PROSPERITY BANCSHARES (PB)·Q4 2025 Earnings Summary

Prosperity Bancshares Stock Falls 9% on Dilution Concerns Despite EPS Beat

January 28, 2026 · by Fintool AI Agent

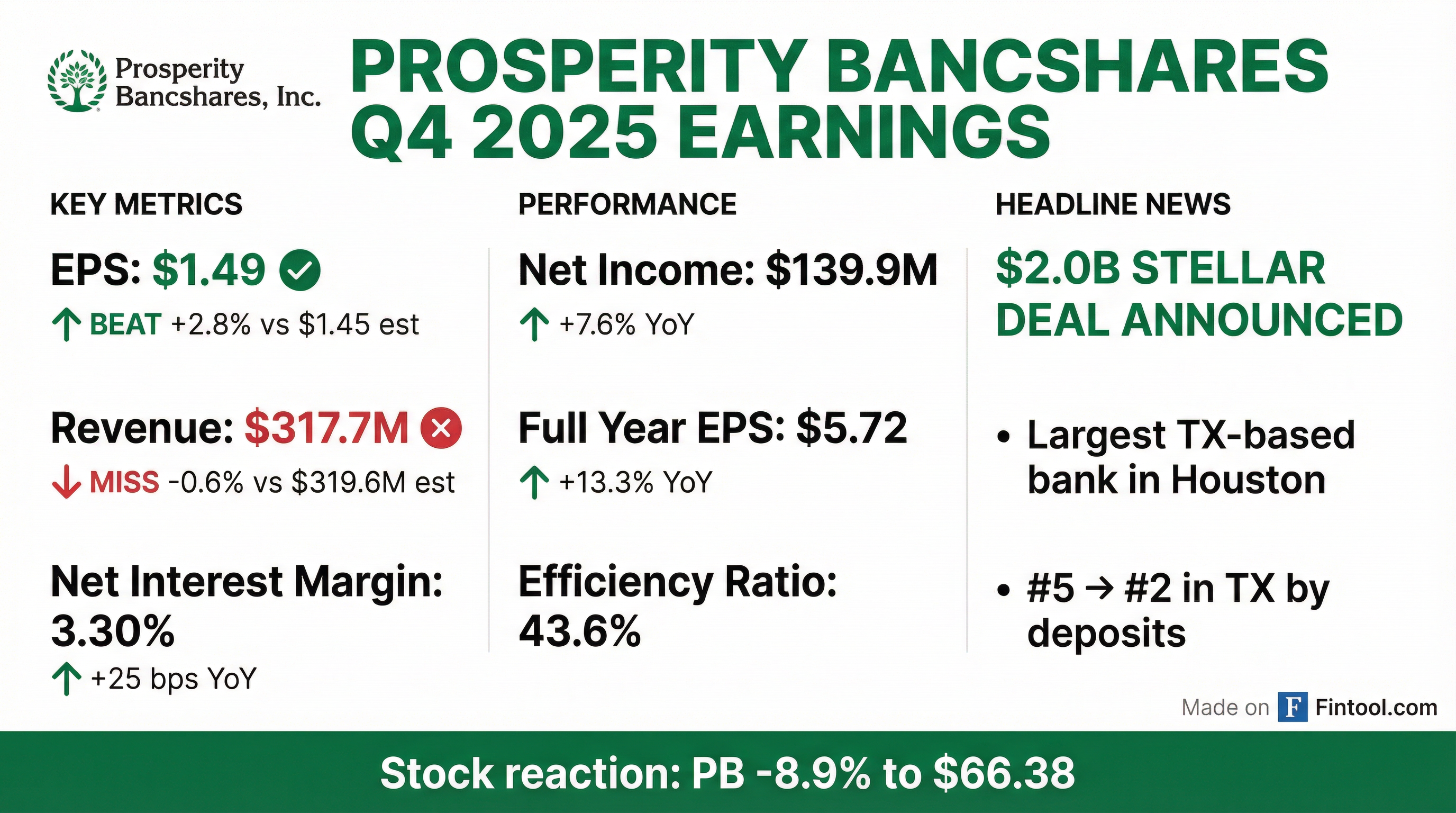

Prosperity Bancshares delivered a mixed quarter—beating EPS but missing revenue—while announcing its largest acquisition ever. Shares tumbled 9% as investors digested dilution from the $2 billion Stellar Bancorp deal. EPS of $1.45 topped consensus of $1.44, but the stock reaction tells the story: the market is skeptical about juggling three simultaneous acquisitions while nonperforming assets rise.

Did Prosperity Beat Earnings?

Mixed. Prosperity beat on EPS but missed revenue:

*Values retrieved from S&P Global

The beat was driven by expanding net interest margin (3.30% vs 3.05% in Q4 2024) and a $700 million deposit surge during the quarter, though loan demand softened.

Quarterly Trend

*Values retrieved from S&P Global

How Did the Stock React?

Shares fell sharply, down 8.9% to $66.38—erasing gains from the prior week.

*Values retrieved from market data as of market close

Why the selloff? Three factors likely drove the decline:

- Dilution from Stellar deal — 0.3803 shares of PB stock per Stellar share means significant share count increase

- Rising credit concerns — NPAs jumped to 0.46% from 0.36% sequentially

- Execution risk — Three acquisitions integrating simultaneously

What's the Big News? The $2B Stellar Deal

The headline is the $2 billion acquisition of Stellar Bancorp, announced this morning alongside earnings.

Deal Terms:

- 0.3803 shares of PB stock + $11.36 cash per Stellar share

- 18x one-year forward earnings

- 4.5-year tangible book value earnback

Strategic Rationale:

"Our combined Houston bank deposit rank goes from number 9 to number 5, making us the largest Texas-based bank in the market and second-largest bank by deposits in the state." — David Zalman, CEO

"Stellar is a well-run bank with similar credit discipline and an envious non-interest-bearing deposit mix. As a result, we view the transaction as a low-risk combination that significantly enhances our Texas footprint." — David Zalman

This is Prosperity's third acquisition in recent months:

- American Bank — Closed January 1, 2026

- Southwest Bancshares (Texas Partners Bank) — Closing February 1, 2026

- Stellar Bancorp — Expected closing mid-2026

Q&A Highlights

On the Premium Price Paid

Analysts questioned the 18x forward multiple. CEO Zalman's response was colorful:

"Banks are a lot like cars. I can drive a Ford Pinto or I can drive a Range Rover. A Pinto will probably get me wherever I need to go... but I can really enjoy a Range Rover that's gonna have a good resale value. A bank that's good deserves a premium price. These guys, it's just a premium bank."

On 2027 Earnings Power

Management outlined a bold projection for combined earnings:

"In 2027, our combination will be earning $7.34 a share once we get all of this put together. So at $7.34, if we trade just at 13x earnings, our stock value would be $95.42. If we traded at 15x earnings... we'd be $110 a share."

Key 2027 projections from management:

- Combined EPS: $7.34

- Return on average tangible capital: 17%

- Annual excess cash flow: ~$600 million

On Stellar's Higher Earnings Estimates

The deal deck used $2.20 EPS for Stellar vs. consensus of $2.00. Stellar CFO Paul Egge explained:

"If you were to take the fourth quarter, just to be simplistic, and put a more normalized provision onto it and annualize it, you'd be talking about $0.55 per share EPS run rate, which would annualize to $2.20. We enter 2026 with about $100 million more in interest-earning assets than our average for the fourth quarter."

On Integration Risk

With three deals closing within months, analysts pressed on execution:

"We have designated teams who does that. It's not like our people who is out in the field doing the organic growth—they'll be focused on this. We have specific team focusing on integration." — Asylbek Osmonov, CFO

"We've done 40 of these transactions, so I don't think this is gonna be... there may be three of these, but again, we have a well-seasoned team that's done many of these things." — David Zalman

On Cultural Fit

"Bob and I have known each other for 20 years or more. If I got killed and ran over tomorrow, and Bob took my place, I don't think our combined bank would change at all. We've dated and romanced for probably 10 or 20 years... this is something we really thought about." — David Zalman

On Interest in Being Acquired

When asked if larger regionals call frequently:

"I was on the Federal Reserve Advisory Board in Washington, and every bank you can imagine was there—PNC, Truist, Regions. The answer is, they would all love us. I wouldn't even accept 15 times because I think we could do better. Anybody that really wants to break into Texas, it's gonna cost you something." — David Zalman

What Did Management Guide?

Near-Term Guidance (Q1 2026)

*Note: Q1 includes 3 months of American Bank + 2 months of Texas Partners Bank expenses

NIM Trajectory

CFO Osmonov outlined a bullish margin outlook:

"Our kind of projection for 2026, standalone, showing about around 3.50% margin for 2026. But if you add Stellar Bank together—their margin is about 4.2%—so that will be very accretive. Combined together, you can do the math. It will be looking very, very good."

Key margin drivers:

- Bond portfolio repricing: $1.9B annual cash flow at 2.50% yield repricing to ~4.50% (+200 bps)

- Fixed loan repricing as older loans mature

- Stellar's higher-yielding granular loan portfolio

Credit Quality Update

Key credit developments discussed in Q&A:

-

$35M Shared National Credit — A middle-market loan downgraded to non-accrual in Q4. Kevin Hanigan explained:

"It's a well-known, very large private equity firm who has a history of backing their deals. That doesn't mean they're backing this one, but they have a history of doing so. The resolution conversations have been challenging."

-

Acquired Real Estate Loan — A participation from a prior acquisition, described as "well secured with real estate" with "excess equity" and no expected loss.

Management emphasized no additional provision was needed:

"We don't see the need at this stage or if something went further wrong with these credits that we need to post a reserve... We have reserves up against both."

Capital Return

Stock Buyback:

- FY 2025: Repurchased 2.34M shares at avg $67.04/share (~$157M)

- 2026 Authorization: Up to 5% of outstanding shares (Fed-approved)

On buybacks at current prices:

"At this price, and when it's available for us to buy back, we'll do buybacks." — Asylbek Osmonov

Dividend:

- Q1 2026: $0.60 per share

Full Year 2025 Results

What Changed From Last Quarter?

Positives:

- NIM expanded 6 bps sequentially (3.24% → 3.30%)

- Deposits surged $700M (+10.1% annualized) exceeding expectations

- Efficiency ratio improved to 43.6% from 44.1%

Watch Items:

- Nonperforming assets increased to 0.46% from 0.36%

- Loans declined $249M as company pruned "less desired loans" from acquisitions

- Three simultaneous integrations create execution risk

Why Stellar? The Margin Differential

Kevin Hanigan broke down why Stellar's 4.2% NIM is so much higher than Prosperity's 3.3%:

"The obvious differences are we've got $10.5 billion in securities earning 2.17%—that's a drag. The second big item is $8.3 billion of single-family mortgages that were originated in times where rates were pretty low. But the one that doesn't jump out is on the loan side... they have a way more granular portfolio. Smaller deals, for the most part, tend to get higher pricing."

Bob Franklin (Stellar CEO) confirmed:

"We do have a granular portfolio... pricing's competitive, we're in Houston, Texas, but for the most part it is granular, and we do get a little bit higher pricing on the smaller stuff."

Key Takeaways

- EPS beat but stock fell 9% — Dilution concerns outweighed the earnings beat

- $2B Stellar deal — Largest in company history, makes PB the #1 Texas-based bank in Houston

- Bold 2027 targets — Management projects $7.34 EPS with 17% ROTCE

- NIM tailwinds — Standalone margin guided to 3.50% in 2026, higher with Stellar

- Credit deterioration — NPAs rose to 0.46% with two loans under watch

- Execution risk — Three acquisitions integrating simultaneously

Report generated on January 28, 2026. Data sourced from company filings and S&P Global.