Earnings summaries and quarterly performance for OHIO VALLEY BANC.

Executive leadership at OHIO VALLEY BANC.

Larry E. Miller II

Detailed

President and Chief Executive Officer

CEO

BF

Bryan F. Stepp

Detailed

Senior Vice President

RJ

Ryan J. Jones

Detailed

Chief Operating and Risk Officer

SW

Scott W. Shockey

Detailed

Senior Vice President and Chief Financial Officer

TR

Tom R. Shepherd

Detailed

Senior Vice President and Secretary

Board of directors at OHIO VALLEY BANC.

AP

Anna P. Barnitz

Detailed

Director

BA

Brent A. Saunders

Detailed

Director

BR

Brent R. Eastman

Detailed

Director

DW

David W. Thomas

Detailed

Lead Independent Director

EB

Edward B. Roberts

Detailed

Director

EJ

Edward J. Robbins

Detailed

Director

KR

K. Ryan Smith

Detailed

Director

KA

Kimberly A. Canady

Detailed

Director

SI

Seth I. Michael

Detailed

Director

TE

Thomas E. Wiseman

Detailed

Chairman of the Board

Research analysts covering OHIO VALLEY BANC.

Recent press releases and 8-K filings for OVBC.

Ohio Valley Banc Corp. Reports Record Fiscal Year 2025 Earnings

OVBC

Earnings

Revenue Acceleration/Inflection

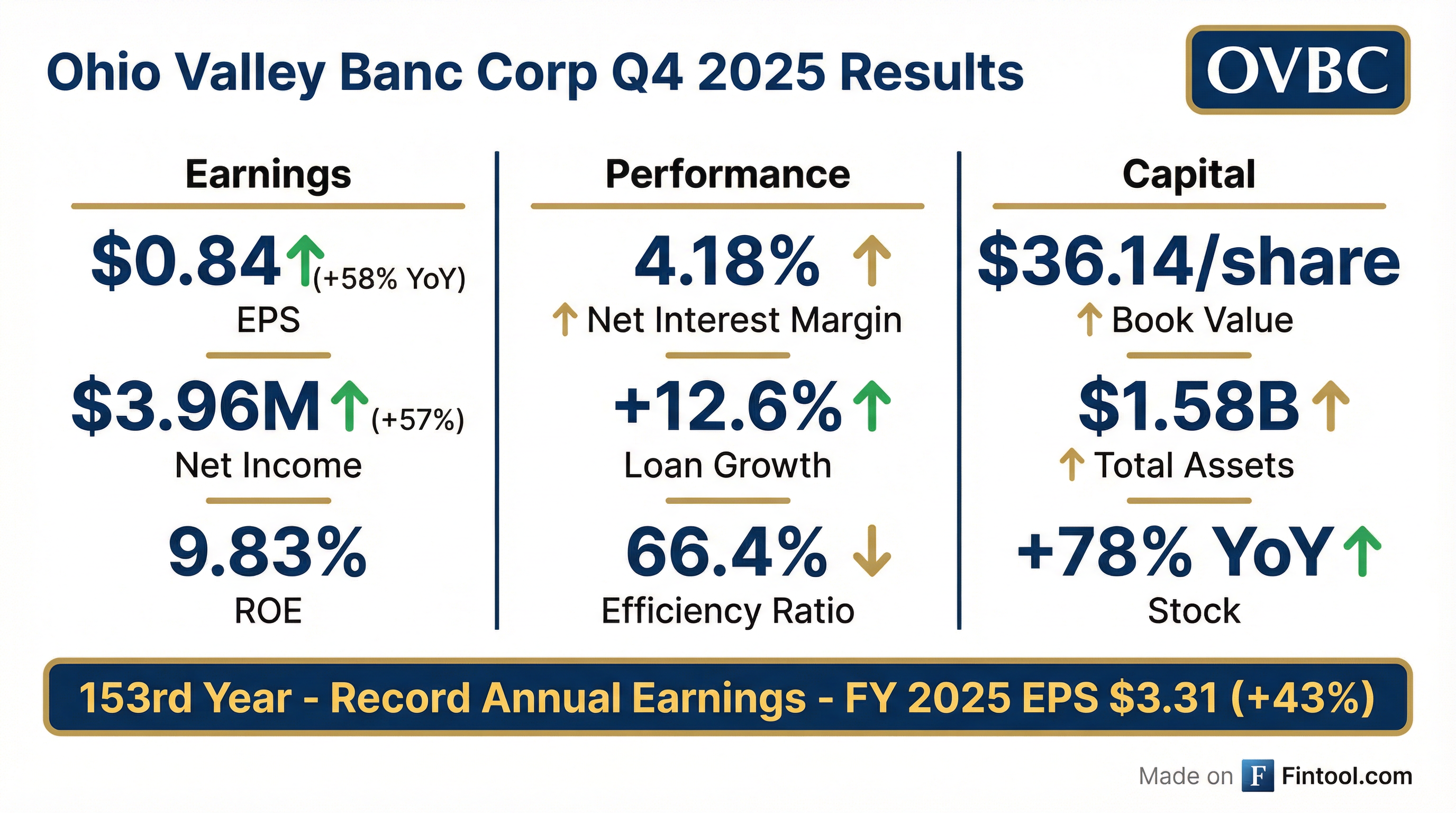

- Ohio Valley Banc Corp. reported record net income of $15,601,000 for the year ended December 31, 2025, representing a 41.8% increase from the prior year, with earnings per share of $3.31.

- For the fourth quarter of 2025, net income was $3,955,000, an increase of 57.3% from the same period last year, and earnings per share were $0.84.

- The company's net interest margin improved to 4.18% for the fourth quarter of 2025 and 4.07% for the full year 2025, driven by increased yield on earning assets and decreased cost of funding sources.

- Total assets grew to $1.583 billion at December 31, 2025, an increase of $79 million from December 31, 2024, primarily due to a $134 million increase in loan balances.

- For the year ended December 31, 2025, return on average assets was 1.02% and return on average equity was 9.83%.

Jan 27, 2026, 8:38 PM

Ohio Valley Banc Corp. Reports Record Q4 and Full-Year 2025 Earnings

OVBC

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- Ohio Valley Banc Corp. reported record net income of $3,955,000 for the fourth quarter of 2025, a 57.3% increase from the prior year, with earnings per share of $0.84. For the full year 2025, net income totaled $15,601,000, up 41.8%, and EPS was $3.31.

- The net interest margin improved to 4.18% for Q4 2025, up from 3.70% in Q4 2024, and to 4.07% for the full year 2025, up from 3.71% in 2024.

- Total assets reached $1.583 billion at December 31, 2025, an increase of $79 million from December 31, 2024, primarily driven by a 12.6% increase in loan balances.

- Noninterest income decreased due to $3,747,000 in losses from strategic security sales in 2025, while noninterest expense decreased by $1,921,000 for the full year, mainly from savings related to a Q4 2024 voluntary early retirement program.

Jan 27, 2026, 6:34 PM

Ohio Valley Banc Corp. Reports Strong Q3 2025 Earnings and Net Interest Margin Expansion

OVBC

Earnings

New Projects/Investments

Dividends

- Ohio Valley Banc Corp. reported net income of $3,030,000 for the third quarter of 2025, an 11.4% increase from the prior year, with earnings per share of $0.64. For the first nine months of 2025, net income totaled $11,646,000, up 37.3% year-over-year, and EPS was $2.47.

- The net interest margin increased to 4.05% for Q3 2025, up from 3.76% in Q3 2024, and to 4.03% for the nine months ended September 30, 2025, compared to 3.71% in the prior year period. This improvement was driven by an increase in the yield on earning assets and a decrease in the cost of funding sources.

- Total assets reached $1.570 billion at September 30, 2025, an increase of $67 million from December 31, 2024, primarily due to a $69 million increase in loan balances and a $57 million increase in total deposits.

- During the third quarter of 2025, the company sold $11.0 million in securities yielding 1.32% and reinvested the proceeds into securities yielding 4.37%, a strategic move to increase future interest income and net interest margin.

Oct 27, 2025, 8:42 PM

Ohio Valley Banc Corp. Reports Strong Q3 2025 Earnings and Improved Net Interest Margin

OVBC

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- Ohio Valley Banc Corp. reported net income of $3,030,000 for the third quarter of 2025, an 11.4% increase from the prior year, with earnings per share of $0.64. For the first nine months of 2025, net income totaled $11,646,000, a 37.3% increase, and EPS was $2.47.

- The company's net interest margin improved to 4.05% for Q3 2025, up from 3.76% in Q3 2024, and to 4.03% for the first nine months of 2025, up from 3.71% in the prior year. This increase was attributed to a higher yield on earning assets and a decreased cost of funding sources.

- Total assets grew to $1.570 billion at September 30, 2025, an increase of $67 million from December 31, 2024. Over the same period, loan balances increased $69 million, and total deposits increased $57 million.

- The company strategically sold $11.0 million in securities yielding 1.32% and reinvested the proceeds into securities yielding 4.37% to enhance future interest income and net interest margin.

- Asset quality remained strong, with the ratio of nonperforming loans to total loans decreasing to 0.42% at September 30, 2025, compared to 0.46% at December 31, 2024.

Oct 27, 2025, 4:38 PM

OVBC Declares Cash Dividend

OVBC

Dividends

- Ohio Valley Banc Corp. (OVBC) declared a cash dividend of $0.23 per common share on October 21, 2025.

- The dividend is payable on November 10, 2025, to shareholders of record as of October 31, 2025.

- The Chairman of the Board stated that 2025 has been a very successful year so far, with the company achieving double-digit earnings growth through the first three quarters.

Oct 21, 2025, 9:52 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more