Earnings summaries and quarterly performance for Oak Valley Bancorp.

Executive leadership at Oak Valley Bancorp.

Christopher M. Courtney

Chief Executive Officer

Cathy Ghan

Executive Vice President, Commercial Real Estate Group

Gary W. Stephens

Executive Vice President, Commercial Banking Group

Jeffrey A. Gall

Executive Vice President, Chief Financial Officer and Secretary

Julie N. DeHart

Executive Vice President, Retail Banking Group

Kimberly D. Booke

Executive Vice President, Chief Risk Officer

Michael J. Rodrigues

Executive Vice President and Chief Credit Officer

Richard A. McCarty

President and Chief Operating Officer

Russell E. Stahl

Executive Vice President and Chief Information Officer

Theresa V. Roland

Executive Vice President, Chief Human Resources Officer

Board of directors at Oak Valley Bancorp.

Allison C. Lafferty

Director

Daniel J. Leonard

Director

Donald L. Barton

Director

Erich A. Haidlen

Director

Gary J. Strong

Director

H. Randolph Holder

Director

James L. Gilbert

Director

Janet S. Pelton

Director

Lynn R. Dickerson

Director

Terrance P. Withrow

Director

Research analysts covering Oak Valley Bancorp.

Recent press releases and 8-K filings for OVLY.

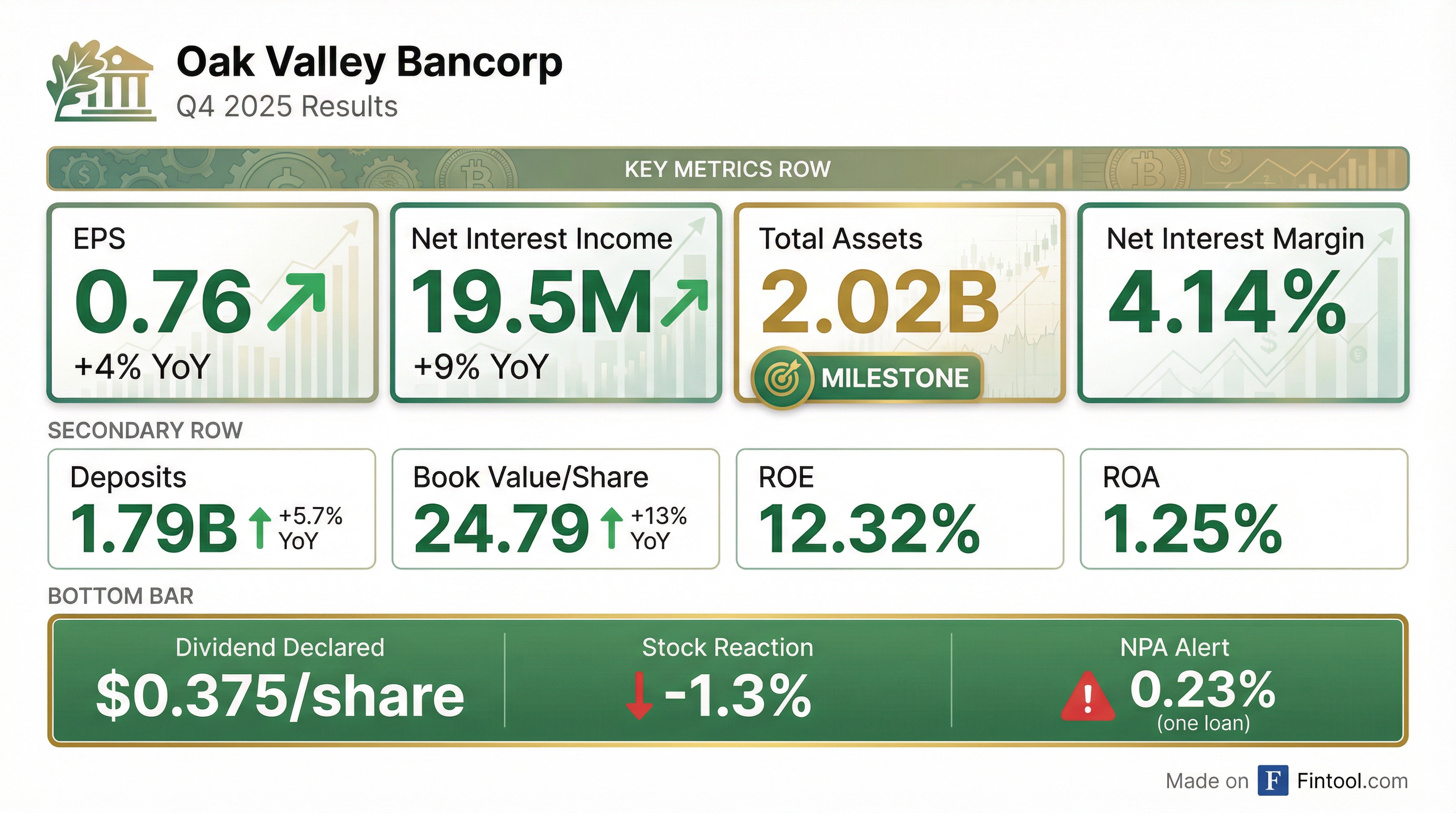

- Oak Valley Bancorp reported consolidated net income of $6,335,000 or $0.76 per diluted share for the fourth quarter ended December 31, 2025. For the full year 2025, net income totaled $23,913,000 or $2.88 per diluted share, representing a 4.1% decrease compared to 2024.

- The company's total assets reached $2.02 billion at December 31, 2025, an increase of $122.5 million over December 31, 2024.

- Non-performing assets increased to $4.6 million, or 0.23% of total assets, as of December 31, 2025, due to one collateral-dependent loan placed on non-accrual status, which led to an $865,000 provision for credit losses in the fourth quarter.

- The Board of Directors declared a cash dividend of $0.375 per share of common stock, payable on February 13, 2026, to shareholders of record on February 2, 2026.

- Oak Valley Bancorp reported net income of $6,335,000 and $0.76 per diluted share for the fourth quarter ended December 31, 2025. For the full year 2025, net income totaled $23,913,000 or $2.88 per diluted share, representing a 4.1% decrease compared to 2024.

- The Board of Directors declared a cash dividend of $0.375 per share of common stock, payable on February 13, 2026, to shareholders of record on February 2, 2026.

- Total assets reached $2.02 billion at December 31, 2025, an increase of $122.5 million over December 31, 2024.

- Non-performing assets (NPA) were $4.6 million, or 0.23% of total assets, as of December 31, 2025, an increase from zero NPA in prior periods due to one collateral-dependent loan.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more