Oak Valley Bancorp (OVLY)·Q4 2025 Earnings Summary

Oak Valley Bancorp Hits $2B Asset Milestone, But Credit Blemish Weighs on Q4

January 26, 2026 · by Fintool AI Agent

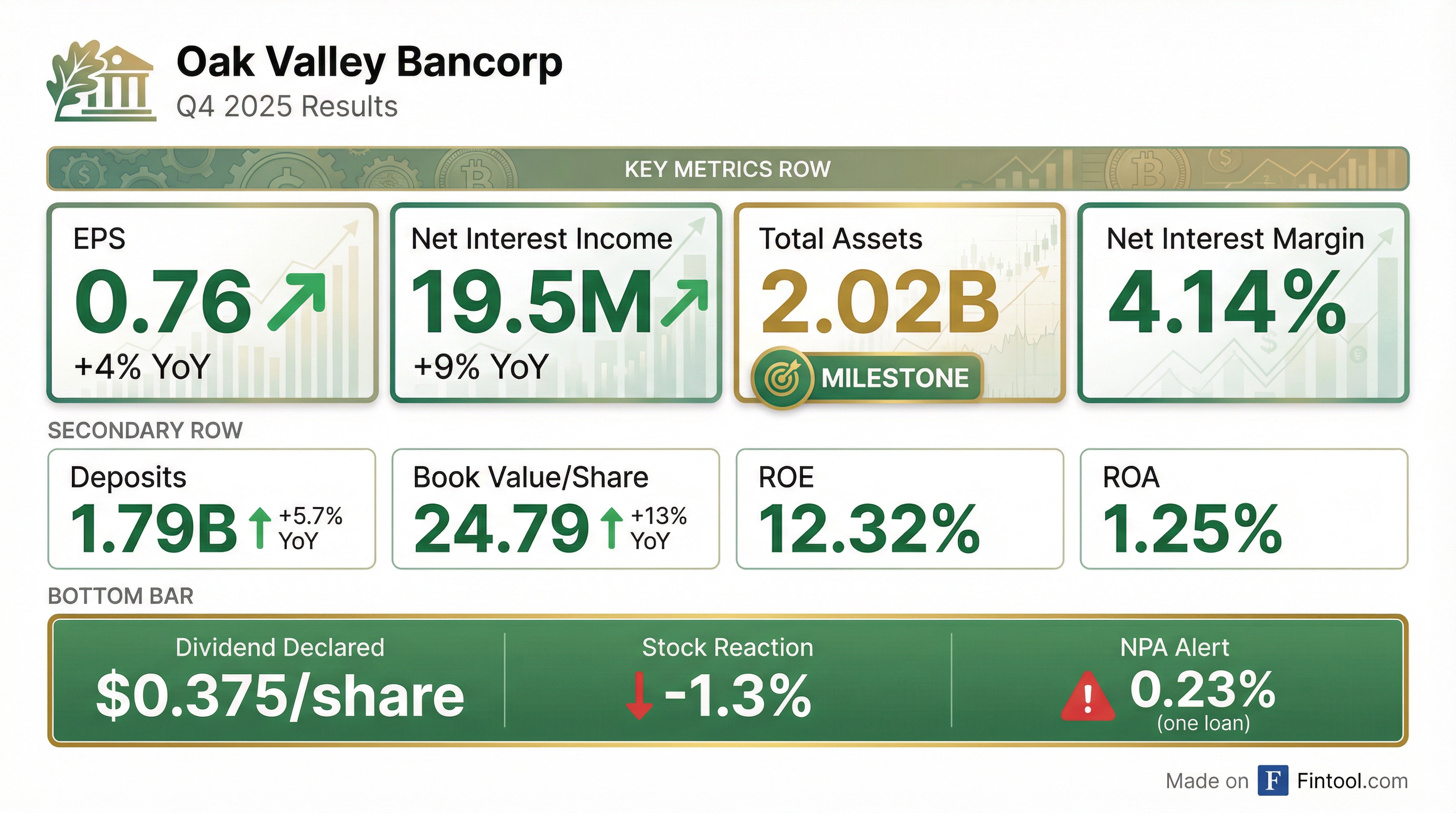

Oak Valley Bancorp (NASDAQ: OVLY) reported Q4 2025 earnings of $0.76 per diluted share, up 4% year-over-year but down from Q3's $0.81 . The quarter was defined by two competing narratives: a landmark $2 billion in total assets milestone showcasing sustained growth, versus the bank's first non-performing asset in years that required an $865,000 provision .

CEO Chris Courtney struck an optimistic tone despite the credit charge: "We are pleased to report another strong operational performance. Our sustained growth and solid financial results have enabled us to reach the milestone of $2 billion in total assets and reflect the dedication of our team and our steadfast focus on building lasting relationships with our clients."

Did Oak Valley Bancorp Beat Earnings?

Oak Valley Bancorp has limited sell-side analyst coverage, so there's no formal consensus to measure against. Here's how Q4 2025 stacked up against recent quarters:

Key Takeaway: Earnings grew 5.4% YoY but declined 5.4% sequentially, entirely due to the $865K credit provision .

What Changed This Quarter?

The $2 Billion Milestone

Total assets reached $2.02 billion, up $122.5 million (6.4%) from year-end 2024 . This milestone reflects:

- Gross loan growth: $1.14B, up $37.4M YoY

- Deposit growth: $1.79B, up $97.3M YoY

- Strong liquidity: $232.2M in cash and equivalents

- Branch expansion: Now 19 locations, up from 18

The Credit Blemish

For the first time in years, OVLY reported non-performing assets:

The culprit: "One collateral-dependent loan that was placed on non-accrual status in December 2025, when management became aware that full collection of the loan balance was not likely."

Management provided reassurance on the broader CRE portfolio: "Given industry concerns of credit risk specific to commercial real estate, management has performed a thorough analysis of this segment within the ACL computation, concluding that the credit loss reserves relative to gross loans remain at acceptable levels, and credit quality remains stable."

How Did Net Interest Margin Hold Up?

Despite three Fed rate cuts totaling 75 basis points starting in September 2025, OVLY's margin proved resilient:

The 2 basis point sequential decline was "due to the three federal fund rate cuts totaling 75 basis points that began in September 2025" — remarkably modest compression given the rate environment.

Full-year NIM expanded to 4.13% from 4.07% in 2024, driven by loan yield improvement and lower funding costs .

Full Year 2025 Performance

Full-year earnings declined despite revenue growth due to expense increases (+9.3%) and the credit provision swing — OVLY had a $1.6M reversal in 2024 versus an $805K provision in 2025 .

Did Oak Valley Declare a Dividend?

Yes. The Board declared a $0.375 per share cash dividend at their January 20, 2026 meeting :

- Record Date: February 2, 2026

- Payment Date: February 13, 2026

- Total Payout: ~$3.15 million

- 2025 Total Dividends: $0.60 per share

- 2024 Total Dividends: $0.45 per share

The 33% YoY increase in annual dividends reflects confidence in the bank's capital position and earnings power.

How Did the Stock React?

OVLY shares fell 1.3% on earnings day (January 23, 2026), closing at $32.13 versus $32.55 the prior session. Volume was elevated at 14,000 shares versus the typical ~5,000.

The stock has rallied 29% over the past year despite the modest post-earnings dip, reflecting the bank's consistent execution and the $2B milestone achievement.

Key Risks and Concerns

-

CRE Concentration: Management proactively addressed commercial real estate concerns, but the NPA spike (even if isolated) raises questions about what else may be lurking

-

Expense Growth: Non-interest expense grew 9.3% YoY, faster than revenue, pushing the efficiency ratio higher

-

Rate Sensitivity: While NIM held up well through 75bps of cuts, continued Fed easing could pressure margins further

-

Geographic Concentration: All 19 branches are in Central/Eastern California, creating regional economic exposure

Bottom Line

Oak Valley Bancorp's Q4 2025 was a tale of two narratives. The $2 billion asset milestone and resilient net interest margin demonstrate the bank's growth engine is working. But the first NPA in years — even if management dismisses it as isolated — introduces uncertainty for a stock trading near 52-week highs. The 33% dividend increase signals confidence, but investors will be watching closely for any signs the credit blemish was more than a one-off.

Data sourced from Oak Valley Bancorp 8-K filed January 26, 2026. Stock data from market sources.