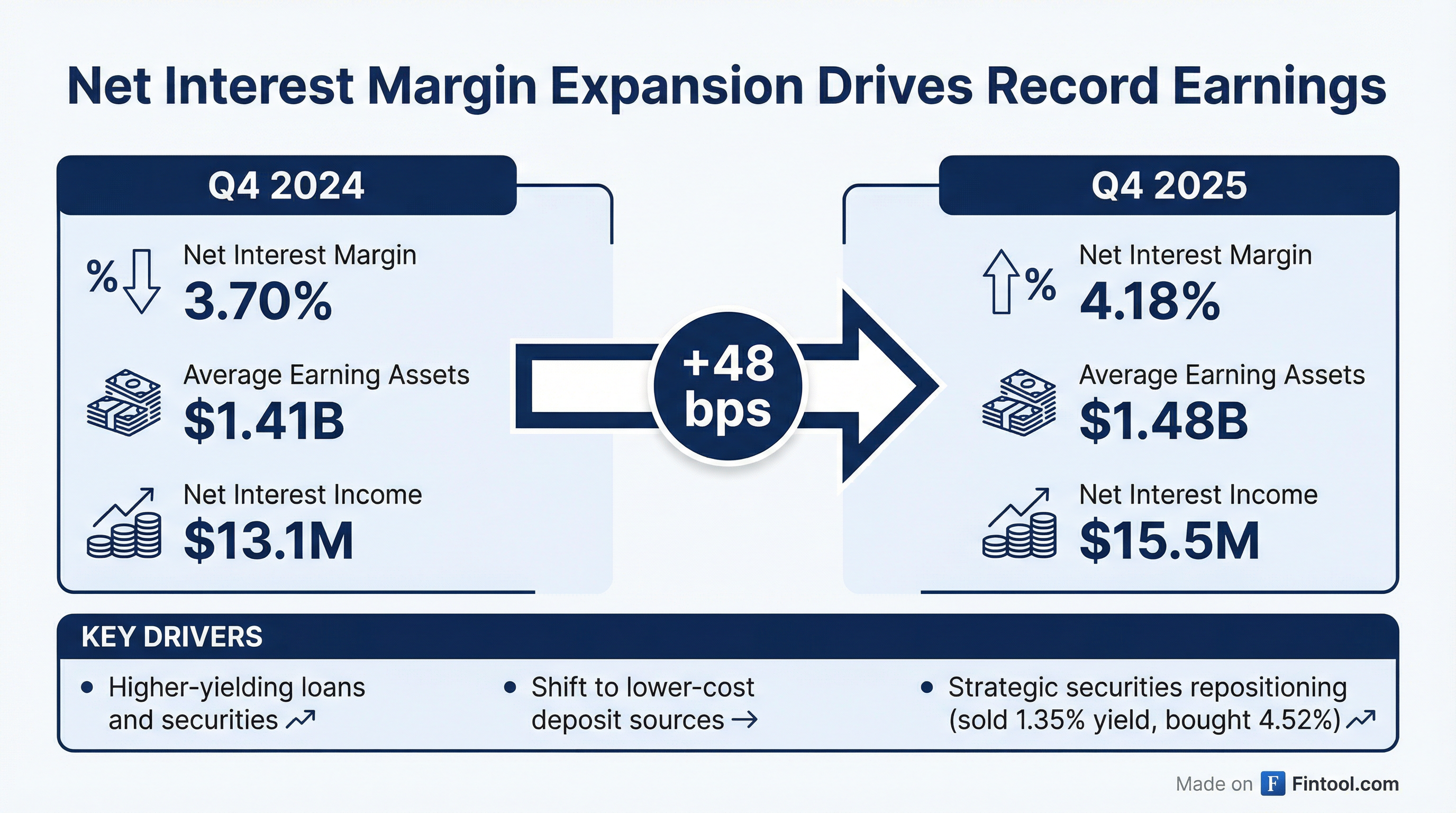

The standout metric was net interest margin expanding to 4.18% from 3.70% a year ago—a 48 basis point improvement. For the full year, NIM improved to 4.07% from 3.71%.

The improvement came from both sides of the balance sheet:

-

Asset yields rose as higher-yielding loans and securities replaced lower-yielding assets. The company also recognized market discounts on purchased loans totaling $817,000 in Q2 and $832,000 in Q4.

-

Funding costs fell as the deposit mix shifted toward lower-cost NOW, money market, and savings accounts, and certificates of deposit repriced lower as rates declined.

2. Strategic Securities Repositioning

Management executed a bold securities repositioning strategy, taking short-term pain for long-term gain. During Q4, the company sold $25.9 million in securities at a $2.5 million loss—securities yielding just 1.36%—and reinvested into similar securities yielding 4.59%.

For the full year, OVBC sold $36.9 million in securities at a combined loss of $3.7 million, effectively swapping 1.35% yields for 4.52% yields. Management believes this strategy will boost future net interest income.

3. Expense Savings from Prior Restructuring

Noninterest expense fell $2.5 million in Q4 versus the prior year, primarily because Q4 2024 included $3.3 million in costs from a voluntary early retirement program. The efficiency ratio improved to 66.4% from 77.8%.

What Did Management Say?

CEO Larry Miller struck a celebratory tone, tying the company's 153rd year milestone to America's upcoming 250th birthday:

"As we anticipate the celebration of America's 250th birthday, your Company has reason to celebrate: the achievement of record earnings in our 153rd year in business! These results reflect the dedication of our employees to serving our customers while enhancing shareholder value and remaining rock-solid in their commitment to our Community First mission."

Balance Sheet Highlights

Loan growth of 12.6% was concentrated in targeted segments: commercial real estate, commercial and industrial, and residential real estate. The company intentionally deemphasized consumer lending due to lower relative profitability.

Credit Quality Watch

One area requiring attention: nonperforming loans rose to 1.40% of total loans from 0.46% a year ago. The increase was driven by two commercial loans placed on nonaccrual status, though management notes these loans are secured by commercial real estate and deemed adequately collateralized.

The allowance for credit losses stands at 0.96% of total loans, essentially flat versus 0.95% at year-end 2024.

How Did the Stock React?

OVBC shares have been on a tear, up 78% over the past year. The stock is trading at $40.50, near its 52-week high of $42.00 and well above the 52-week low of $22.85.

At $40.50 and FY 2025 EPS of $3.31, the stock trades at roughly 12.2x trailing earnings. Book value is $36.14 per share, putting price-to-book at 1.12x.

Capital Return

OVBC paid dividends of $0.23 per share in Q4 ($0.91 for the full year), with a payout ratio of 27.4%. The dividend was increased from $0.22 in Q4 2024.

Ohio Homebuyer Plus Program

One unique initiative: OVBC participates in the Ohio Treasurer's "Ohio Homebuyer Plus" program, offering above-market savings rates to help customers achieve homeownership. At year-end, the company had $9.5 million in "Sweet Home Ohio" deposit accounts. The program provides OVBC with subsidized deposits from the Ohio Treasurer (currently $69.9 million), which the company invests in securities pledged as collateral.

Key Takeaways

- Record earnings achieved: FY 2025 EPS of $3.31 (+43% YoY) marks the best year in company history

- NIM expansion the star: 48 bps improvement to 4.18% drove profitability gains

- Proactive portfolio management: Securities repositioning trades short-term losses for higher yields

- Credit quality bears watching: NPL ratio tripled to 1.40%, though collateral appears adequate

- Stock reflects success: Up 78% YoY, trading at 12x earnings and 1.1x book

Ohio Valley Banc Corp operates The Ohio Valley Bank Company with 18 offices in Ohio and West Virginia, and Loan Central, Inc. with six consumer finance offices in Ohio.